In a stunning reversal, the Trump administration is scrambling to rehire USDA experts crucial to combating the worst bird flu outbreak in U.S. history. Accidental firings have left the agency short-staffed as H5N1 ravages poultry flocks, infects dairy cows, and sends egg prices soaring. Can they contain the crisis?

The Summary:

As the USDA races against time to rebuild its depleted workforce, this incident is a stark reminder of the delicate balance between government efficiency and public health preparedness. The accidental firing of key personnel has exposed critical vulnerabilities in the nation’s ability to respond to zoonotic threats, potentially jeopardizing food security and public safety. For dairy farmers and the agricultural industry, this crisis underscores the importance of robust biosecurity measures and the need for a well-staffed, expertly coordinated federal response to emerging diseases. As H5N1 continues to evolve and spread, the coming weeks will be crucial in determining whether the USDA can regain its footing and effectively contain this outbreak. The lessons learned from this staffing debacle must inform future policy decisions to ensure that cost-cutting measures don’t come at the expense of our ability to protect both human and animal health in the face of increasingly complex global health challenges.

Key Takeaways:

- The Trump administration accidentally fired several USDA officials critical to the bird flu (H5N1) response during mass layoffs.

- The USDA is scrambling to rehire these experts as the worst bird flu outbreak in U.S. history continues to spread.

- Over 23 million poultry birds have been culled since 2022, and the virus has infected dairy cows in 16 states.

- Egg prices have hit a record high of $4.95 per dozen due to the outbreak.

- The Department of Government Efficiency (DOGE), led by Elon Musk, orchestrated the federal workforce reductions that led to the accidental firings.

- 25% of staff at the National Animal Health Laboratory Network (NAHLN) program office were terminated.

- The firings have left critical gaps in outbreak surveillance, testing, and data management capabilities.

- 68 human cases of H5N1 have been confirmed, including one death, though the CDC still rates the public health risk as “low.”

- The incident has drawn bipartisan criticism and raised concerns about the impact of aggressive cost-cutting on public health preparedness.

- The USDA faces challenges in quickly reinstating fired personnel and maintaining practical outbreak response efforts.

The Trump administration attempts to reverse course after accidentally firing U.S. Department of Agriculture (USDA) staff critical to containing the worst bird flu outbreak in U.S. history. Over 23 million poultry birds have been culled since 2022, dairy cows in 16 states tested positive for H5N1 avian influenza, and egg prices hit a record $4.95/dozen as the USDA confirmed it mistakenly terminated “several” outbreak response personnel during mass layoffs orchestrated by Elon Musk’s Department of Government Efficiency (DOGE). The agency now faces bipartisan criticism for jeopardizing food security while scrambling to rehire veterinarians, lab technicians, and emergency response specialists.

A “Public Safety” Crisis in the Making

The USDA acknowledged Tuesday that positions supporting the Highly Pathogenic Avian Influenza (HPAI) response were “accidentally” included in DOGE’s sweeping federal workforce reductions. A spokesperson confirmed the agency is “working to swiftly rectify the situation and rescind those letters” sent over Presidents’ Day weekend.

Among those fired:

- 25% of staff at the National Animal Health Laboratory Network (NAHLN) program office, which standardizes testing across 58 U.S. animal disease labs

- Emergency response veterinarians coordinating containment measures on poultry and dairy farms

- Data managers tracking viral mutations critical for vaccine development

Keith Poulsen, director of the Wisconsin Veterinary Diagnostic Laboratory, warned:

“They’re the front line of surveillance for the entire outbreak. If you remove all the probationary staff, you eliminate the capacity to do the work.”

Systemic Failures in Workforce Cuts

The mishap highlights structural flaws in DOGE’s aggressive downsizing campaign, which has eliminated thousands of federal jobs since January 2025 through a private consultant-led review process. Internal USDA communications reveal:

- No Public Health Safeguards: DOGE’s algorithm targeted positions based on budgetary metrics without input from USDA epidemiologists or veterinarians.

- Communication Breakdown: Terminated NAHLN staff received automated emails notifying them of their firing, and some are still awaiting official reinstruction notices.

- Critical Expertise Lost: At least 28 researchers were dismissed at the National Bio and Agro-Defense Facility (NBAF) in Kansas, including a lead avian flu response coordinator.

Republicans on the House Agriculture Committee privately urged the administration to pause cuts, fearing they’d “hinder the avian flu response”. Rep. Don Bacon (R-NE) criticized DOGE’s approach:

“There’s an old saying: ‘Measure twice, cut once.’ They’re measuring once and having to cut twice. Many of these decisions will need to be reversed.”

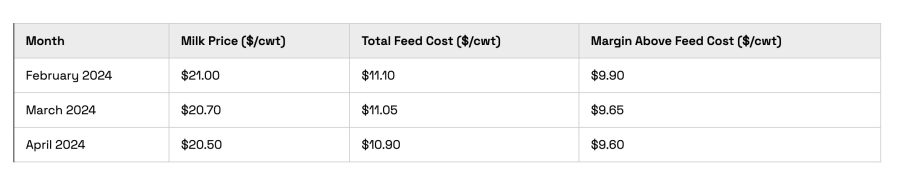

Dairy Industry Implications

The staffing chaos couldn’t come at a worse time for dairy farmers. H5N1 has infected over 90 dairy herds since March 2024, causing:

- 10-20% drops in milk production per infected cow

- Quarantines delaying shipments of replacement heifers

- Rising feed costs as corn prices spike 18% YoY

While the CDC maintains the public health risk remains “low,” 68 human cases have been confirmed—primarily among poultry and dairy workers—with one fatal encephalitis case in Louisiana.

A Pattern of Precarious Priorities

This marks the second major staffing debacle under DOGE’s watch. Last week, the National Nuclear Security Administration struggled to rehire 300 mistakenly terminated nuclear safety engineers. Agriculture Secretary Brooke Rollins, confirmed in January 2025, has faced scrutiny for her delayed response to the crisis despite pledging to make HPAI a “top priority”.

The administration’s new strategy of prioritizing poultry vaccinations over mass culling adds complexity. At the same time, the USDA approved an updated H5N1 vaccine in January 2025, but only 12 million doses are available—enough for 5% of the national flock.

The Bottom

As the USDA races to rebuild its outbreak response team, the incident exposes a fatal flaw in treating public health infrastructure like a corporate balance sheet. With H5N1 now endemic in wild birds and spilling over into mammals, sustained expertise—not just emergency funding—will determine whether the U.S. contains this crisis or faces a full-blown pandemic.

The lesson for dairy producers is clear: Monitor herd health vigilantly, enforce strict biosecurity protocols, and advocate for USDA reforms that protect livestock and the specialists tasked with defending our food supply.

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!