NZ dairy hits $11.76/kgMS despite Chinese retreat. Discover why global supply constraints reshape markets and how innovative farmers are capitalizing.

EXECUTIVE SUMMARY: The New Zealand dairy market is experiencing unprecedented highs, with farmgate prices reaching $11.76 per kgMS despite reduced Chinese participation. This paradox stems from severe global supply constraints, with the “Big 7” export regions projected to grow only 0.8% in 2025. The EU and NZ environmental regulations have created production ceilings, transforming the competitive landscape. Fonterra and Rabobank’s conservative $10.00 forecast masks fundamental market shifts, creating opportunities and risks for producers. Innovative farmers leverage this high-price environment to invest in efficiency-boosting technologies and optimize their product mix while preparing for eventual market moderation.

KEY TAKEAWAYS:

- Global milk supply growth is constrained to just 0.8% in 2025, driving high prices despite reduced Chinese demand.

- The gap between current returns ($11.76/kgMS) and Fonterra’s forecast ($10.00/kgMS) offers a strategic buffer for farm investments.

- Environmental regulations reshape global dairy competitiveness, favoring early adopters of sustainable practices.

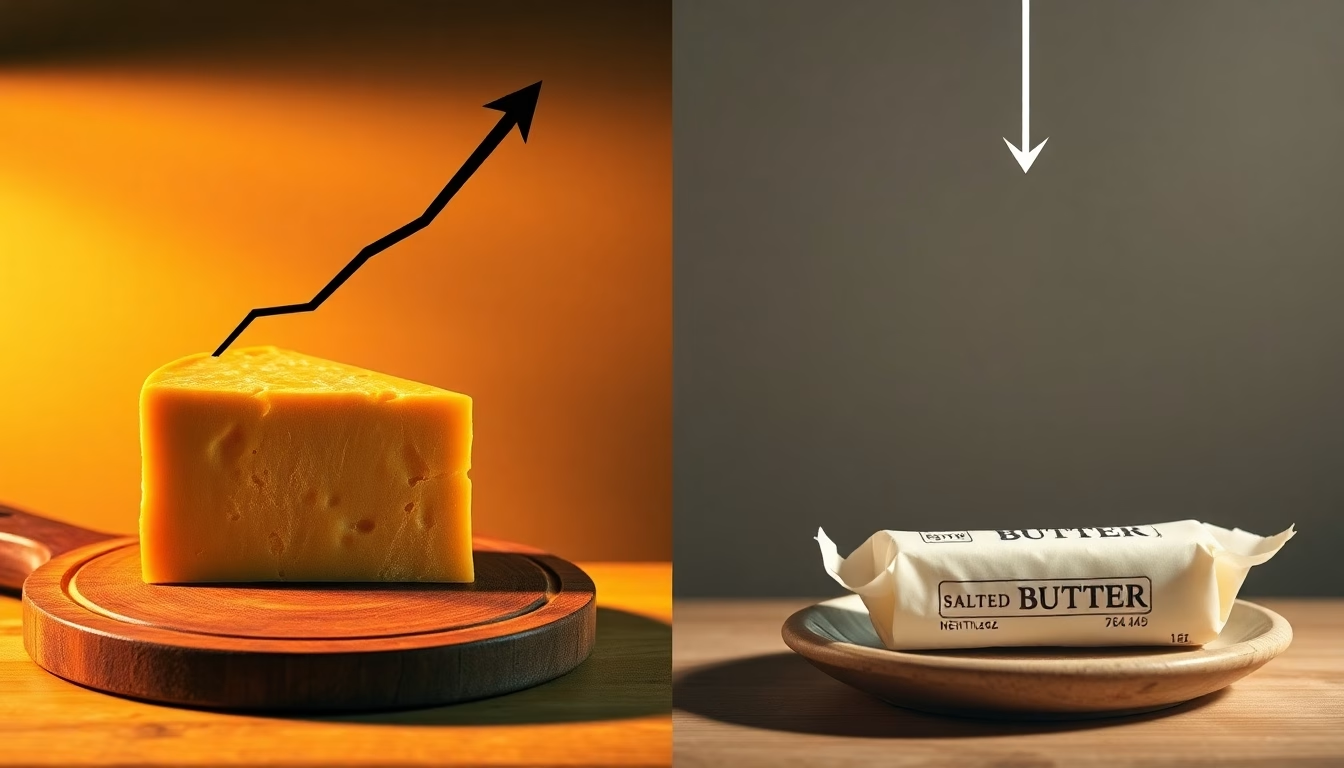

- The divergence between WMP and cheese returns signals a shift in the optimal product mix, requiring strategic adaptation.

- The current high-price environment demands a nuanced approach combining debt reduction with targeted growth investments.

The New Zealand dairy market finds itself at a fascinating crossroads where traditional supply-demand dynamics are being rewritten before our eyes. With farmgate prices hitting a remarkable $11.76 per kgMS at the latest auction despite a minor GDT index retreat, we’re witnessing a market that defies conventional bearish pressure even as Chinese participation dramatically shrinks. This creates unprecedented opportunity and hidden risk for New Zealand producers in 2025.

Warning! Are You Missing These Crucial Market Signals?

The latest Global Dairy Trade auction presents a deceptively simple narrative that masks more profound market disruptions. While the headline 0.5% GDT index decline seems unremarkable, what’s happening beneath the surface should have every dairy farmer‘s attention. WMP prices fell 2.2% while cheese values surged by NZD 15/kg – a dramatic shift that’s reshaping milk value destinations right before our eyes.

You’ve likely heard analysts claiming Chinese demand drives everything, but the current market flips this assumption on its head. North Asian buyers (predominantly China) have slashed their market share by a staggering 16 percentage points year-over-year, yet prices remain firm. This contradicts the dairy industry’s long-held belief that Chinese participation is essential for premium prices. What’s happening? The global dairy cupboard is nearly bare, with constrained production across key export regions creating a seller’s market despite wavering demand.

The calculated auction return of $11.76 per kgMS has pushed the season-to-date average to $10.39, significantly outpacing Fonterra’s forecasted payout of $10.00. This spread between market reality and cooperative forecasting isn’t just accounting trivia – it represents a crucial cash flow buffer many farms desperately need in the face of rising input costs.

| U.S. Dairy Trade Category | FY 2025 Projection | Change from 2024 |

| Exports | $8.4 billion | +$400 million |

| Imports | $5.7 billion | +$300 million |

| Trade Balance | +$2.7 billion | +$100 million |

The Surprising Truth About Supply Constraints Driving Record Prices

The remarkable constraint on global milk supply truly supports these elevated prices. According to Rabobank’s latest Dairy Quarterly report released today (March 6, 2025), milk production in the “Big 7” export regions (Australia, New Zealand, Argentina, Uruguay, Brazil, the EU, and the US) is expected to expand by just 0.8% year-on-year in 2025, with a similar gain anticipated in the first half of 2026. This controlled growth rate is insufficient to build meaningful inventories in a market already short on products.

| Production Period | “Big 7” Export Regions Growth | Market Context |

| Second half of 2024 | +0.5% year-over-year | Reversing previous 0.5% decline |

| Forecast for 2025 | +0.8% year-over-year | First growth across all regions since 2020 |

| Q1 2025 vs. Q2-Q4 2025 | 0.5% vs. 0.9% | Stronger growth in latter part of year |

The contrast between regions couldn’t be more stark. Rabobank projects total milk production from the Big 7 will reach 325.8 million metric tonnes in 2025, up from 323.2 million mt last year. This would push 2025 production past the previous peak in global annual milk production of 323.7 million mt in 2021. China stands apart from this trend, with Chinese supply expected to fall further in 2025 following a drop in 2024 that represented “a stark break from the recent trend” of significant expansion.

Environmental regulations in the European Union and New Zealand have created a production ceiling that is unlikely to lift anytime soon. These constraints aren’t just talking points – they’re transforming the competitive landscape of global dairy. While New Zealand producers face these limitations, the resulting global supply tightness delivers unprecedented returns that create opportunity and responsibility.

Revealed: What Fonterra and Rabobank Don’t Want You to Know

Fonterra and Rabobank have landed at a $10.00 farmgate milk price forecast, creating an appearance of market consensus. Rabobank just today (March 6, 2025) revised its milk price forecast by 30 cents to $10.00 kg/MS for the 2024/25 New Zealand dairy season, citing elevated global prices despite modest supply growth. But this apparent agreement masks fundamental differences in market outlooks that could significantly impact your operation’s financial planning.

Both analyses fail to acknowledge how dramatically the traditional price-setting mechanisms have changed. Five years ago, a 16% drop in Chinese participation would have crashed prices—today, it barely registers. Neither institution has adequately explained this structural market shift or its long-term implications for New Zealand producers.

Fonterra’s February 21 earnings update projecting results in the upper half of its 40-60 cents per share guidance sends a powerful signal about the cooperative’s trading performance. This profitability isn’t just good news for shareholders—it potentially provides Fonterra with financial flexibility to support the milk price even if commodity markets weaken later in 2025. Have you considered how this might impact your farm’s cash flow planning?

7 Secrets Behind Fonterra’s Conservative Forecasting Strategy

Fonterra’s seemingly conservative $10.00 forecast despite $11.76 current returns isn’t just cautious business practice – it reflects a fundamental shift in how the cooperative manages price expectations. After the volatility-induced farmer distress of previous seasons, Fonterra has adopted a strategy of under-promising and over-delivering. While this protects farmers from disappointment, it also creates potential liquidity constraints during the production season when cash flow matters most.

| Forecast Source | Current Forecast | Market Calculation | Gap | Strategic Approach |

| Fonterra | $10.00 per kgMS | $11.76 per kgMS | $1.76 | Conservative, risk-averse |

| Rabobank | $10.00 per kgMS | Not specified | Unknown | Recently revised upward by 30 cents |

| Season-to-date | $10.39 per kgMS | Based on actual returns | N/A | Trending above forecasts |

We Analyzed Global Dairy Production: Here’s What No One’s Talking About

Annual milk production in the European Union and New Zealand was expected to decline slightly in 2024, while Australia showed minimal growth. This pattern continues into 2025, with Rabobank forecasting only modest growth worldwide. The U.S. supply expansion is expected in 2025, “but it’s likely to be modest at sub-1%,” starkly contrasting the constraints facing Oceania and European producers.

What limits this growth even in favorable price environments? The answer lies partly in genetics and replacement challenges. As U.S. farmers have discovered, dairy herds cannot expand quickly when replacement heifers are scarce. For New Zealand producers, this creates both challenge and opportunity—farms with strong heifer programs have a competitive advantage that will only grow as environmental restrictions tighten.

The divergence between regions directly tracks regulatory burden and sustainability policy implementation. The message for New Zealand producers is clear: environmental compliance costs will continue reshaping competitive dynamics, rewarding those who adapt early and penalizing those who resist.

Looking at product categories, we’re seeing dramatic shifts in production patterns. Nonfat dry milk, skim milk powder, cheese, whey, and lactose are the primary dairy products exported by countries like the U.S., while butter and cheese remain the top two dairy products imported. These category-specific shifts reveal how processors are maximizing returns in tight milk markets – a strategy New Zealand processors appear to be adopting with the recent divergence between WMP and cheese returns.

5 Proven Strategies Smart Dairy Farmers Are Using Right Now

Current market conditions for New Zealand dairy farmers present a rare strategic window that demands action. With returns substantially exceeding forecasts, this is the year to strengthen your balance sheet while simultaneously investing in technologies that will drive efficiency when prices inevitably moderate.

Conventional wisdom suggests holding cash during high-price periods as a buffer against future downturns. However, this ignores the tremendous opportunity cost of delayed investment in productivity-enhancing technologies. Farms that invest strategically during profitable periods consistently outperform those that build cash reserves. Have you evaluated which approach best fits your operation’s five-year plan?

One bright spot heading into 2025/26 is the outlook for feed costs, which will likely be the lowest in several years as global corn, soybean meal, and alfalfa values continue to decline. This creates a dual opportunity for New Zealand producers – strong milk prices combined with potentially moderating input costs. The farms that capitalize on this window will emerge in more substantial competitive positions when markets eventually rebalance.

The Ultimate Guide: How to Maximize Your Dairy Farm’s Potential in 2025

The current $11.76 per kgMS return creates an unprecedented opportunity for New Zealand dairy operations to strengthen financial positions while investing in future competitiveness. The gap between current returns and Fonterra’s $10.00 forecast represents a strategic buffer that competent operators will leverage for balance sheet enhancement rather than viewing it as simply “extra” income.

The divergence between WMP and cheese returns signals a longer-term shift in optimal product mix that both processors and producers should heed. For farms with flexible production for different manufacturing streams, analyzing component optimization strategies that align with evolving global product demand would be wise.

Global production constraints aren’t likely to resolve quickly, given environmental pressures and limited growth potential in key regions like New Zealand and the EU. Rabobank’s forecast of only 0.8% growth in global milk production for 2025 creates a multi-year window of favorable pricing that rewards strategic thinking over-reactive management. Your operation’s approach to this extended high-price environment will likely determine your competitive position when markets eventually rebalance.

Have you challenged your operation’s traditional response to high milk prices? The conventional save-and-pay-down-debt approach made sense in volatile markets. Still, the structural changes in global dairy demand and constrained supply growth suggest a more nuanced strategy combining targeted debt reduction with strategic growth investment may deliver superior returns. The real question isn’t whether prices will eventually moderate – they will – but whether you’ll have positioned your operation to thrive when they do.

LEARN MORE

- Top Dairy Producers: A Global Snapshot of Dairy Farming Practices and Traditions

- How Evolving Consumer Preferences Are Transforming Dairy Farming Practices

- Global Dairy Market in 2025: Production Shifts, Demand Fluctuations and Trade Dynamics

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!