How is bird flu impacting dairy farmers and milk production? What critical insights does the latest USDA report reveal about regional declines? Read on to find out.

Have you ever considered how avian flu may affect your dairy operations? It may initially seem unlikely, but the most recent USDA production report shows an unexpected relationship. Milk output in the 24 central states fell by 0.2% in July 2024 compared to the previous year, but this is more than simply a blip in the data. It’s also a story of regional issues and extraordinary consequences, especially in places hard impacted by avian flu epidemics. Could the viral outbreak, which seems to be unrelated to dairy farms, have a part in these numbers?

According to the USDA, “the number of milk cows on farms in the United States was 9.33 million head, 43,000 less than in July 2023, but 5,000 more than in June 2024” [USDA Report].

As we examine these figures, it becomes clear that areas such as Colorado, Idaho, and other states that have had both bird flu outbreaks and significant losses in milk production are suffering the weight of numerous agricultural strains. How does this interwoven influence play out, and what does it imply for your dairy farm? Let’s look at the shocking impact of avian flu on our beloved dairy business.

The USDA Report Unveils a Double-Edged Sword for Dairy Farmers

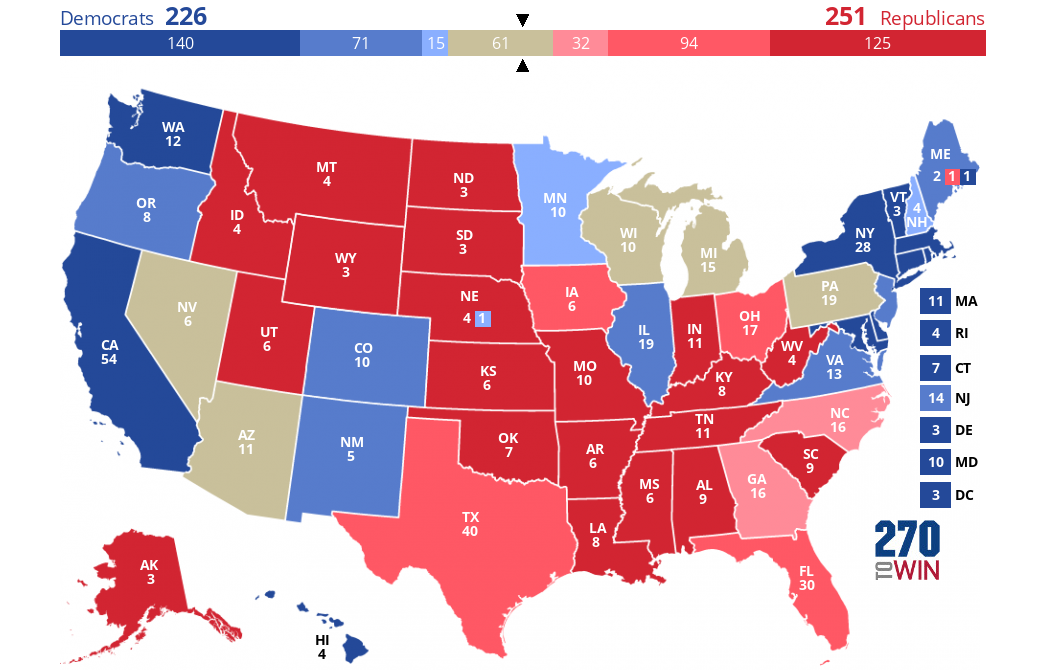

According to the most recent USDA study, dairy producers face significant challenges. Milk output in the 24 central states fell by 0.2% in July compared to the previous year. This loss was more critical nationally, with milk output falling by 0.4%.

Despite these decreases, it is crucial to recognize certain good elements. In July, output per cow in the 24 central states grew marginally by 2 pounds compared to July 2023. However, this was insufficient to offset the overall decrease in production.

The number of dairy cows also reduced. In July, the 24 primary states had 8.88 million cows, 31,000 less than the previous year. Milk cows totaled 9.33 million nationwide, a 43,000 decrease from July 2023.

These data illustrate the dairy industry’s continued struggles. The minor rise in output per cow demonstrates some efficiency advantages, but the overall decline in cow number and milk production suggests possible difficulties that must be addressed.

Regional Analysis: Where Bird Flu Hits Hardest

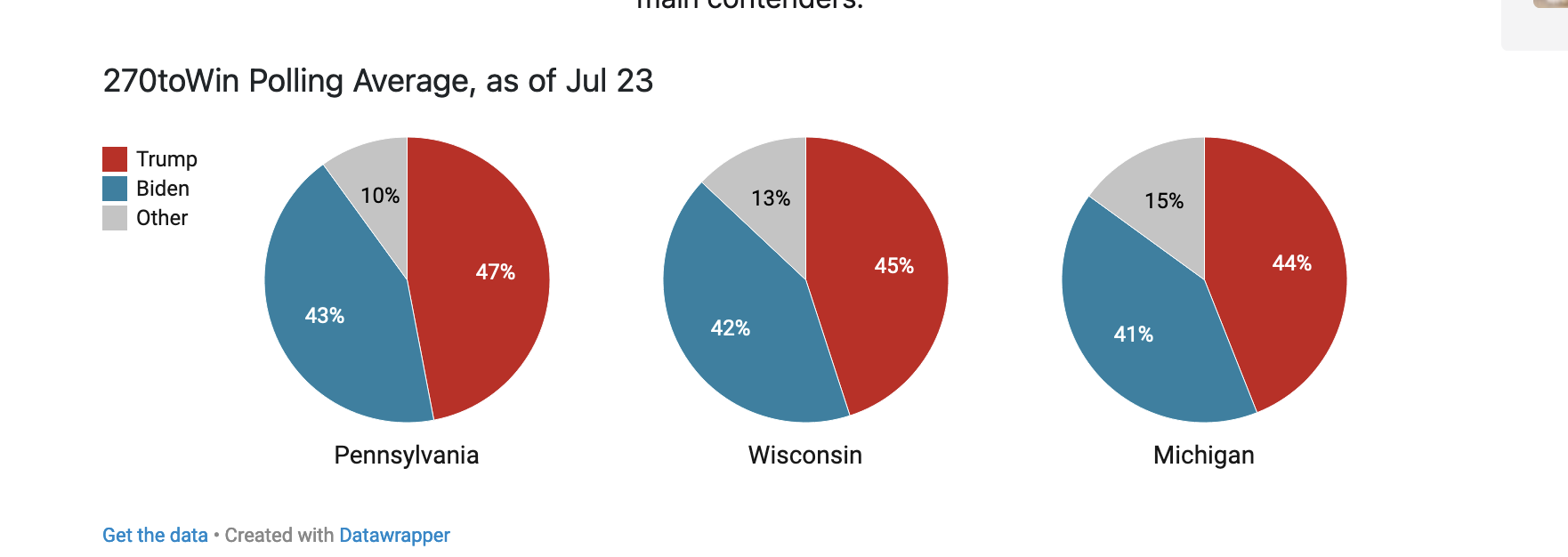

Our investigation finds a remarkable link between areas highly affected by avian flu and significant losses in milk output. States like California, Minnesota, and New Mexico have suffered substantial consequences for their dairy industries.

Colorado

The USDA estimate predicts a significant increase in Colorado milk output from June 2023 to June 2024. In June 2023, Colorado dairy farms generated 438 million pounds of milk. However, revised month-over-month figures reveal a 3.7% decline in output, which is more substantial than the previously reported 1.1%. Colorado has witnessed an increase in bird flu infections, with 64 herds reported, especially in the northern and eastern districts.

Idaho

Milk output in Idaho fell sharply between June 2023 and June 2024. The output per cow declined from 2,145 pounds to 2,095 pounds, while total milk production decreased from 1,437 million pounds to 1,397 million pounds. This 2.8% reduction, corrected from an initial -1.0%, may be related to avian flu cases in dairy cows, with 30 herds testing positive for bird flu.

Michigan

Michigan saw a decline in milk production when comparing June 2023 to June 2024. In June 2023, the state’s dairy farms produced 1,012 million pounds of milk. However, by June 2024, production dropped to 994 million pounds, marking a decrease of approximately 1.8%. Bird flu has exacerbated these challenges in Michigan. Twenty-seven herds in the state tested positive for bird flu during this period, contributing significantly to the production decline.

Iowa

Iowa produced 497 million pounds of milk from a herd of 240,000 cows in June 2023, but this figure fell slightly to 489 million pounds in June 2024 despite a minor rise in herd size to 242,000. This 1.6% decline in output contrasts sharply with the USDA’s original estimate of a 1.2% increase. Bird flu has taken its toll, with the state reporting 13 herds affected.

Minnesota

Minnesota also saw a drop in milk supply, presumably due to bird flu problems. The state’s output in July 2024 was 866 million pounds, down 4.0% from 902 million pounds in July 2023. Such a reduction highlights the severe consequences of the ongoing avian influenza pandemic, with nine herds reported.

New Mexico

The consequences in New Mexico are much more apparent, with a sharp drop in output. According to estimates for June 2024, milk output declined by 12.5%, from 550 million pounds in June 2023 to 481 million pounds in June 2024. This state has one of the highest bird flu reports at eight herds, considerably impacting dairy output.

Texas

The only outlier in these states is Texas, with milk production in Texas seeing a 3.1% growth rate. This comparison highlights resilience and the ongoing need for strategies to mitigate broader industry challenges [USDA Report]. However, the forecast for Texas dairy production in the upcoming months presents a more complicated picture due to ongoing bird flu concerns.

Data highlight the critical need for comprehensive actions to combat the spread of avian flu, maintain poultry health, and protect dairy producers’ livelihoods in these impacted areas.

Proactive Strategies for Dairy Farmers Amid Bird Flu Crisis

The avian flu outbreak necessitates dairy producers using proactive methods to protect their farms. First and foremost, supply networks must be diversified. Establish partnerships with numerous sources for feed and other essentials so that others may cover the void if one source fails. This lowers reliance on a single provider, which is susceptible to epidemics.

Improving biosecurity measures may be an essential line of defense against avian flu. Simple efforts, such as restricting farm access to needed staff, disinfecting equipment regularly, and installing footbaths at animal area entrances, may make a significant impact. It’s also a good idea to keep a closer eye on cattle health, allowing for faster isolation and treatment of any problems.

Another method is to seek financial aid to mitigate economic damage. Investigate government programs and subsidies, such as those granted by the USDA, to provide financial assistance during interruptions. These programs often have particular qualifying requirements, so staying current on what is available and applying as soon as possible is critical.

Here are some actionable tips:

- Establish a contingency plan outlining steps to take if bird flu is detected nearby.

- Train staff on updated biosecurity protocols to ensure everyone understands and follows best practices.

- Consider insurance options that cover losses due to disease outbreaks.

- Stay connected with local agricultural extension offices or industry groups for the latest updates and support.

- Maintain detailed records of livestock health to identify and respond to any warning signs quickly.

By incorporating these strategies, dairy farmers can better prepare for and mitigate the impact of bird flu on their operations, ensuring continued productivity and stability.

The Bottom Line

Dairy producers must grasp the most recent USDA data and the geographical effect of avian flu on milk output. This information allows you to make educated judgments and alter methods as necessary. We’ve seen how states like Idaho and Colorado, as well as other states, face particular issues due to avian flu and declining milk output.

The value of biosecurity measures cannot be emphasized. Pasteurization, donning protective equipment, and keeping up to date on bird flu outbreaks can protect your herd and your company.

The USDA study emphasizes the need for adaptation and resilience. Staying informed and proactive is more important than ever before. As Alan Bjerga of the Federation’s Industry Relations points out, strict safety standards are critical in light of the H5N1 pandemic.

So, how will you change your dairy operations to address these challenges? Staying ahead in these unpredictable times requires a scientific, vigilant, and proactive approach.

Summary: The article explores the dual challenges dairy farmers face amid recent USDA reports indicating a drop in milk production and regions heavily impacted by bird flu. It underscores the need for enhanced biosecurity to control virus spread and proactive strategies for dairy farmers. Milk output in 24 states fell by 0.2% in July 2024 compared to the previous year, with significant losses in Colorado, Idaho, and Michigan, while Texas saw a 3.1% increase.

- USDA reports reveal a 0.2% decline in milk production in 24 states for July 2024 compared to the same month last year.

- Colorado, Idaho, and Michigan experienced significant losses in milk output, contrasting with a 3.1% increase in Texas.

- The spread of bird flu has heavily impacted several regions, highlighting the need for enhanced biosecurity measures.

- The dairy industry faces challenges from both avian influenza and declining milk production, necessitating proactive strategies.

- Addressing health crises in both avian and dairy farming sectors is essential to ensure industry stability and public health safety.