Discover the recent changes in global dairy prices. How will the 0.3% dip affect your business? Get the latest insights and market analysis.

Summary:

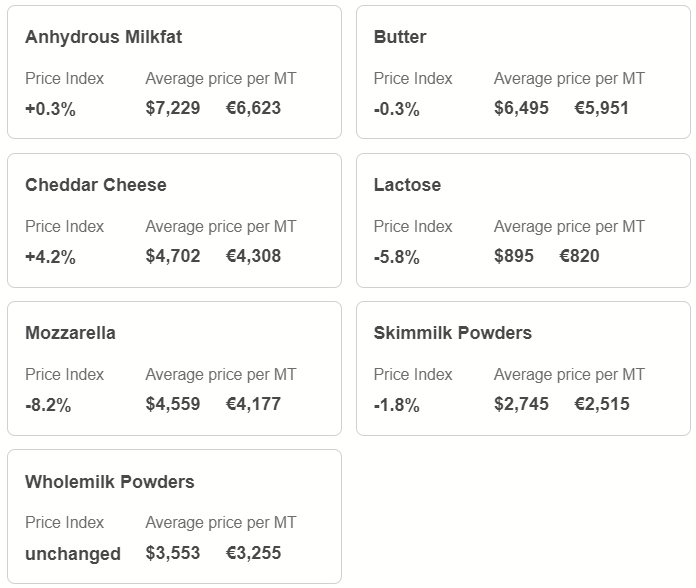

The October 15th Global Dairy Trade auction highlighted a nuanced downturn in the dairy market with a slight 0.3% dip in the overall index. Whole milk powder remained constant, while mozzarella and lactose significantly declined, contrasting with cheddar’s 4.2% rise. These fluctuations reflect the challenges and strategic responses required from industry professionals. The European Union’s decision to impose tariffs on Chinese electric vehicles due to unfair subsidies has spurred China to retaliate by investigating European dairy subsidies, potentially reshaping the global market. This move, amidst the EU’s plans to export substantial amounts of milk and cream to China, indicates shifting dynamics that may lead to increased dairy costs for Chinese consumers and compel European exporters to adapt and innovate in their approaches.

Key Takeaways:

- Global Dairy Trade price index decreased by 0.3%, with total sales reaching 38,956 metric tonnes.

- Whole milk powder prices held steady, while cheddar saw the largest increase at 4.2%.

- Significant price drops were observed in mozzarella and lactose, falling by 8.2% and 5.8%, respectively.

- The New Zealand dairy industry remains robust despite slight global price fluctuations.

- Market analysts note a lack of price volatility, suggesting stable buyer behavior within the dairy sector.

- The Ornua Monthly Purchase Price Index rose in September, indicating improved market returns.

- Lakeland Dairies announced an increase in base milk prices and supplier incentives, reflecting favorable market conditions.

Recent moves have highlighted the dairy industry as the economic chess match between the European Union and China heats up. With the EU imposing vital duties on Chinese electric vehicle imports, the ground is set for China to launch retaliatory investigations into European dairy subsidies, ushering in a new chapter in their simmering trade war. As the world’s biggest dairy exporter, Europe will sell 24% of its milk and 39% of its cream to China in the first half of 2024 alone. This is more than just a conflict of geopolitical superpowers; it is a scenario with far-reaching consequences for global dairy markets. Why should this matter to you as a dairy industry stakeholder? This trade friction might restructure the market landscape. Still, it also allows European farmers and exporters to diversify their methods, driving Chinese consumers to pay higher dairy costs. The stakes are higher than ever as these international alliances face unprecedented challenges, putting the strength and adaptability of dairy markets worldwide to the test.

| Product | Price Change | Average Price (US$/MT) |

|---|---|---|

| Whole Milk Powder | 0.0% | 3,553 |

| Skim Milk Powder | -1.8% | 2,754 |

| Cheddar | +4.2% | 4,702 |

| Butter | -0.3% | 6,495 |

| Anhydrous Milk Fat | +0.3% | 7,229 |

| Lactose | -5.8% | 895 |

| Mozzarella | -8.2% | 4,559 |

Retaliatory Games: EU’s Tariff Move and China’s Dairy Dilemma

The European Union’s decision to levy tariffs on Chinese electric vehicles represents a significant shift in the intensifying trade war between these global powerhouses. The EU justified its decision by citing the Chinese government’s subsidies to the electric vehicle market, which created an unequal playing field that harmed European producers. With 7.8% to 35.3% tariffs, the EU seeks to defend its automobile industry from unfair competition.

In reaction, China attacked the European dairy industry, an economic segment in which Europe wields considerable power as the world’s leading exporter. China’s investigation into over twenty subsidy programs purportedly aiding Europe’s dairy sector attempts to unearth any preferential treatment that could provide European dairy goods an advantage in the global market.

The countries backing the EU’s tariffs are a group of big dairy-producing countries—France, the Netherlands, Italy, and Poland—that see these measures as critical to protecting their industrial interests. Germany and Belgium, on the other hand, dissented, citing concerns about the potential consequences and strain on their export-led economies, particularly their automobile industry.

This trade dispute exemplifies the complex dynamics at work, in which economic protectionism collides with goals for market supremacy. It raises complex considerations about global trade ethics and the long-term viability of such policies, allowing the dairy and car businesses to navigate these geopolitical waters.

A Storm in a Milk Churn: How EU-China Trade Tensions Threaten Dairy Stability

The current spat between China and the EU over dairy subsidies is more than another chapter in their trade story; it is a potential interruption. China’s recent decision to investigate European dairy subsidies may shake up the business in ways we’re only beginning to understand. How does this impact dairy farmers and firms like yours?

Let’s examine the possible consequences. First, there is the risk that trading patterns will shift. With China investigating European dairy subsidies, it may levy tariffs on imports. This could prompt European dairy processors to turn and seek new markets. Are countries like Japan and South Korea ready to absorb the surplus? This move may eventually impact global dairy trade dynamics. If China were to impose tariffs on European dairy imports, it could significantly reduce the demand for European dairy products in China, leading to a surplus in the European market. This surplus could drive down prices and force European dairy processors to find new markets, disrupting the global dairy trade dynamics.

Pricing pressures also loom huge. If Europe fills other markets with dairy products that it cannot sell to China, we may see a global drop in pricing. While this sounds wonderful for customers, dairy farmers may suffer. Lower prices may reduce margins, adding financial stress to farmers already on a tightrope.

Furthermore, organizations that provide critical services and products to dairy producers should prepare for change. Farmers may tighten their belts with anticipated declines in dairy income, reducing demand for farm equipment, feed, and technological solutions. Could your business adapt to the new reality?

Finally, while dismissing these trade disputes as distant and abstract is tempting, they directly impact the ground. Staying informed, adaptive, and ready to pivot will be critical for dairy professionals navigating these turbulent waters. The ability to adapt to changing market conditions will be a critical factor in determining the success of dairy businesses in the face of these challenges.

New Horizons in Dairy: Navigating the Shift in Global Trade Winds

With the intensifying trade war between the EU and China, one must question where European dairy products will find new homes. As China shifts its focus on dairy imports, Asian, African, and Middle Eastern countries emerge as potential alternatives to Europe’s dairy heavyweights. This tectonic shift in trade networks might have a global impact, changing market dynamics. If Europe shifted its focus to new markets, it could disrupt the current global dairy trade dynamics. New competitors entering these sectors with competitive pricing may pressure global dairy prices. Remember, Europe’s share of the global dairy pie is not tiny; any change here has serious consequences.

Why does this matter? Breaking new ground in undeveloped markets brings opportunities and competition. These shifting trade channels have the potential to ripple world prices. New competitors entering these sectors with competitive pricing may pressure global dairy prices. Remember, Europe’s share of the global dairy pie is not tiny; any change here has serious consequences.

On the one hand, a greater market reach could reduce Europe’s reliance on China. Still, it may also increase competition for countries such as New Zealand and the United States. Furthermore, nations rich in natural resources but lacking in dairy production may see a leveling of the playing field as they get easier access to European dairy products. This redirection may provide a short-term boost with low-cost imports but raises long-term concerns regarding self-sufficiency and local industry development.

Will European dairy’s global expansion bring prosperity or risk? That remains the golden question. The dairy trade is on the verge of a revolutionary moment when maps may be unexpectedly rewritten. As this situation continues, dairy experts must keep their eyes open and their strategies flexible, ready to react to the shifting sands of today’s global market.

Taste Shift or Temporary Turmoil: The Future of European Dairy in China’s Cart

As the EU and China engage in this rising trade war, we must consider how it may affect Chinese consumer preferences. Rising pricing and limited availability may cause Chinese customers to reconsider purchasing European dairy. Are the days of plentiful French cheese and luscious Italian milk over?

Tariffs and trade restrictions inevitably lead to price hikes. European dairy goods, formerly considered premium imports in China, may now be priced beyond the reach of the typical customer. This fiscal pressure may prompt buyers to seek different suppliers or stop consumption entirely. Asian-local dairy farmers should leverage this chance to increase market share by positioning their goods as cost-effective alternatives. Could this cause a taste change away from Europe?

Another unknown factor in this trade war is availability. Chinese importing companies may find difficulties getting European dairy, resulting in shortages. Are these customers ready for such disruptions? While luxury food enthusiasts may continue to seek out their favorite European brands, the general public may shift to domestic products, enticed by price and accessibility. This trend may result in long-term shifts in consumption patterns, even if tariffs finally drop.

Finally, the unpredictability of this trade war forces us to assess the strength of European dairy’s market presence in China. Will loyalty to traditional flavors endure price increases and scarcity? Or will the Asian market adapt and seek satisfaction in closer-to-home, maybe less expensive dairy delights?

Charting New Courses: European Dairy’s Quest in Turbulent Trade Seas

As the EU and China dispute, European dairy exporters face rough trade conditions. Quick adaptation to these obstacles is essential. Market diversification is one of the most prominent strategies. Can European exporters expand their reach beyond China? Absolutely! Exploring new markets such as Southeast Asia, the Middle East, and Africa may mitigate the impact of lower Chinese demand. These locations have significant expansion potential due to growing middle classes and changing food trends.

However, diversification is only part of the picture. Another important aspect is cost management. Reducing overheads without sacrificing quality may help European businesses remain competitive. Could improving production methods, investing in energy-efficient technologies, or renegotiating supplier contracts make a difference? These solutions may lessen the immediate effects while fortifying the industry against future market instability.

Furthermore, increasing brand strength could open up new opportunities. By emphasizing the unique attributes of European dairy, such as heritage, quality, and sustainability, exporters can capture consumer loyalty in unexplored countries. Building solid and recognizable brands is not a defensive strategy but a proactive method of gaining a footing in the global market.

The volatile nature of the trade war catalyzes dairy industry innovation and resiliency. By focusing efforts on broadening markets, effectively managing expenses, and strengthening brand presence, European dairy experts can weather these challenges while potentially becoming more relevant than ever.

Echoes from the Past: How EU-China Trade History Frames Today’s Cheese Clash

Understanding the present EU-China trade crisis necessitates revisiting their long history of economic disagreements and diplomatic agreements. Trade between the European Union and China has increased dramatically since China’s economic reform in the late twentieth century, resulting in a partnership oscillating between collaboration and confrontation.

Trade conflicts have become commonplace in recent decades. A noteworthy chapter occurred in 2013 when the EU placed tariffs on Chinese solar panels. Beijing responded by investigating European wine imports. While these difficulties may appear unconnected to dairy, they signaled a pattern in which conflicts in one industry reverberated throughout others. This disagreement was eventually resolved after lengthy negotiations, with a price agreement on solar panels demonstrating the potential for de-escalation.

While only sometimes at the forefront, dairy commerce has had its share of tension. In 2015, disagreements emerged over EU-origin milk powder as alleged illicit subsidies were investigated under WTO guidelines. Critical to many European economies, the sector was hit hard when excess caused prices to fall. These skirmishes highlighted dairy’s fragility in the broader economic crossfire, warning stakeholders that global demand fluctuations can have a knock-on effect at farm gates.

History reminds us that, despite their intricacies, these trade disputes frequently occur in cycles. A combination of negotiation, strategy shifts, and, in some cases, lasting patience resolves them. Whether the present dairy conflict between two economic behemoths follows this script remains to be seen. However, based on previous experience, it is apparent that dairy producers will need to be vigilant, adaptable, and make strategic decisions as they navigate this geopolitical scenario.

The Bottom Line

In short, the EU-China trade war is rapidly expanding, with both sides engaged in a tug-of-war that has now included the critical dairy industry. As the European Union imposes tariffs on Chinese electric vehicles, China responds by inspecting European dairy imports. These measures jeopardize the stability of the global dairy trade, posing risks and problems for both exporters and importers. The rivalry between Europe and China over dairy exports and imports can impact prices and market share.

Consider the far-reaching ramifications of these trade decisions: How will they affect your company and the overall market dynamics? As a dairy farmer or industry professional, remaining informed and adaptive is critical in these uncertain times. Finally, this circumstance raises an important question: May the conclusion of this trade dispute change the face of international trade relations, affecting agricultural trade policies and practices worldwide?

Learn more:

- Global Dairy Trade: Key Insights Every Dairy Farmer Should Know

- US Dairy Farmers’ Revenue and Expenditure rose slightly in March

- Markets are not Bullish or Bearish, but Indecisive: Cheese Stocks Shrink Amid Soaring Milk Demand

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!