Find out how global dairy market shifts affect U.S. and Indian farmers. What do these changes mean for your dairy business? Keep reading to learn more.

Summary: Have you ever wondered how global dairy markets are evolving and what it means for you as a dairy farmer? The Idele conference in Paris highlighted industry trends, from growth and consumption to varied pricing across regions. Key insights revealed that Asia drives much of the global production growth, while Europe and North America see modest increases. India stands out for its massive milk production yet remains complicated in market dynamics. Meanwhile, economic challenges in China add layers of uncertainty to the global picture. “Growth in milk production has stopped in Europe and the United States, with demand showing signs of weakness in China and milk margins still offering few incentives in surplus areas,” said Gérard You from Idele. In 2023, global dairy experienced a moderate growth of 1.3% to 950 million tonnes, with Asia being the most significant contributor. The EU-27 saw a 0.3% increase in milk output, China experienced a 7.1% growth, and India climbed by 2.5%. However, milk production is slowing in Europe and the United States, while demand weakens.

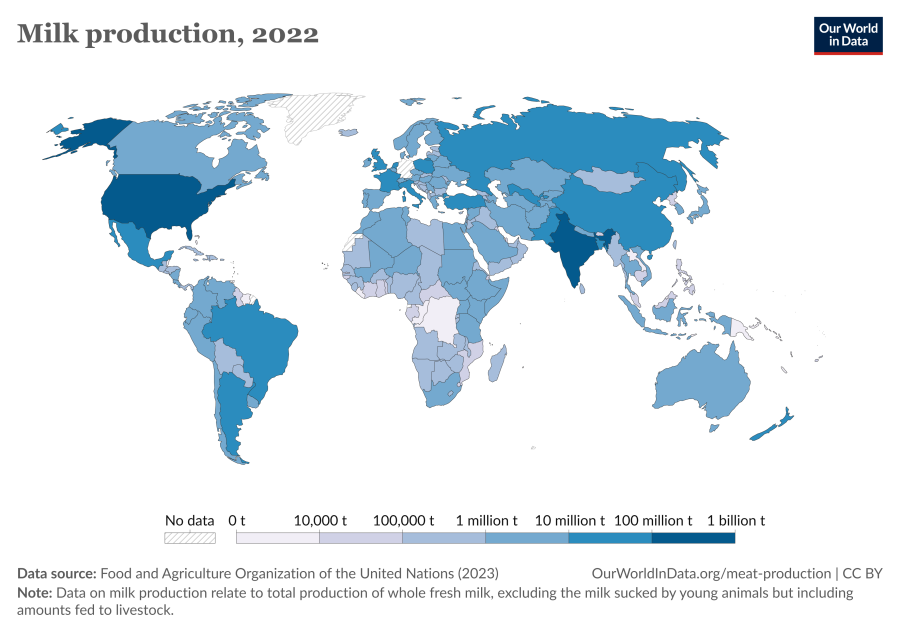

- Global milk production increased by 1.3% in 2023, reaching 950 million tonnes, with Asia contributing the most to this growth.

- EU-27 saw a minimal increase in milk output by only 0.3%, while China and India experienced significant growth of 7.1% and 2.5% respectively.

- Milk prices varied significantly across regions, with France seeing an increase, while New Zealand and the US experienced sharp declines.

- International dairy trade slightly decreased to 88 million TEL in 2023, with the EU-27, New Zealand, and the US being the top exporters.

- India remains the leading global milk producer, with its production largely divided among self-consumption, informal markets, and industrial collection.

- The global dairy market outlook for 2024 is marked by uncertain demand, particularly due to economic challenges in China and stagnant production in Europe and the US.

- India’s dairy sector faces significant political and environmental challenges, yet there’s a strong drive to increase exports, which might require opening borders to imports.

- Despite being a significant player, China’s dairy market is dealing with economic instability, overproduction, and declining demand post-COVID-19 pandemic.

Imagine waking up to discover that the rules of the dairy game had radically altered overnight. Have you ever considered how your farm is part of a more extensive, interconnected system of global dairy production? These surprising developments are not just a matter of curiosity; they have the potential to significantly impact your agricultural choices and success. Let’s delve into what’s going on and why it’s crucial for you to stay informed and adapt to these global trends.

Global Dairy Market: Surprising Shifts and Key Insights from the Idele Conference

As addressed at the Idele conference, milk output in the global dairy industry has grown moderately, by 1.3%, to 950 million tonnes in 2023. Asia was the most significant contributor, accounting for 10 million tons, followed by Europe and North America. However, production patterns differed by country; the EU-27 had a 0.3% increase, while China saw a significant 7.1% growth, and India climbed by 2.5%. This diversified environment emphasizes the many characteristics of the global dairy market.

Regional Dynamics: The Complex Interplay of Global Milk Production

When reviewing production patterns in key dairy-producing regions, it is evident that some are undergoing considerable changes. Let’s start with China and India, which have seen significant growth in milk output. In 2023, China’s milk output increased by an astonishing 7.1%. This expansion is consistent with the country’s continuous attempts to increase food self-sufficiency, as Jean-Marc Chaumet of CNIEL reported. He highlighted that China’s agricultural output increased by 5% 2023 over the previous year.

India, the world’s largest milk producer, is also experiencing a steady increase. With more than 200 million tons of milk produced by 70-80 million farmers, India’s output is set to rise by 2.5% in 2023. The country’s gradual development underscores its potential to play a significant and positive role in the global dairy industry. As Marion Cassagnou of ATLA points out, ‘There is a strong political will to export, but the country will have to open its borders to imports, potential game-changer for the global dairy market.’

In comparison, milk output in the EU-27 increased just 0.3% in 2023. This tiny increase suggests a more stable market in Europe, where production has hit a plateau. According to Gérard You from Idele, milk production has slowed in Europe and the United States while demand is weakening.

Furthermore, output stability is visible in the six primary exporting basins: Belarus, Argentina, Australia, New Zealand, the United States, and the EU-27. These areas enjoyed 0.9% growth in the first half of 2023 but decreased in the second half, resulting in a flat yearly collection with just a 0.2% rise over 2022. This stability implies that some areas increase fast while others maintain output levels, indicating a diversified and reassuringly stable global dairy market environment.

And Now: What’s the Deal with Milk Prices? A Rollercoaster Ride for Dairy Farmers!

Price variations keep dairy producers on their toes—when you believe you understand what to anticipate, the market shifts—sometimes dramatically. Let’s look at producer milk pricing in various nations in 2023.

In France, dairy producers may have sighed with relief when prices rose. The producer price rose to €471 per kilogram, a 6% rise over the previous year. This rise may be seen as a much-needed boost in a tumultuous market.

Meanwhile, things were not looking so good on the other side. In New Zealand, the producer price fell to €344 per kilogram, a 22% drop from 2022. The United States followed suit, with prices plummeting to €430 per kilogram, a 22% reduction.

However, the narrative still needs to finish there. The drop was not restricted to particular nations; it affected the price of dairy components globally. For example, the cost of butter fell by 22%, while low-fat powdered milk fell by 31%. These developments have far-reaching consequences for farmers and everyone else engaged in the dairy industry.

Understanding these swings and being updated is critical for dairy professionals. Are you prepared for what could happen next?

World Dairy Trade: Who’s In and Who’s Out in 2023?

Regarding international commerce, dairy products have recently experienced some promising developments. Despite being an essential item, trade volume fell marginally in 2023. The worldwide trade in dairy products was projected at 88 million tonnes of milk equivalent (TEL), down by around 1 million TEL from 2022.

Three significant actors dominate this trade: the EU-27, New Zealand, and the United States. These export powerhouses account for 68% of the worldwide dairy trade. The EU-27 continues to dominate, with its share growing to 26 million TEL, closely followed by New Zealand with 20 million TEL. Conversely, the United States had a modest drop, exporting 13 million TEL.

China, Mexico, and Algeria are the biggest importers, accounting for approximately 25% of total commerce. Asia dominates the worldwide dairy trade, accounting for 56% of the total. The region’s ravenous thirst for dairy emphasizes its importance in the business.

Gérard, you accurately stated, “In 2024, the global dairy market is mainly marked by uncertain global demand.” Market instability is apparent, with a 9% reduction in the value of worldwide commerce, reaching €73 billion in 2023, mainly owing to falling dairy commodity prices such as butter and milk powder.

2024 and Beyond Navigating the Uncertainty of the Global Dairy Market

As we approach 2024, the global dairy market remains to be seen. Critical variables such as stalled milk production growth in Europe and the United States contrast sharply with China’s sluggish demand signals. Gérard You of Idele highlights that the global dairy scene is entangled in a web of uncertainty, with market volatility tempering cautious optimism.

Milk production growth, which was previously strong, has slowed significantly. Both typically robust dairy markets, Europe and the United States, suffer stagnation. Production levels have plateaued, posing possible issues for farmers and industry partners. The current downturn may indicate a long-term trend unless market circumstances change significantly.

Meanwhile, China’s appetite for dairy goods, which formerly supported global markets, shows weakness. A slow economy, significant young unemployment, and altering consumer preferences after COVID-19 have all impacted dairy demand. The penetration rate and purchase frequency have declined, resulting in a supply excess that the market is straining to absorb.

According to You, the dominant emotion for 2024 is one of careful watchfulness. “Growth in milk production has stopped in Europe and the United States, with demand showing signs of weakness in China and milk margins still offering few incentives in surplus areas,” he says. His assessment of a “moderately quiet” year reflects a global market on the verge of turmoil, with supply and demand remaining precariously balanced.

India: A Complex Giant in the Global Dairy Market

India’s involvement in the global dairy sector is extensive and complicated. Did you know India is the world’s largest producer of milk? With over 200 million tons generated by 70-80 million producers, this quantity alone is astonishing. But let’s explore what this implies for the nation and the globe.

First, India’s milk production is separated into three primary markets: self-consumption, informal, and collecting. Marion Cassagnou states that these divisions are critical to the dairy sector’s operations. Self-consumption accounts for 46% of output, translating to around 95 million tons. The informal market accounts for 29%, or 60 million tons, while the collection market, which includes private industrials and cooperatives, contributes 25%, or 52 million tonnes.

This divided market system poses issues, particularly for small-scale producers. Around 75% of breeders have just 1-2 cows yet contribute considerably to livestock, accounting for 40% of the total. Most of these farmers are landless and have little access to water, making their livelihoods very fragile. Cassagnou said that “54% of India faces high to extremely high water stress,” highlighting the challenges these small-scale growers encounter.

It’s fascinating to compare the dynamics of huge and small farms. While more giant farms with more than 200 cows have begun to appear since 2000, they still account for a small percentage of the entire sector. Small dairy operators with 3-20 cows and farming crops and fodder account for a larger market share.

Despite these problems, milk consumption in India is gradually growing, owing to a youthful population, urbanization, and rising earnings. This expansion is mirrored in the predictions, which indicate that output might reach 321 million tons by 2032 under favorable circumstances, as underlined by Cassagnou.

However, India’s contribution to exports could be more extensive and irregular. While a solid political resolve exists to increase exports, India must open its borders to imports to assist with this development. The nation remains strongly protectionist, with state-supported dairy cooperatives limiting the opportunities for private producers and foreign corporations.

So, what is the takeaway? India’s dairy industry is a powerhouse with enormous potential, but it confronts severe challenges, particularly for small-scale farmers. With changing market dynamics and rising demand, the future may provide both possibilities and difficulties for this critical industry.

China’s Dairy Market: Wrestling with Economic Storms Post-COVID

China’s economic environment has been unstable, significantly influencing the dairy sector. Lower customer demand has proven to be a key concern after Covid-19. Jean-Marc Chaumet of CNIEL identified the weakening real estate industry, high young unemployment, and shrinking GDP as the causes of the lower average price, purchase frequency, and penetration rate of dairy products.

Despite this, China’s agricultural output increased by 5% in 2023 compared to 2022, with beef production growing by 22% between 2016 and 2023. Dairy output increased 36% from 2018 to 2023, with a 6.7% increase between 2022 and 2023. This spike is primarily due to the expansion of enormous farms.

Between 2020 and 2022, China constructed or planned 562 new dairy farms with a total capacity of more than 3.77 million heads. Seventy percent of these farms are enormous, with over 10,000 heads. By 2023, 164 new projects had employed 980,000 employees, underscoring the size of these activities.

However, vast farms have issues. Since 2022, rising production costs and falling milk prices have imposed economic strain on farmers. “In 2023 and 2024, large dairy farms lost money, and the construction of new farms slowed down,” Chaumet told me. Furthermore, half of China’s dairy cows now live on farms with more than 1,000 heads, leading smaller farms to perish. Concurrently, Chinese dairy imports have fallen since 2022, indicating a troubling market trend.

The Bottom Line

The worldwide dairy market environment is dynamic and complicated, influenced by regional production patterns, shifting pricing, and unexpected demand. From Asian nations’ substantial impact on milk production growth to the unpredictable milk prices farmers face in New Zealand and the United States, there are numerous challenges and opportunities. The main actors in international commerce emphasize high-value dairy products, but the economic challenges of emerging giants like India and China suggest that the future is far from assured. Staying current on global trends is critical for dairy farmers, especially those in the United States and India, and the lessons from the Idele conference highlight the need for adapting agricultural techniques to these evolving trends. In a continually changing market, proactive flexibility may be key to success in the coming years.