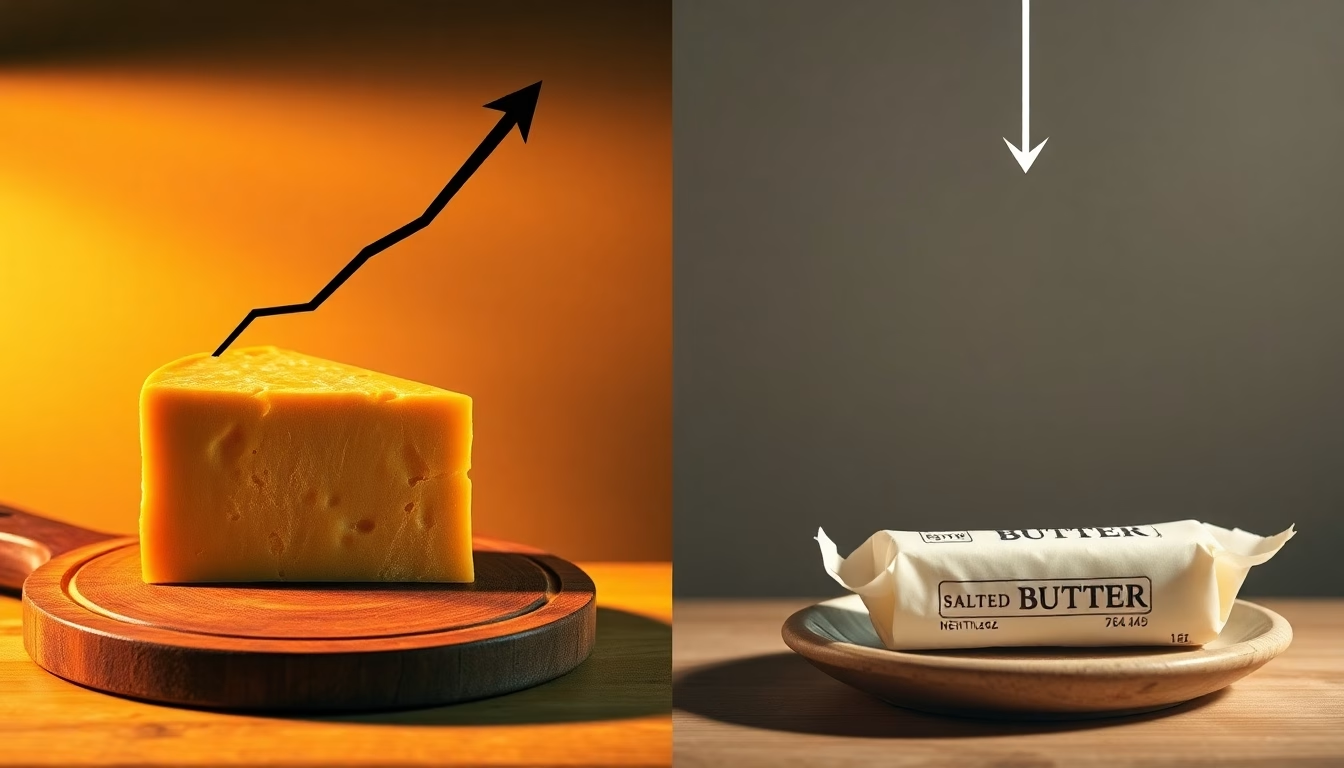

Dairy farmers face a market of extremes as 2025 kicks off. Cheese prices soar while butter plummets, trade wars loom, and feed costs squeeze margins. From regional variations to tech innovations, navigate the complexities of today’s dairy landscape. Discover strategies to thrive in this volatile market.

Summary:

Adaptability and strategic planning will be key to success as the dairy industry navigates these turbulent waters. The contrasting trends in cheese and butter markets, regional production variations, and looming trade uncertainties present challenges and opportunities. Farmers who stay informed, embrace technological innovations, and remain flexible in their approach stand the best chance of thriving. Whether optimizing production for high-demand products, exploring new export markets, or implementing cost-effective feed management strategies, the path forward requires a blend of traditional wisdom and modern innovation. As we move further into 2025, the dairy landscape will continue to evolve. Those who can swiftly adjust their strategies, leverage data-driven insights, and capitalize on emerging trends will be best positioned to weather the storms and reap the rewards of this dynamic industry. What steps will you take to ensure your dairy operation survives and thrives in the coming years?

Key Takeaways:

- Cheese prices surge due to high demand, especially from Asia, while butter experiences a significant price drop due to oversupply.

- Dairy farmers must adapt strategies based on regional production trends and potential trade disputes affecting export markets.

- Rising feed costs pressure profit margins, pushing farmers toward efficient feed management and cost-effective alternatives.

- Adopting technology and sustainable practices can enhance efficiency and optimize operations amid market volatility.

- Farmers should focus on maximizing opportunities in cheese production and explore alternative uses for cream to manage butter oversupply.

- Trade tensions may impact international markets, urging diversification of export destinations to mitigate risks.

As January 2025 ends, U.S. dairy farmers encounter significant market differences. Cheese prices have surged an unexpected 15% this month, while butter values have plummeted to an 18-month low, reshaping strategies across the industry.

Surge in Cheese Prices Driven by High Demand in the Market

CME cheese prices surged from $1.80 to $2.07 per pound in three weeks. Demand has outstripped availability despite industry expectations of oversupply due to new production capacity.

Despite industry expectations of oversupply, the market responds positively to increased demand. We’re seeing a 20% increase in export inquiries, particularly from Asia, which drives this unexpected surge.”

Dairy farmers can benefit from the current strength in the cheese market. Are these changes sustainable, and what steps should farmers take?

Butter Market Faces Oversupply Challenges

| Product | Current Price | Change from Last Year | Stock Level Change |

|---|---|---|---|

| Cheese | $2.07/lb | +15% | -6.0% yoy |

| Butter | $2.45/lb | -22% | +11.4% yoy |

In stark contrast to cheese, the butter market is drowning in surplus. On Thursday, CME spot butter hit $2.45 per pound, marking an 18-month low and a 22% drop from last year’s prices. December stocks were up 11.4% year-over-year, exceeding expectations by 15 million pounds.

The surplus of inexpensive cream is influencing the pessimistic outlook on butter prices. Cream prices are at $1.20 per pound of butterfat, down 30% from last year. To address the oversupply, farmers should be cautious in butter production and consider alternative uses for cream.

Regional Variations Paint a Complex Picture

The December U.S. milk production report reveals significant regional differences:

| Region | Production Change (YoY) |

|---|---|

| California | -6.8% |

| Wisconsin | +2.1% |

| Idaho | +3.5% |

| Texas | +4.2% |

| New York | -1.2% |

This divergence could have notable impacts on local market dynamics and pricing. Tom Brown, a dairy industry consultant, advises, “Farmers need to tailor their strategies based on their specific region. What works in California might not be applicable in Wisconsin or Texas. For instance, California farmers might consider shifting more milk to cheese production given the current market trends.”

Trade War Concerns Loom Large

The dairy industry faces potential disruption from looming trade disputes. From February 1, the U.S. plans to add tariffs of up to 25% on dairy imports from China, Canada, and Mexico. Canada and Mexico have indicated they may retaliate against U.S. dairy products.

While previous trade disputes in 2018 had limited impact, the uncertainty could affect export markets and prices. Farmers relying heavily on exports to countries facing potential tariffs should explore diversifying their markets. South America and Southeast Asia could offer promising alternatives.

“It is an ongoing battle to ensure Canada upholds its trade commitments on dairy,” stated Kimberly Crewther, Executive Director of DCANZ.

Feed Costs Squeeze Margins Across Regions

| Feed Type | Price Increase (Last Quarter) |

|---|---|

| Corn | +8% |

| Soybean Meal | +12% |

| Hay | +5% |

| Silage | +3% |

Higher-than-expected feed costs in all regions are impacting profit margins. Corn prices have risen 8% and soybean meal 12% since last quarter, squeezing farm profitability.

Farmers need to focus on efficient feed management and explore cost-effective alternatives. To address high feed costs, you can increase the use of homegrown forages or explore alternative feeds to reduce dependence on costly commodities.

Jennifer Hayes, Chair of the Canadian Dairy Commission, commented on the slight decrease in farmgate milk prices: “Although a continued inflationary environment, producer efficiencies, and productivity gains have contributed to help balance on-farm costs this year, resulting in a decrease in the cost of production.”

Embracing Technology and Sustainability for Future Success

As market volatility increases, some farmers turn to technology and sustainable practices to maintain profitability. Precision dairy farming tools, such as automated milking systems and data-driven feed management, are gaining traction.

Looking Ahead: Strategies for Dairy Farmers

Given the complex market conditions, dairy farmers are encouraged to consider the following strategies to navigate the challenges ahead:

- Optimize cheese production to capitalize on the currently strong cheese prices in the market

- Exercise caution in managing butter production and explore innovative uses for surplus cream to mitigate the oversupply issue

- Implement efficient feed cost management, considering alternative feed sources

- Develop region-specific strategies based on local production trends

- Prepare for potential trade war impacts by diversifying export markets

- Focus on margin optimization through technology adoption and sustainable practices

- Monitor both domestic and international markets closely, particularly EU and New Zealand trends

Nate Donnay, Director of Dairy Market Insight at StoneX, explained the recent cheese market trends: “In a single month, the CME spot cheese market dropped around 20%, with Class III futures dropping around 15%”.

As the dairy landscape evolves, staying informed and adaptable will be key to navigating challenges and seizing opportunities. As the future unfolds, those swiftly adapting their strategies will be best positioned to succeed.

Learn more:

- Dairy Market Analysis: Milk Futures Hold Steady, Spot Cheese Gains, and Butter Slips

- Cheese and Butter Prices Plummet After Holiday Weekend: Market Struggles to Recover

- Markets are not Bullish or Bearish, but Indecisive: Cheese Stocks Shrink Amid Soaring Milk Demand

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!