Discover Dave Eastman’s transformative impact on dairy genetics. How did his strategic insight and innovation reshape the industry? Uncover his legacy today.

Dave Eastman’s strategic thinking and unwavering devotion have revolutionized the dairy genetics business, establishing unprecedented standards for innovation and quality. From humble origins on a family farm, Eastman rose to prominence in dairy breeding, pioneering genetic improvements and grooming the next generation of industry leaders. His emphasis on mentorship and collaboration has been a cornerstone of his success. Join us as we examine how his insight, passion, and values have influenced dairy genetics globally. Dave Eastman is to dairy genetics what pioneers were to exploration: a visionary mapping the unknown.

The Humble Beginnings: Where Passion and Curiosity Were First Cultivated

Dave Eastman, from Kinburn, Ontario, got his start in dairy genetics on his family’s farm. From an early age, he was involved in operating their 35-cow herd, learning directly about herd maintenance and the complexities of milking and feeding. His active participation in 4-H, a program that promotes agricultural knowledge and leadership skills among young people, significantly enhanced his early experience. Eastman thoroughly grasped animal husbandry via 4-H and became fascinated by the possible breeding advances. The combination of hands-on farm experience and the educational framework offered by 4-H sharpened Eastman’s early understanding and piqued his interest in dairy genetics. These formative experiences sparked a lifetime interest and pioneering career in dairy genetics. Eastman’s 4-H experience provided him with valuable agricultural skills and established a deep respect for the complex art of animal breeding, paving the way for his substantial contributions to dairy genetics.

From Sales Rep to Visionary Leader: Dave Eastman’s Ascendance in Dairy Genetics

Dave Eastman’s professional path in the dairy genetics sector is one of ambition and vision. He started as a sales representative at Cormdale Genetics, where he swiftly rose through the ranks due to his exceptional grasp of the nuances of sales and genetics. His excellent insight was recognized, and he was promoted to National Sales Manager. In this job, Eastman was instrumental in growing the company’s reach throughout Canada, stressing the thorough recruiting and training of new salespeople and establishing a complete distributor network.

As the industry grew more globalized, Eastman’s strategic acumen proved invaluable. Cormdale Genetics, led by Albert Cormier and supported by Eastman’s vision, embraced the globalization of dairy genetics. This was a transformative moment, as they led activities that resulted in the first semen imports from Holland Genetics and other overseas sources. This was a watershed moment for the firm, paving the way for future endeavors.

Eastman made a daring move in 1999, co-founding GenerVations with Albert Cormier, and later bought the firm from him in 2004. This strategic decision was motivated by understanding the inherent instability in distributing semen from other firms, which increased the danger of losing product lines due to industry mergers and acquisitions. Eastman established GenerVations to develop a more reliable business strategy. In his early days, he faced tremendous hurdles, notably the unpredictable nature of young sires whose genetic potential was unknown until demonstrated. To overcome this, Eastman carefully used precision breeding procedures, drawing on his extensive understanding of pedigrees and genetic possibilities to gain a footing in the market. His resilience and determination in these challenges set the stage for his future success in the industry.

Champion: The Beacon in GenerVations’ Formative Years

The purchase and sample of Calbert-I HH Champion, one of the first bulls GenerVations introduced to the market, was a watershed point in their early history. He was born in August 1997 and was among the first few bulls sampled by GenerVations; soon after the company’s foundation, it proved to be a revolutionary hit. His tremendous popularity and excellent genetic quality catapulted the fledgling corporation into the limelight, establishing the groundwork for future success. Champion’s influence provided financial stability, allowing for the employment of additional employees, increased marketing activities, and the development of an extensive worldwide distribution network.

Another significant milestone was the development of SireLodge. This facility, purchased in Alberta, was intended to hold and gather the company’s bulls. It not only maintained a

consistent supply of semen but also met the demands of other AI firms worldwide, strengthening GenerVations’ market position. These methods and accomplishments represented a larger vision of mastering their genetic destiny, giving a foundation for navigating the complicated environment of the dairy genetics sector.

Strategic Vision: Pioneering Genetic Milestones in Dave Eastman’s Career

Vogue’s 1st purchase was the 35 brood-star Comestar Goldwyn Lilac VG-89 in 2006. She was nominated for All-Canadian, Canadian Cow of the Year & Global Impact Cow of the Year.

In dairy genetics, strategic forethought and decisive action may be the difference between success and failure. Dave Eastman’s time in this challenging sector has been distinguished by critical choices that have improved his operations and established standards for others. Acquiring top-tier females such as Lila Z demonstrates Eastman’s dedication to genetic excellence. Her offspring set the genetic foundation for future success, as seen by bulls like Farnear Delta-Lambda, whose exceptional performance can be linked to this intelligent purchase.

However, one of the most transformational aspects of Eastman’s strategic playbook was the early acceptance and introduction of sexed semen into North America. In collaboration with Cogent, Eastman led his firm into previously uncharted territory. This decision formed market needs rather than just aligning with them. He provided North American breeders with the first sexed semen, which opened up new pathways for genetic gain, improved the quality of herds worldwide, and ensured the long-term profitability of his projects.

These judgments demonstrate Eastman’s interpretative expertise and ability to anticipate more significant market ramifications. This insight increased organizational stability, positioned his companies as innovators, and cemented his status as an industry visionary. His efforts did more than adjust to changes in the field; they sparked alterations that others would ultimately replicate, leaving an enduring stamp on the landscape of dairy genetics. Eastman established a bar for genetic innovation while demonstrating the need for strategic planning to achieve long-term success.

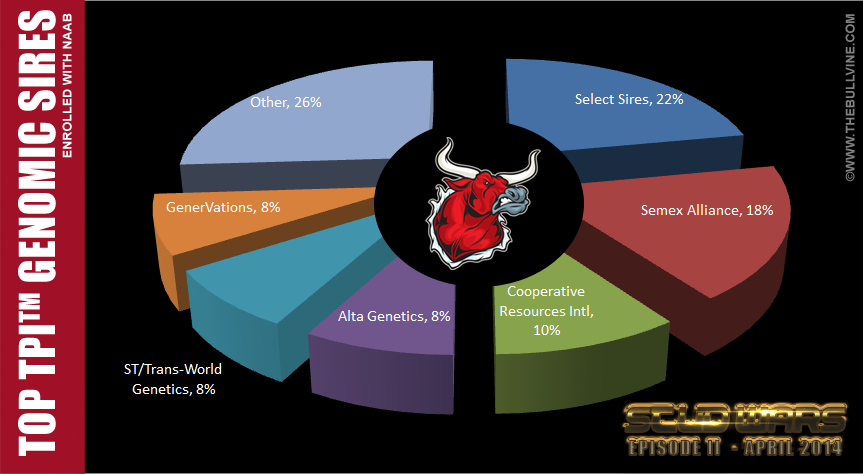

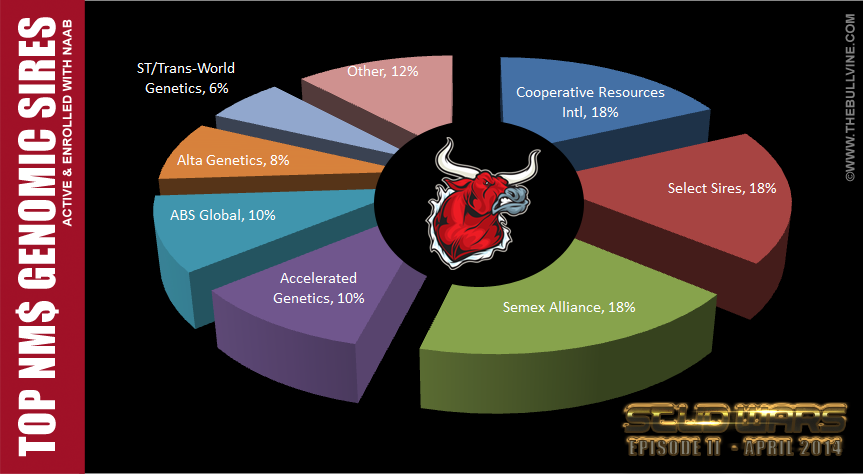

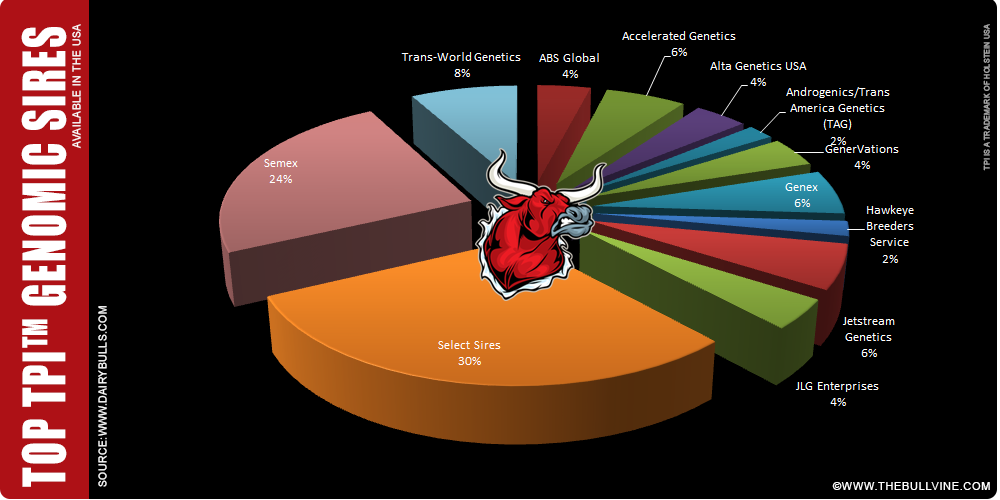

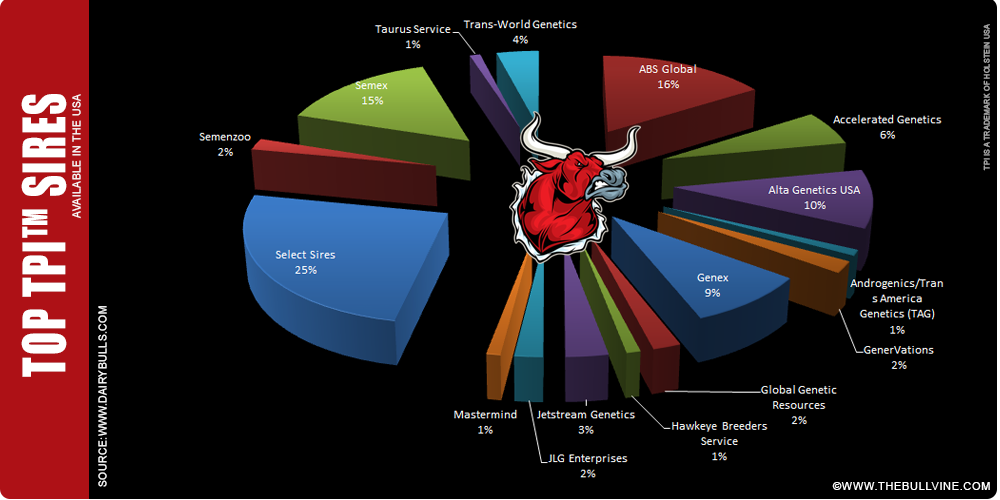

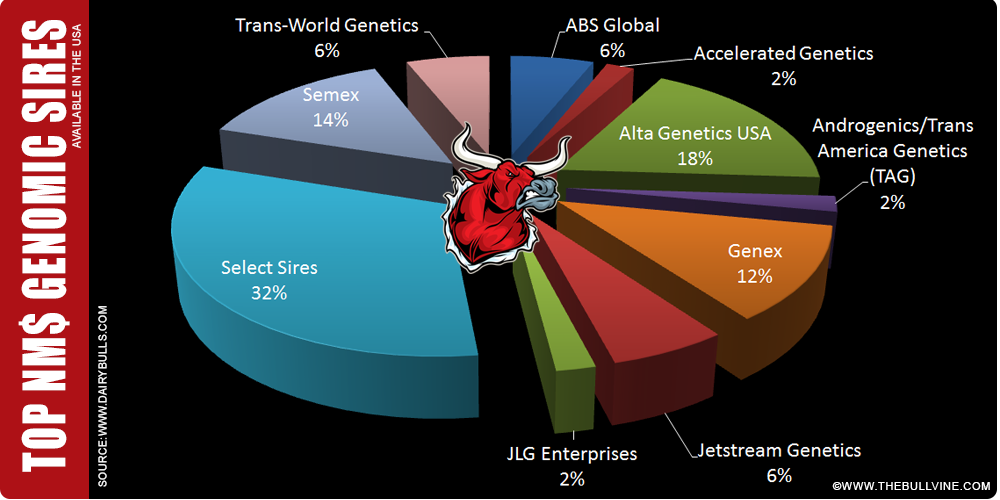

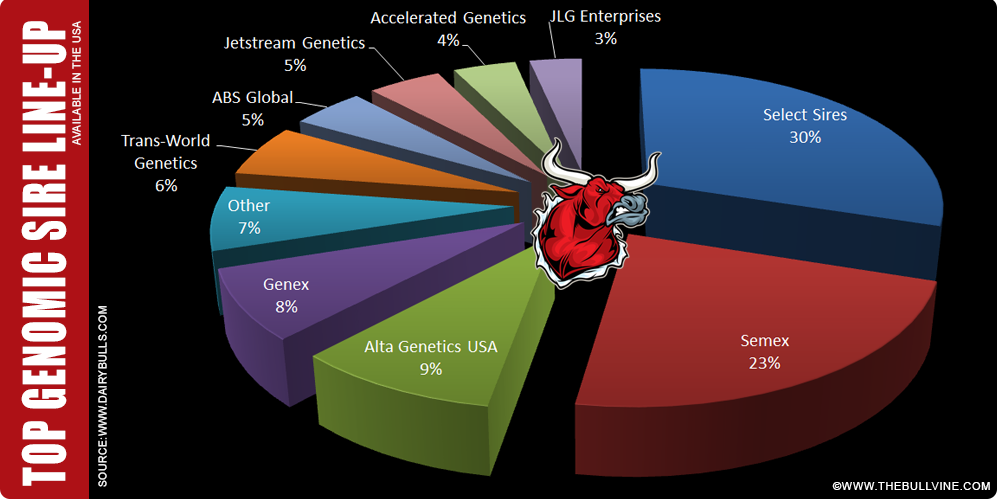

Genomic Prowess: How Eastman’s Vision Transformed Breeding Dynamics at GenerVations

Dave Eastman’s strategic use of genomic technology has been a revolutionary factor in improving GenerVations’ breeding operations, minimizing risks, and maintaining its competitive advantage. By incorporating genomic data into decision-making procedures, Eastman minimized the uncertainty associated with breeding, enabling early and precise identification of possible high-value genetic features. This foresight streamlined the selection process, ensuring that GenerVations regularly produced bulls with market-leading genetic value. As a result, this creative strategy increased the marketability of their services, assuring long-term high demand and cementing their position at the forefront of the dairy genetics business. Eastman’s innovative approach to breeding, using cutting-edge technology, has set a new standard in the industry and solidified his reputation as a visionary leader.

Forging Alliances: Dave Eastman’s Mastery of Strategic Partnerships in Dairy Genetics

The Vogue partners L-R: Len Vis, Dave Eastman, Sean O’Connor, Kelly O’Connor. The partners have bred Brewmaster, Epic, Lexor, Liquid Gold, Salt and Pepper, and more.

Strategic partnerships have the power to reshape the dairy genetics market, a concept Dave Eastman understood fundamentally. Eastman chose collaboration over costly competition when confronted with the challenge of competing against larger AI firms. This wisdom led to the creation of GMO (GenerVations, Maplewood, and O’Connor), a revolutionary alliance with top breeders like Len Vis of Maplewood and Sean and Kelly O’Connor of O’Connor Land and Cattle Co. This partnership offered GenerVations an unparalleled opportunity to tap into elite pedigrees typically inaccessible to smaller enterprises. By harnessing the strengths of its partners—Maplewood and the O’Connors in raising and developing livestock—each entity gained more than it could achieve alone.

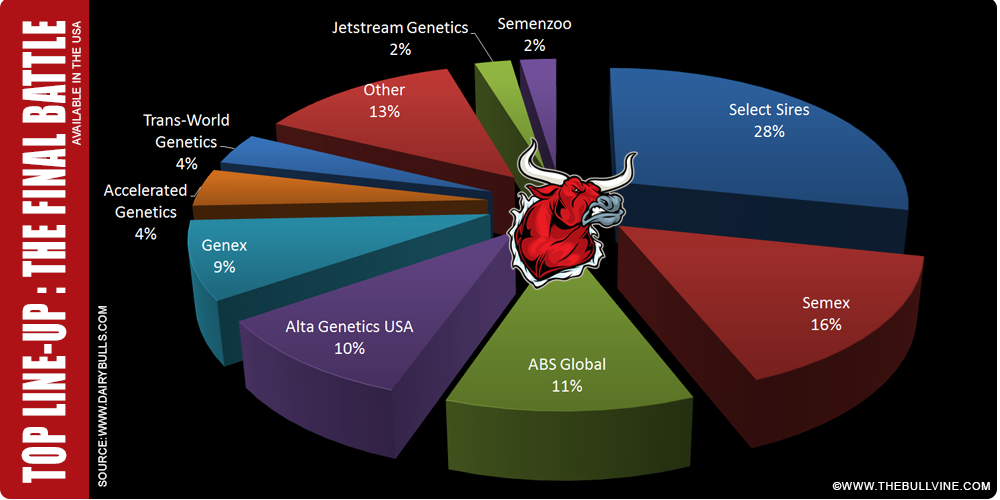

One of the collaboration’s hallmarks was its innovative branding strategy. The bulls carried the GenerVations prefix, while the female offspring bore the names of their partners’ herds. This mutually beneficial relationship elevated each partner’s standing while giving GenerVations greater control over breeding directions. After GenerVations’ sale in 2014, a strategic move was made to unify the branding under Vogue Cattle Co. By adopting advancements like polled genetics and the A2A2 trait, they stayed ahead of market demands and solidified their influence in dairy genetics. Although the original partnership concluded in 2021, its impact persists, showcasing how strategic alliances drive genetic innovation in the industry.

Strategic Exit: How Dave Eastman’s Sale of GenerVations Shaped the Future of Dairy Genetics

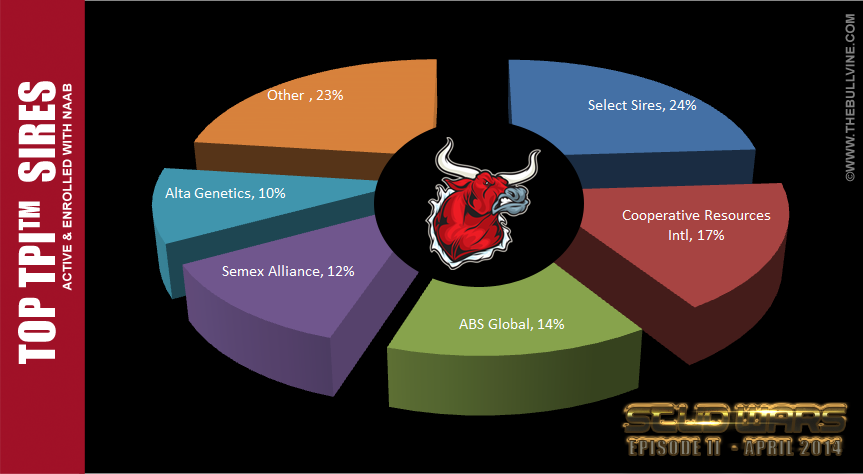

Several strategic considerations impacted Dave Eastman’s decision to sell GenerVations in 2014, demonstrating his excellent financial skills and insight in managing the difficulties of the dairy genetics market. At the heart of it all was GenerVations’ genomic bulls, which had become among the industry’s leading contributors to genetic development. Under Eastman’s leadership, GenerVations proved its capacity to lead the pack in genomic innovation, making it an appealing option for more prominent AI firms looking to expand their genetic portfolios.

Selling time was also an essential factor in the strategic decision-making process. Regular genomic testing began to level the playing field for genetic enterprises during this time. Eastman gained a competitive advantage by using GenerVations’ reputation for developing high-ranking bulls like Epic and securing a successful purchase. This decision was not just about capitalizing on present success but also about conserving the company’s past and ensuring its future effect inside a more extensive organization capable of increasing its reach.

The transaction had a varied influence on Eastman’s career. It enabled him to shift his emphasis to other projects and pursue novel paths in the industry, such as genomic testing (Validity Genetic Testing )research and the continuous selling of exceptional bulls under Vogue (now Vector prefix). Furthermore, this change demonstrated Eastman’s versatility and dedication to pushing the frontiers of dairy genetics while providing him the stability to pursue his larger goal.

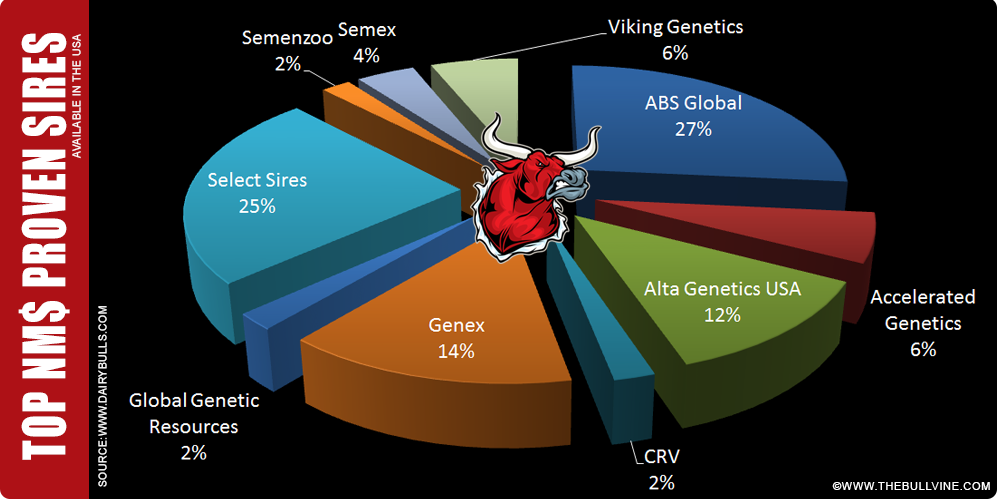

From the industry’s standpoint, selling to a well-established operator such as Select Sires enabled more worldwide access to GenerVations’ outstanding genetic resources. This integration emphasized the importance of intelligent breeding initiatives and the fast-changing genomic environment in propelling industrial growth. It also facilitated the global spread of high-quality genetic material, emphasizing the significance of innovative breeding strategies in improving dairy cow genetics.

Charting New Territories: Dave Eastman’s Visionary Approach to Polled and Homozygous Genetics

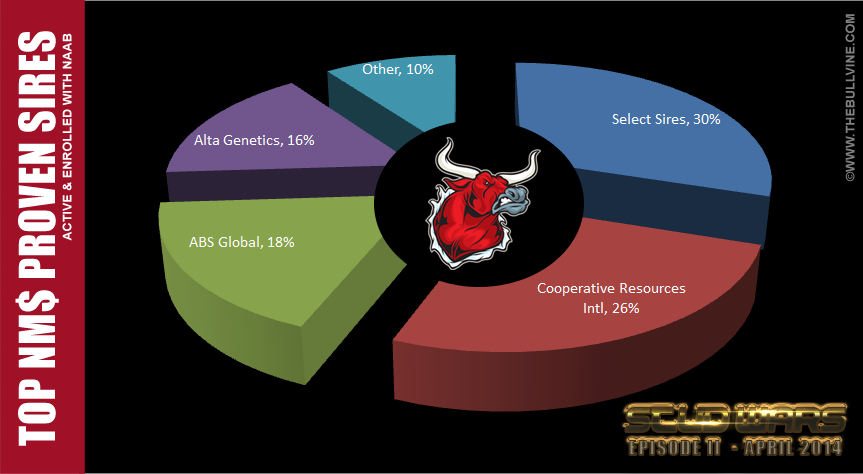

Dave Eastman’s continuous endeavors in dairy genetics, concentrating on polled and homozygous genetics, have resulted in substantial advances. Recognizing the growing demand for these features, Eastman carefully manages a portfolio of homozygous bulls for desired genes, guaranteeing that these traits are consistently transmitted to future generations. His strategy emphasizes meeting a significant industry need for high-producing cattle with these advantageous genetic traits.

Eastman’s dedication extends to marketing these high-quality bulls, which he tackled with increased zeal after the sale of GenerVations. He assures the bulls he promotes meet the highest genetic requirements using his vast industrial network and longtime contacts. This endeavor aims to sustain quality while pushing the frontiers of dairy genetics.

The bulls are kept at the cutting-edge ST facility in Listowel, where they are given the best care possible to reach their full genetic potential. The demand for sexed semen, primarily for export, has been robust, with Eastman’s bulls leading the way in supplying this need. As he continues contributing to the genetic enhancement of dairy cattle, Eastman’s diligent bull selection guarantees that they meet global market needs and stay at the forefront of genetic breakthroughs.

A Legacy of Mentorship and Family Support: Dave Eastman’s Path in Dairy Genetics

Dave Eastman’s path in the dairy genetics field was greatly influenced by the profound guidance he got, most notably from Albert. Albert’s inventive energy and commercial ability shaped Eastman into the visionary leader he is today. This mentoring gave Eastman strategic insights and the capacity to handle the complexity of foreign marketplaces, which were critical to his industry-changing breakthroughs.

Equally crucial was his family’s continuous support. They encouraged him to expand his horizons outside the family farm, develop a strong work ethic, and cultivate perseverance. Such solid support was critical to his quest for greatness.

Wendy, Eastman’s wife, was also a rock during tough times. Her support, particularly on critical occasions such as the launch of GenerVations and times of crisis, helped him stay focused and motivated. This emotional support enabled Eastman to accomplish his ambitious vision for the organization.

As a mentor, Eastman has been similarly committed to developing talent across the business. His inclusive mentoring philosophy emphasizes people skills and product expertise, providing opportunities for people from many backgrounds. This strategy has inspired many professions, creating a culture of creativity and devotion that benefits the industry. Andrew Hunt of The Bullvine got his start owing to Dave. While still an undergraduate and just getting into agricultural marketing, Eastman called Andrew and asked him to assist with the marketing of GenerVations as it began and continued through the Champion era, enabling both to build their businesses and establish themselves in the field.

Dave’s mentoring was received and offered, and his strong family support has left an everlasting mark on his legacy. This caring atmosphere fueled his career and prepared him to inspire and educate others, resulting in a progressive and dynamic dairy genetics landscape.

The Bottom Line

Dave Eastman’s career in the dairy genetics sector shows the power of strategic thinking and innovation. Eastman’s path, from his upbringing on the family farm to his transformational responsibilities at Cormdale Genetics and the pioneering founding of GenerVations, is distinguished by a visionary attitude that has continuously pushed limits. His strategic actions, such as applying genomic advancements and forming multinational collaborations, transformed genetic breeding, giving dairy farmers a global competitive advantage. Eastman’s current concentration on polled and homozygous genetics demonstrates his dedication to fulfilling changing business needs. His legacy, defined by a persistent commitment to quality and innovation, is a baseline for future advances in dairy genetics.

Reflecting on Eastman’s history, it’s a necessary time to explore how strategic vision may affect an industry’s future. What can we learn from his path to help you with your challenges? The discourse continues, and I welcome you to add your ideas and observations in the comments section below. Let’s talk about how innovation might generate success in dairy genetics together. Share this article with your coworkers to spark more extensive talks about this critical sector.

Key Takeaways:

- Dave Eastman’s early experiences on a family farm and in 4-H were foundational to his lifelong engagement with the dairy industry.

- His rise from a sales representative to a national leader in dairy genetics showcases his business acumen and strategic foresight.

- Innovative strategies, including early adoption of genomics and groundbreaking partnerships, mark the success of GenerVations.

- Eastman’s strategic decisions, like expanding into polled and homozygous genetics, underline his visionary approach to breeding innovation.

- Mentorship and family support were crucial to Eastman’s success, highlighting the importance of personal relationships in professional growth.

- His decision to sell GenerVations was strategic and timely, setting a precedent for strategic business exits in the industry.

- Dave Eastman’s legacy in dairy genetics continues to evolve as he focuses on market-leading traits and genetic advancements.

Summary:

Dave Eastman is a visionary pioneer in the dairy genetics industry, transforming it with his relentless pursuit of innovation and excellence. From his beginnings on a modest dairy farm in Kinburn, Ontario, he rose to Cormdale Genetics ranks, eventually co-founding GenerVations with Albert Cormier in 1999 and becoming its sole owner in 2004. Eastman introduced groundbreaking advancements like sexed semen, leveraged genomic technologies, and formed strategic partnerships to redefine dairy genetics. His acquisition of Calbert-I HH Champion brought financial stability and international growth. Choosing collaboration over costly competition, Eastman helped create GMO/Vogue (GenerVations, Maplewood, and O’Connor), an alliance with top breeders. His enduring legacy includes mentorship and a focus on polled and homozygous genetics, profoundly impacting the global dairy landscape.

Learn more:

- Creating a Lasting Dairy Farm Legacy: 5 Essential Steps You Need to Know

- Dairy Cattle Breeding Secrets from Legendary Trainer D. Wayne Lukas

- 5 Things You MUST Know about the Future of the Dairy Breeding Industry

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!