Texas herds surge 10.6% as US milk production hits 3-year high. Component-adjusted output up 3% – what it means for dairy margins.

EXECUTIVE SUMMARY: April 2025 saw U.S. milk production jump 1.5% year-over-year – the largest gain since 2022 – driven by a 89,000-cow herd expansion and rising yields. Texas dominated growth with a 10.6% output surge, while Idaho’s 4.2% rise faced emerging H5N1 risks. Component-adjusted production soared 3%, amplifying manufacturing potential despite California’s lingering avian flu challenges. Markets reacted bearishly as Class III futures dropped 20¢, signaling concerns about sustained oversupply. The data reveals a geographic shift, with Southern Plains states outpacing traditional dairy regions.

KEY TAKEAWAYS:

- Historic expansion: 102K cows added in 10 months, pushing herds to 9.4M head – highest since mid-2021.

- Texas powerhouse: 50K new cows + 55 lb/cow yield gain = 10.6% production spike.

- Component revolution: 4.31% fat (+1.7%) and 3.34% protein (+1.2%) created 3% manufacturing value surge.

- Regional realignment: Kansas (+11.4%) and South Dakota (+9.2%) boom as Washington (-4.5%) and Florida (-3.7%) contract.

- Market warning: Bearish price reactions signal oversupply risks if demand doesn’t match 2%+ component-adjusted growth.

April 2025’s milk production statistics aren’t just another monthly data point—they’re the smoking gun confirming a fundamental restructuring of America’s dairy landscape. The 1.5% production surge (3.0% on a component basis) reveals how rapidly production power is shifting south and west, creating winners and losers in an industry transformation many producers aren’t prepared to acknowledge, much less address. USDA’s latest data confirms that the production center is shifting dramatically away from traditional dairy states toward regions that many “experts” dismissed as unsustainable just a decade ago.

The Numbers That Shatter Conventional Wisdom

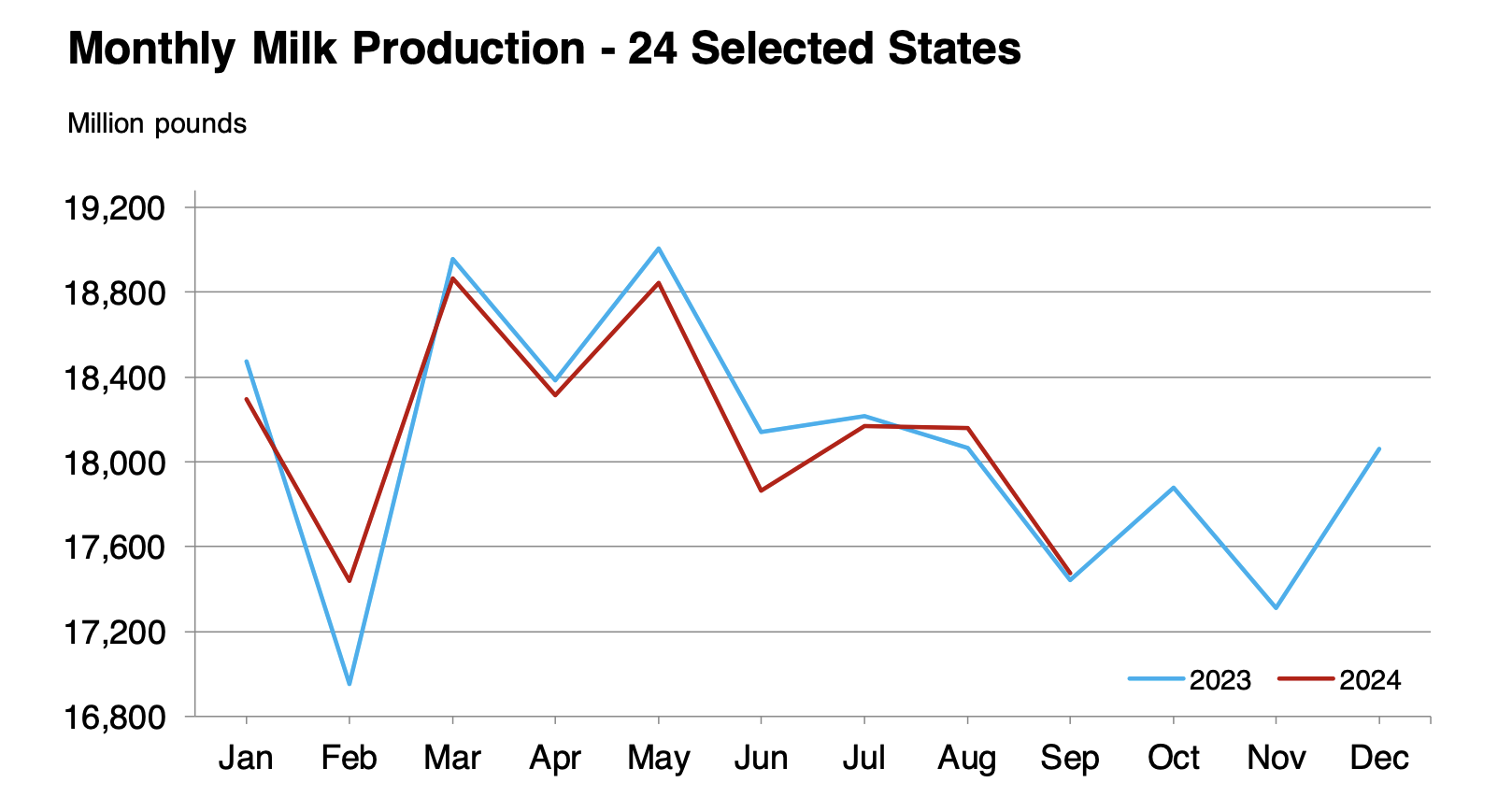

Let’s be brutally honest about what April’s milk production report tells us. The nationwide 1.5% production increase compared to April 2024 doesn’t just mark the fourth consecutive month of rising output—it represents the most substantial year-over-year percentage gain since August 2022, according to USDA data released May 21, 2025.

What should make you sit up straight is the component-adjusted production increase of 3.0% that vastly outpaced the raw volume growth. This isn’t just more milk—it’s dramatically more valuable milk, with fat content reaching 4.31% (up 1.7% from last year) and protein climbing to 3.34% (up 1.2%).

When was the last time anyone in your cooperative meeting mentioned that component-adjusted production was growing at double the volume rate? It’s like celebrating a 200-bushel corn crop while ignoring that the test weight jumped from 56 to 58 pounds per bushel. The manufacturing value of America’s milk supply is expanding at a rate that’s reshaping processing economics in ways many industry observers seem determined to ignore.

This wasn’t supposed to happen. Market analysts had predicted a modest 1.2% growth. Instead, producers delivered an expansion that sent Class III futures and cheese prices tumbling approximately 20 cents in nearby months. When the market pundits and economists consistently underestimate production growth for four consecutive months, it’s not just a miscalculation—it’s a failure to recognize fundamental structural changes in the industry.

The Triple-Threat Expansion That Nobody Saw Coming

The April data exposes an industry expanding through three simultaneous vectors, creating a multiplier effect that catches even experienced market watchers flat-footed.

Heifers Stay Home: The Return of National Herd Expansion

For years, conventional wisdom claimed that the national dairy herd would remain flat, or contract as consolidated operations focused on efficiency rather than cow numbers. That narrative just collided head-on with reality. According to USDA’s National Agricultural Statistics Service, the April milking herd reached 9.425 million head, up 89,000 compared to April 2024 and adding 5,000 just since March.

This isn’t a statistical anomaly. U.S. dairy farmers have added 102,000 cows to the national herd in just 10 months—a 1.1% increase that has brought the milking population to its highest level since mid-2021, with the exception of that single month in March 2023.

What makes this expansion truly remarkable is its timing. Producers are actively growing herds despite cull cow prices that would typically have them backing up the trailer to the freestall barn every time a cow shows the slightest sign of trouble. When dairy producers choose milk production over $1,500+ cull checks, it signals they’ve run the numbers and see substantially more long-term value in keeping those animals in the parlor than in the beef supply chain.

We should ask whether this herd growth is driven by confidence in dairy fundamentals or by producers chasing more substantial cash flow in regions where cowside margins remain artificially inflated by unsustainable subsidies or environmental regulatory forbearance? The geographic distribution of this growth suggests the latter may be more significant than industry cheerleaders care to admit.

From Good to Great: Yield Climbs Despite Dilutive Factors

As the national herd grows, individual cow productivity isn’t reduced by first-lactation heifers and held-over cull candidates. It’s improving. USDA reports milk per cow averaged 2,055 pounds in April, 11 pounds more than April 2024, representing a 0.6% increase.

This yield improvement is particularly telling because it’s happening simultaneously with herd expansion. The industry’s conventional wisdom holds that you can grow aggressively or improve per-cow production, not simultaneously. The USDA data directly contradicts this assumption.

Typically, rapid herd growth involves bringing in younger, first-lactation animals and retaining older cows longer, which drag down average productivity. Yet national yields are still climbing, suggesting that the genetic advancement curve is steepening rather than flattening, despite widespread complaints about genetic diversity constraints. The annual rate of genetic improvement appears to be outpacing the dilutive effects of herd expansion—a phenomenon that undermines decades of dairy management assumptions.

The Component Revolution Nobody’s Talking About

Perhaps the most significant trend in the April data—and the one getting the least industry attention—is the continued improvement in milk components. Analysis shows fat content reached 4.31% (up 1.7% from last year) while protein rose to 3.34% (up 1.2%).

This component boost is why the true expansion of U.S. milk production is double what the fluid numbers suggest. While raw volume increased 1.5%, component-adjusted production surged 3.0%. This means processors receive substantially more manufacturing material from each tanker, dramatically expanding the dairy solids available for cheese, butter, and powder production.

For farmers in Federal Orders with component pricing, this represents a significant revenue multiplier beyond simple volume growth. For processors, it means substantially improved manufacturing efficiency. Yet how many producer meetings have you attended where the focus was entirely on hundredweight volume rather than component yield? The industry’s fixation on fluid metrics is increasingly disconnected from the economic reality of modern milk production.

MYTH BUSTER: The Expansion/Efficiency Trade-Off Is Dead

Dairy advisors and economists have repeated the same mantra for decades: “Rapid herd expansion inevitably dilutes per-cow productivity.” The April data completely demolishes this long-held belief. Despite adding 89,000 cows nationally and expanding the dairy herd at the fastest rate in years, milk per cow still increased 0.6% year-over-year, according to the USDA’s official report.

This wasn’t supposed to happen. The traditional wisdom suggests that when operations add significant numbers of younger animals and retain marginal older cows longer, average production should decline or at best remain flat. But the evidence is clear—we’re simultaneously experiencing both quantity (more cows) AND quality (more milk per cow) expansion.

What changed? And why aren’t industry advisors acknowledging this new reality? The data suggests genetic advancement is accelerating faster than previously recognized. Modern genetic selection tools, genomic testing, and AI-driven breeding decisions deliver productivity gains that outpace the natural dilutive effects of herd turnover.

This has profound implications for dairy business planning. Suppose you’re still operating on the old assumption that you must choose between expansion and efficiency. In that case, you’re using an outdated playbook that places your operation at a significant competitive disadvantage against producers who recognize and leverage this new reality.

America’s Dairy Geography Revolution: The New Powerhouses Emerge

The national production increase masks the most important story in the April data: a fundamental geographic restructuring of America’s dairy industry happening faster than most industry veterans believed possible.

Texas: The Undeniably New Dairy Capital

If you’re still thinking of Wisconsin as America’s Dairyland, it’s time to update your mental map. According to USDA figures, Texas’s milk production surged an astonishing 10.6% year-over-year in April, reaching 1.511 billion pounds. This extraordinary expansion wasn’t just incremental growth but a seismic shift in production capacity.

Texas added 50,000 cows to its dairy herd in just 12 months, growing from 640,000 to 690,000 head. That single-state expansion accounts for 56% of the entire national herd growth, as verified by the USDA’s state-level data. Even more impressively, milk per cow jumped from 2,135 to 2,190 pounds, demonstrating that Texas isn’t just adding cows—it’s continuously improving productivity.

Let’s put this in perspective: Texas alone accounted for more than half of America’s net dairy herd expansion. The state is no longer merely an emerging dairy power; it has established itself as the epicenter of U.S. dairy growth with a production model that combines aggressive expansion with improving efficiency.

This rapid growth raises uncomfortable questions about resource allocation. When a single state adds more cows in one year than many traditional dairy states’ milks, how sustainable is the resulting concentration of animals, manure nutrients, and water demand? Texas’s growth model depends on groundwater from the rapidly depleting Ogallala Aquifer and cheap feed grain production subsidized by federal crop programs. Is this the sustainable future of American dairying, or are we witnessing a resource bubble that will eventually burst with devastating consequences?

Idaho: Growth Despite Disease Shadows

According to the USDA’s April report, Idaho posted a robust 4.2% milk production increase in April, reaching 1.471 billion pounds. Unlike Texas, however, Idaho’s growth came entirely from herd expansion. The state added 28,000 cows year-over-year while milk per cow remained flat at 2,110 pounds.

This reliance on herd growth rather than productivity improvement creates potential vulnerability, particularly as The Bullvine reports new cases of H5N1 avian influenza have begun to emerge in Idaho. While the impact was described as “limited” in April, this development warrants close attention. Have we learned nothing from California’s experience with H5N1? When an industry builds growth projections entirely on herd expansion without concurrent productivity improvements, it’s creating a house of cards that can collapse with the first strong biological headwind.

Idaho’s production model—focusing on cow numbers rather than cow efficiency—resembles a crop farmer expanding acreage without improving yield. When margins tighten or disease challenges emerge, operations without productivity improvements to buffer against herd reductions become disproportionately vulnerable. Is Idaho making the same strategic error that cost California its production dominance?

California: Beyond Bird Flu

California, America’s largest milk-producing state, continued to feel the effects of H5N1 with April production falling 1.4% year-over-year to 3.480 billion pounds, according to USDA data. However, analysts note this represents improvement from March’s 2.7% decline and outperformed their forecast of a 1.7% reduction.

Interestingly, California’s struggles stem primarily from reduced productivity rather than herd contraction. The state’s cow numbers increased slightly by 1,000 head year-over-year, but milk per cow fell by 30 pounds. This suggests H5N1’s primary impact has been on cow health and productivity rather than triggering widespread culling—an object lesson in the differential effect of disease on production parameters versus herd demographics.

The recovery trend in California and the stronger-than-expected performance elsewhere create a dichotomy of negative milk production in California and strong recovery in the rest of the country. This divergence has significant implications for regional milk pricing and product flows that FMMO reform advocates have yet to address adequately.

The Reshuffling of America’s Dairy Map

Beyond these major players, USDA’s state-level data revealed several other states posted dramatic production shifts that further illustrate the geographic redistribution of U.S. dairy capacity:

- Kansas: +11.4% (emerging as another major growth center)

- South Dakota: +9.2% (continuing its multi-year expansion trend)

- Georgia: +7.2% (showing surprising strength in a traditionally shrinking region)

- Washington: -4.5% (accelerating contraction in the Pacific Northwest)

- Florida: -3.7% (continuing its long-term decline)

- Wisconsin: +0.1% (essentially flat production from America’s traditional dairy heartland)

This pattern reveals a fundamental restructuring of U.S. dairy geography that’s happening regardless of whether industry leaders choose to acknowledge it. The traditional Upper Midwest and Pacific Northwest regions show minimal growth or outright contraction, while the Southern Plains and certain parts of the Southeast are experiencing explosive expansion.

Regional Production Shifts Reshaping the U.S. Dairy Landscape

| State | April 2025 Production (million lbs) | YoY Change | Key Drivers | Future Implications |

| Texas | 1,511 | +10.6% | +50,000 cows, +55 lbs/cow | Emerging dominant production center requiring massive processing expansion |

| Idaho | 1,471 | +4.2% | +28,000 cows, flat yield | Growth is vulnerable to the emerging H5N1 situation |

| California | 3,480 | -1.4% | +1,000 cows, -30 lbs/cow | Gradual recovery from H5N1 impact, primarily yield-driven |

| Wisconsin | 2,713 | +0.1% | +7,000 cows, +15 lbs/cow | The traditional dairy heartland is showing minimal growth |

| Kansas | 382 | +11.4% | +16,000 cows, +40 lbs/cow | Emerging as a significant growth center in the Central Plains |

| South Dakota | 440 | +9.2% | +16,000 cows, +30 lbs/cow | Sustained multi-year expansion continuing |

This geographic shift has profound implications for processing capacity, transportation logistics, and regional price relationships that industry planners seem determined to ignore. The industry’s infrastructure was built around historical production centers, but milk is increasingly produced in regions lacking adequate processing capacity.

Who’s asking the tough questions about this mismatch? When milk production growth is concentrated in regions without proportional processing expansion, the result is inefficient transportation, pressure on class prices, and increased vulnerability to market disruptions. Is anyone planning for a dairy industry where Texas and Kansas collectively produce more milk than Wisconsin? Because that’s the trajectory we’re on, according to the multi-year trend in USDA production data.

H5N1: Managing Through Rather Than Solving

The emergence of H5N1 avian influenza in dairy herds created significant uncertainty for the industry over the past year. While still a concern, the April data suggests producers are developing effective management strategies to limit its impact on production, managing through rather than solving the underlying problem.

California, which was hit hardest by H5N1, is showing signs of recovery with the production decline rate moderating from -2.7% in March to -1.4% in April. This improvement, coupled with the slight increase in California’s cow numbers, indicates farmers are adapting to manage through the challenge rather than reducing herd size.

Analysts note that “most H5N1 cases in dairy cattle are being reported as subclinical, and many affected producers have not reported a decline in milk production on the farm.” But let’s be clear: ‘subclinical’ doesn’t mean ‘inconsequential.’ Subclinical infections can still compromise long-term health, reproduction, and lifetime productivity. The industry’s apparent satisfaction with “managing through” rather than solving the H5N1 challenge reflects a troubling pattern of addressing symptoms rather than root causes.

Are we witnessing another example of the dairy industry adapting to a new normal rather than solving a fundamental problem? Just as we’ve collectively accepted declining reproductive performance, shortened productive life, and escalating transition cow challenges as “normal,” the industry appears to be normalizing endemic H5N1 as just another management variable rather than a solvable problem.

Market Implications: Reality Check Coming

The April production report triggered immediate bearish reactions in dairy markets. Class III milk and cheese prices dropped approximately 20 cents soon after release. Market volatility was evident, as “at one point Class III was limit up (+75 cents) after the spot session” before settling lower.

What makes this production boom particularly significant is that it’s being driven by multiple simultaneous factors: expanding herd size, improving yields, and rising component levels. This multi-pronged expansion creates sustained upward pressure on supply that could continue through mid-2025, potentially crushing producer margins if demand doesn’t keep pace.

Analysts project that “component-adjusted growth could remain above 2% through June” if current trends persist. This suggests the supply pressure in the market could intensify in the coming months.

The embedded momentum in the system—102,000 additional cows added in just 10 months, according to USDA—creates production inertia that will continue even if expansion decisions slow. These newly added cows will continue contributing to the milk supply for multiple lactation cycles, maintaining elevated production levels even if farmers pause further expansion.

Is the industry headed for another self-inflicted oversupply crisis? When milk production substantially outpaces domestic consumption growth and exports fail to absorb the difference, the result is predictable: inventory buildups, price pressure, and eventual margin compression that forces painful contractions. Have we learned nothing from the cyclical boom-bust patterns of the past two decades?

Your Strategic Response: Five Critical Adjustments

How should dairy farmers respond to this rapidly changing production landscape? Here are key considerations for producers looking to maintain profitability in this environment:

1. Make Components Your Production North Star

With component-adjusted production growing at double the rate of fluid volume (3.0% vs 1.5%), the economic return on component improvement has never been clearer. Stop fixating on tank volume and start obsessing over component yield. Evaluate your feeding program, genetic selection, and management practices focusing on fat and protein optimization.

DHIA records can be invaluable for identifying your highest component producers for breeding decisions. Consider strategic culling based not just on volume but on component production efficiency. A 65-pound cow producing 4.5% butterfat and 3.6% protein might be more profitable than an 85-pound cow with 3.5% fat and 3.0% protein, especially in component-based payment systems.

When did you last sort your herd list by fat and protein pounds rather than milk volume? If you’re still selecting primarily for milk volume in your breeding program, you’re fighting yesterday’s economic battle while your competitors focus on today’s profit drivers.

2. Understand Your Regional Vulnerabilities

The dramatic regional disparities in the April data highlight how local conditions increasingly determine dairy success. Texas producers face very different challenges and opportunities from those in Wisconsin or California.

Have you honestly assessed whether your region is a long-term winner or loser in this geographic redistribution? If you’re in a contracting region, what competitive advantages can you leverage to overcome the structural headwinds? If you’re in an expansion area, are you prepared for the inevitable infrastructure constraints and environmental scrutiny that follow rapid growth?

Areas to critically evaluate include:

- Local processing capacity trends and expansion plans

- Regional feed cost and availability projections

- Water access guarantees and regulatory trajectory

- Labor market stability and cost escalation

- Land base constraints and nutrient management limits

These factors are increasingly divergent across regions and will determine which areas can sustainably support continued growth. Many producers are making long-term capital investments based on outdated assumptions about regional competitiveness that the April USDA data directly contradicts.

3. Prepare for Price Pressure Now, Not Later

The sustained production expansion, particularly on a component-adjusted basis, creates the potential for inventory buildups and price pressure if demand doesn’t keep pace. Strategic risk management isn’t optional in this environment—it’s essential for survival.

Consider:

- Forward contracting opportunities through your co-op or private buyers

- Options strategies to protect downside risk

- Building financial reserves while margins remain positive

- Stress-testing your operation against potential Class III and component value scenarios

Are you budgeting based on the current milk price or the cost when your newest heifer group enters the milking string? The Federal Order system’s classified pricing means different producers will experience this market pressure differently. Understanding how your milk is utilized and priced becomes increasingly critical in this environment of growing supply.

4. Rethink Your Culling Strategy

The trend of slowed culling rates suggests that many producers retain older cows longer than usual due to favorable margins. While this maximizes short-term production, it could create vulnerability if margins tighten.

Are you keeping unprofitable cows in your herd because they’re still producing milk? Evaluate your culling decisions based on:

- Individual cow profitability accounting for component production

- Reproductive status and projected productive life

- Current beef market opportunities (cull cow prices remain historically strong)

- Replacement availability and costs

A clear culling strategy—rather than simply retaining all cows—will provide flexibility if market conditions change rapidly. This is the dairy equivalent of a crop farmer’s harvest strategy—knowing when to take profits rather than hoping for ever-higher yields.

5. Plan for H5N1 as Endemic, Not Temporary

While H5N1’s impact appears moderate, its continued presence creates ongoing risk. The experience in California shows how quickly production can be affected when disease challenges emerge.

Hoping H5N1 will simply disappear is not a strategy. Instead, develop comprehensive management protocols:

- Robust biosecurity measures beyond basic visitor logs

- Early detection systems and regular surveillance testing

- Staff training on disease identification and management

- Contingency plans for potential outbreaks, including segregation strategies

Have you calculated the economic impact of a 2% drop in herd productivity from subclinical H5N1 infection? For most operations, this “invisible” loss would significantly erode profitability. Yet, few have quantified this risk or developed specific mitigation strategies, despite the numerous cases documented by the USDA and reported in agricultural publications like The Bullvine.

The Bottom Line: Adapt or Be Left Behind

April’s milk production data from the USDA reveals an industry fundamentally transforming itself through geographic redistribution, component enhancement, and overall expansion. The 1.5% increase in raw volume—amplified to a 3.0% boost in component-adjusted terms—signals strengthening supply pressure that will challenge milk prices in the coming months.

The regional divergence in production performance—from Texas’s 10.6% surge to California’s ongoing struggles—highlights how local conditions increasingly determine dairy success. Producers must recognize that geography, processing capacity, and biological resilience now play outsized roles in determining competitive position.

The U.S. dairy landscape is evolving rapidly, with the dramatic growth in Texas and other Plains states shifting the center of gravity for American milk production. Traditional dairy regions like Wisconsin and the Pacific Northwest see their relative influence diminish as the Southern Plains emerges as the new growth engine.

For dairy farmers, now is the time to honestly reassess your strategic position in this changing environment:

- Are you optimizing for components or still chasing volume?

- Does your region have the infrastructure to support profitable dairy production in the long term?

- Are you prepared for the price pressure inevitably following this supply expansion?

- Have you developed a reproductive program to maintain herd size without retaining unprofitable cows?

- Is your operation structured to withstand the biological challenges that appear increasingly endemic?

The winners in this new environment won’t necessarily be the largest producers, but rather those who best align their operations with the emerging realities of America’s restructured dairy map. The geographic revolution beneath the surface of these production numbers will reshape competitive dynamics for years to come.

Take a hard look at where your operation fits in this changing landscape. Are you positioned in a growth region with the right cows producing the right components for your market? Or are you holding onto outdated production models in regions facing structural decline?

The April production report isn’t just another data point—it’s a roadmap to the industry’s future. Those who read it correctly and adjust accordingly will thrive. Those who dismiss it as just another monthly fluctuation may wonder why their business model no longer works in an industry that’s moved on without them.

What specific change will you implement this month to align your operation with these emerging realities? Your answer to this question may determine whether you’re leading this transformation or being left behind by it.

Learn more:

- Behind The Numbers of April’s Milk Production Report: This article provides context from the previous month’s (March 2025) production report, highlighting early signs of herd expansion, component value outpacing volume, and the initial impacts of HPAI, setting the stage for the April surge.

- U.S. Dairy Supply Surge: USDA Forecasts Higher Production & Mixed Price Outlook Through 2026: This piece offers a longer-term perspective on production trends and price forecasts, discussing how the current surge fits into broader USDA projections for the coming years and the potential impacts on dairy farm revenues.

- Discover How U.S. Cows Are Shattering Milk Production Records: This article delves into the historical context of U.S. milk production efficiency, explaining the factors like genetics, technology, and management practices that have led to significant increases in per-cow output and butterfat levels over the decades, providing background to the current productivity gains.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!