Ever wondered why most of your milk is regulated by federal orders? Learn how this impacts your dairy farm with key facts and stats.

Summary: Curious about how most of the milk in the United States is marketed? You might be surprised to learn that a whopping 70% is sold through Federal Milk Marketing Orders (FMMOs). This system has been a game-changer for dairy farmers, providing stability, fair prices, and consistent income. Since their inception in 1937, FMMOs have ensured that both producers and consumers benefit. With over 130 billion pounds of milk involved annually, representing over 60% of U.S. milk production, FMMOs play a crucial role. The U.S. Department of Agriculture enforces these regulations to maintain fair market practices. In 2023, almost 70% of all milk sold in the U.S. was promoted via FMMOs, underscoring their influence. All handlers in an FMMO-covered region must pay the same minimum for milk of a particular class, ensuring transparency and fairness in the sector.

- Federal Milk Marketing Orders (FMMOs) handle about 70% of milk sold in the U.S., providing stability and fair prices for dairy farmers.

- FMMOs were established in 1937 to ensure that both producers and consumers benefit from the milk marketing system.

- Over 130 billion pounds of milk, accounting for more than 60% of U.S. milk production, are marketed through FMMOs annually.

- The U.S. Department of Agriculture enforces FMMO regulations to uphold fair market practices.

- In 2023, FMMOs significantly influenced the dairy sector, with almost 70% of all milk sales going through this system.

- Transparency and fairness are achieved as all handlers in an FMMO region must pay the same minimum for milk of a particular class.

Have you ever wondered who controls your milk? The answer will surprise you! For dairy farmers, knowing milk prices and regulations is more than just a curiosity; it is critical to their enterprises’ survival and profitability. With the bulk of milk passing via federal directives, understanding the complexities of these regulatory procedures may impact your bottom line. “The Federal Milk Marketing Orders (FMMOs) handle over 130 billion pounds of milk annually, representing more than 60% of the total U.S. milk production.” Understanding these standards is more than simply complying with them; it is also about using them to achieve fair pricing and market stability.

Ever wondered why most of your milk is regulated by federal orders? You might be surprised to learn just how crucial Federal Milk Marketing Orders (FMMOs) are to the dairy industry. These orders don’t just set the standard price for milk; they’re the backbone that keeps dairy farms like yours thriving. Let’s dive into some key facts and stats that reveal the importance of FMMOs in the dairy market.

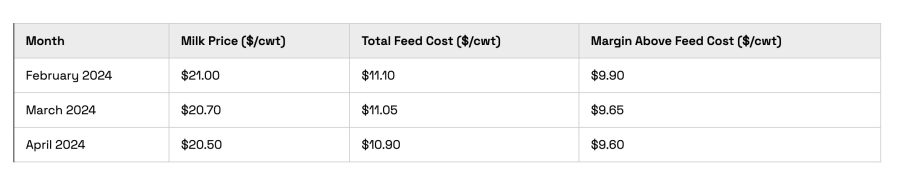

| Year | Percentage of Milk Marketed Through FMMOs | Average Milk Price Under FMMOs (USD/cwt) |

|---|---|---|

| 2020 | 65% | 18.25 |

| 2021 | 68% | 19.10 |

| 2022 | 70% | 20.35 |

| 2023 | 70% | 21.50 |

The Lifeline That Saved Dairy Farmers: How FMMOs Brought Stability to a Struggling Industry

During the Great Depression of the 1930s, dairy producers faced a dismal economic situation. Milk prices plunged, making it more difficult for farmers to maintain their businesses. The United States government implemented Federal Milk Marketing Orders (FMMOs) as part of the Agricultural Marketing Agreement Act of 1937 to address this. The goal was to stabilize the unpredictable milk market, keeping prices fair for dairy farmers and consumers.

FMMOs created a controlled system for classifying milk depending on its ultimate use, which is still in use today. This method classified milk into four separate types, allowing producers to obtain minimum prices. By stabilizing prices via these categories, FMMOs offered a safety net for dairy producers, allowing them to continue producing milk without fear of unanticipated market sags.

Over time, FMMOs have evolved to provide more than just price stability. They were intended to provide a fair market environment, allowing dairy producers to compete on an equal footing. This method forced dairy processors to pay a fixed price for milk of comparable quality, regardless of its intended use. This strategy promoted fair competition and offered customers a consistent supply of milk products at competitive costs. The continued evolution of FMMOs demonstrates their adaptability and their ongoing significance to the industry’s economic health.

The Secret Behind Milk Prices: How FMMOs Maintain Dairy Farmers’ Livelihoods

Federal Milk Marketing Orders (FMMOs) specify minimum milk prices that dairy processors must pay depending on the product’s intended use. This process is grounded in a classified pricing system, which categorizes milk into four distinct classes:

- Class I: Fluid Milk (e.g., whole milk, skim milk)

- Class II: Perishable Manufactured Products (e.g., yogurt, ice cream)

- Class III: Hard Cheese and Whey Products

- Class IV: Butter and Powdered Milk

The United States Department of Agriculture (USDA) plays a crucial role in enforcing these regulations, ensuring fair market practices and secure wages for dairy producers. The USDA determines the minimum monthly pricing for each milk class, a process heavily influenced by market conditions and regional supply-and-demand dynamics. This enforcement by the USDA is a key factor in the success of FMMOs in stabilizing the dairy market.

FMMOs provide a financial safety net for dairy producers. They safeguard farmers from uncertain market situations by ensuring a minimum price and consistent cash source. This stability is critical since market prices for dairy products might vary due to changes in consumer preferences, international trade rules, and feed and input costs.

Furthermore, FMMOs promote openness and justice in the sector. All handlers (processors and distributors) in an FMMO-covered region must pay the same minimum for milk of a particular class, leveling the playing field. This homogeneity eliminates pricing manipulation and encourages a more equal income distribution among farmers, enabling them to continue operations and invest in upgrades.

In context, almost 70% of all milk sold in the United States in 2023 was promoted via FMMOs, indicating the system’s widespread influence. This coverage demonstrates how important FMMOs have become in protecting farmer incomes and stabilizing the dairy industry.

In essence, FMMOs contribute to establishing a dependable framework in an often unpredictable industry. By matching milk prices with the market value of the finished product and maintaining strict monitoring, the USDA gives dairy farmers the economic assistance they need to prosper in a competitive environment.

According to the USDA, an Impressive 70% of All Milk Sold in the United States Was Marketed Through Federal Milk Marketing Orders (FMMOs) as of 2023.

According to the USDA, 70% of the milk sold in the United States in 2023 was marketed under Federal Milk Marketing Orders (FMMOs). This regulatory system is more than simply keeping prices stable; it provides the foundation of market stability for a large section of the agriculture business (source: USDA).

The influence of FMMOs on the dairy market is significant. FMMOs provide farmers with a safety net in uncertain market situations by ensuring a minimum price based on end-product consumption. The categorized pricing system categorizes milk into Classes I through IV. It guarantees that farmers are compensated independently of market changes. For example, Class I milk is designated for fluid consumption and often commands the highest price, creating a profitable income stream that subsidizes lower-value applications such as cheese (Class III) and butter/powder (Class IV).

The impact of FMMOs on dairy farmers’ livelihoods is significant. These regulations help farmers manage their finances more effectively by stabilizing prices, allowing them to invest securely in their enterprises without fear of sudden market reductions. In 2023, pooled milk revenues under these directives totaled 158.4 billion pounds, benefiting 22,035 dairy farms. This broad acceptance emphasizes the significance of FMMOs in guaranteeing market liquidity, enough cash flow, and, ultimately, the viability of dairy farming as a livelihood.

How Regional FMMOs Shape Local Dairy Markets and Boost Farmer Profits

The variability of FMMOs across geographies reflects the specific dairy dynamics of various places. For example, in the Northeast, the FMMO prioritizes fluid milk (Class I) owing to the high population density and metropolitan markets, guaranteeing that dairy producers earn a premium for liquid milk. In contrast, locations such as the Upper Midwest are more focused on manufacturing classes (Class III and IV), which cater to manufacturing cheese, butter, and dry milk solids. This unity with local market demands helps dairy producers maintain stable pricing and distribution.

One prominent example is the California FMMO, which was implemented in 2018 and significantly altered the situation for local dairy producers. California’s FMMO, well-known for its significant cheese production, strongly emphasizes Class III milk prices, which align with the state’s substantial cheese market. Consequently, California rates are often more beneficial than in areas with various class usage focuses.

Another example is from the Southeast, where the perishable quality of fluid milk and limited local availability drive significant Class I differentials. This often results in a sizeable pay-price advantage for milk intended for fluid consumption compared to areas focused on manufactured purposes. These geographical variances may influence a dairy farmer’s choice about where and how to sell their milk, emphasizing the need to know local FMMO legislation and its consequences for pricing and distribution.

Why Every Dairy Farmer Should Thank FMMOs for Keeping Their Business Afloat!

One of the critical advantages of Federal Milk Marketing Orders (FMMOs) for dairy producers is the increased price stability they provide. FMMOs protect farmers from abrupt market swings caused by supply-demand mismatches or international trade dynamics by setting minimum milk prices depending on end use. For example, during the economic turbulence caused by the COVID-19 epidemic, FMMOs played a crucial stabilizing role. As demand patterns changed substantially due to school and restaurant closures, FMMOs guaranteed that dairy producers continued to get a fair price for their milk, averting a market collapse.

In addition to price stability, FMMOs provide dairy producers with considerable market access benefits. FMMOs allow even small-scale farmers to participate in larger markets that would otherwise be out of reach by pooling milk from numerous suppliers and distributing it among several processors. This pooling arrangement provides a more predictable financial flow and boosts trust in long-term planning. According to USDA statistics, a fantastic 158.4 billion pounds of milk were pooled and distributed under FMMOs in 2023, helping 22,035 dairy producers nationwide (USDA).

Furthermore, FMMOs have a proven track record of protecting farmers during market turbulence. For example, after foreign trade conflicts that resulted in retaliatory tariffs on American dairy goods, FMMOs kept the home market viable for farmers. FMMOs have always served as a buffer against external economic shocks by maintaining stable marketing connections and providing a fair division of income, preserving the lives of numerous dairy producers.

Critics Cry Foul: The Hidden Pitfalls of FMMOs Every Dairy Farmer Needs to Know!

The Federal Milk Marketing Orders (FMMOs) are not without criticism, with many citing the system’s complexity and the possibility of market distortions. One significant concern is that the complex pricing formulae and rules may need to be clarified for many farmers, making it difficult to comprehend how milk prices are established completely. This intricacy may create an unequal playing field, favoring more prominent producers with the resources to navigate the system properly.

Furthermore, some farmers believe that FMMOs disrupt the market by establishing artificially high or low prices that may not represent genuine supply and demand dynamics. In certain circumstances, this might result in overproduction or underproduction, which harms both farmers and consumers. Economists have remarked that imposing minimum prices may undermine farmers’ natural incentives to be more efficient and sensitive to market signals.

Critics also point to FMMOs’ bureaucratic character, which may cause delays in pricing releases and revisions. These delays may limit farmers’ capacity to make timely and informed choices regarding their operations. Furthermore, there is criticism about the fairness of pooling and reallocation systems, which are intended to balance inequities but may often seem opaque and unfair to individual producers.

Regardless of these problems, it is critical to understand that FMMOs are intended to address the volatility and unpredictability inherent in dairy markets. While the system may have shortcomings, it has also offered decades of stability and protection for farmers from dramatic market fluctuations. The current discussion emphasizes the need for continual examination and future revisions to guarantee that FMMOs can adapt to the dairy industry’s changing situation.

The Future of Federal Milk Marketing Orders (FMMOs) Remains a Hot Topic Among Dairy Industry Stakeholders

The future of Federal Milk Marketing Orders (FMMOs) is a contentious subject among dairy industry stakeholders, particularly as the dairy farming environment changes. One possible change under consideration is the reorganization of class pricing. While the current classified price structure has stabilized, some consider it to be out of date. According to the USDA Agricultural Marketing Service, modifications to pricing algorithms to better reflect current market circumstances and cost structures are being considered.

Industry experts, like Dr. Marin Bozic of the University of Minnesota, believe that revising these formulae better reflects the value of milk utilized in diverse products. According to Bozic, “adopting more flexible, market-responsive pricing models could benefit producers and processors.”

Furthermore, current legislative initiatives seek to alleviate regional inequities while increasing the economic sustainability of smaller dairy farms. The Dairy Pride Act, reintroduced in Congress, intends to defend the meaning of dairy words, perhaps increasing demand for fluid milk—a sector that has witnessed diminishing use via FMMOs, now at 25.5% in 2023, down from prior years.

Another subject under investigation is FMMO consolidation. With just 11 orders, compared to 83 in the early 1960s, the future may see additional consolidation to simplify operations and cut administrative expenses. Furthermore, improved digital monitoring and sophisticated analytics might provide more transparent and timely data, optimizing the milk marketing process.

Finally, the future of FMMOs will depend on combining the requirement for stability with the desire for modernization. Working with legislative authorities, industry experts, and the agricultural community will be critical in managing these changes. Mr. John Wilson, Senior Vice President of Dairy Farmers of America, puts it succinctly: “Modernizing FMMOs is not just about keeping up with the times; it’s about ensuring the longevity and sustainability of American dairy farming.”

The Bottom Line

Federal Milk Marketing Orders (FMMOs) have helped to provide stability and predictability in the dairy business, operating virtually as a safety net for dairy producers. FMMOs contribute to regional economic sustainability by guaranteeing that all producers are compensated reasonably well via organized pricing and revenue-sharing. Understanding these rules may significantly impact your bottom line, facilitating strategic decision-making. As we look to the future, remaining knowledgeable about FMMOs is critical; in dairy farming, “knowledge isn’t just power—it’s profit.” It is essential to dairy farming’s future success.

Learn more:

- What Dairy Farmers Must Know About Upcoming FMMO Changes: Impacts on Milk Prices, Exports, and Next Steps

- Unveiling the USDA Milk Report: Find Out Which States are Leading and Lagging!

- Struggling Family Dairies vs Booming Milk Monopolies: The Fight for Survival in California’s Milk Industry

- The Hidden Crisis: Why U.S. Dairy Farms Are Disappearing Faster Than Ever!