How are rising New Zealand milk prices affecting dairy farmers and global markets, and what do these shifts mean for the dairy industry’s future?

Summary:

The New Zealand milk market is cautiously optimistic amidst unfolding global dairy dynamics. This report dissects key developments impacting farmers and industry stakeholders, like milk price fluctuations and global demand trends. Fonterra has raised its payout forecast to $9.50, highlighting tension between expectations and reality. New Zealand’s milk price surge, above $11 per kg/MS, poses market competitiveness concerns, with the cheese sector facing challenges due to declining prices. Strategic navigation is crucial for maximizing profitability in this fluctuating landscape, as the GDT index rose 1.1%, with WMP up by 4.1%. Regional milk production nuances span from new opportunities in post-crisis California to EU growth exceeding forecasts and Argentina’s resilience with only a 0.4% decline in October. Despite higher prices, global dairy demand remains stable, driven by diverse patterns from key markets.

Key Takeaways:

- New Zealand’s milk payout sees a boost, with Fonterra revising its predictions upwards amidst industry forecasts of over $9.50 per kg/MS.

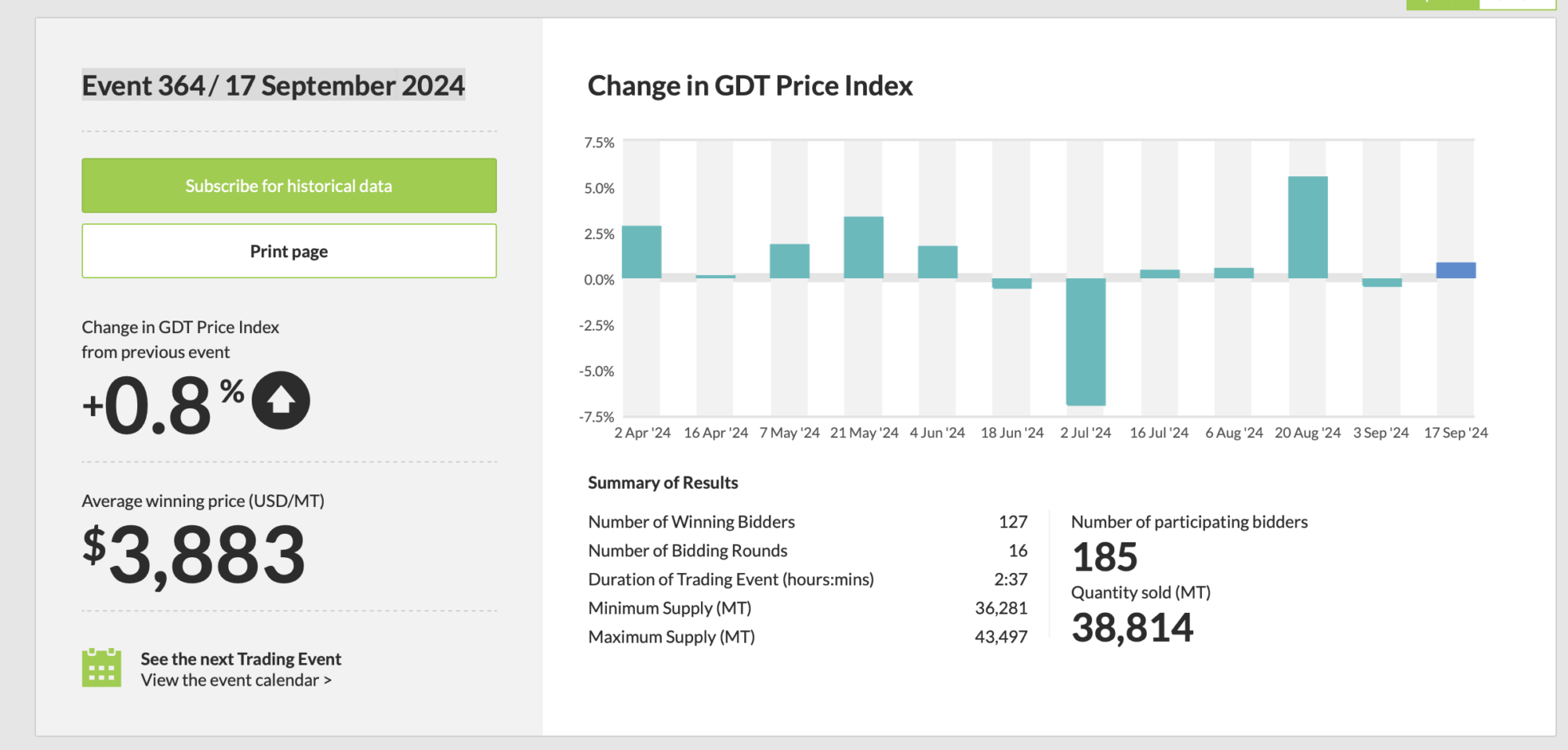

- The GDT index experiences a modest increase of 1.1%, propelled primarily by a 4.1% rise in Whole Milk Powder prices, with lesser activity in butter and SMP.

- U.S. milk production grows slightly above projections, aided by an expanding dairy herd, indicating strong future growth potential.

- EU27+UK milk production surpasses expectations with remarkable growth in milk’s fat and protein content, leading to increased component-adjusted output.

- Argentina’s milk production decline slows, marking the slightest reduction in over a year, keeping farm gate prices favorable and promising future gains.

- Despite higher global prices, dairy import demand remains stable, though high-fat prices significantly impact butter and cheese demand outside China .

- China’s dairy imports are set to improve, though predictions remain cautious due to previously sluggish activity.

The sudden surge in New Zealand’s milk price is a significant development in the global dairy industry, sparking crucial discussions about its potential to redefine global competitiveness. As Fonterra’s forecast climbs and prices soar past the $11 per kg/MS threshold, stakeholders are eager for insights. Understanding these complex changes is essential, especially as regional production shifts and import demands create ripples in commodity valuations and influence strategic directions. Adapting to this dynamic environment is not just advantageous—it’s a necessity for sustained success in the dairy industry.

Optimism in New Zealand’s Milk Pricing: A Double-Edged Sword for Dairy Farmers?

The current state of New Zealand’s milk payouts paints an optimistic picture for dairy farmers, with a notable increase to $11.15 per kg/MS significantly boosting the season-to-date average to $9.85. This upswing is a positive development for many farmers who rely on these payouts for their livelihood. Fonterra’s decision to revise their predicted payout upwards from $9.00 to $9.50 signals potential financial relief for dairy farmers. However, it’s important to note that most forecasters anticipate payouts that may exceed $9.50, underscoring an air of cautious optimism in the industry.

Despite this generally positive outlook, the role of dairy professionals in strategically navigating market trends to maximize profitability amidst fluctuating demand and pricing signals cannot be overstated. Examining the performance of different dairy product streams is crucial. While the higher whole milk powder (WMP) prices help close the gap between varying streams, the cheese sector faces significant hurdles. The decline in cheese prices makes it the least lucrative among major dairy products, posing challenges for producers specialized in this line. These dynamics underscore the crucial role of dairy professionals in the industry.

A Global Tug-of-War: GDT Index Performance and the Subtle Art of Market Navigation

The recent 1.1% increase in the GDT index reflects an intricate dance between forecast expectations and market reality. While futures markets anticipated stronger movement, the results tell a nuanced story. Whole Milk Powder (WMP) ‘s rise by 4.1% emerges as the singular highlight among major products, defying broader market predictions. This suggests a robust, nearly universal demand amidst heightened pricing. Each region played its part in this development.

North Asia maintained its marginal lead in the WMP market share, slightly edging its volume from the previous event. This indicates steady, albeit cautious, procurement strategies despite the cost hikes. Southeast Asia stood parallel, reflecting stable order books and a relentless appetite for dairy nutrition. Demand surged across Africa and South/Central America as these regions increased their purchases, pushing the WMP dynamics into a more competitive and price-resilient space.

Turning to Skim Milk Powder (SMP), the narrative shifts. North Asia saw a dip in its SMP volumes compared to the last event, yet fared better than the previous year. Conversely, Southeast Asia and the Middle East saw an upswing in SMP procurement. These adjustments highlight a diversified demand landscape, where regional strategies adapt swiftly to align with emerging global price signals and local consumption patterns.

California’s Comeback: Will the U.S. Dairy Expansion Flip the Market Script?

U.S. milk production in October presented a cautiously optimistic picture, with a notable 0.2% increase from the previous year. This growth defies earlier forecasts that predicted a marginal decline, showcasing the resilience and adaptability of the U.S. dairy industry. At the heart of this unexpected boost is the expansion of the dairy herd, which saw an increase of 19,000 head in October, adding to the upward adjustment of 18,000 head made in September. This uptick signifies a strategic push from dairy producers to bolster output amidst a competitive global market, instilling a sense of stakeholder reassurance and confidence.

A critical component influencing the landscape is California’s recovery from the avian influenza crisis, a factor expected to significantly bolster milk production growth as we move into late 2024 and early 2025. Historically, California has been a powerhouse in the U.S. dairy sector, so its complete rebound could catalyze a surge in national milk output, providing new opportunities and posing market saturation challenges. Dairy professionals must contemplate how this recovery will shape domestic milk prices and influence international trade dynamics, particularly in a world where global dairy demand remains robust but selectively volatile.

European Dairy Renaissance: The EU27+UK’s Path to Increased Production and Profitability

The EU27+UK milk production scene showcases a promising trend. In September, production increased by 0.2%, surpassing previous forecasts. This uptick in production is complemented by a rise in the fat and protein content of the milk, resulting in a component-adjusted production growth of 1.2% year over year. Such improvements are crucial as they not only indicate healthier herds but also enhance the profitability of milk products.

Key contributors to this upward momentum include countries like France, the UK, and Poland, which have demonstrated robust production growth. Several factors fuel this trend. In France, favorable weather conditions and efficient feed management have bolstered output—meanwhile, the UK benefits from strong domestic demand that drives its dairy sector. Poland’s commitment to technological advancements in dairy farming practices ensures steady gains.

Moreover, current economic conditions paint a lucrative picture for European dairy farmers. Farm gate prices trend upward, and feed costs remain subdued, paving the way for potentially record-high margins in the coming months. This environment injects further confidence in escalating production levels as farmers anticipate better returns, setting the stage for continued growth into 2025.

Argentinian Dairy Defies the Odds: Stabilizing for a Productive Future

Weathering the anticipated downturn, Argentinian milk production showed resilience with a mere 0.4% decline in October—remarkably more minor than the predicted 1.2% drop. This deviation underscores a stabilizing trend in the sector, bolstered primarily by unyielding farm gate milk prices. Despite minor variations in milk composition, notably a slight dip in fat content even as protein levels increased, the component-adjusted production saw its most minor decrease in over a year, sliding by just 0.5%.

The profitability margins sustained by robust milk prices have been pivotal, keeping the financial equilibrium for producers favorable. With these prices defying downward expectations, there’s an assurance for dairy farmers that elevates prospects for productivity. As we approach the new year, 2025 hints at a landscape ripe for substantial gains—after all, by January, the industry will compare against last year’s significant declines, positioning it to showcase notable year-on-year growth. This emerging optimism, with the potential for substantial gains, will likely fuel production increases, paving the way for recovery and expansion and instilling stakeholders a sense of hope and optimism.

Import Resilience vs. Price Pressures: Global Dairy Demand’s Balancing Act

The global import demand for dairy products has shown resilience in 2024 despite the challenges posed by higher prices, which inevitably translate into increased landed costs. Notably, this trend is driven by divergent demand patterns across significant markets. China’s import activities were subdued as of September. Still, they saw a rebound by October, particularly for New Zealand dairy products, highlighting an adaptive response to fluctuating economic conditions. Meanwhile, Mexico exhibited robust import activity during August and September. However, anecdotal evidence suggests a tapering demand in the subsequent months of the third quarter. This points to a complex interplay of factors influencing demand beyond price considerations.

Looking ahead to 2025, cautious optimism about the global dairy import landscape exists. While high-fat dairy products like butter, anhydrous milk fat (AMF), and cheese will likely face dampened demand due to elevated pricing, whole milk powder (WMP) remains vulnerable. However, the uncertainty surrounding China’s import trajectory remains a pivotal factor. Past trends indicate potential volatility, yet forecasts suggest that Chinese demand might gradually stabilize or grow, provided economic conditions are favorable. Such a scenario could shift the global balance, reinforcing optimism among exporters.

In summary, while higher landed costs present a ubiquitous challenge, the overall demand outlook for global dairy imports in 2025 hinges significantly on the economic climates and consumption trends in key markets like China and Mexico. The ability of these markets to absorb costs and maintain demand will largely dictate the global import demand dynamics for the foreseeable future.

The Bottom Line

As we dissect the current landscape of the global dairy market, the key takeaway is the intricate balance and interplay between regions. New Zealand’s optimistic surge in milk pricing indicates a confident yet cautious market stance. Meanwhile, as the U.S. dairy industry bounces back with increased herd sizes and production, European producers also note significant growth, underscoring a promising upward trend buoyed by favorable farm gate margins and robust protein yields. These changes are reverberating through the market, resulting in shifts in global dairy imports that hint at strategic pivots in response to tentative Chinese demand and rising price pressures.

Given these dynamics, a pertinent question emerges: How will this evolving global dairy ecosystem reshape individual business strategies and farm operations, weathering price volatility and consumer demand? Navigating these complex currents will require forward-thinking adaptation strategies from dairy farmers and industry stakeholders. In the face of these challenges and opportunities, one must ponder the strategic shifts necessary to align with the constantly evolving pulse of global trade. Where do you see your operations on this rapidly changing map, and what steps are you considering to secure your place within it?

Learn more:

- Rabobank Forecasts $8.40 Milk Price for 2024-2025 Amid Modest Global Supply – Key Factors Unveiled

- Global Milk Supplies Expect to be Stable for the Remainder of 2024

- Global Dairy Market Trends July 2024: Australia’s Rise as Argentina and New Zealand Face Challenges

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!