While you’re checking frozen FSA payments, processors know exactly what your milk is worth. The game is rigged.

Executive Summary: A Wisconsin farmer told me: ‘I check my frozen FSA account every morning, but what keeps me up at night is the $20,000 in equity I’m burning monthly.’ He’s not alone—half of dairy farms have vanished since 2013, and this October shutdown exposed what processors already knew: most operations face impossible economics. But farmers who act within 90 days can still preserve 85-90% of their equity through three proven paths: scaling to 3,500+ cows ($4M required), transitioning to premium markets (3-7 year commitment), or strategic exit (the difference between keeping $700K versus losing everything). Every month you delay costs $20,000 in family wealth that you’ll never recover. The math is harsh but clear—the only wrong choice is no choice.

You know, I was talking with a dairy farmer from Winnebago County last week—seventh generation, milking about 450 head—and he said something that stuck with me. “I’ve been checking my FSA account every morning for 28 days. Same result. Nothing.”

The government shutdown of October 2025 has frozen billions in farm payments, and that’s creating real stress during harvest season when cash flow matters most. But here’s what’s interesting… as I’ve been talking with producers across the Midwest, what we’re discovering goes way beyond payment delays.

After digging through recent market analyses and comparing notes with dairy economists, there’s a pattern emerging that—honestly—changes how we need to think about survival in this industry. And the farmers who are grasping this, really understanding what it means for their operations, they’re making some tough decisions right now. Decisions that’ll determine whether their families thrive or… well, whether they have to walk away with nothing in three years.

When the Math Just Doesn’t Work Anymore

So here’s a conversation I keep having. A producer in southern Wisconsin—runs about 650 cows, good operation—told me: “When the shutdown started, I was right in the middle of filing our production reports. Now? I’m flying blind on pricing while my milk buyer somehow knows exactly what to offer me.”

Sound familiar?

What many of us are realizing is that this shutdown has pulled back the curtain on something that’s been building for years. The cost structure in dairy… it just doesn’t pencil out for most operations anymore. And I mean most.

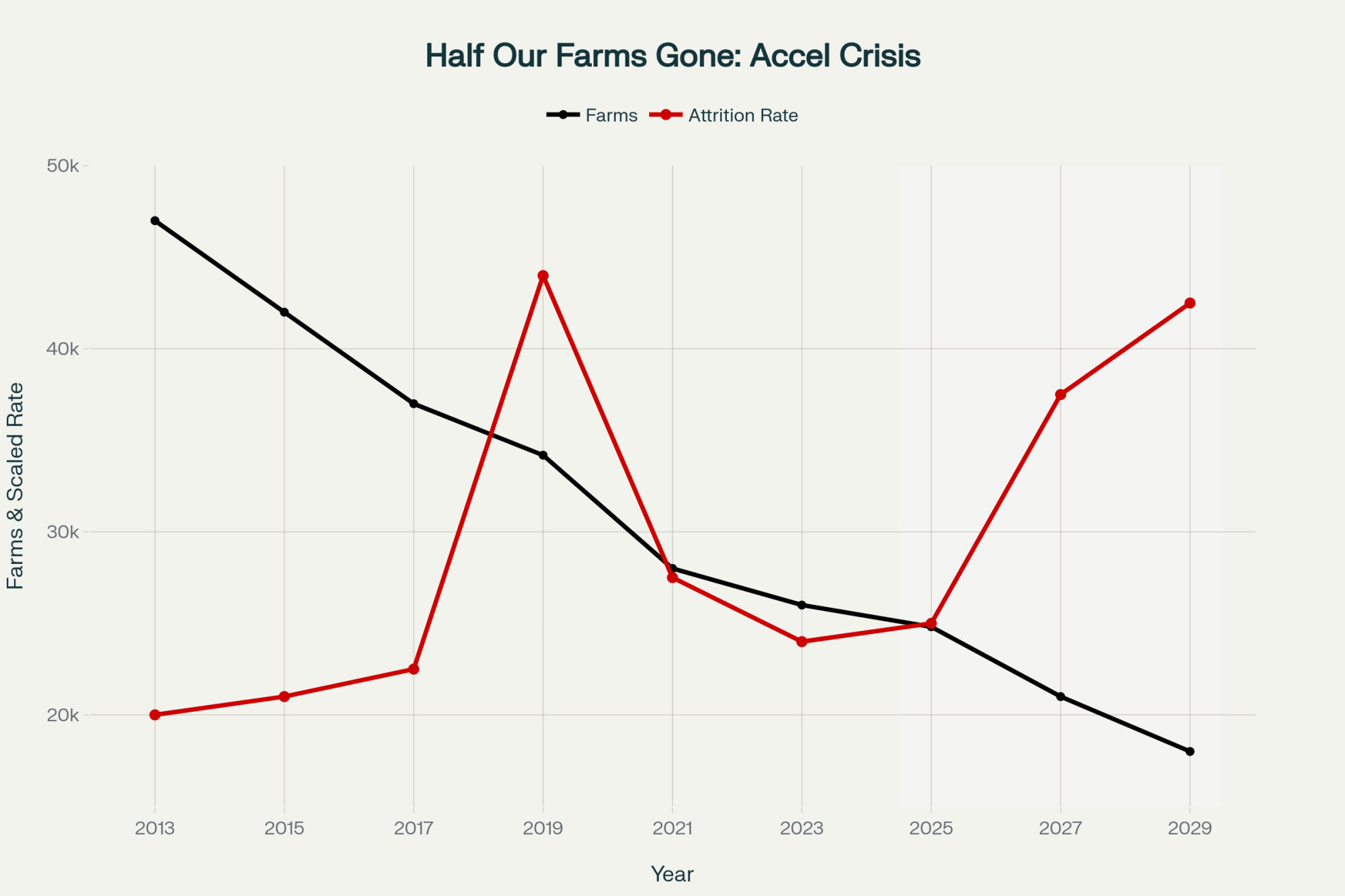

The USDA Census of Agriculture data tells a sobering story. We’ve lost about half our dairy farms since 2013. Half. That’s not gradual change—that’s acceleration. The historical attrition rate used to hover around 4% annually, based on USDA tracking. Industry analysts I’ve talked with are suggesting it could hit 7-9% over the next couple years. Do the math on that… we could be looking at maybe 12,000 operations by 2035. We’re at about 24,000 now, according to USDA’s latest count.

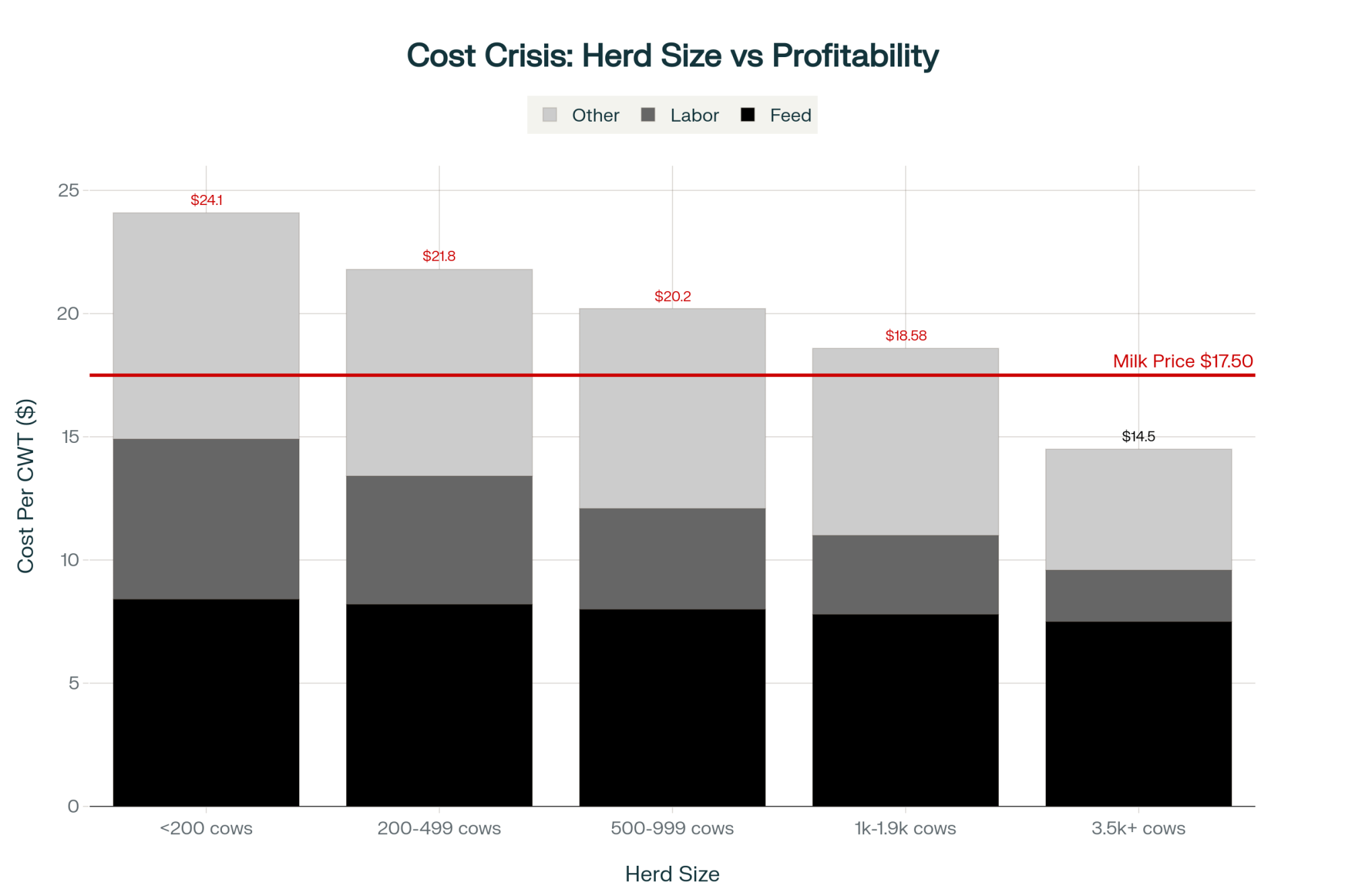

Mark Stephenson over at UW-Madison’s Center for Dairy Profitability, he’s been tracking these trends for years. What he and his team have documented is eye-opening. The cost gap between a 500-cow operation and one milking 3,500? It’s massive—we’re talking hundreds of thousands of dollars annually in structural disadvantage. You can optimize feed efficiency, maybe save 5%. But when the big operations are running three to four dollars per hundredweight lower in total costs? That’s not a gap you close with better management.

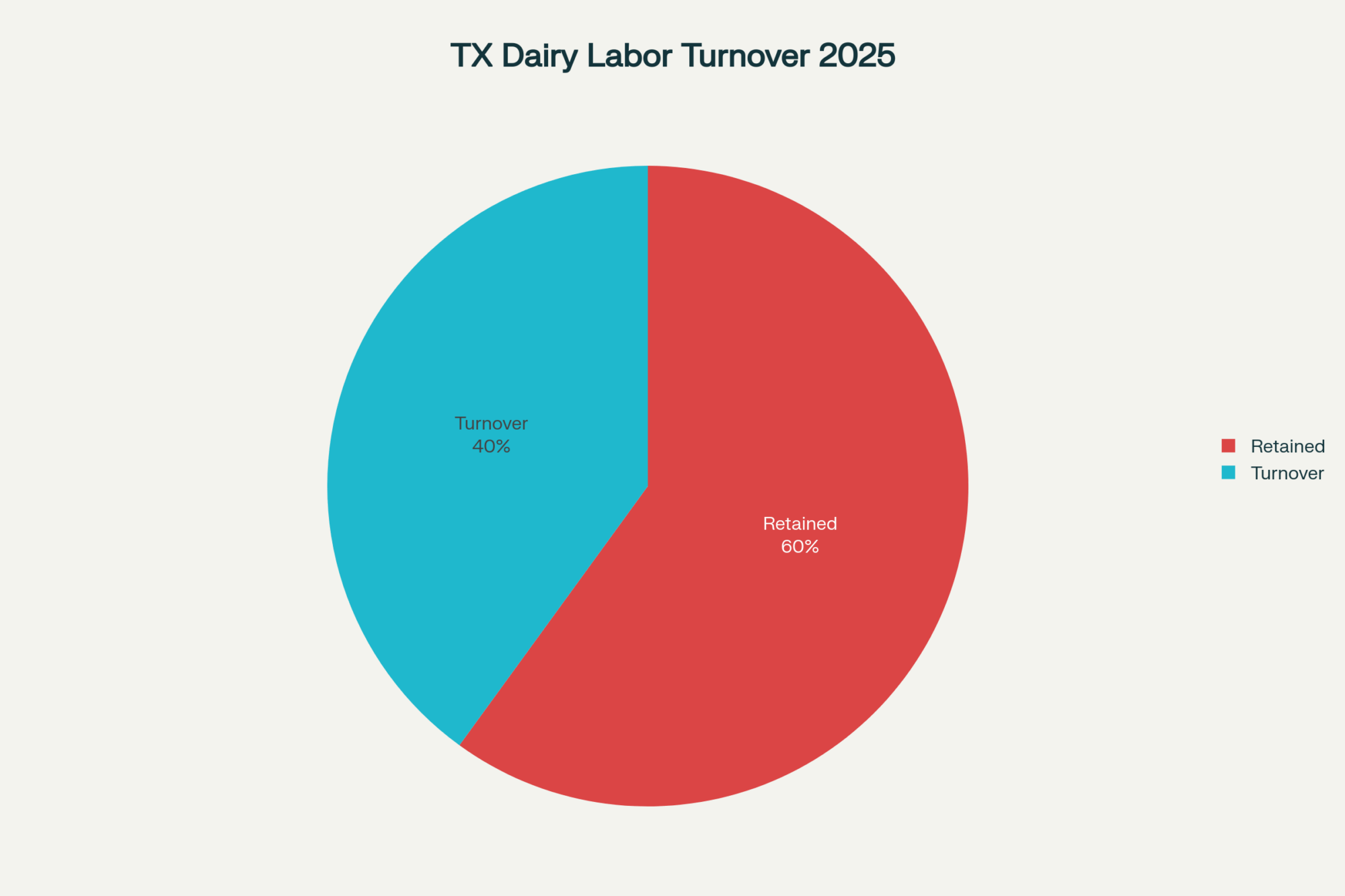

“I dropped $180,000 on robotic milkers last year. Thought I was crazy at the time. But with agricultural labor costs running north of twenty bucks an hour—if you can even find people—that investment’s already cash-flowing positive.” — Dairy farmer, Eau Claire area, 1,100 cows

And here’s the thing he pointed out: feed costs are only about 35-40% of his total expenses now. It’s everything else that’s killing margins.

The Information Game During Shutdowns (And Why We’re Losing It)

What this shutdown has really exposed is something we haven’t wanted to acknowledge about modern dairy economics. While government data collection sits frozen, the processors? They’re operating with full market intelligence through their private channels.

Take a look at what’s been happening in Chicago trading. Butter’s been bouncing around $1.60 per pound. Cheese blocks are pushing toward $1.80. The spread between Class III and Class IV pricing? It’s wider than we’ve seen in years, based on CME data.

Now, if you’re a processor with trading desk access and those expensive market analytics subscriptions—you know exactly what’s happening in real-time. But farmers without the weekly USDA Dairy Market News reports we usually rely on? We’re negotiating in the dark.

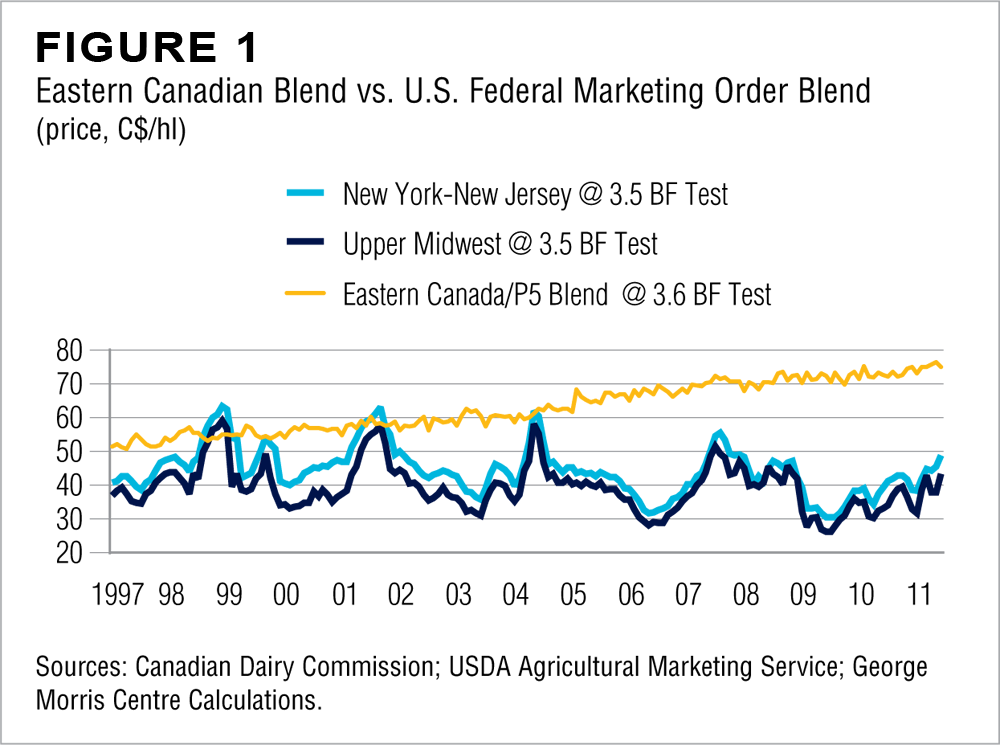

And it gets worse. The Federal Milk Marketing Order formulas—you probably know this already—they’re still using butterfat standards from 2000. Three and a half percent. But today’s milk? Based on USDA testing data, most of us are running 3.9 to 4.1 percent butterfat, especially with the genetics we’ve selected for. That gap between what we produce and what the formulas recognize? It’s real money left on the table. Every load.

Marin Bozic, assistant professor of dairy economics at the University of Minnesota, has been analyzing these formula issues. “The disconnect between current milk composition and FMMO standards represents a significant value transfer from producers to processors,” he noted in recent extension materials. “We’re talking millions annually across the industry.”

Three Paths That Actually Work (And One Nobody Talks About)

After comparing notes with producers from California to Vermont, here’s what I’ve found: there are basically three business models that can work in today’s dairy. Everything else is just… different speeds of losing money.

Path 1: Going Big—Really Big

I know a producer in Idaho who made this jump two years back. Went from 800 cows to 3,600. “The math is brutal but simple,” he told me. At 800 cows, he was bleeding money—losing close to two hundred grand a year. At 3,600? He’s profitable. Same milk price, totally different economics.

But—and this is important—it took over four million in expansion capital. Complete management restructure. And what he calls “two years of hell” getting it all to work. Industry lenders I’ve spoken with suggest relatively few current operations could access that kind of financing. Very few.

What’s encouraging, though, is that those who do make this transition successfully often find unexpected benefits. Better animal welfare through modern facilities. Ability to attract skilled management talent. Even environmental improvements through precision nutrient management at scale.

Path 2: Premium Markets (If You’re in the Right Spot)

There’s an organic producer I know in Vermont, transitioned about four years ago. She’s refreshingly honest about it: “First three years, we lost money. Years four through six, broke even. Year seven—this year—we’re finally profitable.”

She’s getting close to forty dollars per hundredweight through her organic co-op, compared to the seventeen or so conventional farmers are seeing based on current Class III pricing. But here’s the catch—she’s 40 minutes from Burlington. Close to those premium consumers.

Research from Cornell’s dairy program shows something interesting: organic transition success rates tend to drop the further you get from metro markets. The market access piece is crucial. SARE grant applications for transition support typically close in March, so timing matters if you’re considering this path.

One success story worth noting: A group of five farms in Ohio pooled resources to create a shared organic processing facility. By working together, they reduced individual transition costs by about 40% and secured contracts before making the leap. That kind of innovation is what gives me hope.

Path 3: The Strategic Exit Nobody Wants to Discuss

And then there’s the third path. The one we don’t talk about at co-op meetings.

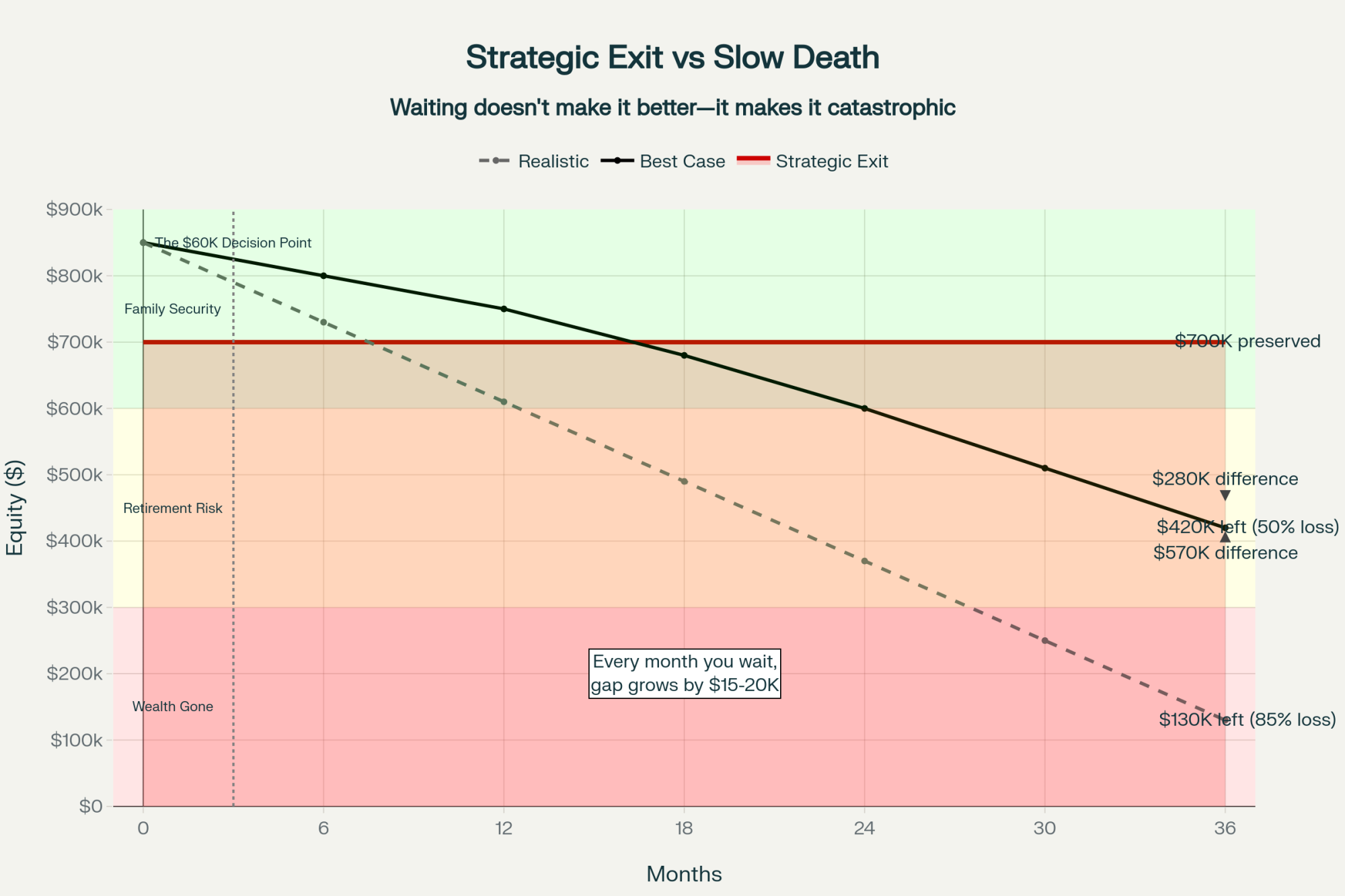

“I had about $850,000 in equity. Could’ve kept fighting, probably lasted three more years. Maybe walked away with a hundred grand if I was lucky. Instead? I sold strategically. Walked away with over seven hundred thousand.” — Recently retired dairyman, Marathon County, Wisconsin

He’s consulting now, helping younger farmers with business planning. His daughter started an agritourism venture. And you know what? He doesn’t regret it. “People think I gave up. I didn’t give up—I looked at the math and protected my family’s future.”

Agricultural financial advisors I’ve talked with suggest strategic exits generally preserve most of your equity—85-90% isn’t uncommon. Forced liquidations after years of losses? They tell me you’re lucky to see 20-30% recovery.

Your Three Options

Path 1 – Scale Up: Requires $3-5 million capital, 3,500+ cows, complete management restructure. Success rate high IF you can access financing (less than 5% of farms can). But those who succeed often thrive with modern efficiency.

Path 2 – Premium Markets: Organic/specialty transition needs 3-7 years losses before profitability, proximity to metro markets critical, $600K-1M transition capital required. SARE grants available (apply by March 2026).

Path 3 – Strategic Exit: Preserves 85-90% of equity NOW versus 20-30% in forced liquidation later. Allows family financial security and new opportunities. Not failure—strategic business decision.

Timeline: Next 90 days critical for decision-making while equity remains.

The Next 90 Days Matter More Than You Think

Let me share something a Fond du Lac County dairyman told me—runs about 650 cows, right in that tough middle ground:

“Every month I keep going, I’m burning through twenty-some thousand in equity. That’s college funds. That’s retirement. That’s the down payment on whatever comes next.”

That “twenty-some thousand in equity” burn isn’t just a number—it’s the cost of indecision. In 90 days, that’s over $60,000 gone. That $60,000? It’s the difference between a strategic exit where you keep most of your wealth and a forced liquidation where you’re lucky to walk away with anything. That’s your window.

His monthly cash needs? About eighteen grand just for essentials—feed, supplies, utilities. The frozen government payments are creating a gap he can’t bridge much longer.

Wisconsin’s Farm Center, which provides financial counseling to farmers, my conversations with their staff suggest they’re getting 40-50 calls daily now. Before the shutdown? Maybe 10-15. One of their senior counselors told me something that really hit home: “We’re watching 30 years of equity disappear in 18 months. The farmers who recognize it early and make strategic decisions—they keep most of their wealth. The ones who wait? They lose everything.”

The Conversation We Need to Have

Can we talk honestly about what this stress is doing to farm families?

Multiple studies in agricultural psychology journals show farmers face significantly elevated stress and mental health challenges compared to other professions. Financial pressure is consistently identified as the primary trigger. According to conversations with Farm Aid staff, their hotline has seen a notable increase in calls this year.

Several farmers shared with me—they asked to remain anonymous—about the mental toll. One said: “I wake up at 3 AM doing the same math. How many months until we’re broke. My wife pretends she’s asleep, but I know she’s running the same numbers.”

The narrative that equates strategic exit with failure? It’s literally destroying people. As agricultural mental health professionals have been saying, recognizing an unwinnable situation and protecting your family isn’t giving up—it’s wisdom.

Resources That Can Actually Help

For those evaluating options, here are organizations that farmers have found helpful:

Financial Planning:

- Farm Financial Standards Council offers free cash flow analysis tools

- UW-Madison’s Center for Dairy Profitability provides quarterly benchmarks

- Agricultural financial advisors can help with exit strategy planning

Transition Support:

- SARE offers grants up to $15,000 for transition planning (March deadline)

- Organic Valley has specific regional openings for new members

- Farm Credit Services offers 18-month interest-only transition financing

Mental Health:

- Farm Aid Hotline: 800-FARM-AID

- 988 Suicide & Crisis Lifeline

- Rural Minds offers online support specifically for agricultural communities

The Bottom Line

After weeks of analyzing this situation and talking with farmers from every angle, something’s clear: the question isn’t whether you can survive another year. It’s whether that fight serves your actual goals.

A fourth-generation producer from Dodge County who sold recently framed it well: “My grandfather would understand I’m protecting what he really valued—the family’s security. He adapted to his era’s challenges. I’m adapting to mine.”

You know what I find encouraging? Farmers who make peace with transition often discover unexpected opportunities. Consulting for younger farmers. Mentoring organic transitions. Exploring agrivoltaics. One former dairyman is now helping beginning farmers with direct marketing—found his passion in a completely different aspect of agriculture.

The dairy industry will survive this transformation, but it’s probably going to look quite different. Maybe 8,000-12,000 large operations. Perhaps a couple thousand premium niche producers. That seems to be where trends are pointing.

Your job—whether you’re milking 50 cows or 5,000—is to honestly assess where you fit in that future. Make decisions based on your family’s actual needs, not what you think a “real farmer” should do. Because at the end of the day, your kids need a parent more than they need a farm. Your spouse needs a partner, not a martyr.

The next 90 days… that’s your window, from what I’m seeing. Make decisions based on math and family priorities, not mythology and peer pressure. That’s the wisdom this moment demands.

And if you need to talk to someone—really talk—don’t wait. Pick up the phone. Call Farm Aid. Call a counselor. Call a friend. Because whatever path you choose, you don’t have to walk it alone.

Key Takeaways:

- The $60,000 question: You’re burning $20K in equity monthly—by February, that’s $60K gone forever

- Path 1 – Go Big: Scale to 3,500+ cows. Requires $4M capital. Only works if you’re in the 5% who can get financing

- Path 2 – Go Premium: Organic/specialty markets. Expect 3-7 years of losses. Must be within 50 miles of metro markets

- Path 3 – Get Out Smart: Exit now keeping $700K vs. waiting 3 years and walking away with $100K

- Hard truth: No decision IS a decision—it defaults to Path 3, just costs you $600K more

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Pick Your Lane or Perish: The 18-Month Ultimatum Facing 800-1,500 Cow Dairies – Explores why October’s $2.47 Class spread proves mid-size dairies must choose between commodity and premium immediately, providing specific financial models for operations caught in the deadly middle ground where neither scale nor niche strategies work.

- 2,800 Dairy Farms Will Close This Year—Here’s the 3-Path Survival Guide for the Rest – Delivers tactical implementation strategies for each survival path, including specific capital requirements, timeline benchmarks, and success metrics that help farmers evaluate which route aligns with their resources and family goals.

- The $11 Billion Betrayal: Your Processor Is Building Your Replacement Right Now – Reveals how vertical integration by cooperatives and processors creates systematic disadvantages for independent producers, explaining the market dynamics that make the 90-day decision window critical for preserving equity before structural forces eliminate choice.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!