Upcoming FMMO changes may reshape milk prices and exports. What should dairy farmers do next? Stay current and prepare for what’s coming.

Consider this: it’s a crisp morning, and as you, a diligent dairy farmer, prepare for the day, the most recent Federal Milk Marketing Order (FMMO) revisions are front and center. The FMMO system, a vital part of dairy market regulation in the United States, maintains fair pricing and stability. Now, with planned changes on the horizon, remaining informed is critical. These changes might directly affect milk pricing, exports, and your farm’s viability. Every element is essential, from new pricing formulae to worldwide market consequences.

The planned FMMO modifications can transform the financial environment, with implications well beyond the farm gate. This is more than simply policy; it’s crucial for the sustainability and profitability of dairy production. Understanding these transitions is critical for making informed decisions and sustaining a competitive advantage in a changing agricultural industry. Let’s discuss what these changes imply for you and how to prepare for the future.

Revamping the Federal Milk Marketing Order Framework: A Blueprint for Modernization

| Proposed Change | Description | Potential Impact |

|---|---|---|

| Amendments to Pricing Formulas | Adjustments to the milk pricing formulas to better reflect current market conditions and production costs. | More accurate pricing, potentially leading to increased revenue for producers. |

| Updated Milk Composition Factors | Revisions to the calculations for protein, other solids, and nonfat solids in milk. | Aiming for a fairer distribution of income among producers based on milk composition. |

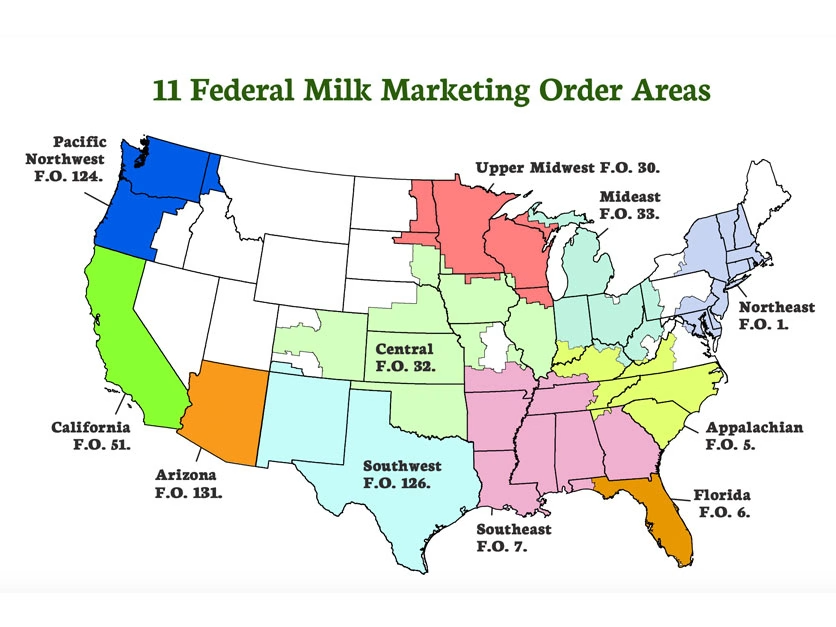

| Uniform Pricing Across Orders | Ensuring uniformity in pricing formulas across all 11 Federal Milk Marketing Orders. | Improved transparency and reduced regional pricing disparities. |

| Enhanced Regulatory Framework | Modernization of the regulatory framework to support a balanced approach for all stakeholders. | Ensuring long-term sustainability and fairness in the dairy market. |

The proposed revisions to the Federal Milk Marketing Order (FMMO) framework are intended to appropriately represent current industry realities by upgrading milk price formulae. The main improvements include adjustments to the milk composition elements and changes to the price structure to alleviate the financial difficulties imposed by rising processing expenses. The USDA advises changing the milk composition variables to 3.3% natural protein, 6% other solids, and 9.3% nonfat solids.

These changes aim to upgrade the FMMO system to reflect better the economic realities and technical improvements that have occurred since the previous formulae were adopted, and over 30 cooperative specialists and 30 farmers actively engaged in decision-making, providing substantial testimony over the 49-day hearing period. The varied feedback highlights the industry’s divided reactions—while some stakeholders are disappointed, others see possible positives from the changes.

The decision process included input from various industry actors, including dairy farmers, cooperatives, and industry experts. This joint initiative seeks to guarantee that the new FMMO framework meets all stakeholders’ unique demands while stabilizing farm milk prices and increasing export possibilities in a turbulent market situation.

Anticipated Impacts on Farm Milk Prices: A Complex Landscape

| Category | Current Pricing | Proposed Pricing | Potential Impact |

|---|---|---|---|

| Class I (Fluid Milk) | $18.55 per cwt | $19.20 per cwt | Increase profitability for producers, slight rise in consumer prices |

| Class II (Soft Products) | $16.25 per cwt | $16.90 per cwt | Overall positive for producers, additional costs for processors |

| Class III (Cheese) | $18.00 per cwt | $18.35 per cwt | Stabilized revenue for cheese manufacturers |

| Class IV (Butter, Powder) | $15.75 per cwt | $16.20 per cwt | Moderate revenue gains for producers, likely manageable for processors |

The planned Federal Milk Marketing Order (FMMO) framework amendments significantly influence farm milk pricing under many scenarios. With the USDA’s new milk composition factors—3.3% natural protein, 6% other solids, and 9.3% nonfat solids—farmers’ milk values may change. These changes might result in more exact pricing that reflects the actual components of the milk, rewarding farmers who produce higher-quality milk with greater solids levels.

However, as indicated by industry stakeholders, more significant processing costs may offset some of these advantages. Dairy farmers have had conflicting responses to the projected significant decrease in class pricing. For example, new pricing formulae better aligned with current market realities may reduce prices for Class I (fluid milk) and Class III (cheese-making) goods. In contrast, Class II (soft goods such as yogurt) and Class IV (butter and powdered milk) may experience changes that better reflect their market value, thereby offsetting the total effect on farm revenue.

Expert opinion on the planned revisions varies greatly. Some cooperative experts believe that the revisions will help stabilize pricing by minimizing the volatility that has traditionally existed in the dairy industry. They argue that a more modernization-driven strategy might boost the industry’s worldwide competitiveness and provide new export prospects. On the other hand, some farmers are concerned that lower-class prices may reduce total income unless cost-cutting initiatives are implemented at the farm level.

Regarding quantitative estimates, the proposed modifications are expected to result in a minor drop in farm milk prices in the immediate term, ranging between 2% and 5%. This projection is based on improved pricing algorithms that appropriately represent supply-demand dynamics and remove overproduction incentives. Nonetheless, these changes may drive efficiency gains and innovation in dairy farming operations, eventually leading to long-term sustainability and profitability.

As the vote approaches, likely in the autumn or early winter, dairy producers should remain attentive and actively engage in talks. Their opinions must be heard to ensure the final adjustments are consistent with economic realities and the dairy industry’s future goals.

The Proposed Federal Milk Marketing Order (FMMO) Changes and the Future of U.S. Dairy Exports: What You Need to Know

| Aspect of FMMO Changes | Potential Impact on Dairy Exports |

|---|---|

| Price Stability | Could enhance competitiveness in international markets by ensuring more predictable pricing. |

| Milk Composition Standards | Adjustments to protein and solids content may align U.S. products with global standards, potentially boosting exports. |

| Uniform Pricing Across Orders | May simplify export processes and reduce administrative burdens, making U.S. dairy more appealing to foreign buyers. |

| Regulatory Modernization | Modernized regulations could foster innovation in product offerings, catering to diverse global market demands. |

The planned Federal Milk Marketing Order (FMMO) modifications might substantially impact the future landscape of U.S. dairy exports, which dairy producers should constantly follow. One of the most important variables determining this result is international competitiveness. As the United States updates its milk pricing formulae, its ability to stay competitive worldwide will depend on how these changes coincide with other essential dairy exporting nations’ production costs and price structures. Given the predicted increase in processing costs, U.S. dairy products’ pricing competitiveness may suffer, possibly surrendering ground to overseas competitors.

Furthermore, the importance of trade agreements cannot be underestimated. Ongoing talks and the conditions of current contracts may either mitigate or worsen the consequences of the FMMO changes. For example, good trade conditions with significant dairy importers in the United States may minimize the effect of rising domestic pricing, ensuring American farmers have access to critical markets. In contrast, any adverse changes in trade ties might erode the competitiveness of the US dairy sector overseas.

Market access is also a critical challenge. Regulatory changes in importing nations and the new FMMO organization may provide hurdles or possibilities for US dairy exports. Farmers and exporters must be watchful in various regulatory settings to respond strategically. Furthermore, while the USDA solicits feedback from diverse industry stakeholders, including over 30 cooperative specialists and more than 30 farmers, these voices must continue to advocate for export-friendly policies within the FMMO framework to secure and extend foreign market access.

Beyond the Farm Gate: Broader Industry Impacts of the Proposed FMMO Changes

| Category | Potential Impact |

|---|---|

| Milk Price Volatility | The proposed changes may reduce volatility, offering more predictable income for farmers, but could also limit the potential for price spikes that benefit producers in times of shortage. |

| Supply Chain Dynamics | Adjustments in pricing formulas may affect the broader supply chain, influencing everything from feed supply costs to dairy product pricing for consumers. |

| Regional Disparities | Differences in how regions are impacted could emerge, with some areas benefiting from higher baseline prices while others struggle with adjusted pricing mechanisms. |

| Industry Consolidation | Smaller farms may find it harder to compete, potentially accelerating industry consolidation and reducing the overall number of dairy farm operations. |

| International Competitiveness | Changes in export dynamics could affect the United States’ competitive position in the global dairy market, either enhancing or undermining its role as a leading exporter. |

The proposed modifications to the Federal Milk Marketing Order (FMMO) have far-reaching ramifications beyond farm gate pricing and exports, affecting many other aspects of the dairy business. Adjustments to milk pricing formulae and composition parameters are expected to rebound across the dairy processing industry, resulting in increased processing costs due to changing milk component value dynamics. This might force processors to re-calibrate their processes, perhaps necessitating new technology or procedures to satisfy the upgraded requirements.

Logistics in the supply chain will also be impacted. The changes to how milk is priced and classified under the FMMO may disrupt existing transportation and distribution networks. Changes in supply patterns caused by pricing changes may require shippers and logistics providers to modify their routes and timetables to maximize efficiency under the new regime.

Finally, these regulatory changes may impact retail pricing. With the expected rise in processing costs and other logistical issues, more excellent prices may be passed on to the end customer. This situation might result in higher pricing for dairy goods on shop shelves. However, the magnitude of such repercussions would be determined mainly by the industry’s capacity to absorb these expenses rather than pass them on to consumers.

Navigating the Path to Finalization: Procedural Steps for FMMO Changes

| Step | Approximate Date |

|---|---|

| USDA Releases Recommendations | Late 2023 |

| Producers Review Recommendations | Early 2024 |

| Producer Vote on FMMO Changes | Mid 2024 |

| Announcement of Voting Results | Late 2024 |

| Implementation of Approved Changes | Mid 2025 |

Regarding procedural procedures, completing the proposed Federal Milk Marketing Order (FMMO) modifications is a complex and comprehensive process that requires a mix of administrative, legislative, and stakeholder-driven measures. Initially, the USDA must publish the proposed revisions and a detailed analysis of the comments from the 49-day hearing, which produced around 12,000 pages of testimony. Following its publication, there will be a specified time for public comment—typically 60 days—to allow farmers, processors, and other industry stakeholders to voice their viewpoints and concerns.

Simultaneously, the USDA will thoroughly analyze and incorporate public comments, resolve severe problems, and amend the proposed adjustments to reflect stakeholder feedback and regulatory concerns. This time of review and adjustment may face several legal and regulatory challenges, including ensuring compliance with federal regulations such as the Administrative Procedure Act (APA), which requires a comprehensive and open rulemaking process.

After completing these procedural stages, the USDA intends to complete and implement the new FMMO framework, with votes likely scheduled for this autumn or early winter. Dairy farmers in each order will vote on whether to approve or reject the proposed revisions in a referendum, most likely in December 2024 or January 2025. This referendum procedure highlights the democratic aspect inherent in the FMMO system, ensuring that dairy farmers’ opinions are prioritized in defining the future regulatory environment. Throughout this process, industry parties displeased with the final judgments may file legal challenges, adding another difficulty to the implementation timeframe.

Preparing for the Future: Strategic Steps for Dairy Farmers Amid FMMO Changes

Given the upcoming Federal Milk Marketing Order revisions, dairy producers must take proactive measures to prepare for the changing situation. First and foremost, financial preparation becomes necessary. Farmers should carefully assess their present cost structures, particularly in light of predicted adjustments in milk prices. Consider working with dairy-specific financial consultants to create comprehensive budgets and projections considering the likely effects of FMMO modifications. Cash flow management measures should be used to maintain liquidity, allowing the farm to handle price volatility.

Diversification may be an essential tactic in terms of market strategy. Farmers can look at other income sources, such as value-added goods or niche markets like organic or artisanal dairy products, which may demand higher prices and serve as a buffer against more considerable market changes. Furthermore, staying current on export potential and matching manufacturing techniques with international standards might offer new markets, reducing local price pressures.

Advocacy must not be forgotten as a crucial component during this transitional moment. Collaborate with industry organizations, such as cooperatives and trade associations, to share concerns and comments about the planned changes. Participate in public comment sessions and hearings to ensure dairy farmers’ viewpoints are included in the final FMMO framework. Furthermore, attending industry seminars and workshops on the subtleties of FMMO modifications will provide farmers with the information they need to make sound judgments and adjustments.

By concentrating on four areas—financial planning, market strategy, and advocacy—dairy farmers can better prepare for the future and guarantee their businesses stay robust in the face of regulatory changes.

The Bottom Line

The proposed modifications to the Federal Milk Marketing Order (FMMO) framework mark a watershed moment for the dairy industry. These measures, which aim to modernize pricing formulae to better line with current market realities, will impact farm milk prices, dairy exports from the United States, and industry dynamics in general. We examined anticipated agricultural price adjustments, export consequences, and the measures necessary to finalize the FMMO modifications. The industry’s reaction is mixed: while some are concerned about processing costs, others support measures such as restoring the “higher-of” formula for Class I skim milk price.

Dairy producers must keep current and actively engage in this changing regulatory environment. Keeping up with innovations will help to make informed strategic choices and drive future growth. Understanding rules and acting proactively is critical. Stay watchful, participate in industry conversations, and use available tools to reduce risks and seize new possibilities. Despite the challenges, educated and deliberate action will guarantee that the dairy community flourishes in the face of change.

Key Takeaways:

- The proposed FMMO changes are designed to modernize the dairy industry, addressing outdated pricing formulas and regulatory structures.

- Dairy producers should closely monitor these developments to understand potential impacts on milk prices, exports, and overall market dynamics.

- Mixed reactions from stakeholders highlight the challenges and opportunities inherent in regulatory reforms.

- The USDA and major dairy organizations are cautiously optimistic about the potential long-term benefits of the proposed amendments.

- The procedural steps to finalize the proposed changes will involve multiple stages, including public comments and further stakeholder consultations.

- Active participation from cooperative experts and farmers underlines the importance of industry input in shaping the final regulations.

- The revisions aim to create a fairer, more transparent market environment for dairy producers while addressing critical issues like the Class I mover.

Summary:

The Federal Milk Marketing Order (FMMO) revisions aim to modernize the dairy industry and address economic realities. The changes include adjustments to milk composition elements and price structure to alleviate financial difficulties caused by rising processing expenses. The USDA recommends changing milk composition variables to 3.3% natural protein, 6% other solids, and 9.3% nonfat solids. The decision process involved input from dairy farmers, cooperatives, and experts. The anticipated impacts on farm milk prices are complex, with some stakeholders expecting more accurate pricing and rewarding higher-quality milk producers. However, processing costs may offset some advantages. Expert opinion on the proposed revisions varies, with some cooperative experts believing it will stabilize pricing, boost industry competitiveness, and provide new export prospects. The FMMO changes could significantly impact U.S. dairy exports, and dairy producers should follow good trade agreements with significant importers to minimize the impact of rising domestic pricing.