Milk keeps flowing, but markets aren’t keeping up — here’s why butter still wins while powder takes the hit.

EXECUTIVE SUMMARY: Milk keeps flowing, and that’s both the good and the bad news this week. Global markets are clearly split: butterfat found support, while powders keep sliding under the weight of spring flushes from New Zealand and South America. The GDT fell for a fifth straight time, confirming that buyers remain hesitant despite stronger global GDP signals. European cheese prices softened again, squeezed by heavy milk flows and stiff export competition from the U.S. Meanwhile, domestic U.S. butter and whey showed small but meaningful rebounds, hinting that seasonal demand is still alive. The story heading into Q4 is crucial but straightforward — fats are holding the line, but milk powder markets are testing just how low they can go.

The global dairy market feels a bit like a full bulk tank these days — there’s plenty of volume, but the challenge lies in finding enough demand to keep things moving. As seasonal production swells across the Southern Hemisphere and buyers take a more cautious approach, markets are struggling to find equilibrium. The story this week is one of contrast: fats holding firm, proteins still under pressure, and a tug-of-war between optimism and oversupply.

EEX Futures – Butter Builds Strength

Volume on the European Energy Exchange (EEX) reached 1,730 tonnes last week, spread across butter, skim milk powder, and whey. Butter led the pack, climbing 1.6% to €5,226 for the Oct 25–May 26 strip.

What’s interesting here is how butter continues to defy broader weakness. European cream supplies remain comfortable, but steady retail demand and ongoing export inquiries — particularly for high-fat butter used in industrial formulations — are helping maintain price momentum (EEX, Oct 2025). Skim milk powder (SMP) slipped 0.2% to €2,163, showing that supply comfort and limited tenders are keeping buyers sidelined. Whey, meanwhile, gained 2.0%, settling around €975, driven by active demand for protein fortification in feed and human nutrition sectors.

SGX Futures – Fat Prices Hold Ground

Across the Singapore Exchange (SGX), 13,123 tonnes traded last week — the majority in Whole Milk Powder (WMP), which eased 0.4% to $3,546. SMP crept up 0.2% to $2,591, while Anhydrous Milk Fat (AMF) added 1.0%, finishing at $6,666.

It’s worth noting that AMF’s firm tone isn’t just about premium dairy fats — it’s about diversification. Food manufacturers are migrating toward AMF for better shelf stability and consistency, widening the AMF–butter spread to $376 per tonne. That gap signals stronger demand in processed and export channels versus commodity butter sales.

Butter on SGX slipped 1.4% to $6,420, reflecting the usual shoulder-season slowdown before Q4 holiday orders gain traction. The NZX milk price futures market traded 426 lots (2.56 million kgMS), keeping farm gate projections near $10/kgMS, supported by the weaker New Zealand dollar.

European Quotations – Region by Region Reality

The EU Butter Index dipped €39 (–0.7%) to €5,390, but the national picture tells more of the story. Dutch butter fell sharply (–3.4%), French butter rose 1.2%, and German butter held steady. The SMP Index fell 1.2% to €2,097, weighed by slow export booking and cautious EU buyers. By contrast, whey improved 1.7% to €912, another sign that protein derivatives continue to offer bright spots amid the softness.

Year-over-year, SMP has dropped more than 15%, while butter remains nearly 30% below 2024 levels. The key here is that fats are still profitable to produce, while powder processors are watching their margins shrink (EU Commission Market Observatory).

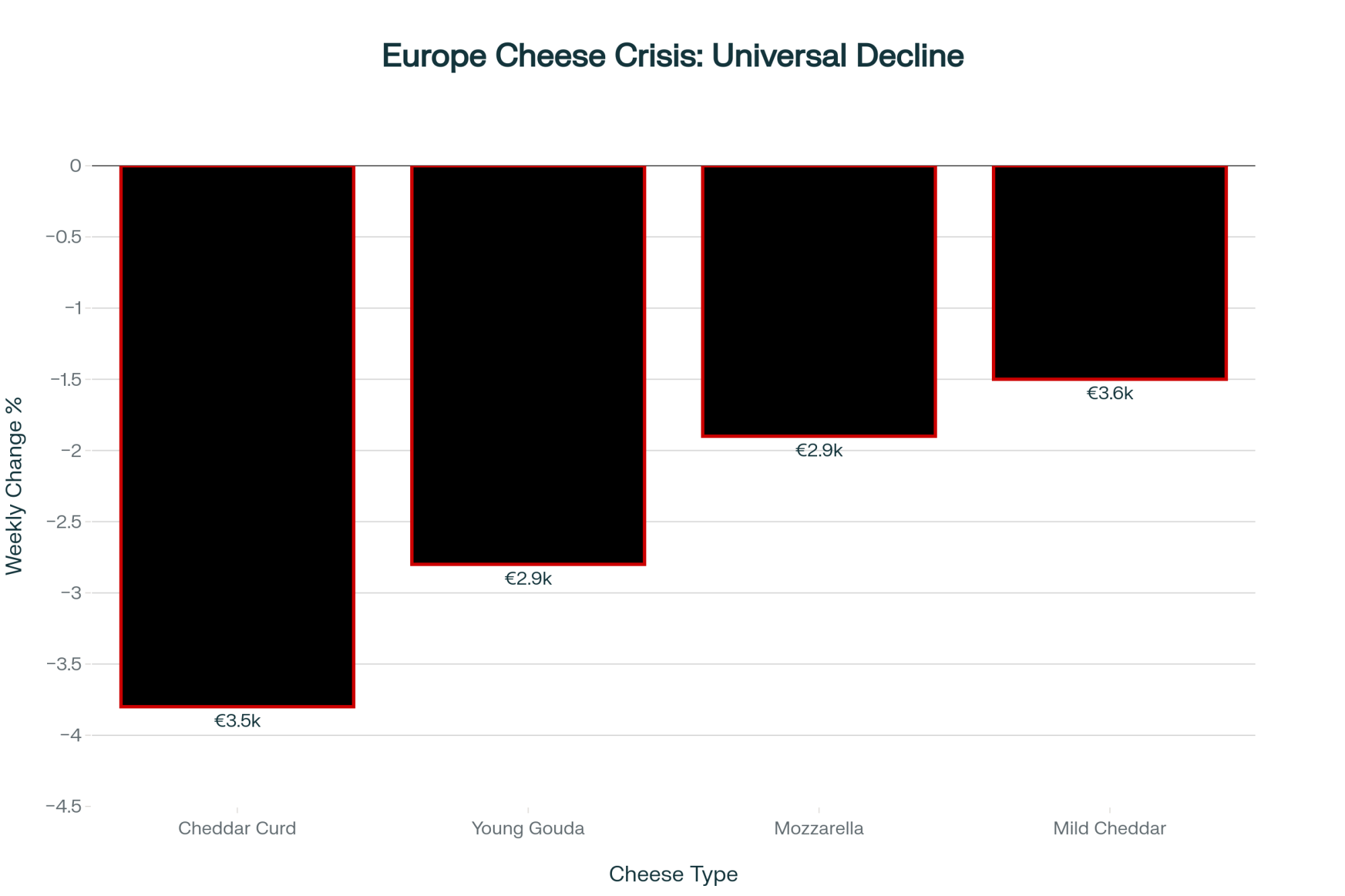

EEX Cheese Index – A Tough Stretch

Cheese prices continue to grind lower. Cheddar Curd fell by 3.8% to €3,501, Mild Cheddar lost 1.5% to €3,636, Young Gouda dropped 2.8% to €2,909, and Mozzarella eased 1.9% to €2,928.

What’s driving this? In short, too much milk, not enough elasticity downstream. European processors have faced strong milk deliveries and limited export momentum, particularly as the U.S. continues to compete aggressively in cheese exports with lower prices and a steadier currency.

GDT Auction – Fifth Consecutive Decline

The Global Dairy Trade (GDT) Price Index fell another 1.4% to $3,881, its fifth straight dip — a clear indicator that the global balance between supply and consumption is still correcting.

Whole milk powder dropped 2.4% to $3,610, and skim milk powder declined 1.6% to $2,559. By contrast, AMF rose 1.5% to $7,038, maintaining its premium over butter. Butter fell slightly (–0.8% to $6,662). That persistent AMF premium shows sustained appetite for high-purity fats, particularly in Asian and Middle Eastern markets (GDT Event 390, Oct 2025).

Cheddar and mozzarella prices fell 1.9% and 5.3%, respectively. Volumes sold at the event totaled 40,621 tonnes, down modestly from the previous auction.

Southern Hemisphere – Production Ramps Up

Down south, spring flush is living up to its name. New Zealand’s September milk collection hit 2.67 million tonnes, up 2.5%, while milk solids jumped 3.4% year over year (DCANZ, Oct 2025). A weaker NZD continues to bolster local payouts, and with PKE (palm kernel expeller) imports up 35%, many herds are maintaining condition through the flush.

Argentina’s production rose 9.9% year over year in September, and solids were up 11.7%, driven by improved pasture and feed efficiency under stable weather (OCLA Argentina, Sept 2025). Meanwhile, the Netherlands reported +6.7%milk collections and a stronger butterfat yield, signaling broad European abundance.

These gains are great news for efficiency metrics but apply downward pressure on global dairy pricing, particularly across SMP and WMP.

Trade and Demand – China Sends Mixed Signals

China’s September milk-equivalent imports rose 4.7% year over year — but that number hides the nuance. WMP imports surged 41%, a recovery from last year’s depressed base, while SMP fell 12.5% and butter jumped an impressive 64.7% (Chinese Customs Data, Oct 2025).

This suggests that Chinese buyers are being tactical. They’re restocking high-fat categories but remain cautious on large-volume powders. New Zealand exports, up 8.7% y/y, captured much of that growth, though SMP flows remain uneven. Demand is stabilizing—not accelerating yet.

U.S. Markets – Glimmers of Recovery

| Product | Weekly Change | Current Price | Market Signal |

| Dry Whey | $+3.5¢$ | $\$0.69/\text{lb}$ | Strong protein |

| Butter | $+0.75¢$ | $\$1.6025/\text{lb}$ | Holiday build |

| Cheddar Blocks | $+0.25¢$ | $\$1.7775/\text{lb}$ | Moderate food |

| Nonfat Dry Milk | $+\$0.05$ | $\$1.16/\text{lb}$ | Steady demand |

Domestic dairy markets found small pockets of strength. CME cheddar blocks ticked up 0.25¢ to $1.7775/lb, butter gained 0.75¢ to $1.6025/lb, and nonfat dry milk rose a nickel to $1.16/lb. Dry whey continued to climb, up 3.5¢ to $0.69/lb, thanks to unflagging demand for high-protein ingredients (USDA Dairy Market News, Oct 2025).

Cream supplies remain ample, butter churns are busy, and foodservice activity is moderate. As one Wisconsin marketing manager put it this week, “We’re not seeing panic buying, but holiday pipeline building is real.” Feed remains a bright spot, with DEC25 corn at $4.28/bu and JAN26 soybeans at $10.62/bu, though both trended higher late in the week.

The Bottom Line

Looking ahead, the key takeaway this week is the growing divide between resilient fats and fragile powders. Butter and AMF continue to attract strong retail and manufacturing interest, offering some price floor protection. But with milk collections swinging higher across the Southern Hemisphere, SMP and WMP are likely to remain under pressure through the year’s end.

Short-term volatility may persist, especially if China’s buying remains uneven. Still, there’s cautious optimism. Farm-level profitability in regions like New Zealand and the Midwest is holding better than last year — proof that leaner operations, feed cost management, and smarter hedging have made this downturn more manageable.

As always, milk will find a home — but the home it finds this season might be one more driven by butterfat than by bulk powder. And that’s a story worth watching as we head toward the new year.

Key Takeaways:

- Fats are holding firm, powders aren’t. Butter and AMF prices found support, but SMP and WMP remain under pressure from surging milk supply.

- GDT slipped again (-1.4%), its fifth straight decline — a reminder that buyer confidence isn’t back yet, even as global GDP nudges higher.

- Europe’s cheese values slid once more, squeezed by full silos, steady milk flows, and competitive U.S. export pricing.

- Southern Hemisphere production is booming — New Zealand up 2.5%, Argentina nearly 10% higher — ensuring plenty of product but few price rallies.

- In the U.S., butter and whey are bright spots, lifted by retail holiday demand and strong protein interest.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 5 Mistakes Dairy Farmers Make With Their Veterinarians (And How to Fix Them) – This guide provides tactical strategies for improving herd health and management efficiency. It reveals how strengthening the farmer-vet relationship through better communication and data sharing can directly reduce costs and improve outcomes in a tight-margin environment.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – For a deeper strategic perspective, this analysis explains the structural forces driving the market. It offers critical context on the production shifts in the EU and US, helping you understand the long-term trends behind this week’s price volatility.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – Explore innovative solutions to the market pressures discussed in the main article. This piece demonstrates how investing in automation and AI for feeding, health monitoring, and milking can deliver a tangible ROI by cutting costs and boosting yields.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!