Find out how stable global food prices could affect your dairy farm‘s profits. Ready to adapt and grow your bottom line?

Summary: Global food prices have shown signs of stabilizing after months of fluctuations, offering hope to dairy farmers facing market uncertainties. In July, the Food and Agricultural Organization’s (FAO) Food Price Index (FFPI) dipped slightly to 120.8 points, while the Dairy Price Index (DPI) slipped by 0.1% due to lower milk powder prices. Stabilizing prices may boost demand, but dairy farmers must remain vigilant in a volatile market influenced by fluctuating cereal, vegetable oil, and meat prices. Understanding the effects of the July DPI adjustment is crucial for making intelligent business choices, as cheese and butter prices rose, largely offsetting the decline in milk powder prices.

- FAO’s Food Price Index dipped slightly to 120.8 points in July 2024 after a period of rising prices.

- The Dairy Price Index saw a minor decline of 0.1% in July, mainly due to lower milk powder prices.

- Despite the drop in milk powder prices, cheese and butter prices increased, offsetting the decline in the Dairy Price Index.

- Stabilizing global food prices could boost consumer demand, benefiting dairy farmers.

- Dairy farmers must remain cautious and adaptable due to ongoing market volatility.

- Shifts in cereal, vegetable oil, and meat prices contribute to the complex and interconnected global food market.

- Monitoring and understanding these market trends are essential for making informed business decisions.

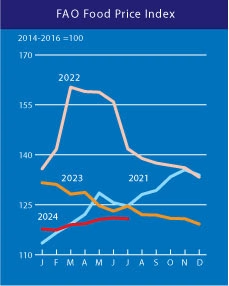

Have you ever wondered when food costs might eventually stop rising? Well, dairy producers, that time has come. Global food prices have steadied following months of turmoil, which might mean significant changes for your company. But what does this imply for farmers like you? The Food and Agricultural Organization’s (FAO) Food Price Index (FFPI) shows that stabilizing food prices may significantly influence dairy producers. The FFPI fell to 120.8 points in July, a small drop amid shifting patterns earlier this year. If you dig further, you’ll see that the Dairy Price Index (DPI) has also slightly decreased. The FAO said, “The Dairy Price Index slipped to 127.7 points, down 0.1% from June, influenced by dampened demand but offset by moderately rising cheese and butter prices.” Despite this, the DPI remained 7.2% higher than the previous year. Understanding the complexities of these pricing swings is not only necessary; it is also beneficial to dairy producers. Rapid changes in global food prices may directly influence feed costs, milk prices, and, ultimately, the profitability of your business. With the economic environment continuing to provide challenges for consumers and producers, it is essential to plan and adapt.

| Index | July 2023 | June 2023 | July 2022 |

|---|---|---|---|

| Food Price Index (FFPI) | 120.8 points | 121.0 points | 124.6 points |

| Dairy Price Index (DPI) | 127.7 points | 127.8 points | 119.1 points |

| Cereal Price Index | -3.8% | N/A | N/A |

| Vegetable Oil Price Index | +2.4% | N/A | N/A |

| Meat Price Index | +1.2% | N/A | N/A |

| Sugar Price Index | +0.7% | N/A | N/A |

Global Food Market Stabilizes: What July’s Price Dip Means for Dairy Farmers

The recent stability of the global food market, notably the minor drop in the FAO’s Food Price Index (FFPI) to 120.8 points in July, is a significant development. This move signals a break from the consistent rises seen between February and June, providing optimism for consumers globally as they traverse a challenging economic environment. Despite the minor dip, it is essential to remember that prices remain below last year’s levels and are far from the high seen in 2022. This trend is especially relevant since it implies a more significant reduction in global food prices, but with specific categories, such as dairy and cereals, displaying inconsistent results.

The Dairy Price Tango: Navigating the July Shifts in Milk Powder, Cheese, and Butter

One critical factor in lower dairy prices was a significant drop in demand for milk powder. According to the Food and Agriculture Organization (FAO), the drop in June milk powder prices was caused by a fall in buying activity. This may be linked to various market phenomena, such as fluctuations in export volumes and customer preferences. Furthermore, several areas facing economic issues have reduced milk powder imports, impacting total demand [FAO Report].

However, not all parts of the dairy category followed this declining tendency. Cheese and butter prices rose, largely offsetting the decline in milk powder prices. The dairy industry’s resiliency in the face of market problems reflects dairy farmers’ hard work and devotion. Cheese prices have risen due to consistent demand from local and international markets, strong consumption patterns, and good trading circumstances. Butter prices increased due to low availability and strong demand in important markets, as reported by FAO.

Regardless of these variations, it is critical to remember the larger historical context. The current DPI of 127.7 points indicates a 7.2% increase over the previous year. This increase suggests a positive trend in the dairy industry despite the recent minor dip. Just over a year ago, in June 2022, the DPI peaked at 158.2 points, demonstrating both volatility and resilience in the dairy industry. This historical comparison shows the relative stability established recently despite market pressures and economic uncertainty.

Understanding the subtleties of the market is crucial for dairy producers. The minor DPI drop, caused by varied trends in dairy products, underscores the importance of strategic planning and market adaptation. As industries such as cheese and butter continue to perform well, there is an opportunity to profit in these high-demand regions. Simultaneously, staying updated about demand patterns for items such as milk powder can help you make better production and marketing choices. This emphasis on strategic planning and market adaptation empowers dairy producers to navigate the market confidently and quickly.

Navigating Price Stability: What Dairy Farmers Need to Know

The recent stability of global food prices, particularly the minor drop in dairy prices, brings various potential benefits for dairy producers. This stability breathes new life into an otherwise unpredictable market, offering a sense of optimism. Farmers may see an increase in demand if customers become more ready to purchase milk powder due to cheaper pricing. This increasing demand may benefit farmers’ income sources, providing a hopeful outlook.

Another critical advantage is pricing predictability. After dealing with sharp changes over the last two years, farmers may now confidently manage their budgets. Predictable pricing simplifies day-to-day operations and allows for long-term investments in efficiency and sustainability.

However, it is essential to evaluate the problems as well. While cheese and butter prices have boosted the dairy index, they also add complexity. Farmers specializing in milk powder may need help to balance the benefits of rising demand and the realities of decreased prices. Furthermore, any rapid rise in input costs—such as feed and energy—could negate the advantages of steady dairy pricing. For instance, a sudden increase in feed costs could significantly reduce your profit margins, highlighting the need for careful cost management.

As a result, although the stability of dairy prices provides much-needed relief, dairy producers must stay alert. To properly traverse this new, more stable terrain, businesses must monitor market developments and alter their strategy.

Interconnected Economic Shifts: The Ripple Effects of Global Food Price Stabilization on Dairy Farming

The recent stability of global food prices occurs within a larger and more complicated economic environment. While the Dairy Price Index fell somewhat, changes in other significant categories substantially affected the total Food Price Index. For example, cereal prices fell by 3.8% due to optimistic supply predictions that put downward pressure on the market. However, higher prices in other industries almost entirely offset this respite. Vegetable oil prices have risen by 2.4%, reaching their highest level since February last year. Concurrently, the meat price index grew for the sixth straight month, up 1.2%. Sugar prices also rose by 0.7%.

How can these developments indirectly affect dairy farming, you ask? Lower grain pricing may lower feed bills for dairy producers, offering much-needed relief in production costs. However, rising prices for vegetable oil, meat, and sugar indicate broader inflationary pressures, which may raise operating expenses in other sectors. Higher meat prices, for example, may increase the cost of breeding and keeping cattle, reducing milk production efficiency. Similarly, rising sugar prices may increase costs for dairy products that need sweetening, such as flavored milk and yogurt.

Given these interwoven dynamics, dairy producers must monitor more significant pricing movements in the dairy industry and throughout the whole food supply chain. Understanding these changes may provide valuable insights into future cost swings, allowing for more effective financial planning and operational efficiency.

Stabilized Food Prices Ripple Through Global Markets: Implications Beyond Dairy Farming

Stabilized food prices have a far-reaching impact on the global economy beyond dairy farming. When prices stabilize and the concern around rising expenses fades, consumer behavior turns toward higher spending. Households may begin investing more money in different food goods, increasing total demand. Increased consumer confidence may create a positive feedback loop, promoting purchase behaviors that promote a more robust food market.

Globally stable pricing allows for more predictable trading ties. Countries that rely significantly on imported food can better plan their spending and protect supply networks without worrying about erratic price surges. This equilibrium may promote a more competitive market environment, ensuring prices are fair and accessible globally. This consistency may lead to a more consistent income stream for exporters, which is critical for investments and development.

These trends are likely to help the agriculture industry as a whole. Predictable pricing might encourage farmers to invest in technology, crop diversification, or sustainable practices previously considered too hazardous under fluctuating circumstances. This might increase production and efficiency, resulting in total sector development.

For dairy producers, these broader economic trends are especially significant. Farmers should anticipate more consistent demand for dairy products as prices stabilize, alleviating some financial strains encountered during difficult times. This atmosphere may also enable more extensive economic planning and investment in farm upgrades, such as modern milking equipment or improved animal welfare standards, resulting in better production and profitability. Furthermore, since global markets are interdependent, stable food prices may assist farmers in shielding themselves from external economic shocks, creating a buffer for more constant operations. As the agricultural market stabilizes, the benefits may spread to all stakeholders, including dairy producers, producing a more resilient and prosperous agrarian environment.

Peering Ahead: Mixed Signals and Cautious Optimism for Dairy Farmers

As we look forward, dairy producers should brace themselves for a world of contradictory signals and cautious optimism. The slight drop in July’s Food Price Index indicates that fundamental issues persist, although short-term pressures may lessen.

Global demand for milk powder, cheese, and butter plays a significant role. If demand stays weak, downward pressure on milk powder prices may continue, as witnessed in June. However, the strong performance of the cheese and butter sectors may continue to support total dairy prices, offering a cushion against substantial falls.

Another critical factor is the overall economic situation. Inflationary pressures and shifting currency values may affect input prices and buying power, impacting manufacturing costs and consumer demand. Climate conditions and geopolitical factors like trade policy and international relations will significantly impact market dynamics.

Farmers should monitor alternate markets and change customer tastes. Growing interest in plant-based dairy substitutes may affect market share and demand trends. Maintaining agility and responsiveness to these developments will be critical in navigating the future.

Although global food price stability provides temporary respite, dairy producers must stay attentive and adaptable. Monitoring market trends, economic movements, and consumer behavior will be critical to ensuring stability and growth in the coming months.

Unraveling the Risks: What Could Disrupt Dairy Farmers Amid Price Stability?

However, this welcome era of stability has its hazards and concerns. Let us address some of the most significant issues that might destabilize this fragile balance.

Geopolitical conflicts are a significant source of anxiety. Disruptions in global commerce, whether due to warfare, trade disputes, or political instability, may swiftly result in unpredictable food prices. Given the continuing issues in Ukraine and portions of the Middle East, dairy producers must remain current on international events and maintain flexible supply networks.

Climate change also has a significant influence. Extreme weather events, ranging from lengthy droughts to sudden frosts, may decimate agricultural output and feed availability, affecting milk supply. To reduce these risks, farmers could invest in resilient agrarian methods, such as drought-resistant crops or improved irrigation systems.

Then, there is the possibility of an economic slump. Global recessions may reduce consumer spending, decreasing demand for dairy products. In such cases, diversifying income sources by investigating value-added items such as artisanal cheeses or organic milk might provide a buffer against economic shocks.

Preparation is crucial. By being watchful and adaptive, dairy producers may negotiate these uncertainties and better prepare for future issues. Proactive efforts taken now may ensure the profitability of their farms for years to come.

The Bottom Line

The current stability of global food prices is both a comfort and a problem for dairy producers. The slight decrease in the Food Price Index (FFPI) and Dairy Price Index (DPI) may provide some breathing room; however, the nuanced shifts within the dairy sector, such as the balancing act between lower milk powder prices and higher cheese and butter prices, highlight the market’s complexities. The interrelated economic swings, which include decreased grain prices but growing expenses in other areas such as vegetable oil and meat, highlight the ongoing instability and the significance of strategic preparation.

Now is the moment for dairy producers to evaluate their businesses critically. Can you use technical breakthroughs and sustainable practices to save expenses and increase productivity? Can you diversify your product offers to protect against particular commodity price fluctuations? These are questions worth considering. Adapting to these changes is more than survival; it’s about establishing yourself for long-term success in a constantly changing market environment.