Discover how Trump’s policies could shape the future of US dairy. Are tariffs and labor changes a risk to your farm?

Could the resurgence of Trump’s hardline trade and immigration policies upend the balance that US dairy farmers have worked so diligently to maintain? With Trump’s second presidency, the stakes are higher than ever for the dairy industry—a cornerstone of American agriculture. “The moment we let our guard down, the ripple effects of trade wars and labor shortages could push us to the brink,” warns Tony Rice, USDEC trade policy director. From looming hefty tariffs on exports to potential crackdowns on immigrant labor, these policies aren’t just political maneuvers; they threaten the delicate dynamics of the US dairy sector. Dairy professionals nationwide brace for disruptions affecting everything from market access to daily operations. The key to overcoming these challenges lies in proactive measures. Are we prepared for these challenges, or will we face uncertainty at a crossroads?

The ‘America First’ Trade Gamble: Is the Past a Prelude to the Future for USDairy?

In President Trump’s first term, the ‘America First’ trade approach was a double-edged sword for the US dairy industry. While it aimed to bolster domestic producers, it also led to significant challenges, mainly through the imposition of tariffs.

Take, for example, the retaliatory tariffs placed by China on US dairy exports. As Tony Rice, USDEC trade policy director, pointed out, these tariffs on cheese, whey products, and milk powders reached 25% to 27.5%. This severely impacted US dairy exporters, who had begun to find promising markets in China.

Throughout Trump’s first term, US dairy exports notably faced ‘mixed results.’ While the ‘America First’ stance sought to create new opportunities, the immediate fallout from tariff wars was challenging to ignore. Dairy products like lactose and whey protein concentrate, although lower in tariffs (5%—10 %), still faced hurdles that complicated international market access.

Yet, it wasn’t all bleak. There were strategic wins, such as negotiations that led to the China Phase One Agreement, which, according to Rice, tackled non-tariff barriers for dairy. This agreement opened doors by suspending some retaliatory tariffs, albeit with a lingering threat of their return.

Nevertheless, weighing these dual outcomes is crucial, considering a potential rerun of these policies. The health of the dairy industry hinges on navigating this complex trade landscape and finding a balance between maintaining market access and protecting domestic interests. Will history repeat itself, or is there room for a more nuanced approach?

The Tightrope of Trade: Balancing Growth and Challenge in US Dairy Exports

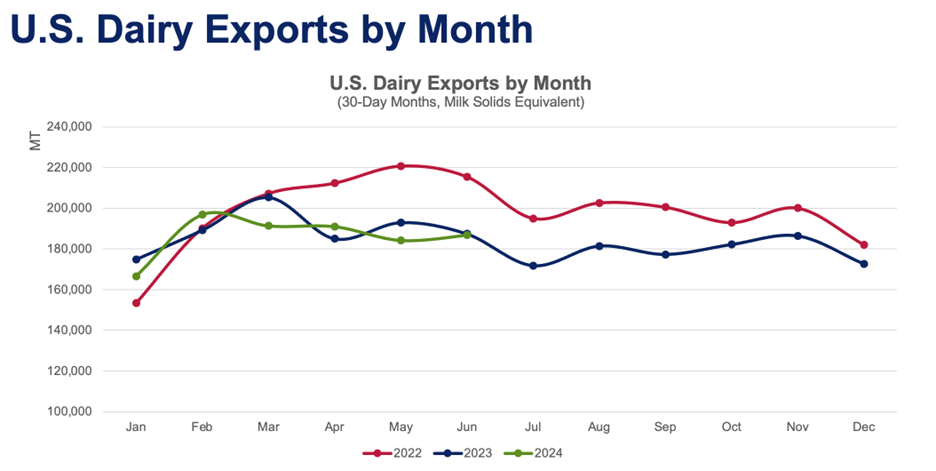

The US dairy export landscape, a critical aspect of the agricultural economy, remains robust yet fraught with challenges. As of September 2024, dairy exports have experienced slight growth compared to the previous year, with cheese and dry whey products showing notable increases of 19% and 9%, respectively. However, nonfat and skim milk powder exports have declined by 6%.

With Trump at the helm for another term, trade policies could veer toward aggressive tariff negotiations similar to those of his first administration. Renewed talks with China and the EU could be on the cards, opening doors to better access or grappling with retaliatory measures reminiscent of past trade wars. China, a vital market, had previously imposed steep tariffs on US dairy – a scenario that might reemerge if negotiations take a wrong turn.

Relations with Canada remain complicated. The dispute over Canada’s dairy import quotas continues to be thorny. US dairy stakeholders are eager for a resolution that favors American exports. Trump’s penchant for renegotiation could bring new dynamics to this northward relationship.

On the prospects of new markets, Trump’s administration might rekindle talks with the UK and explore further opportunities in Southeast Asia, regions previously highlighted for their potential. Given their growing demand for dairy products, Southeast Asia, particularly Indonesia and Vietnam, offers fertile ground for expanding US dairy’s footprint. These markets should improve in the forthcoming years.

A Fragile Backbo, they could become pivotal for U.S. dairy: The Immigrant Labor Dilemma in US Dairy.

In the heart of the US dairy industry lies an often-overlooked yet critical backbone: immigrant labor. According to National Milk Producers Federation research, immigrants comprise more than half of the workforce, accounting for 51% of dairy labor. Their contribution is staggering: Dairies that employ immigrant labor produce a whopping 79% of the US milk supply. But what happens if these vital workers are no longer available due to stringent immigration policies?

Under Trump’s administration, the focus has been on deporting undocumented immigrants—a move that could spell disaster for labor-reliant sectors like dairy. Suppose these policies lead to a labor exodus. In that case, the National Milk Producers Federation warns of dire consequences: a reduction of the US dairy herd by 2.1 million cows, a drop in milk production by nearly 50 billion pounds, and the shuttering of over 7,000 farms. This domino effect would not just touch those directly involved but echo through the economy, possibly driving retail milk prices up by 90.4% and slicing the US economic output by $32.1 billion, with over 200,000 jobs on the line.

Joseph Glauber, a senior research fellow at the International Food Policy Research Institute, sheds light on the complexities of immigration reform. “Immigrants supply at least half of fired labor for the dairy industry,” Glauber notes. Yet, the dairy sector cannot tap into temporary worker programs designed for time-bound harvest tasks, as dairy demands year-round labor. This regulatory gap underscores the urgent need for tailored immigration reform—a politico-economic terrain fraught with division. As Glauber puts it, historical attempts to pass reform have been thwarted by partisan opposition over broader immigration issues, leaving sectors like dairy in a lurch.

A hardline stance on immigration threatens to disrupt the labor supply. It also risks altering the participants’ perceptions of the US as a viable workplace, potentially driving operational costs up due to wage inflation. This precarious balance requires thoughtful policy tailoring. With it, the US dairy industry can handle a labor shortage and an existential challenge.

Riding the Seismic Waves: Navigating the Economic Shocks to US Dairy

The economic ripples from trade and immigration policies under a renewed Trump administration could potentially churn the already tumultuous waters of the US dairy industry. Imposing high tariffs on key trading partners like China and Mexico might be a short-term bump and a long-lasting tremor threatening the industry’s economic stability. Any disruption in these established trade relationships could mean a significant loss of market share, especially in high-demand regions dependent on US exports, further exacerbating price volatility across the sector.

Even a slight tremor can send shockwaves from producers to consumers in the intricate web of the global dairy supply chain. With its deeply integrated supply networks, the North American market is particularly vulnerable to potential trade barriers. Tariffs could unravel these intricate networks, leading to logistical challenges, increased delivery times, and a spike in operational overheads. This would pressure US exporters to remain competitive, potentially necessitating cuts elsewhere, including in labor.

Speaking of labor, the backbone of US dairy heavily leans on immigrant workers. Should the Trump administration enforce stringent immigration reforms targeting undocumented labor, the dairy industry might be shorthanded. This shortage wouldn’t just slow production but push wage demands higher, further straining dairy farmers’ already tight profit margins. Compounded by potential tariff escalations and retaliatory trade policies, operational costs for dairies could see a notable increase, which might get passed down to the consumer, potentially impacting milk prices at the retail level.

The cumulative effect of these factors paints a sobering picture for the sector. It’s a complex chain reaction: tariffs disrupt exports, leading to potential market losses and supply chain chaos, while immigration policies strain labor availability and hike operational costs. For US dairy farmers, these policy paths could signify turbulence and a seismic shift needing strategic pivots to sustain the industry’s growth and profitability. The stakes are high—dairy leaders and policymakers must consider these potential economic impacts carefully to prevent a downturn in one of America’s core agricultural sectors.

The Bottom Line

As we unravel the complexities of Trump’s trade and immigration policies, it becomes increasingly clear that the US dairy industry is poised for uncertainty and potential disruption. From the intricate dance of international trade agreements to the integral role of immigrant labor, these factors cast a long shadow over the industry’s stability.

We must ask ourselves: Are we prepared to navigate the turbulent waters of a trade war with key partners like China and Mexico? How will the tightening grip on immigrant labor reshape the workforce essential to dairy production? The possibility of increased tariffs demands our immediate attention and strategic foresight to ensure the long-term viability of our efforts.

As industry stakeholders, we must actively engage in dialogue and advocate for policies that protect and promote our interests. Should we not leverage our collective voice to drive meaningful immigration reform and negotiate fair trade agreements? Our actions today will set the course for the future of dairy in America.

I challenge you to ponder these questions: What proactive measures can we implement to fortify our industry’s foundation? How can we foster resilience amidst political and economic shifts? Let us not only reflect but also act, for the welfare of US dairy is in our hands.

Key Takeaways:

- Trump’s second term, marked by aggressive trade and immigration policies, raises concerns for the US dairy industry.

- Retaliatory tariffs from significant trading partners like China and Mexico could hurt US dairy exports, threatening market access and stability.

- Trade actions targeting China, Mexico, and Canada may disrupt established supply chains, causing price fluctuations and market shares.

- Dairy’s dependence on immigrant labor makes it vulnerable to potential labor shortages amid Trump’s immigration policies.

- Efforts for immigration reform are complex and unlikely to be quickly resolved despite their significance for maintaining labor force stability in dairy.

Summary:

Donald J. Trump’s reelection has spurred anticipation among U.S. dairy farmers and industry professionals, with concerns over his assertive trade and immigration policies. His approach has historically been double-edged, offering both opportunities and turbulence. Retaliation from China on American cheese and whey with tariffs up to 27.5% demonstrated the impacts of his ‘America First’ policies. However, agreements like China’s Phase One have also partially suspended these barriers. As of September 2024, U.S. dairy exports are slightly up, with cheese and whey products growing, though nonfat and skim milk powder exports have dipped by 6%. With renewed talks with China and the EU on the horizon, experts like Tony Rice from the US Dairy Export Council caution about future reprisals while hoping for improved market access. Meanwhile, Trump’s immigration stance could lead to a drastic labor shortage in the dairy sector. It relies on immigrant labor for 51% of its workforce, potentially reducing the U.S. dairy herd, cutting production, and shutting down over 7,000 farms.

Learn more:

- American Dairy Farmers Grapple with Trade War and Immigration Policies: The Fight to Stay Afloat

- Trump vs Biden: Who is the Best Presidential Choice for Dairy Farmers?

- U.S Dairy Industry Pushes for Enhanced Trade Policies to Boost Exports and Strengthen Supply Chain

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!