Uncover how surging milk prices and decreased feed costs are enhancing dairy profitability. Interested in the freshest trends in milk production and inventory? Dive in to learn more now.

The dairy market witnessed a significant upturn in May, attributed to the rise in milk prices and the decrease in feed costs. This has led to a boost in profitability for dairy producers. Despite milk production still trailing behind last year, the gap is gradually closing, indicating a path to recovery. The USDA’s latest reports, being a reliable source, provide crucial insights that can potentially shape the dairy market.

- Dairy margins improved in late May.

- Milk production dropped 0.4% from last year, the smallest decline in 2023.

- Weaker feed markets lowered costs.

These factors are setting the stage for improved profitability. Farmers, demonstrating their adaptability, are strategically extending coverage in deferred marketing periods to maximize these gains. Grasping these changes is of utmost importance in navigating the evolving dairy margin landscape.

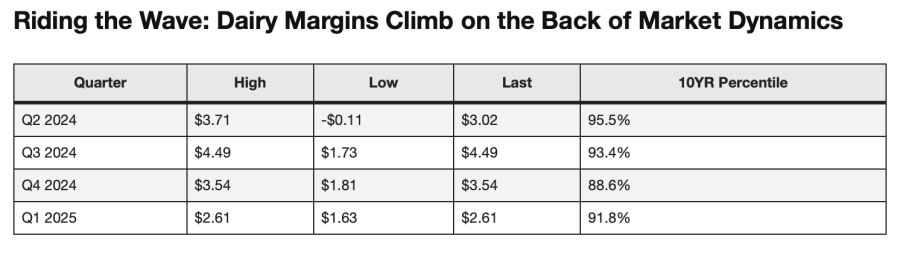

Riding the Wave: Dairy Margins Climb on the Back of Market Dynamics

Dairy margins have experienced notable improvements, especially towards the end of May. Apart from the spot period in Q2, ongoing rallies in milk prices coupled with declines in feed market costs have significantly bolstered profitability for dairy producers. This positive shift in margins can be traced back to several market dynamics that have unfolded over the past month.

Steadying the Ship: Signs of Stability in Milk Production Trends

| Month | Milk Production (billion pounds) | Year-over-Year Change (%) | Dairy Herd Size (million head) |

|---|---|---|---|

| February 2023 | 17.925 | -0.8 | 9.36 |

| March 2023 | 18.945 | -0.7 | 9.35 |

| April 2023 | 19.135 | -0.4 | 9.34 |

| March 2023 (Revised) | 18.945 | -0.7 | 9.36 |

| April 2024 | 19.135 | -0.4 | 9.34 |

Milk production trends show a continued year-over-year decline, but the gap is narrowing, hinting at stability. The USDA’s April report recorded 19.135 billion pounds of milk, a slight 0.4% drop from last year. This is the smallest decline in 2024, indicating that production levels may stabilize.

The USDA also revised March data, showing a 0.7% decrease compared to the reported 1.0%. This revision suggests that the production landscape might be improving. While still below last year’s levels, these updates point to a possible upward trend.

Adapting to Market Pressures: Implications of the Changing U.S. Dairy Herd

The dynamics of the U.S. dairy herd tell of broader milk production trends and market conditions. The USDA reported a reduction from 9.348 million dairy cows in March to 9.34 million in April, marking an 8,000-head decline. Year-over-year, the herd is down by 74,000 cows.

These figures underscore a contraction in the dairy herd, a crucial aspect for comprehending market dynamics. A revision of March’s data revealed the herd was more significant than initially reported, indicating dairy producers are adapting to market pressures for sustainability and profitability.

Contrasting Fortunes: Dramatic Spike in Butter Stocks versus Modest Cheese Inventory Growth

| Product | April 2023 (lbs) | March 2024 (lbs) | April 2024 (lbs) | Change from March to April 2024 (lbs) | Change from March to April 2024 (%) |

|---|---|---|---|---|---|

| Butter | 331.7 million | 317.3 million | 361.3 million | 44 million | 13.9% |

| Cheese | 1.47 billion | 1.45 billion | 1.46 billion | 5.6 million | 0.4% |

According to the USDA’s April Cold Storage report, butter inventories notably increased. As of April 30, there were 361.3 million pounds of butter in storage, up 44 million pounds from March – the most significant jump since the pandemic. This rise indicates strong domestic production outpacing demand, with stocks now up 9% from last year, highlighting consistent growth in 2024.

Conversely, the cheese market experienced milder growth. Cheese stocks rose by only 5.6 million pounds from March to April, totaling 1.46 billion pounds by the end of April, down 0.6% from last year. This limited increase is mainly due to a surge in cheese exports this spring. However, with U.S. cheese prices losing global competitiveness, these exports may slow down, potentially changing this trend.

Export Dynamics: The Balancing Act of U.S. Cheese Inventory

| Year | Cheese Exports | Price Competitiveness | Key Markets |

|---|---|---|---|

| 2020 | 800 million lbs | High | Mexico, South Korea, Japan |

| 2021 | 850 million lbs | Moderate | Mexico, South Korea, Canada |

| 2022 | 900 million lbs | High | Mexico, China, Japan |

| 2023 | 950 million lbs | Moderate | Mexico, South Korea, Australia |

| 2024 | 500 million lbs (estimated) | Low | Mexico, South Korea, Japan |

Cheese exports have significantly influenced U.S. cheese inventories this spring. Increased exports have helped manage domestic cheese stocks despite high production levels. However, with U.S. cheese prices losing their competitive edge onthe global market, exports will likely slow. This may result in growing domestic cheese stocks, presenting new challenges for inventory management.

Looking Ahead: Promising Outlook for Dairy Margins

Looking ahead, dairy margins show promise. In Q2 2024, margins ranged from -$0.11 to a high of $3.71, with the latest at $3.02, in the 95.5th percentile over the past decade. This is a solid historical position. For Q3 2024, margins vary from $1.73 to $4.49, currently at the high end of $4.49, in the 93.4th percentile. This suggests continued profitability. Q4 2024 sees more variability, with margins from $1.81 to $3.54, currently at $3.54, in the 88.6th percentile. Lastly, Q1 2025 shows a slight dip with margins from $1.63 to $2.61, but still favorable at the 91.8th percentile. These figures depict an optimistic outlook for dairy margins in the coming quarters, driven by solid milk prices and stable feed costs.

The Bottom Line

Due to rising milk prices and weakening feed markets, recent market dynamics have boosted dairy margins. Despite a year-over-year drop in milk production, USDA data revisions show smaller declines and changes in dairy herd numbers. Butter and cheese inventory trends emphasize the importance of diligent market monitoring.

Understanding these margins and staying informed is crucial for dairy producers. Fluctuations in butter and cheese stocks highlight the industry’s ever-changing landscape. Extending coverage in deferred marketing periods can offer strategic advantages.

Stay ahead by monitoring industry reports like the CIH Margin Watch report. For more information, visit www.cihmarginwatch.com. Adapting to market changes is critical to sustaining profitability in the dairy industry.

Key Takeaways:

- Improved Dairy Margins: Late May witnessed a significant rise in dairy margins as milk prices rallied and feed costs dropped.

- Milk Production Trends: Though milk production is still down compared to last year, the rate of decline is slowing, signaling a move towards stability.

- USDA Reports: April figures showed a smaller-than-expected decrease in milk production and larger inventories of butter, while cheese inventories grew at a slower pace.

- Future Margins: Projections show promising dairy margins through the end of 2024 and into early 2025, suggesting sustained profitability for dairy farmers.