Milk consumption plummets 40% since 1970s! Senate battles to bring whole milk back to schools—discover how this impacts dairy farmers’ profits and genetics.

EXECUTIVE SUMMARY: The Senate Agriculture Committee’s hearing on the Whole Milk for Healthy Kids Act revealed a stark 40% decline in adolescent milk consumption since the 1970s, linked to the 2012 school milk fat restrictions. New science debunks old fat-phobia myths, showing no obesity or heart risks from whole milk consumption. If passed, the bipartisan bill could reverse decades of lost demand, boost farm revenues via component pricing, and reshape breeding strategies for higher milkfat yields. Producers must adapt genetics and advocate now—schools waste 2.6B lbs of milk annually, while global competitors like the EU already prioritize whole milk in cafeterias.

KEY TAKEAWAYS

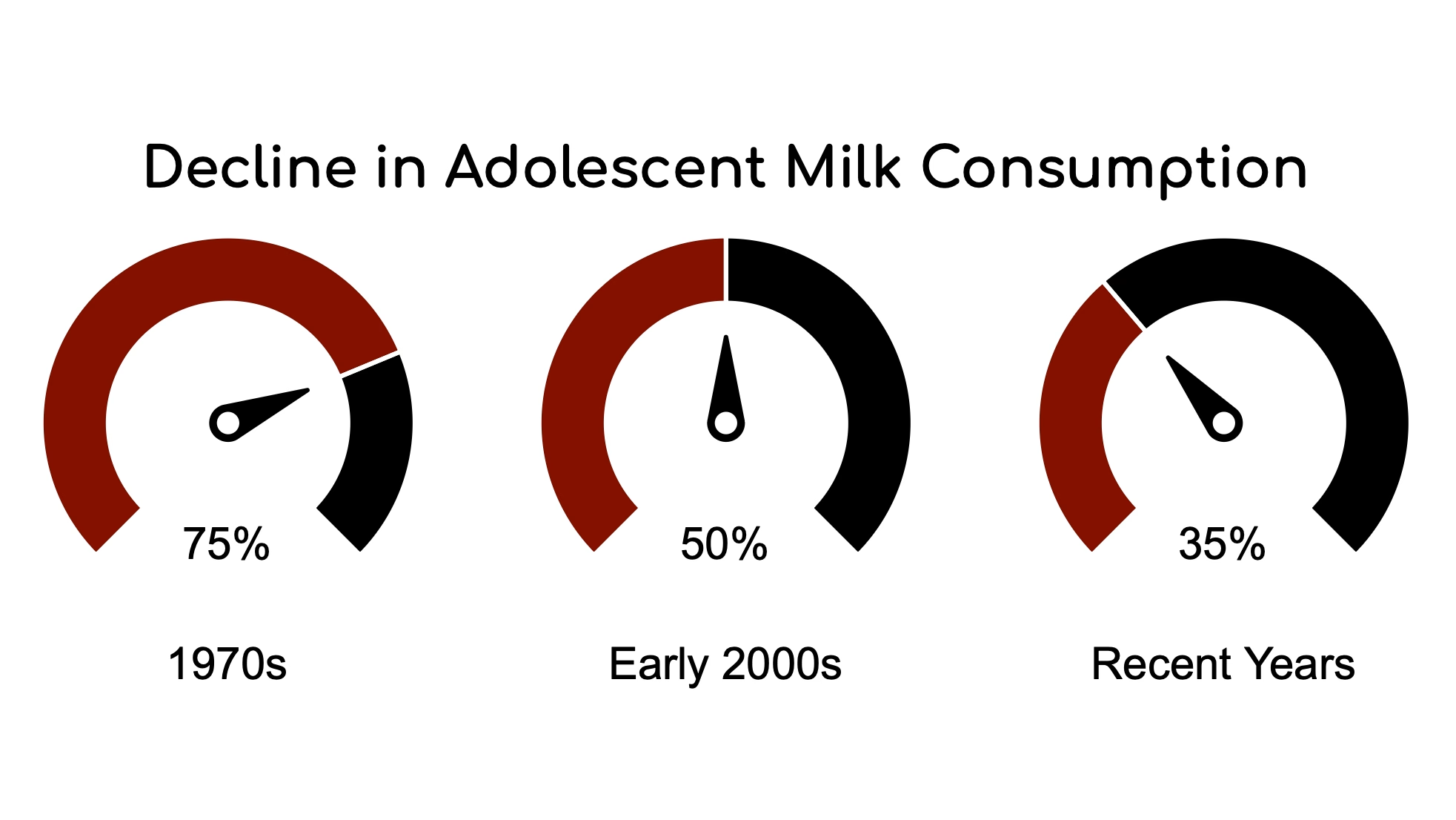

- Consumption Crisis: Only 35% of teens drink milk daily vs. 75% in the 1970s—a $2.6B annual waste issue.

- Science Shift: Modern research shows dairy fat doesn’t harm heart health or cause obesity in kids.

- Profit Potential: Schools could drive 3-5% higher Class I milk demand, rewarding farms breeding for butterfat.

- Genetic Edge: Holstein fat % jumped 0.31% in a decade; crossbreeding and DGAT1 gene selection maximize gains.

- Act Now: Contact Senate Ag leaders to pass legislation—your milk check could rise $127K/year per 1,000 cows.

In a packed Senate Agriculture Committee hearing on April 1, USDA officials dropped a bombshell statistic: American adolescent milk consumption has plummeted from 75% in the 1970s to a dismal 35% today. This alarming decline comes directly after a 2012 federal ban on whole and 2% milk in school cafeterias. This restriction might soon be overturned as the bipartisan Whole Milk for Healthy Kids Act gains momentum. With 30 million daily school lunches at stake and billions in potential dairy revenue on the line, the hearing showcased mounting scientific evidence challenging the decade-old “fat phobia” that removed fuller-fat dairy options from America’s schools.

The Dairy Consumption Crisis

The hearing quickly centered on troubling nutritional trends that have emerged since whole and 2% milk were banned from school lunch programs in 2012. Dr. Eve Stoody, Director of Nutrition Guidance with USDA, presented sobering statistics about America’s deteriorating relationship with dairy products.

“In adolescents, the percent reporting drinking milk was about 75 percent in the 1970s, just under 50 percent in the early 2000s, and the most recent data suggests that about 35 percent of adolescents report drinking milk on any given day,” Stoody testified. This represents a staggering 40-percentage-point decline over five decades.

Even more alarming, Dr. Stoody revealed that 90% of Americans don’t consume the daily recommended amount of dairy. The problem is particularly acute among school-aged children, with research showing between 68% and 94% of school-age boys and girls fail to meet recommended daily intake levels. This widespread underconsumption cuts across demographic groups and directly impacts nutritional status during critical developmental years.

“Across the board, current consumptions need to increase, so whatever the form is, we need to have greater consumption of dairy,” emphasized Dr. Stoody. The timing of these consumption declines correlates directly with the 2012 nutritional guidelines that removed whole and 2% milk from federal school meal programs.

The Home-School Milk Disconnect

One of the most compelling arguments presented during the hearing highlighted the disconnect between milk options available in schools and what children consume at home. Executive Vice President of the International Dairy Foods Association Matt Herrick testified that “83% of shoppers purchase whole and 2% milk for their families” for home consumption. This creates a double nutritional standard where children are offered milk different from what they’re accustomed to drinking at home and school.

This mismatch potentially undermines consumption patterns and contributes to declining milk consumption overall. When schools can only offer fat-free and 1% options while families predominantly purchase whole and 2% milk at home, children receive conflicting nutritional messages.

Evolving Science Challenges Old Assumptions

Kansas Senator Roger Marshall, a physician and chairman of the Make America Healthy Again Caucus, raised concerns about the need for healthy fats in children’s diets and noted troubling increases in osteoporosis cases linked to reduced bone mass density.

Pediatric nutritionist Dr. Keith Ayoob delivered pivotal testimony challenging the scientific foundation of the 2012 restrictions. “The body of credible nutrition science has evolved,” Dr. Ayoob testified. “It no longer supports the previous policy of only allowing fat-free and low-fat milk in schools.”

Dr. Ayoob presented evidence directly contradicting previous assumptions about dairy fat and children’s health. “A systematic review of studies that looked at cardiometabolic health in children ages 2 to 18 years found that consumption of dairy products, including whole and reduced-fat milk, had no association with cardiometabolic risk,” he explained.

This represents a significant shift in understanding since 2012 when the USDA specifically removed whole and 2% milk to keep saturated fat levels below 10% in school meals. Dr. Stoody acknowledged that “part of the reasoning for the 2012 Nutritional Guidelines was because of the limited room for the extra calories in high-fat dairy products.”

The Nutritional Matrix in Milk Fat

The hearing delved into the unique nutritional properties of dairy fat that weren’t fully understood when the 2012 restrictions were implemented. Recent research indicates that dairy fat doesn’t exist in isolation but as part of a “dairy protein-fat matrix” that the body processes differently than other saturated fats. In this form, dairy fat appears less likely to increase bad cholesterol and may even reduce harmful lipid fractions.

Moreover, testimony highlighted that consumption of whole milk has not been associated with increased obesity rates in children, directly challenging one of the primary concerns that led to the 2012 restrictions.

Farm Economics: What Whole Milk Legislation Means for Your Bottom Line

The economic implications of the Whole Milk for Healthy Kids Act extend far beyond school cafeterias—they reach directly into the milk checks of America’s dairy farmers. With school meal programs providing nearly 30 million lunches and 15 million breakfasts daily, this legislation could significantly boost dairy demand nationwide and restore critical revenue streams for producers.

Potential Market Impact

The math is straightforward: schools represent one of America’s largest institutional milk markets. When whole and 2% milk were banned in 2012, consumption plummeted as students rejected the taste of fat-free alternatives. This created a double economic hit—dairy farmers lost volume while schools wasted significant quantities of undrunk milk.

A USDA study shows that school meal programs provide 77% of daily dairy milk consumption for low-income children aged 5-18. With the Whole Milk for Healthy Kids Act, this massive institutional market could transition from primarily fat-free to higher-component milk options, creating multiple revenue advantages for producers:

- Higher Component Utilization: Milk pricing formulas reward butterfat and protein—the very components that would see increased demand

- Reduced Waste: Students consume more of what they enjoy, reducing the estimated 2.6 billion pounds of milk currently wasted annually in schools

- Long-term Consumer Development: Children who develop taste preferences for dairy in school become lifelong consumers

For the average producer, this translates to potentially higher milk prices through Federal Milk Marketing Order component pricing. While exact projections vary by region, industry analysts suggest the legislation could increase Class I utilization rates by 3-5% nationally while raising average component values.

Breeding Implications: Selecting for Butter Fat in a Whole Milk Future

The potential shift in school milk policy comes at a fascinating moment in dairy genetics. Over the past decade, the industry has rushed toward higher component production, creating a perfect alignment between consumer demand, policy changes, and genetic selection.

The Component Revolution

Data from DHIA testing shows remarkable progress in boosting milk components through breeding:

| Breed | Milkfat % 2010 | Milkfat % 2020 | Change |

| Holstein | 3.65% | 3.96% | +0.31% |

| Jersey | 4.69% | 4.82% | +0.13% |

The genomics revolution has accelerated this progress. According to industry experts, Holstein milk fat percentages have continued climbing to approximately 4% as of 2025, representing a stunning half-percentage point increase in just a decade and a half. This rapid progress is no accident—it reflects deliberate selection pressure enabled by genomic testing and the economic incentives of component pricing.

The DGAT1 Effect

At the genetic level, this transformation has been driven partly by selection for specific genes that control fat synthesis. Most notably, the DGAT1 gene plays a crucial role in assembling fatty acids in the udder. Breeders have increasingly selected the high-fat version of this gene, helping overcome the traditional genetic antagonism between milk volume and fat percentage.

Holstein Association USA reported that the correlation between milk production and fat percentage—historically around -0.60—has shifted to approximately -0.30 in recent years. This means today’s elite genetics can deliver higher volume and higher components, previously thought impossible.

Strategic Breeding Decisions

Forward-thinking producers should consider these breeding strategies to position their herds for a whole milk future:

- Prioritize Fat Yield + Percentage: Select sires that boost both total fat pounds and fat percentage

- Consider Crossbreeding Options: F1 Holstein-Jersey crosses deliver component advantages while maintaining volume

- Balance Component Traits: Look for bulls that maintain protein levels alongside fat improvements

- Emphasize Feed Efficiency: Higher component production requires efficient conversion of feed to milk solids

Many progressive breeders are already finding success with these approaches. Holstein-Jersey crossbreeds (or F1s) are gaining popularity, with some AI organizations reporting sales of 5,000 units monthly of F1 semen. These animals produce milk with approximately 4.25% fat while maintaining a reasonable volume.

Producer Action Plan: Five Steps to Prepare for Whole Milk Legislation

The potential shift in school milk policy requires proactive planning from dairy producers. Here are five specific actions you can take now to position your operation for success:

1. Advocate for the Legislation

Please make your voice heard where it matters. The National Milk Producers Federation (NMPF) has established an advocacy campaign connecting producers directly with their elected officials. Visit www.nmpf.org/take-action/ to contact your senators and representatives, urging them to support the Whole Milk for Healthy Kids Act.

2. Adjust Your Breeding Program

Review your genetic selection criteria with your breeding specialist. Prioritize bulls with superior fat and protein genetic evaluations, particularly those with positive deviations in both volume and components. Consider these breeding approaches:

- Holstein herds: Select for bulls with fat percentages >0.20% PTA

- Jersey herds: Focus on combined fat and protein yield

- Crossbreeding: Evaluate F1 Holstein-Jersey options for component advantages

3. Optimize Nutrition for Components

Work with your nutritionist to fine-tune rations for maximum component production through these proven strategies:

- Ensure adequate, effective fiber (minimum 22% physically effective NDF)

- Maintain proper forage-to-concentrate ratios

- Consider dietary fat supplements like rumen-protected fat

- Monitor feeding management: bunk space, feed pushups, and feed availability

4. Engage With Local Schools

Build relationships with school nutrition directors in your area to understand how they might implement expanded milk options:

- Offer farm tours for school nutrition professionals

- Provide educational materials about dairy nutrition

- Discuss potential sourcing arrangements if the legislation passes

- Support infrastructure needs for milk dispensers or refrigeration

5. Prepare for Market Transitions

The transition to whole milk in schools won’t happen overnight. Make these operational adjustments to maximize opportunities:

- Review your milk marketing arrangements for component optimization

- Consider maintaining flexibility in production if component premiums increase

- Monitor regional processing capacity for higher-fat milk products

- Develop contingency plans for seasonal adjustments to school milk demand

Global Context: How Other Countries Handle School Milk

Several witnesses referenced international approaches to school milk programs that could inform U.S. policy. Unlike the restrictive U.S. approach, the European School Milk Scheme provides subsidies for whole and reduced-fat milk options, recognizing their nutritional value for growing children.

Canada has similarly maintained flexibility in its school milk programs, allowing provincial and local authorities greater discretion in milk options. These international examples demonstrate that restrictive fat policies are not universal and that alternative approaches prioritize overall dairy consumption.

Most European dairy producers benefit from this more flexible policy approach, with school milk providing a stable market for dairy products across fat specifications. This contributes to stronger dairy consumption patterns in countries with flexible school milk standards.

Voices of Opposition

While support for the legislation was strong among committee members and most witnesses, opposing viewpoints were also presented. The Physicians Committee for Responsible Medicine, representing 17,000 doctor members, expressed concerns that the legislation prioritizes dairy industry profits over health considerations.

“Congress should be putting less saturated fat on school lunch trays, not more, and it can do that by making it easier for students to access nondairy beverages and plant-based entrees,” stated Neal Barnard, MD, President of the Physicians Committee.

This opposition highlights the ongoing debate about saturated fat in the American diet and reflects evolving nutritional understanding. Proponents of the bill countered that the legislation provides more options than mandating higher-fat milk consumption, allowing students and parents to choose based on their dietary needs and preferences.

Legislative Momentum Building

The Whole Milk for Healthy Kids Act has garnered impressive bipartisan support. The House of Representatives previously passed the legislation with an overwhelming vote of 330-99 in December 2023, demonstrating broad support across party lines. More recently, in February 2025, the U.S. House Committee on Education and the Workforce passed the current version by a decisive 24-10 vote.

Bipartisan sponsors, including Reps, introduced the 2025 version of the bill. Glenn “GT” Thompson (R-Pennsylvania) and Kim Schrier (D-Washington) in the House, and Sens. Roger Marshall (R-Kansas), Peter Welch (D-Vermont), Dave McCormick (R-Pennsylvania) and John Fetterman (D-Pennsylvania) in the Senate.

In his opening statement at the hearing, Senate Agriculture Committee Chairman John Boozman (R-AR) emphasized the bill’s strong support: “This bill, which would permit schools to offer students whole, reduced-fat, low-fat, and fat-free flavored and unflavored milk, has enjoyed strong bipartisan support in both the House and Senate, including from many members on this committee.”

If passed, the Whole Milk for Healthy Kids Act would:

- Allow schools to offer whole, reduced-fat, low-fat, and fat-free flavored and unflavored milk

- Exempt fluid milk from saturated fat content calculations for school meals

- Provide greater flexibility to school nutrition programs while maintaining nutritional standards

Herd Management Strategies to Maximize Component Production

For producers looking to capitalize on the potential shift toward higher-fat milk in schools, implementing proper management practices alongside genetic improvements is essential. Research shows that environment and management account for approximately two-thirds of the improvements in Holstein fat percentages in recent years.

The CowSignals Approach

Industry experts recommend the CowSignals methodology to optimize cow comfort for maximum component production:

- Feed Space: Provide at least 24 inches of bunk space per cow to maximize intake

- Water Access: Ensure clean, accessible water with 3-4 inches of linear space per cow

- Light Management: Maintain 16-18 hours of light followed by 6-8 hours of darkness

- Air Quality: Proper ventilation reduces heat stress that can depress components

- Rest: Target 12-14 hours of lying time in comfortable stalls

- Space: Avoid overcrowding, which reduces lying time and feed intake

Critical Management Factors

During the transition to potentially higher-fat milk demand, focus on these key management areas:

- Heat Stress Mitigation: Components drop significantly during heat stress; invest in cooling systems, including fans, sprinklers, and shade

- Mastitis Prevention: Clinical and subclinical mastitis dramatically reduce fat test; prioritize milking hygiene and udder health

- Feed Timing and Availability: Push the feed 6-8 times daily and ensure 24-hour access.

- Transition Cow Management: Proper transition cow protocols minimize metabolic disorders that impact fat tests

- Consistent Routines: Minimize stress by maintaining consistent milking times and handling practices

What’s Next for Whole Milk in Schools?

Following this hearing, the Senate Agriculture Committee will likely vote on whether to advance the legislation to the entire Senate floor. Given the strong bipartisan support already demonstrated in the House, prospects for passage appear promising.

Michael Dykes, President and CEO of the International Dairy Foods Association, urged swift action: “It’s time for Congress to pass the Whole Milk for Healthy Kids Act and bring whole and 2% milk back to schools.”

The legislation represents a potential turning point for America’s dairy farmers after more than a decade of restricted school milk options and declining consumption. If passed, the bill would create immediate demand for dairy products while helping establish consumption patterns that could benefit the industry for future generations.

The testimony makes clear that this isn’t just about producer profits—it’s about reversing troubling nutritional trends and ensuring American children have access to the full range of dairy options they need for optimal growth and development. As nutritional science continues to evolve, so too must policies that affect the health and well-being of our nation’s youth.

Component Production Calculator

| Herd Size | Current Fat % | Potential Fat % | Additional Fat Value |

| 100 cows | 3.8% | 4.0% | $12,775/year |

| 500 cows | 3.8% | 4.0% | $63,875/year |

| 1000 cows | 3.8% | 4.0% | $127,750/year |

Calculator assumptions: 80 lbs/day average production, $3.50/lb butterfat price, 305-day lactation

Contact Your Lawmakers

The future of whole milk in schools depends on Senate action. Make your voice heard by contacting these key Senate Agriculture Committee members:

- Sen. John Boozman (R-AR), Chairman: 202-224-4843

- Sen. Debbie Stabenow (D-MI), Ranking Member: 202-224-4822

- Sen. Roger Marshall, M.D. (R-KS): 202-224-4774

Or visit www.nmpf.org/take-action/ to send a message directly through the National Milk Producers Federation advocacy platform.

Your advocacy today can help shape milk policy for decades to come.

Learn more:

- North Dakota Enacts Groundbreaking Whole Milk Legislation for Schools

- USDA Dairy Consumption Trends: Record Butter, Plummeting Ice Cream, and Shifting Milk Habits

- Why Milk Components Trump Production in Unlocking Profits

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!