Witness December’s dairy market surprise! Whey’s unexpected rise is driving Class III futures. Explore key insights today.

Summary:

The CME Dairy Market Reports of December 5th, 2024, reveal a dynamic shift in the dairy sector, with dry whey futures experiencing a significant rally while spot prices hold steady, directly influencing Class III futures amidst declining cheese values. Despite cheddar price dips, cheese exports to Mexico remain robust. The market exhibits divergent trends, with US dry whey supplies tightening, contrasting with EU markets and revealing a stark difference in butter import-export activities. As whey prices surge, prompting a reevaluation of market strategies, the intricate link between whey and Class III futures highlights potential profit margin enhancements despite input cost pressures. Concurrently, NFDM shows unexpected gains, and strategic planning becomes crucial to navigate potential volatility, which is complicated further by the bird flu outbreak‘s agricultural impact. The industry’s growth and stability pivot on addressing these evolving challenges, underscoring whey as a pivotal market force.

Key Takeaways:

- Dry Whey futures experienced a significant rally, closing limit up in multiple contract months amidst unchanged spot prices.

- Protein demand, driven by health trends, has led to decreasing sweet, dry whey stocks in the US, in contrast to a less robust EU market.

- Class III futures have seen a bullish impact from Dry Whey trends despite mixed movements in cheese prices.

- Spot butter prices remained steady, yet futures markets responded with declining enthusiasm.

- NFDM futures diverged from global trends, maintaining a premium in the US, pointing towards potential short-term stability.

- Export dynamics show that US cheese exports are robust, particularly to Mexico, while butter imports have risen sharply.

- Dairy cow slaughter numbers increased significantly year-over-year, impacting supply dynamics.

The sudden surge of whey, a usually overlooked component in the dairy industry, has unexpectedly taken center stage, causing market disruptions beyond anyone’s anticipation. This surge is not just a blip on the market charts; it signifies the beginning of a ‘whey revolution’ reshaping the dairy industry. Whey, often considered a byproduct, has become a key player, compelling dairy farmers and industry professionals to reassess their market strategies and production priorities. The stakes have never been higher for those in the dairy sector, as the soaring whey prices demand immediate attention and adaptation. As whey prices skyrocket, dairy farmers face a transformed landscape, presenting both opportunities for profit and challenges in balancing whey production with traditional dairy outputs. For industry professionals, the task lies in leveraging this shift to optimize operations and capture market share, as the implications of this ‘whey revolution’ reverberate through every level of the dairy supply chain, necessitating strategic transformations for competitive survival.

Whey: The Unexpected Diva of the Dairy Market

This week, dry whey futures have emerged as the undeniable star of the dairy market, stealing the spotlight from other commodities. Despite spot prices maintaining a steady balance, the futures have been propelled to impressive heights. The surge reflects a confluence of factors, predominantly the tightening of supplies and a robust demand landscape. Industry insiders suggest that these constraints mainly drive the market’s dynamics, indicating increased bullish sentiment among traders.

While spot-dry whey has remained stagnant, not experiencing the fluctuations mirrored in futures, the divergence highlights an essential dichotomy in the market dynamics. Futures, often a window into market sentiment and expectations, reveal an underlying tension that spot prices have yet to absorb fully. The market’s heightened sensitivity to supply and demand alterations has thrust whey into the limelight, indicating a keen interest and prioritization of stocks among buyers who perhaps feared being left out of an upward trend.

As dry whey takes the lead in the dairy market this week, it underscores a broader narrative within the dairy sector that highlights the pivotal role of proteins and their evolving market dynamics. As the ripple effects of this surge continue to unfold, industry stakeholders are left to ponder whether this buzz will solidify into long-term market shifts or merely represent a transient chapter. This uncertainty underscores the need for strategic planning and foresight in the face of potential long-term changes in the dairy market.

Whey’s Ripple Effect: Fueling Class III Futures

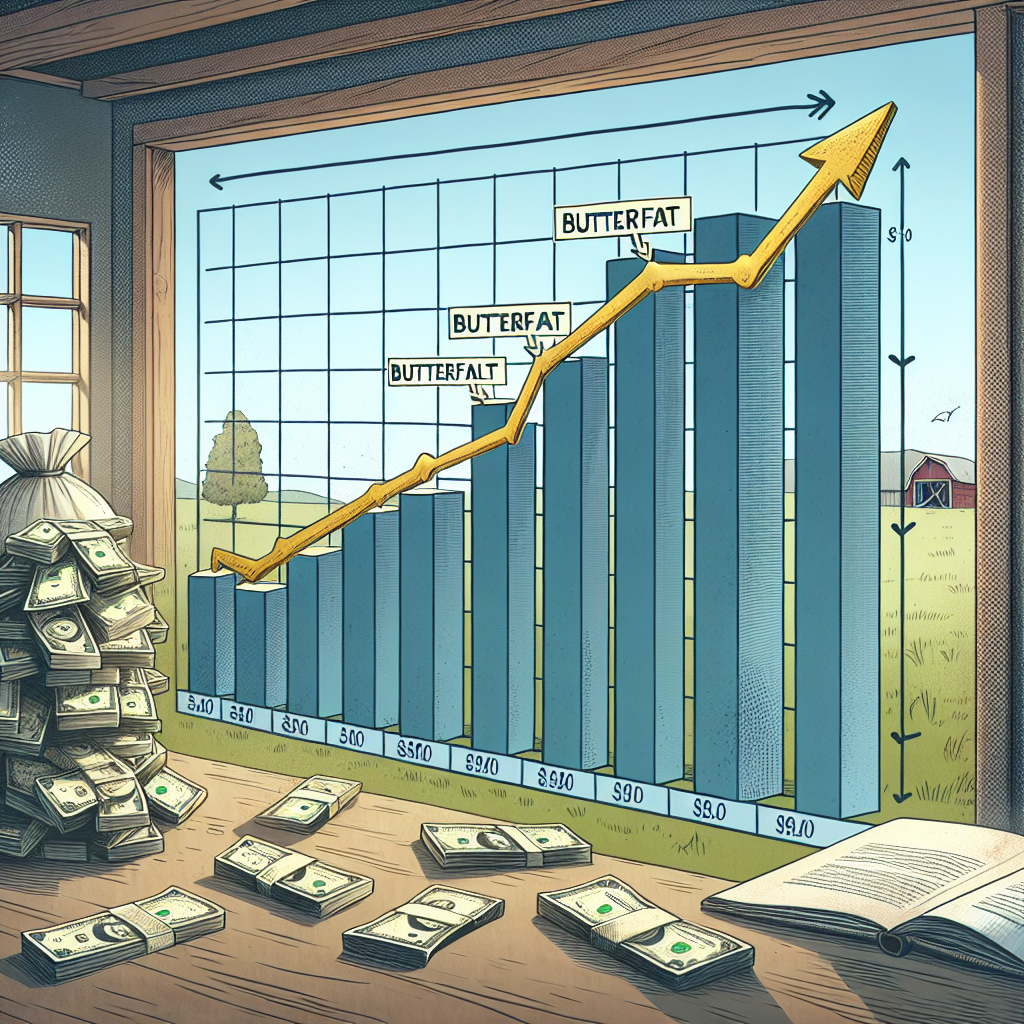

The surge in dry whey prices has significantly imprinted Class III futures, demonstrating the intricate link between these two market components. Every penny increase in dry whey contributes six cents to Class III futures. This mathematical relationship underscores whey’s substantial influence within the broader dairy pricing structure. Over recent weeks, the market has witnessed a notable uptick in whey prices due to tightened supplies, driving Class III futures up to $19.12 per hundredweight.

This price hike unfolds a complex economic scenario for dairy producers. On one hand, the increased value of milk components, driven by rising whey prices, can enhance profit margins. However, the accompanying cost pressures on inputs and operational expenses pose challenges that must be carefully managed. Therefore, the convergence of higher whey prices and elevated Class III futures demands strategic planning from producers to navigate potential volatility.

The ripple effects extend beyond immediate producer economics. As processors and manufacturers grapple with these shifts, there could be downstream impacts on product pricing, potentially affecting consumer markets. Additionally, competitive dynamics in export markets might adjust as US cheese exports leverage strong domestic pricing to assert a robust international presence.

Cheese: Navigating Market Swings and Export Expansions

The cheese market continues to capture attention, particularly in recent movements in spot cheddar prices and impressive export figures. Spot cheddar prices recently reversed, witnessing a decline, with blocks and barrels seeing price reductions of 3.5 and 2.5 cents per pound, respectively. This shift in spot prices indicates a market recalibration that may influence trading behaviors as participants respond to fluctuating price signals.

Conversely, the export front presents a more buoyant narrative. US cheese exports surged, reaching 88.8 million pounds in October—a 12% increase from the previous year. This growth is predominantly driven by increased demand from key partners like Mexico, which imported 38 million pounds. This uptick highlights a strengthening export relationship and suggests a positive demand trajectory in international markets.

The dip in spot prices is attributed to an accumulation phase in the domestic market, where buyers operate at current levels without aggressive purchasing activities. On the other hand, robust exports underscore an external demand buoyant enough to offset some domestic price pressures. Nonetheless, this dual narrative of dipping domestic spot prices and climbing export volumes creates a dynamic interplay likely to affect domestic producers, who strategically leverage international demand to stabilize revenues amidst fluctuating US prices.

Such trends hold significant implications for the broader dairy industry. While lower domestic prices pressurize margins, vibrant export activities act as a buffer, ensuring consistent demand. This balance between domestic challenges and global opportunities remains critical for the industry’s resilience, particularly as stakeholders navigate ongoing market fluctuations and seek growth avenues beyond traditional markets.

Butter and NFDM: Divergent Paths Amid Market Volatility

In recent days, the butter market has exhibited notable fluctuations. After an initial recovery, butter futures experienced a decline, influenced by the interplay between spot market stability and trading dynamics. Although spot butter prices held flat at $2.5400, the previous 5.5-cent increase earlier in the week hinted at underlying market firmness. Yet, the absence of vigorous buying interest curbed any substantial upward movement in futures. The rising open interest suggests mounting selling pressures to counteract remaining buy-side hedging activity. As a result, the butter market might stabilize around the mid-$2.50 mark, with potential for short-term holding patterns.

Conversely, NFDM (Non-Fat Dry Milk) futures displayed a surprising upward trajectory, defying overarching global price signals that suggested weakness. This deviation was marked by a dip in open interest in nearby contracts, indicating a waning interest in the current pricing range. Although technically, a more significant downward correction could occur, the US market maintains a premium over its global counterparts. This stability may lead to a prolonged sideways trading range with limited drastic downsides. Additionally, ongoing concerns about bird flu in California introduce an element of uncertainty, which could influence market dynamics in the coming months. While a significant state-level recovery isn’t anticipated until early 2025, these uncertainties contribute to the complex outlook for NFDM.

Navigating the Dairy Divide: US Versus EU Market Dynamics

The global dairy market is complex. Contrasting conditions between the US and the EU significantly contribute to price dynamics, particularly in the dry whey sector. US dry whey prices have reached unprecedented highs, amplifying the price spread with European counterparts. This disparity in pricing underscores a more robust demand or constrained supply situation within the US market, driving prices upwards.

However, industry stakeholders face multifaceted challenges that could impact this precarious balance. A pressing concern is the bird flu outbreak, particularly severe in regions like California, which has ripple effects across the broader agricultural sector. If animal health concerns escalate, this situation risks supply chains and export markets.

Another challenge pertains to the sustainability of these current dry whey price levels. While tight supplies and strong protein demand have buoyed the market, questions remain about the longevity of these conditions. The reliance on diet trends and consumer preferences, such as the popularity of high-protein consumption tied to weight loss products, introduces a degree of volatility and unpredictability.

The industry’s future growth and stability will depend on effectively addressing these challenges, balancing high demand with mitigating potential threats to supply continuity. Stakeholders are cautioned to consider these factors when navigating the ever-evolving dairy landscape.

The Bottom Line

The dairy market is witnessing a fascinating phenomenon: dry whey is emerging as the unexpected leader, drastically influencing Class III futures. This surge embodies a broader trend of proteins significantly overtaking fats. As whey prices rally, they bolster futures and invite scrutiny into supply dynamics, raising questions about sustainability, especially when compared with the EU market. As we see class III futures experiencing momentum, the implications of such a shift could be extensive, potentially redefining investment strategies and operational decisions in the dairy sector.

Meanwhile, cheese and butter exhibit divergent trends. Though the cheese market experiences price fluctuations, it benefits from robust export figures, particularly to Mexico. Butter and NFDM navigate their unique paths amidst market volatility, highlighting the complexity and interconnectedness of the global dairy trade.

Ultimately, these developments prompt a reevaluation of market priorities and the influence of economic forces on traditional dairy commodities. As stakeholders ponder these shifts, they must consider whether this ‘whey revolution’ signals a fundamental change in market paradigms. How will the dairy industry adapt to these changing tides? Could they continue revolutionizing market dynamics, or will other forces emerge to shape the future? The answers to these questions will significantly impact strategic decision-making in this evolving market landscape.

Learn more:

- What’s New in Dairy? Exciting Product Debuts from January to June 2024

- U.S. Dairy Exports Surge in April: Record Cheese Shipments and Whey Boost

- Mid-Year 2024 Global Dairy Business Review: Key Developments from January to June

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!