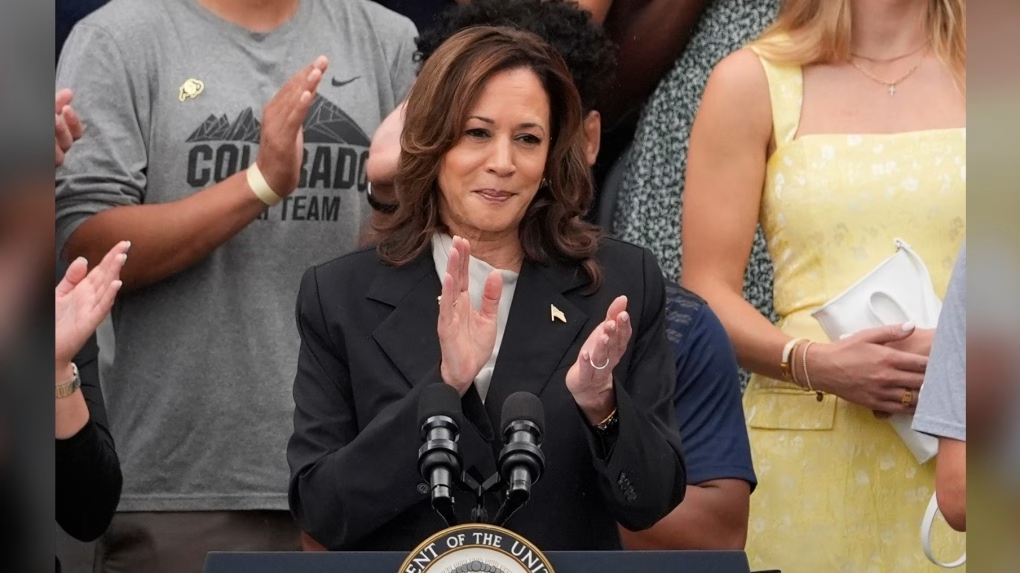

Kamala Harris is now leading in key dairy states. What does this mean for the 2024 election and dairy farmers? Keep reading to find out.

Summary: The 2024 US presidential election is heating up, with dairy-producing states taking center stage. Initially, President Biden was trailing in key states like Pennsylvania, Wisconsin, and Michigan, where former President Trump held a slight lead. However, with Vice President Kamala Harris now the Democratic nominee, the dynamics have shifted. According to a recent New York Times/Siena College poll, Harris leads in Michigan, Pennsylvania, and Wisconsin by a slim margin. She’s also gaining ground in Arizona, North Carolina, Nevada, and Georgia. Political expert Lynn Vavreck from UCLA stresses that the race is still wide open, suggesting that any shift could be pivotal. The outcome in these critical states will likely decide the presidency, making every vote crucial. The 2024 election could significantly impact dairy farmers. Harris’ potential policies include climate action and expanding financing for sustainable agriculture. Her labor and trade proposals could influence costs and workforce stability. While environmental rules could tighten, her support for small and medium farms might offer much-needed assistance. Balancing ecological responsibility and economic viability will be key.

- President Biden initially trailed in key dairy states; former President Trump had a slight lead.

- With Kamala Harris as the Democratic nominee, dynamics have shifted with her leading in Michigan, Pennsylvania, and Wisconsin.

- Harris is also gaining ground in Arizona, North Carolina, Nevada, and Georgia.

- Political expert Lynn Vavreck suggests the race remains wide open and any shift could be pivotal.

- The election outcome in key states will likely decide the presidency, making every vote crucial.

- Harris’ potential policies include climate action and expanding financing for sustainable agriculture.

- Her labor and trade proposals could impact costs and workforce stability for dairy farmers.

- While environmental regulations might tighten under Harris, small and medium farms could receive more support.

- Balancing ecological responsibility with economic viability will be essential.

Have you ever considered the profound influence your vote could have on the future of our country? This question is particularly pertinent for dairy farmers across the critical states of Pennsylvania, Wisconsin, and Michigan. These states, known for their dairy production, also hold the key to determining the future leadership of the United States . As we delve into the latest polling data, one fact becomes increasingly clear: Kamala Harris’ potential lead in these crucial dairy-producing states could be a game-changer for the 2024 US presidential election. ‘The trends are crucial, but November is still a long way off. In a close election, any factor could alter the result in a state or overall,’ warns Lynn Vavreck, Marvin Hoffenberg Professor of American Politics and Public Policy at UCLA.

The Shifting Landscape: Battleground States and the 2024 Election

Have you observed any changes in the battleground states as we approach the election? It’s been quite the whirlwind. According to a recent New York Times/Siena College survey conducted from August 5-9, Democratic candidate Kamala Harris leads by 4% in the critical dairy-producing states of Michigan, Pennsylvania, and Wisconsin, with a 50% to 46% edge over her opponent. This move has the potential to reshape the electoral dynamics.

And that is not all. According to the same survey from August 8 to 15, Harris has made significant gains in the Sun Belt. For example, she leads Arizona 50% to 45% and North Carolina 49% to 47%. These improvements are significant because they reflect increasing support in usually swing states.

Impact on Dairy Farmers: Election Results Matter

So, what does a Harris administration mean for you as a dairy farmer? Election results may pave the way for policy reforms that either support or threaten your everyday operations and long-term viability. Let’s look at what is ahead.

First up is climate policy. Harris has been outspoken about taking dramatic action to combat climate change. This might lead to more robust controls on methane emissions, which make up a significant component of emissions from animals like cattle. While this is a barrier, it has the potential to spur innovation. For instance, stricter regulations could push us towards adopting more sustainable practices that will ultimately benefit the environment and industry. However, it’s important to note that these changes might also increase operating costs and require significant adjustments in farming practices.

Furthermore, Harris’ administration may expand government financing for sustainable agricultural efforts, which could significantly benefit the dairy business. According to Lynn Vavreck of UCLA, ‘Federal investment in green technologies could make it easier for farmers to transition without bearing the full cost themselves.’ This potential support offers a glimmer of hope for the future of dairy farming.

Furthermore, Harris’ labor proposals might directly affect you. Plans to alter immigration restrictions might lead to a more stable workforce, which is critical for labor-intensive dairy farming businesses. For instance, Chegg’s pledge to train 100,000 Hondurans by 2030 emphasizes the significance of improving immigration regulations to ensure a competent workforce. However, it’s important to consider the potential impact of these changes on operating costs and the overall structure of the dairy farming workforce.

However, only some things are going well. Potential rises in the minimum wage and harsher labor rules may raise operating expenses. However, many claim that improved working conditions increase productivity—investing in your personnel may pay dividends.

So, what is the bottom line? The 2024 election is a watershed moment for dairy producers. Stay aware, adapt, and seek possibilities within the problems. According to Medeiros, farming has always required adaptability. “This election will be no different.”

What’s Next for Dairy Farmers in the 2024 Election?

As we navigate this volatile election season, we must understand dairy farmers’ issues and objectives in vital states. Pennsylvania, Wisconsin, and Michigan are more than simply political battlegrounds; they are also the dairy production hubs of the United States. So, what does Kamala Harris’ leadership mean for you?

First, let’s discuss agricultural subsidies. Many dairy producers depend on these subsidies to maintain financial stability. Harris, who has previously backed extended relief packages, may advocate for more extensive assistance for small and medium-sized farmers. Her attitude might directly influence your bottom line, offering a buffer in unpredictable market circumstances.

Trade policies are also a significant source of worry. Harris proposes renegotiating trade agreements to safeguard American farmers better. If you are concerned about foreign competition and unfair trade practices, her administration might benefit you. Improved trade agreements provide new markets and level the field with foreign dairy imports.

Environmental restrictions often cause disagreement. Harris has been passionate about pursuing green policies, which may result in tighter environmental rules for dairy farms. While some contend this may raise operating expenses, others feel it represents a long-term road to sustainable agricultural techniques. It’s important to consider the potential impact of these changes on operating costs and the overall structure of the dairy farming industry. For example, her backing for biofuel programs might increase demand for dairy byproducts, which could be a potential opportunity for the industry.

Finally, the policies and initiatives of a Harris government may provide both possibilities and problems. What are your thoughts? Do these policies reflect your objectives as a dairy farmer?

Expert Opinions: The High-Stakes Game

Understanding the political scene is as crucial as understanding the newest market developments for dairy producers throughout America. Political analyst Lynn Vavreck, the Marvin Hoffenberg Professor of American Politics and Public Policy at UCLA, provides vital insights into the present political landscape. This knowledge empowers farmers to make informed decisions about their future.

Vavreck emphasizes the razor-thin margins: “This election was expected to be a close one, and the recent swing toward Harris has tightened up the race,” she says. “It looks as it should: like a very close contest.” Her sentiments resonate with every farmer who has seen the markets swing on a knife’s edge.

But here’s the kicker: the campaign is still in its early stages, and November is far off. Vavreck concurs: “In a close election, literally anything could change the result in a state or overall.” So, what does this imply for central dairy-producing states such as Wisconsin, Michigan, and Pennsylvania? These states are more than battlegrounds; they are the linchpins of the 2024 presidential election.

Vavreck asserts: “The winner of the 2024 election will more than likely need to win all of these states to become president.” For dairy farmers, this is more than just political rhetoric; it is a demand to be aware and active, as the stakes could not be more significant.

The Power Trio: Why Wisconsin, Michigan, and Pennsylvania Can Decide the Presidency

Regarding the Electoral College, Wisconsin, Michigan, and Pennsylvania are often crucial to any presidential election plan. Why are these states so important? Their combined 46 electoral votes may make or break a candidate’s route to victory, which requires 270 votes.

Historically, these were the ultimate swing states. Consider the 2016 election, when Donald Trump won Michigan by 0.23%, Wisconsin by 0.76%, and Pennsylvania by 0.72%—margins that combined gave him the president. In 2020, Joe Biden recaptured these states with close victories, changing the Electoral College balance again. This variation emphasizes their importance as battlegrounds where elections are contested and often won or lost.

So, why are these states so dynamic? Demographically, they are a mix of urban and rural communities and industrial and agricultural sectors, making them microcosms of national trends. Because of this variety, politicians must address various voter issues, including job growth, healthcare, and environmental policy.

Recent polling data has shown how close the 2024 race remains in certain states. According to an August New York Times/Siena College survey, Harris leads by only 4% in all three categories. This narrow advantage emphasizes how unpredictable and significant these nations remain.

Understanding the electoral dynamics in Wisconsin, Michigan, and Pennsylvania is more than simply electoral strategy; it is critical for any candidate seeking the presidency. These states are essential to those of us in the dairy business since the result of this ever-critical contest affects our lives.

Rust Belt Roulette: How Dairy States Are Shaping Presidential Elections

Historically, dairy states such as Wisconsin, Pennsylvania, and Michigan have had a significant role in deciding the result of US presidential elections. These states, dubbed the “Rust Belt,” have shifted between Democratic and Republican inclinations. For example, in 2016, these central dairy states were essential in Donald Trump’s unexpected victory, as he converted them from their previous Democratic support in 2012 when President Obama achieved a triumph.

Dairy producers’ voting tendencies have also shifted significantly. Rural voters, including many dairy sector workers, traditionally supported the Republican Party. However, economic issues in the dairy business, such as shifting milk prices, trade policy, and labor shortages, have begun influencing voting habits. Disillusioned by recent trade battles that harmed their bottom line, some farmers reevaluated their political allegiances. In 2020, Joe Biden recovered Pennsylvania and Michigan, although barely.

As we approach the 2024 election, these historical developments provide critical insights. Dairy farmers, who are increasingly outspoken about climate change, dairy subsidies, and immigration policy, might significantly impact the election results. The data showing Vice President Kamala Harris leading in these states implies that current economic and policy challenges are more relevant to dairy farmers’ objectives than ever.

Understanding these past tendencies allows us to forecast the current election cycle. Dairy farmers’ votes will be widely watched if history repeats itself as they react to critical concerns directly affecting their livelihoods.

The Bottom Line

As we negotiate the convoluted path to the 2024 election, it’s evident that dairy-producing states like Wisconsin, Michigan, and Pennsylvania hold the keys to the presidency. Kamala Harris’ latest poll rise highlights the importance and volatility of these contested states. Your vote is crucial in this contest, which is razor-thin. So, dairy producers, will your vote tip the scales?