Discover how modest gains and strategic shifts are shaping the dairy industry’s future. Read more.

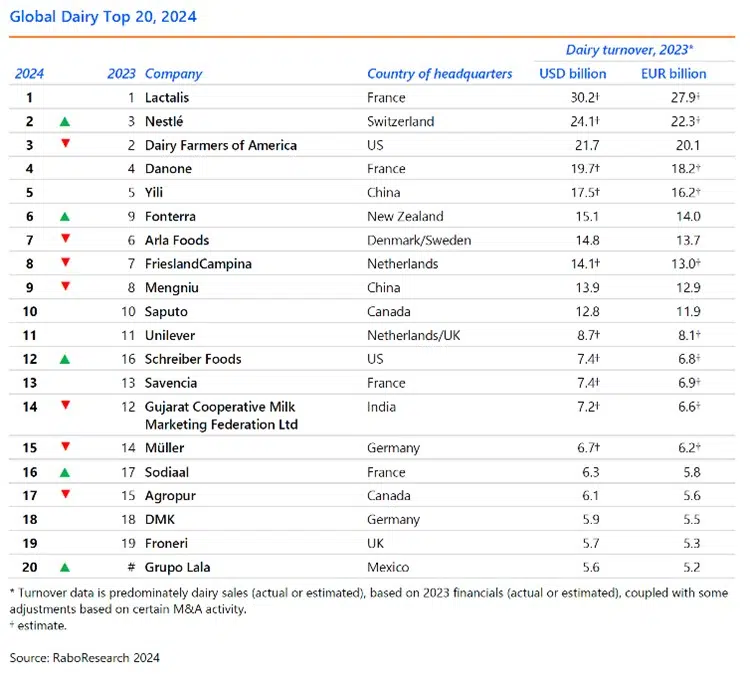

Summary: Are you curious about the latest trends in the global dairy industry? RaboResearch’s annual Global Dairy Top 20 report reveals a year marked by modest gains and strategic shifts among the world’s leading dairy companies, with a 0.3% increase in combined turnover in US dollar terms, a significant drop from the previous year’s 8.1% growth. Lactalis continues to dominate, while Nestlé has leapfrogged Dairy Farmers of America due to fluctuating milk prices. Due to favorable foreign exchange changes, Mexico’s Grupo Lala debuted in the top 20. The report also highlights limited M&A activity, with upcoming deals poised to reshape the industry’s landscape. The dairy industry continues to experience limited merger and acquisition (M&A) activity, with Danone’s divestment of Russian business and the shedding of its Horizon Organic and Wallaby brands being notable exceptions. Insights into these strategic shifts and modest gains offer essential information for any dairy industry stakeholder.

- Global Dairy Top 20 report shows a 0.3% increase in combined turnover for leading dairy companies in US dollar terms.

- Lactalis remains the number one dairy company for the third year.

- Nestlé climbs to second place, surpassing Dairy Farmers of America due to weaker milk prices.

- Grupo Lala makes its debut in the top 20, driven by strong organic growth and favorable foreign exchange rates.

- Mergers and acquisitions activity remains limited, with notable exceptions like Danone’s divestments.

- Upcoming deals, including Unilever’s ice cream business divestment, suggest potential industry rankings changes.

How do the leading dairy sector firms handle these difficult times? The RaboResearch Global Dairy Top 20 study is now out, providing an intimate look at the highs and lows of the world’s biggest dairy firms. This yearly study focuses on the financial health, strategy developments, and market dynamics affecting the sector.

This year’s figures, while reflecting the present environment, also underscore the dairy industry’s resilience. Despite a modest 0.3% increase in combined turnover, a sharp contrast to the previous year’s 8.1% rise, the industry continues to navigate challenges. From fluctuating foreign exchange rates to developing mergers and acquisitions (M&A) activity, these insights are critical for anybody involved in dairy production and sales.

Here are some essential highlights you should not miss:

- Lactalis has kept the top rank for the third consecutive year with record revenue.

- Grupo Lala entered the Top 20, boosted by positive FX developments.

- M&A activity remains muted but strategic, with several important anticipated transactions.

- Dairy firms in the United States prioritize internal development, with more than USD 7 billion set aside for new facility building and expansion.

“The Global Dairy Top 20 report is an invaluable resource for understanding the broader trends impacting the dairy sector worldwide,” according to an analyst at RaboResearch.

Stay with us as we investigate what these results indicate for your company and how you may adjust to the industry’s changing environment.

Global Dairy Industry: Modest Gains and Strategic Shifts Highlighted in 2023 Report

RaboResearch’s annual Global Dairy Top 20 study indicates a year of moderate advances and strategic moves in the dairy industry. The total sales of the world’s biggest dairy firms increased by 0.3% in US dollars, a dramatic contrast to the previous year’s 8.1% gain. While reduced milk prices in 2023 significantly slowed revenue growth, the industry’s potential for growth remains high. This slump mainly impacted European cooperatives, with seven firms globally reporting reduced sales in their currencies.

Furthermore, the year saw little merger and acquisition (M&A) activity, contributing to moderate growth. Compared to past years, when strategic acquisitions often supported growth, 2023 saw fewer. The limited M&A activity mirrored a more significant industry trend in which corporations refocused on core activities rather than extending their portfolios. This strategic recalibration offers a comprehensive picture of the industry’s current state and its cautious confidence about the future.

Lactalis Leads the Pack

Lactalis did it again! For the third year, the French dairy behemoth tops the Global Dairy Top 20 list. How did they do this? By exceeding USD 30 billion in yearly dairy-related income, a record for any dairy firm.

Lactalis’ success is based on two fundamental pillars: organic expansion and intelligent acquisitions. They’ve extended their footprint in developed and developing regions, capitalizing on global demand for dairy products. This technique has increased revenue and strengthened their market position.

In addition to its organic solid development, Lactalis has successfully negotiated the acquisition environment. Over the years, they’ve made significant acquisitions to expand its product line and geographical reach. Their strategic acquisitions have increased value, allowing them to retain a solid competitive advantage.

So, what lessons can other firms take from Lactalis? Focus on developing your core competencies while open to smart acquisitions that provide long-term advantages. Lactalis has perfected the delicate balance required to remain ahead of the curve.

Nestlé Climbs, DFA Slides: The FX Factor

While Lactalis remained at the top, Nestlé and Dairy Farmers of America saw significant rank shifts. Nestlé, for example, rose to second position, mainly aided by lower milk costs. Dairy Farmers of America, on the other hand, dropped to third place, indicating the same financial challenges.

But what triggered these changes? The shifting foreign currency (FX) rates had a significant effect. The value of the US dollar fluctuated, affecting the income of these worldwide titans. For Nestlé, good FX movements mitigated the impact of reduced milk prices, allowing them to retain excellent sales in USD. Dairy Farmers of America were not as lucky since lower domestic milk prices hurt hard, and any prospective FX advantages were insufficient to preserve their former position.

The complicated interaction between milk prices and foreign exchange rates explains how global variables may impact localized results. Keeping an eye on these developments is more important than ever to be competitive in the worldwide dairy industry.

Grupo Lala Joins the Global Elite: A Triumph of Strategy and Strength

Grupo Lala of Mexico has made its maiden appearance in the Global Dairy Top 20, a significant achievement. What propelled them to this top list? A mix of favorable foreign currency (FX) developments and organic solid revenue growth. The Mexican peso’s 11.8% increase versus the US dollar significantly impacted this situation. Grupo Lala had a 6% increase in organic sales growth in Mexican pesos, propelling their performance and ousting Ireland’s Glanbia off the list. This result emphasizes the value of local market strength and careful budget management. Are you intrigued by the tactics they used? It’s an enthralling account of negotiating the intricate global dairy market.

Refocusing for the Future: A Strategic Shift in Dairy M&A Activities

The dairy business continues to see modest merger and acquisition (M&A) activity. Danone’s recent divestiture of its Russian operations and discontinuation of its Horizon Organic and Wallaby brands are significant instances. Why is there this restraint? It is part of a more important trend in which corporations concentrate on their core activities, striving for more simplified processes and better efficiency.

For example, Danone is not alone in its strategy adjustment. Many dairy companies are returning to basics, eliminating less lucrative or non-core sectors. This tendency indicates a desire to focus on what they do best: producing high-quality milk, cheese, and other dairy products. It represents a shift towards sustainability and long-term development.

While this may result in fewer dramatic headlines about industry-changing acquisitions, it indicates a thoughtful recalibration geared at long-term performance rather than fast benefits. Understanding this transformation enables dairy farmers and industry stakeholders to integrate with more extensive market plans and capitalize on new prospects for development and stability.

Ready for Some Industry Shake-Ups?

Consider impending transactions that might significantly alter the Global Dairy Top 20 standings:

Unilever’s Ice Cream Exit

Unilever is one of the big players making headlines. They intend to offload their ice cream company, which might have far-reaching consequences. Consider the scaling prospects for an acquired firm! This change underscores Unilever’s approach of focusing on its core capabilities, possibly opening up more market space for current and new dairy giants.

Fonterra’s Core Focus

Then there’s Fonterra, which is planning to exit its consumer business. They’re getting back to basics and focusing on their core activities. This strategic choice reflects a broader industry trend: businesses are narrowing their focus to create more excellent value and adapt to changing market circumstances.

Sustainability and Strategic Pivots

These developments point to a broader narrative: an industry realigning itself. Sustainability has become more critical in these strategic pivots. As Unilever and Fonterra alter their sails, they navigate market movements and an increasing need for sustainable operations.

What does this mean to you? Maintain a watchful eye on the industry scene. These transitions might lead to new collaborations, inventions, and market positioning possibilities. Who will come out on top next? Only time will tell.

US Dairy Industry’s Interior Makeover: Is Bigger Always Better?

When it comes to US dairy firms, they are altering gears. Instead of pursuing acquisitions, they’re focusing their efforts internally. Consider this a primary home renovation job. With more than $7 billion set aside for new plant development and expansions from 2023 to 2026, the emphasis is squarely on increasing production capacity, particularly in cheese. This internal growth strategy demonstrates a commitment to improving operations and responding to market needs.

The Bottom Line

This year’s Global Dairy Top 20 study highlights moderate improvements and smart reorganizations. Lower milk prices and little M&A activity have led many businesses to prioritize internal development and core operations. Significant firms like Lactalis and Nestlé dominate, while newcomers like Grupo Lala make noteworthy debuts. Upcoming transactions and strategic pivots indicate that the dairy landscape may soon evolve.

Dairy farmers must remain aware of these developments. Strategic adjustments, particularly those involving mergers and acquisitions, have the potential to alter market dynamics drastically. Are you prepared to adapt and prosper amid these changing trends? The dairy industry’s future will provide problems and possibilities; you’re ready to seize them.