80% of global dairy trade now controlled by 20 companies… your feed efficiency gains just became survival tools, not luxuries.

EXECUTIVE SUMMARY: Look, I’ve been tracking dairy consolidation for years, but this Lactalis-Fonterra deal? It’s different. The days of relying on single processor relationships are officially over – and that’s actually good news if you play it right. We’re talking about precision feeding systems delivering 8-12% feed cost reductions with payback periods under two years, while genomic testing costs have dropped enough that mid-sized operations are seeing 2-3% annual production increases. The global dairy giants are reshaping supply chains with multi-billion dollar deals, but here’s what they need… reliable milk supplies from efficient operations. Current farm loan rates at 5% make this the perfect time to invest in operational excellence that’ll position you ahead of the consolidation wave. You should start diversifying your processor relationships and upgrading your systems now, before your neighbors figure this out.

KEY TAKEAWAYS

- Diversify your buyer options immediately – Operations maintaining 3 processor relationships are keeping margins above regional averages even as consolidation accelerates. Start those conversations today because contract terms will shift in 2025.

- Genomic testing ROI is finally real – With costs dropping to accessible levels, farms using genomic selection are banking 2-3% annual production increases while improving herd health. Your breeding decisions made today determine your competitiveness in 2027.

- Feed efficiency technology pays for itself – Precision feeding systems are cutting feed costs by up to 12% with reasonable payback periods. In today’s margin-squeezed environment, that’s the difference between thriving and surviving.

- Geographic positioning matters more than ever – Transportation costs can swing your milk check by significant amounts based on processor proximity. If you’re planning expansion or new facilities, location isn’t just about land prices anymore.

- Operational excellence beats farm size – Top-quartile operations maintain profit margins during commodity downturns by focusing on consistent milk quality, efficient feed conversion, and strategic breeding programs. The market rewards efficiency over acreage.

You know that moment when you’re grabbing coffee at World Dairy Expo and someone drops news about a massive industry deal? That sinking feeling of “what does this mean for the rest of us”? Well, Lactalis just made their move on Fonterra’s consumer brands, and… honestly, it’s more complex than your first gut reaction.

What’s Actually Going Down Here

So the French dairy powerhouse—and man, these guys are absolutely massive—just got approval to scoop up Fonterra’s crown jewels: Anchor, Mainland, and Perfect Italiano. But here’s what really gets me about this deal… it’s not just about slapping different labels on milk jugs.

What strikes me is how this fits into something much bigger. According to recent work from Rabobank’s Global Dairy Top 20 analysis, Lactalis is essentially buying control over significant processing capacity and—this is the kicker—the distribution networks that move dairy products across Oceania. When you control the infrastructure, you control the game.

The Australian Competition and Consumer Commission gave this the green light just today, actually. July 10th. But regulatory approval? That’s just paperwork. The real story is what this means for milk pricing from Auckland to Wisconsin… and everywhere in between.

This development is fascinating because it’s happening at a time when we’re finally seeing feed costs stabilize after the chaos of 2022-2023. But energy costs and labor shortages? Still eating into everyone’s margins. Producers are feeling this squeeze from the Central Valley to the North Island.

The Numbers That Keep Me Up at Night

Let’s discuss the current market reality for a moment. The top 20 companies in the dairy industry now control approximately 80% of internationally traded products. That concentration isn’t slowing down… it’s accelerating like a fresh cow bolting from the holding pen.

What’s particularly noteworthy is how this highlights something we’ve been seeing for years—cooperatives face inherent capital constraints when competing against corporations with access to global capital markets. Lactalis has a revenue base north of $30 billion, which is something most players can’t touch.

Current financing conditions show farm operating loans at 5.000% and ownership loans at 5.875% according to recent USDA data. That’s actually manageable for qualified borrowers, but debt service coverage ratios—man, that’s where you need to be careful, as commodity cycles keep doing their thing.

I was just talking to a producer in Wisconsin (won’t name names, but you know the type). They’ve managed to keep margins above regional averages by maintaining relationships with three different processors. Extra paperwork? Sure. But when contract terms shift, having options is… well, it’s everything.

Consolidation is Moving Fast—Really Fast

Look what’s happening in Europe right now. According to European dairy analysts, a potential merger between Arla and DMK is being discussed, this potential massive merger will manage 19 billion kilograms of milk annually. That’s essentially three months’ worth of U.S. Grade A supply in one entity. When you think about it that way… it’s pretty staggering.

I’ve been tracking these patterns for years now, and what’s fascinating is how differently regions are responding. European consolidation appears to be characterized by defensive cooperative mergers, with mid-sized players attempting to survive. North American dynamics involve more strategic acquisitions. But Asia-Pacific? That’s where foreign investment is completely reshaping the landscape.

The Australian experience from 2016 still gives me chills. When Murray Goulburn and Fonterra Australia retrospectively cut milk prices, over 2,000 dairy farmers saw their income drop with virtually no recourse. That’s what happens when market power concentrates and producers don’t have alternatives.

What This Means for Your Operation

So, where does this leave independent producers? Look, I won’t sugarcoat it—you’re facing fewer buyer options. But that doesn’t automatically spell disaster. Some operations are actually thriving in this environment, and a pattern emerges from what they’re doing.

Feed conversion efficiency… this is where the rubber meets the road. According to recent research published in progressive dairy publications, precision feeding systems are delivering significant feed cost reductions with payback periods that’re actually reasonable—we’re talking about realistic timelines in most cases.

Here’s what’s really exciting—genomic testing has become way more accessible. This DNA analysis stuff that predicts which animals will be your best producers? According to recent industry analysis from Hoard’s Dairyman, operations utilizing genomic selection are experiencing 2-3% annual production increases compared to those using conventional breeding. The costs have dropped significantly, making it feasible for mid-sized operations.

Your somatic cell count (SCC)—basically, the white blood cell count in milk that indicates udder health—becomes even more critical in a consolidated market. Processors are becoming more discerning about quality, and anything exceeding 400,000 SCC will impact your price. Hard.

Technology is Changing Everything

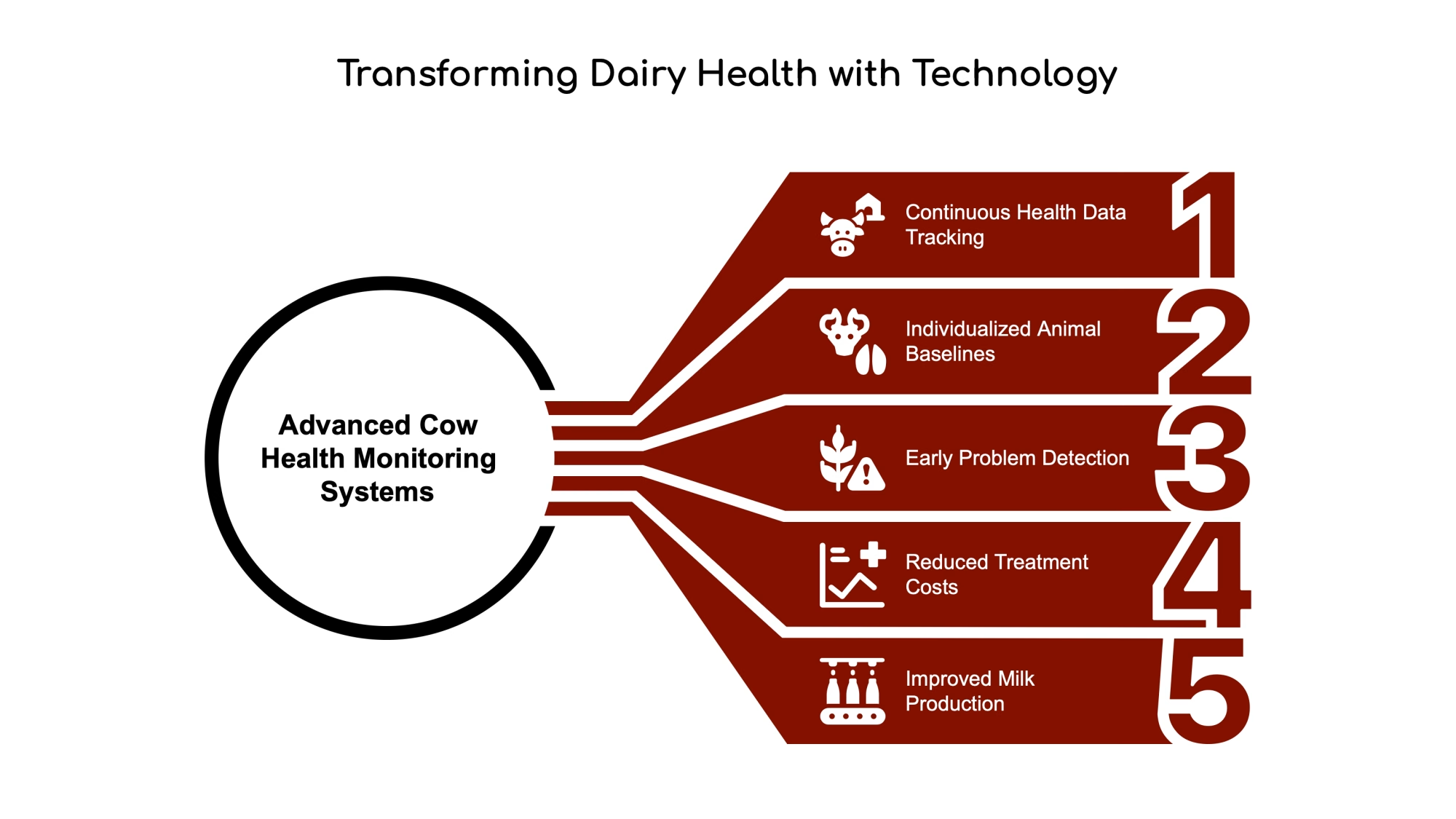

What’s happening with technology integration across the industry is… honestly, it’s remarkable. Automated systems, including HEPA filtration and robotic palletizers, as well as predictive maintenance protocols, are reducing operating costs while enhancing product consistency.

Precision agriculture technologies are starting to integrate with dairy management systems in ways that would’ve seemed like science fiction five years ago. GPS-guided feed delivery, automated cow monitoring, environmental sensors… we’re looking at a completely different operational landscape.

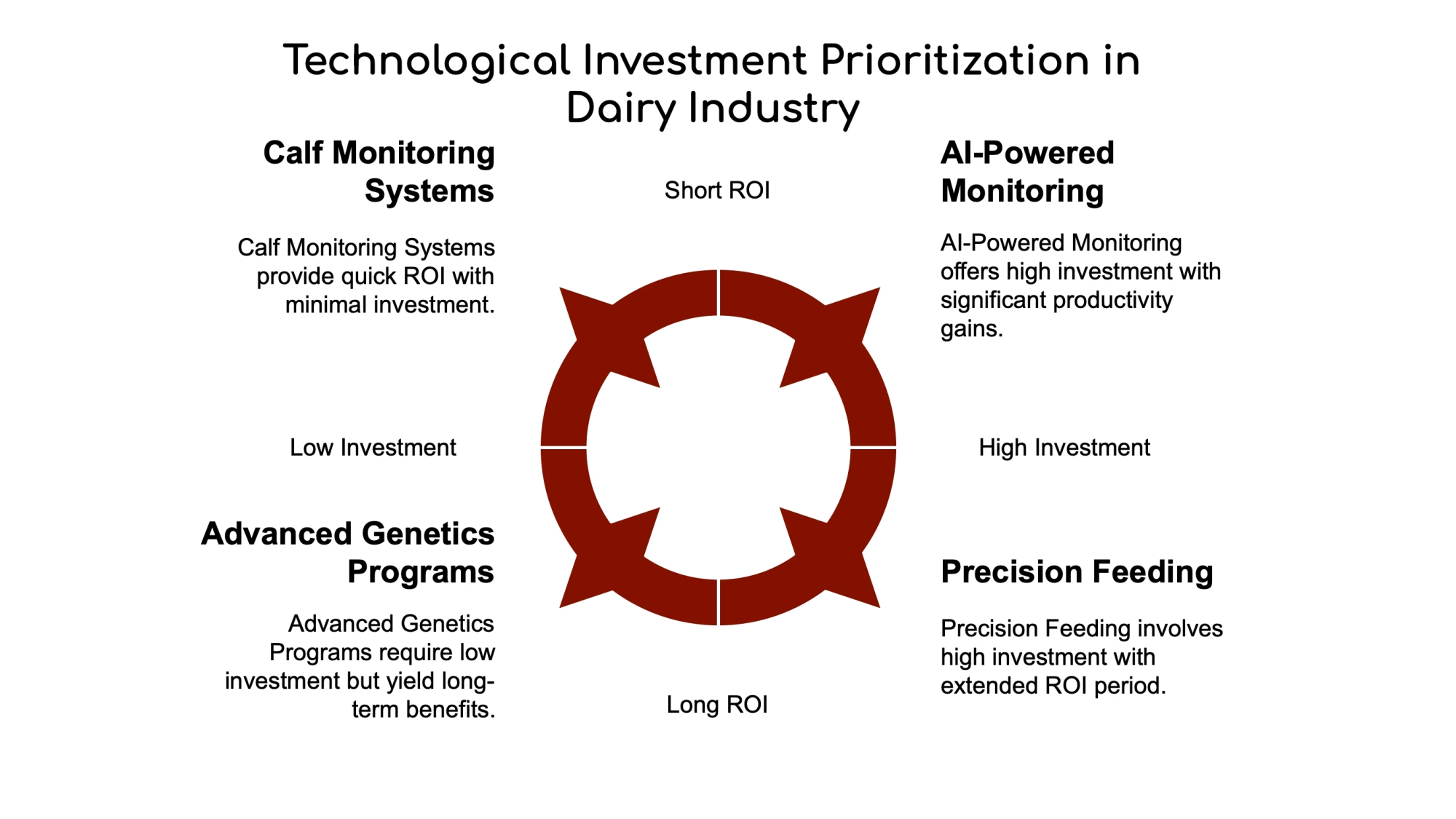

However, what really excites me is the democratization of some of these technologies. Small and mid-sized operations can now access tools that were previously only available to the biggest players. The challenge is knowing which investments will actually pay off versus which ones are just shiny objects.

Regional Differences Are Getting Starker

European processors moved immediately after news of this deal broke. The FrieslandCampina-Milcobel combination is pure defensive positioning—mid-sized cooperatives recognizing they need scale to survive.

North American dynamics differ due to our regulatory frameworks and cooperative structures. Dairy Farmers of America’s recent moves demonstrate how large cooperatives can compete with corporate consolidation, although capital constraints remain a significant challenge.

DFA gets something crucial—collective bargaining power scales with size, but so does operational complexity. Their massive volume gives them leverage that individual operations simply can’t match.

Asia-Pacific markets are absolutely fascinating right now. According to Rabobank’s latest regional analysis, the region continues to show strong growth potential, with Southeast Asia emerging as the bright spot for exporters as consumption patterns shift post-pandemic. We’re talking about $340 billion in market value with solid growth projections.

What You Can Actually Do About This

Alright, enough theory. Here’s what I’m seeing work in the field…

Diversify your processor relationships. Even in concentrated markets, multiple buyers exist for quality milk. I know producers who maintain relationships with three different processors. Yes, it’s extra paperwork. Yes, it’s more complicated. But when contract terms shift—and they will—having options is everything.

Operational excellence isn’t optional anymore. Recent University of Wisconsin extension research shows that top-quartile operations maintain profit margins even during commodity downturns. Key differentiators? Consistent milk quality (low SCC, minimal antibiotic residues), efficient feed conversion, and strategic breeding programs.

Strengthen your cooperative relationships. Cooperatives handle the majority of U.S. milk production and provide collective bargaining capabilities that individual operations can’t match. But not all cooperatives are created equal. Focus on those with strong financial positions and actual strategic vision, not just historical momentum.

Geographic positioning matters more than most people realize. Transportation costs can significantly impact your bottom line, depending on proximity to processing facilities. If you’re building or expanding… location, location, location.

The Road Ahead Gets Bumpy

This deal signals an evolution in the industry, not a disruption. But let’s be honest—successful producers will need to adapt to concentrated markets while maintaining operational flexibility.

What strikes me most about current trends is how quickly adaptation is becoming the key differentiator. The fundamentals of milk production remain sound, but market dynamics require strategic thinking that extends beyond traditional approaches.

Consolidation creates both challenges and opportunities. Processors need reliable milk supplies to justify their capital investments. Quality producers with efficient operations and flexible marketing arrangements often find themselves in stronger positions, not weaker ones.

However, what worries me is that the middle is getting squeezed. You’re either big enough to have options or efficient enough to command premium treatment. The producers caught in between? That’s where the real challenges lie.

Bottom Line—What Really Matters

Look, the dairy industry is consolidating whether we like it or not. This Lactalis deal isn’t some anomaly—it’s a preview of what’s coming. Smart producers are already positioning themselves for this reality.

Your move? Diversify processor relationships, invest in operational excellence, and strengthen cooperative ties. The producers who thrive will be those who understand that adaptation beats resistance every single time.

The market rewards efficiency, quality, and strategic thinking. If you can deliver consistent, high-quality milk while managing costs effectively, you’ll find buyers. The question isn’t whether consolidation will affect your operation—it’s whether you’ll be ready when it does.

And honestly? That preparation starts today, not tomorrow. Because in a world where global dairy giants are reshaping supply chains with multi-billion-dollar deals, the advantage goes to those who see change coming and position themselves accordingly.

The industry is evolving fast. Make sure your operation evolves with it.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Will Your Dairy Farm Survive the Next Decade? The Brutal Math of Consolidation – Breaks down the accelerating pace of industry consolidation and reveals practical strategies for scaling or specializing to survive, helping you assess your farm’s path to longevity in a shrinking market.

- Lactalis Unleashes $2.1 Billion Dairy Domination Strategy – Explores the strategic implications of global processor deals, offering insights into how to position your operation for premium contracts and protect margins amid shifting market dynamics.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Highlights cutting-edge innovations—from robotic milking to AI analytics—showing how adopting tech can slash costs, boost yields, and secure your farm’s future in a consolidating industry.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!