Dairy crisis 2025: Plummeting prices, trade wars & butterfat glut crush farmers—survival strategies to weather the storm inside.

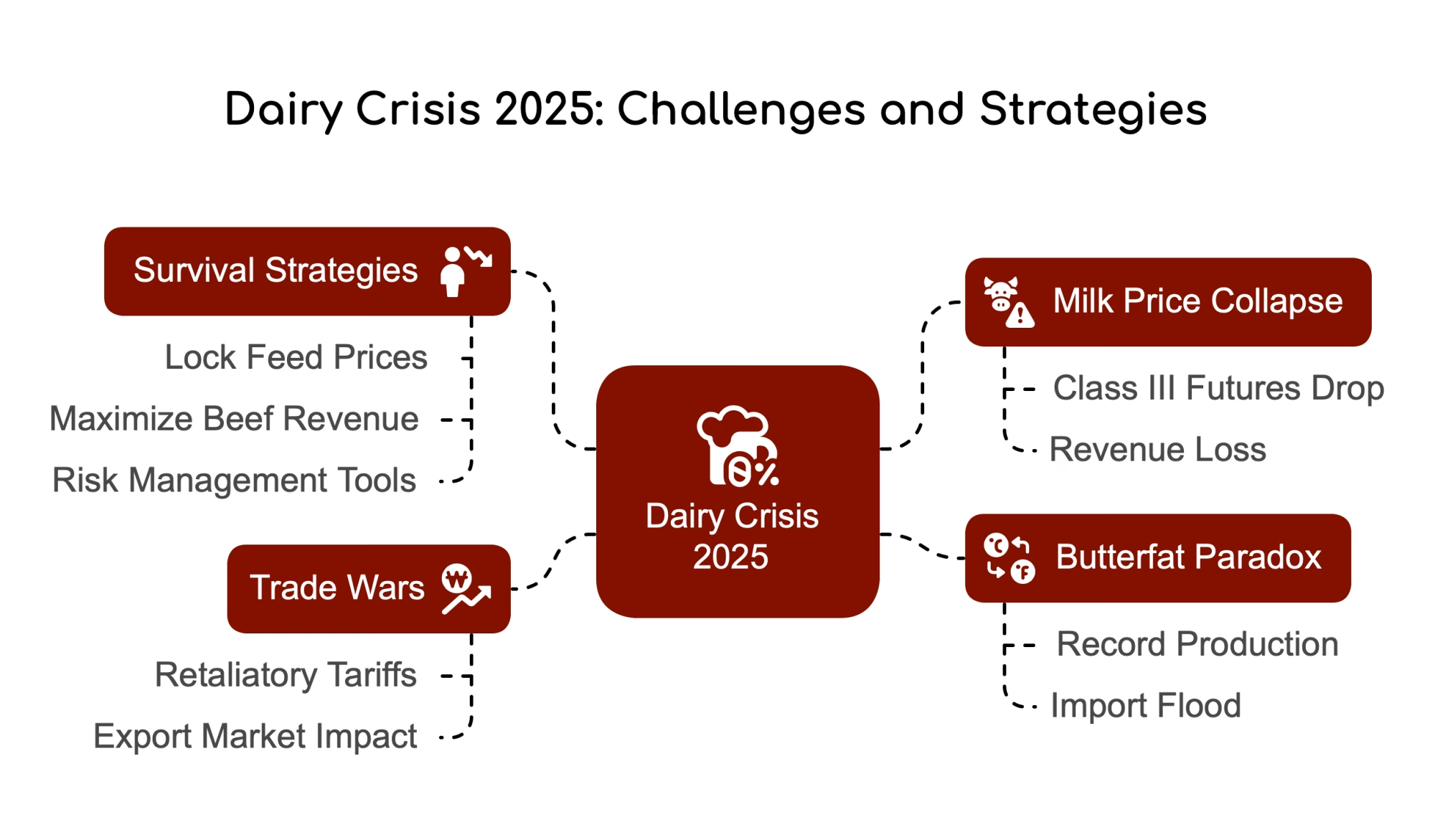

EXECUTIVE SUMMARY: U.S. dairy farmers face a triple threat in 2025: milk prices nosedived (Class III at $16.86/cwt, -15% since January), retaliatory tariffs slashed exports to key markets, and a butterfat glut from record-high components and surging imports. Feed cost relief offers limited respite, while beef-on-dairy breeding risks long-term herd shortages. Survival hinges on locking feed prices, maximizing beef revenue, and deploying risk management tools like DMC. Farmers must balance short-term cash flow with strategic herd planning to endure the downturn.

KEY TAKEAWAYS:

- Milk price collapse: Futures dropped $2.50/cwt since January, erasing $25K/month for 1M-lb herds.

- Butterfat paradox: 4.4% milk components + 172M lbs imported butter = price crash despite production success.

- Feed relief: Corn ($4.20/bushel) and alfalfa ($210/ton) prices down 14% and 9%—lock savings now.

- Beef-on-dairy gamble: 7.9M beef semen units sold in 2024 boost cash flow but risk 20-year lows in replacement heifers.

- Risk management critical: Tools like DMC and Dairy-RP stabilize margins amid volatility.

The optimism of January has evaporated as plummeting milk prices, trade wars, and butterfat oversupply create unprecedented challenges for dairy producers. Yet, within this turbulence lie strategic opportunities for those who can adapt.

The Vanishing Promise of 2025

At the start of 2025, dairy farmers had every reason to feel optimistic. Domestic retail sales climbed $2 billion over the previous year to $78 billion, while restaurant sales surged from $93.7 billion in March 2024 to $97.6 billion by November 2024. Export markets were equally promising, with international cheese shipments growing by 17% to hit a record 1.13 billion pounds and overall dairy exports reaching .2 billion—second only to the .5 billion all-time high in 2022.

But that optimism didn’t last long. By February 2025, restaurant sales had dipped to $95.5 billion—a seven-month low—and escalating tariffs on U.S. dairy exports made international buyers hesitant. Meanwhile, U.S. dairy farmers continued producing record levels of components like butterfat and protein, further saturating the market and sending futures contracts into a tailspin.

“The current market downturn, following a period of relative optimism, may accelerate underlying industry trends,” notes Dr. Mark Stephenson, dairy economist at the University of Wisconsin-Madison. “Operations with weaker financial positions or higher production costs could face heightened pressure, potentially leading to further consolidation within the sector as more resilient farms find opportunities to expand.”

The Price Plunge: $2.50/cwt Vanishes Overnight

Milk prices have taken a nosedive in early 2025, erasing significant revenue for dairy farmers across the country and dropping by $2.57 per hundredweight (cwt), settling at an average between January and April of $16.86/cwt for April-to-June contracts. Class IV futures fell even further, losing $2.73/cwt during the same period.

| Month/Contract | Class III ($/cwt) | Class IV ($/cwt) | Key Event |

| Jan 2025 (Peak) | $20.34 | $20.73 | Tariff talks begin |

| Feb 2025 | $20.18 | $19.90 | Restaurant sales dip |

| Mar 2025 | $18.62 | $18.21 | Retaliatory tariffs imposed |

| Apr-Jun 2025 Futures | $16.86 | $17.77 | Record butter imports reported |

Source: CME Group, USDA AMS

For farmers producing one million pounds of milk monthly, this price drop translates to roughly $25,000-$27,500 less revenue every month—a devastating hit to cash flow and profitability.

“A drop like this isn’t just numbers on paper—it’s a real gut punch when you’re trying to pay feed bills or make loan payments,” says John Newton, Chief Economist at the American Farm Bureau Federation.

Demand-Side Worries: Restaurants and Exports Falter

The food service sector—responsible for half of all dairy consumption—has shown troubling signs of weakening demand in recent months. Restaurant sales fell from $97 billion in December 2024 to $95.5 billion by February 2025, marking a noticeable decline as consumers tighten discretionary spending on dining out.

Export markets aren’t faring much better due to escalating trade tensions with key partners like Canada, Mexico, and China—countries that collectively account for half of U.S. dairy exports by volume and over 40% by value. Retaliatory tariffs imposed by these nations have made U.S.-produced dairy less competitive globally.

“This reliance on exports makes the U.S. dairy sector increasingly susceptible to geopolitical tensions and trade policy decisions,” explains Tom Vilsack, president and CEO of the U.S. Dairy Export Council.

The Butterfat Paradox: Record Production Meets Import Flood

U.S. dairy farmers have achieved remarkable success in boosting milk components over the years—average butterfat levels have climbed from 3.70% to 4.40% over two decades—but this triumph has created new challenges in today’s saturated market.

| Metric | 2024 Value | 2023 Value | Change |

| U.S. Butterfat Production | 4.40% avg | 4.25% avg | +0.15% |

| Butter Imports | 172M lbs | 118M lbs | +46% |

| Butter Stocks (Dec) | 97M lbs | 90M lbs | +7% |

| CME Butter Price (Apr ’25) | $2.33/lb | $2.89/lb | -19% |

Source: USDA Milk Production, USDA FAS

Despite record butterfat production domestically, processors are overwhelmed with cream supplies. At the same time, butter imports continue flooding into the U.S.—up 46% year-over-year from countries like Ireland and New Zealand.

“We’re drowning in cream while still importing butter—it makes zero sense,” says Mary Ledman, Global Dairy Strategist at Rabobank.

Beef-on-Dairy Strategy: Short-Term Gain vs Long-Term Risk

Many farmers have turned to beef-on-dairy breeding strategies to capitalize on strong beef markets while reducing reliance on low-value bull calves from traditional Holstein breeding programs.

Beef semen sales hit a record 7.9 million units in 2024—a clear sign that producers prioritize short-term cash flow over herd expansion.

“Beef prices are saving us right now—but replacement heifers are scarce as hen’s teeth,” warns Dr. Albert De Vries from the University of Florida.

While this strategy provides immediate financial relief through premium crossbred calves fetching up to $300 per head, it risks creating long-term shortages in replacement heifers for herd growth and sustainability.

The Bottom Line: Survival Strategies for Dairy Farmers

1. Lock In Feed Costs While Prices Are Low

Corn prices are down significantly at $4.20/bushel (-14% year-over-year), while alfalfa hay is averaging $210/ton (-9%). Securing feed contracts now can protect margins against future price volatility during summer droughts or other disruptions.

2. Milk Every Penny from Beef Markets

Strong beef prices provide a lifeline for cash flow through crossbred calves and cull cows—but balancing short-term gains with long-term herd needs is critical, given replacement heifer shortages.

3. Use Risk Management Tools

With milk prices tumbling—Class III futures averaging .86/cwt—programs like Dairy Margin Coverage (DMC) and Dairy Revenue Protection (Dairy-RP) are essential tools for stabilizing farm finances during volatile times.

“Risk management isn’t optional anymore—it’s survival,” says John Newton.

Learn more:

- Dairy Caught in Trump’s Tariff Crosshairs as Rollins Teases Trade Deals by Friday

Explore how sweeping tariffs are disrupting dairy exports, with survival strategies to mitigate losses and adapt to volatile trade policies. - Milk’s Surprising Renaissance: How Dairy Farmers Are Navigating New Opportunities and Challenges

Learn how fluid milk sales are surging while farmers balance rising costs, labor shortages, and sustainability demands to seize new opportunities. - Why Feed Prices Are Bouncing Back: What Dairy Farmers Need to Know

Understand the factors driving feed price volatility and discover strategies like forward contracting and diversified feed sources to manage costs effectively.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!