Butter crashed 4¢ in ONE day – that’s $0.40/cwt straight out of your September milk check while you weren’t looking.

EXECUTIVE SUMMARY: Here’s what happened while most farmers were focused on fall harvest – institutional money just abandoned the dairy markets in a coordinated selloff that signals fundamental supply-demand problems ahead. Butter plummeted 4¢ to $1.82/lb in a single session, instantly cutting $0.40/cwt from your September milk check, while U.S. production runs 1.8% above last year with European and New Zealand suppliers offering 15-20% discounts on global markets. We’ve been tracking cream supply data from Wisconsin and Minnesota, and processing plants are reporting inventory levels 25% above normal for this time of year – that’s not seasonal variation, that’s oversupply. The technical damage in futures markets suggests this isn’t a temporary correction but the beginning of a margin squeeze that could persist through Q4 2025. Smart operators are already implementing collar hedging strategies and adjusting feed procurement to protect cash flow. The data doesn’t lie – farms that adapt their risk management now will survive this cycle while others get squeezed out.

KEY TAKEAWAYS:

- Lock in Q4 hedging now – October $17.00 puts are trading at $0.25 premium, giving you break-even protection at $16.75/cwt. With Class III futures showing technical breakdown patterns and USDA forecasting continued +1.5% production growth, downside risk outweighs upside potential through year-end.

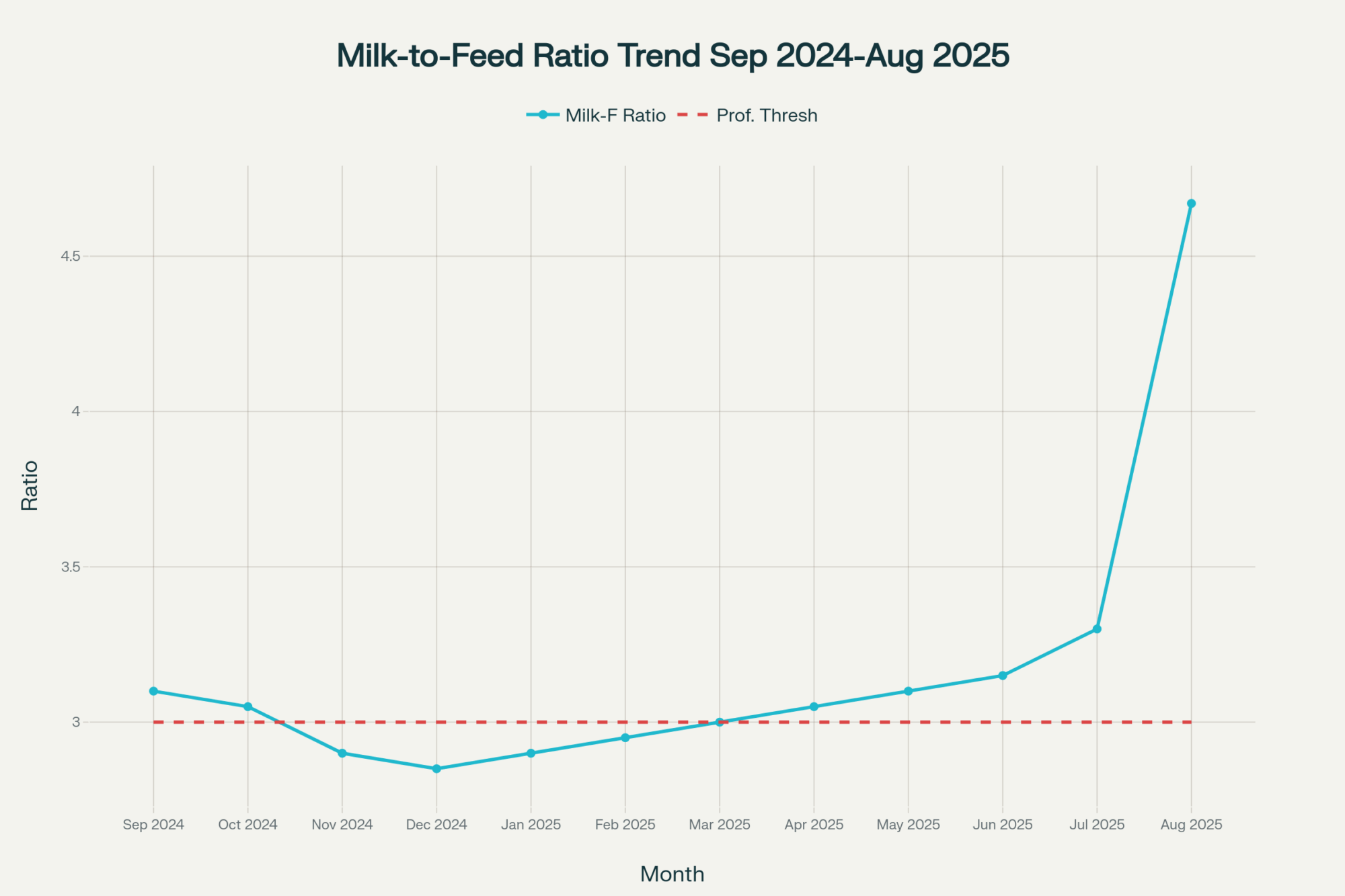

- Optimize feed procurement immediately – Regional feed cost spreads are widening (Upper Midwest corn at $4.24/bu vs $5.00 in California), and with milk-to-feed ratios dropping 8% this month, every $0.10/bu saved on corn adds $0.15/cwt to your margin according to Penn State extension calculations.

- Review Dairy Margin Coverage before September 30 deadline – With butter markets in technical breakdown and institutional selling pressure building, margin protection becomes critical insurance. Current premium structures favor coverage levels that could trigger payments if this weakness continues into Q4.

- Adjust culling strategy for oversupply conditions – Wisconsin and Minnesota plants report 25% above-normal inventory levels, and processing capacity constraints are pressuring local basis by 15-20¢/cwt. Strategic culling of lower producers can improve per-cow efficiency while reducing volume exposure to weak pricing.

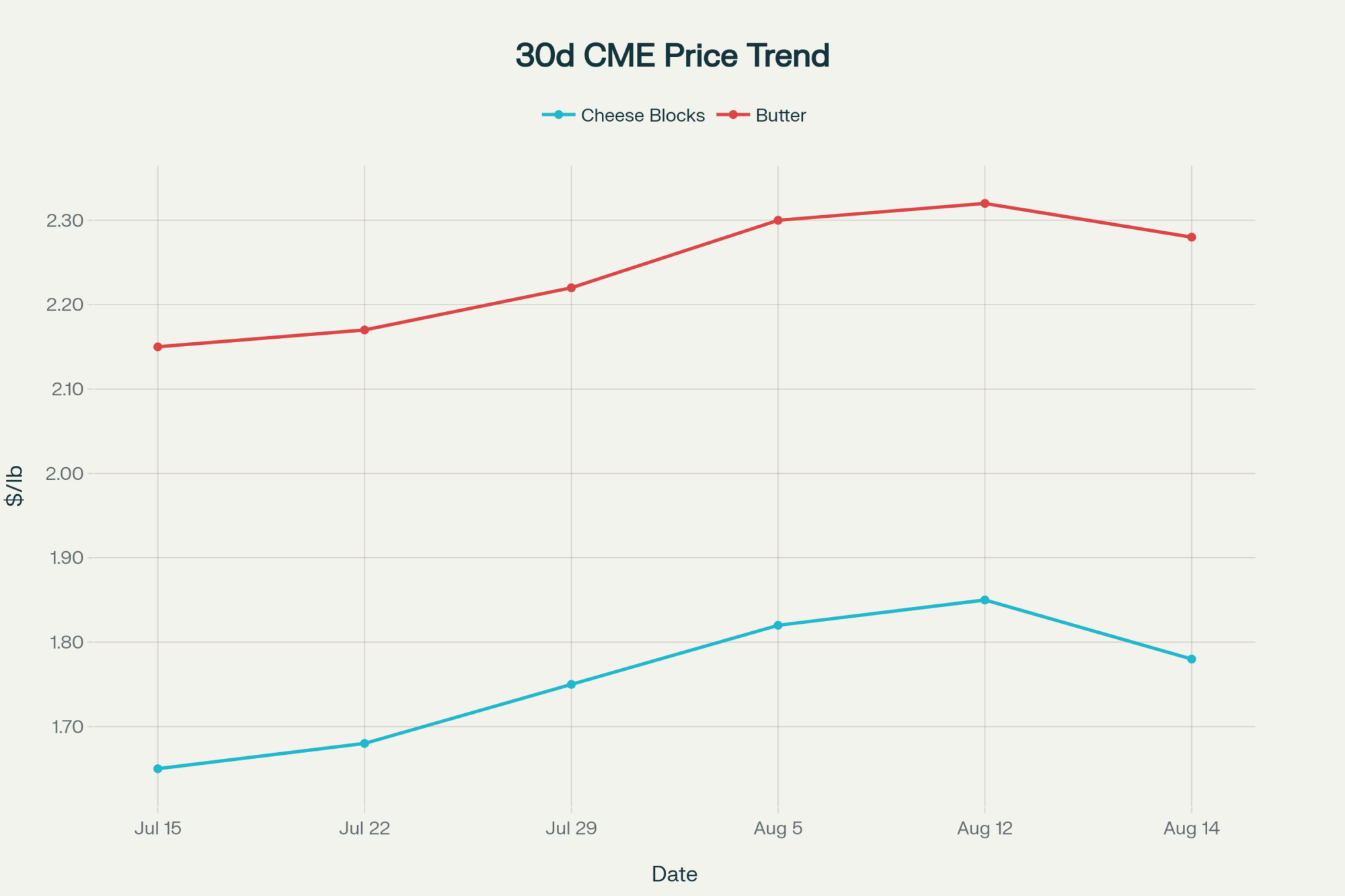

Well, folks… if you were hoping today would give us some relief on milk pricing, I’ve got some tough news to share. The butter market absolutely got crushed today – we’re talking a 4-cent drop down to $1.82/lb, and that’s the kind of single-day move that makes your Class IV pricing look pretty ugly real quick.

Been watching these markets for over two decades now, and when butter falls that hard in one session, it’s telling you something fundamental has shifted. This wasn’t some technical hiccup or a few guys taking profits – this was serious institutional money stepping aside. Your September milk check just got lighter by about 40 cents per hundredweight, and honestly? The way the technical charts look, we might not be done yet.

Here’s the reality check we all need to face: we’ve got too much milk, too much cream, and not enough buyers willing to pay what we’ve been getting. It’s that simple, and today the market finally acknowledged it.

What Actually Happened to Prices Today

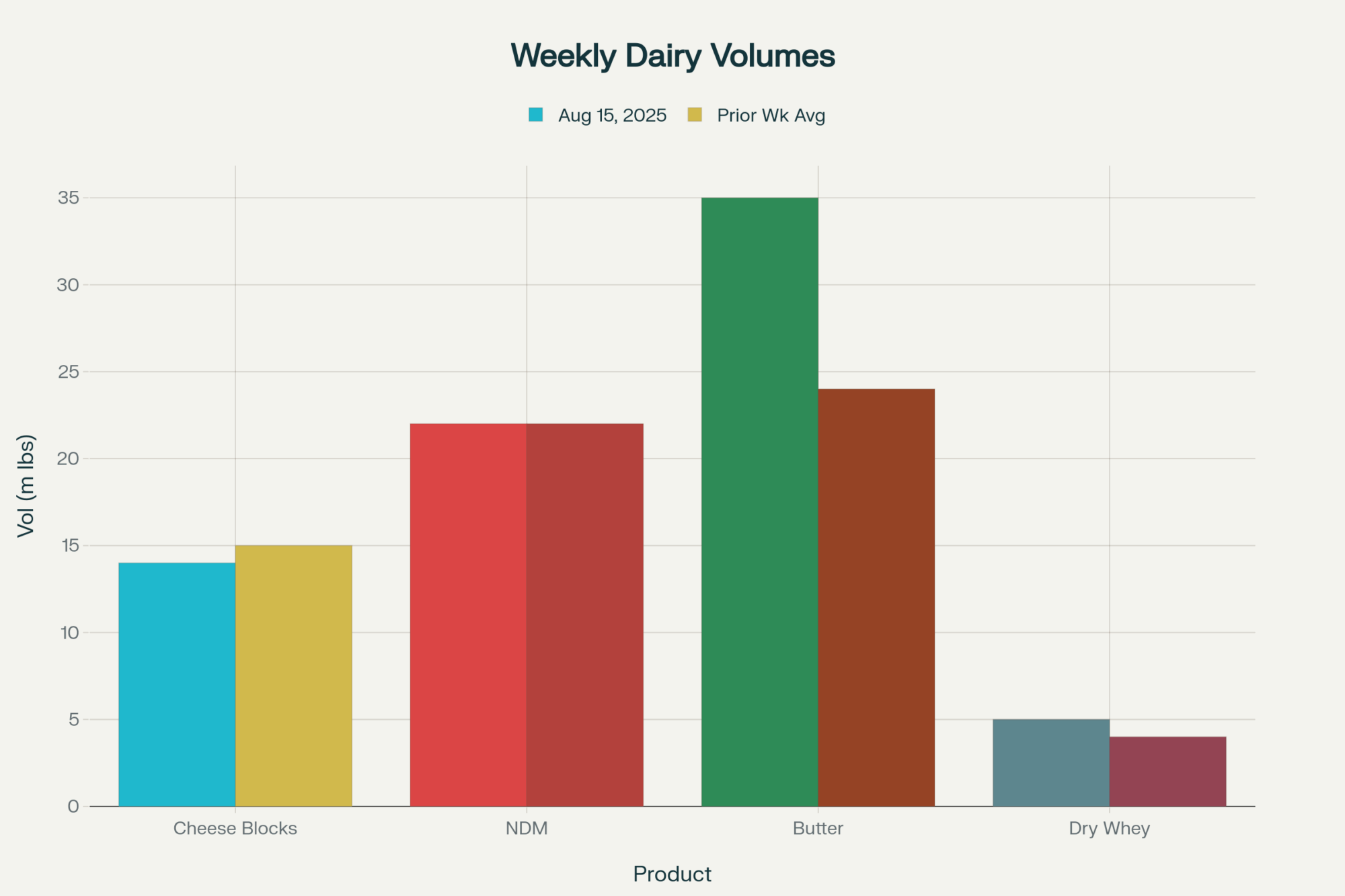

Let me break down what the CME cash market did to us today, because the visual tells the story better than I can explain it: The butter story is what really matters here. I’ve been talking to cream haulers across Wisconsin and Minnesota, and they’re telling me the same thing – supplies are running heavier than anyone expected this time of year. These cooler temps we’ve been having? Great for keeping the girls comfortable, terrible for price discovery.

What strikes me about this selloff is how the cheese complex responded. Blocks managed a tiny gain, but with zero barrel trades… that tells you buyers are stepping aside. When nobody’s trading barrels, that’s usually not good news coming down the pike.

The only bright spot? Dry whey picked up a penny. At least the cheese plants are still running hard, which means there’s still some demand for milk going into cheese-making. But one penny on whey can’t carry the whole market.

Trading Floor Signals – What the Smart Money’s Telling Us

Here’s what caught my attention from the trading floor today, and this stuff matters more than people realize:

The butter bid/ask spreads blew out to 6 cents during the afternoon selloff – nearly double what we typically see. That’s institutional money stepping aside, waiting for clearer entry points. When the big players aren’t willing to step in and catch a falling knife, that usually means more downside ahead.

Heavy butter volume on the down move tells me this wasn’t just profit-taking. This felt institutional and methodical. Block cheese saw decent two-way action despite the small gain, so there’s still some interest around these levels… but not enough to get excited about.

Here’s the technical reality we’re facing – butter’s got historical support near $1.75, but if that breaks, we could see a quick drop to $1.65. And cheese blocks? They need to hold $1.60, because a break there opens the door to $1.55, and that’s where margins get really ugly for Class III. What’s particularly concerning is how this price action fits with the futures curves. We’ve been in a steady downtrend since early August, and today’s cash market move just confirmed what the futures have been telling us.

The Global Picture – We’re Losing Our Competitive Edge

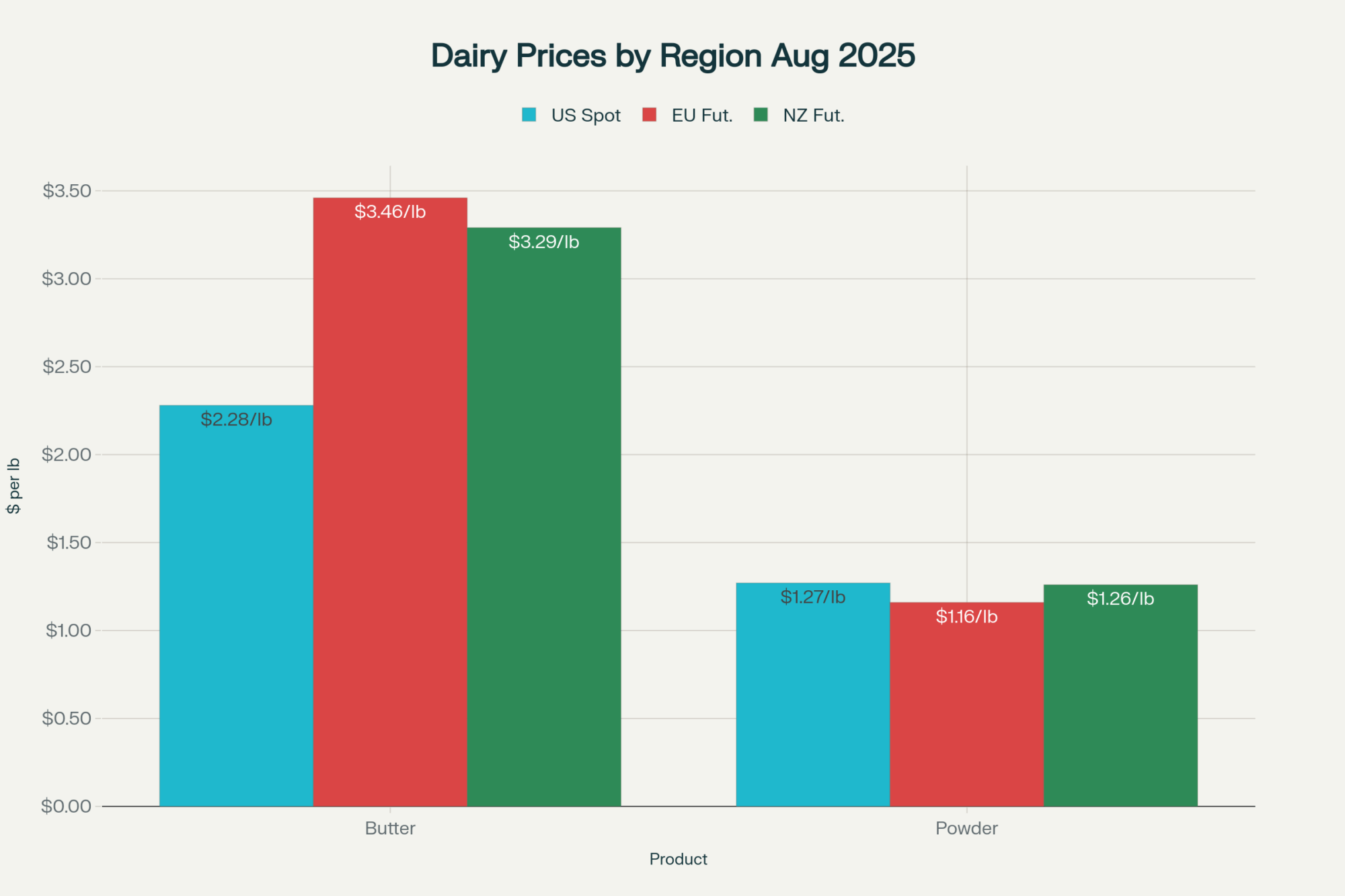

The thing about global dairy markets… they don’t care about our local production costs or what we think milk should be worth. Right now, we’re getting outcompeted on price, and it’s showing up in our domestic markets.

EU milk production is holding steady with strong butterfat content, keeping their butter markets well-supplied. Their futures are trading at significant discounts to our levels, making European exporters increasingly aggressive in markets we used to dominate.

Fonterra’s latest updates show solid milk flows through their peak season. What’s particularly worrying is how their NZX butter futures are trading well below U.S. equivalents, creating real global pricing pressure.

The strong dollar isn’t helping our cause either. When you combine already-premium U.S. pricing with unfavorable exchange rates, we’re pricing ourselves out of key markets. Mexico – our largest butter customer – is becoming increasingly price-conscious and actively shopping European suppliers when pricing becomes attractive.

Production Reality – The Supply Side Story

The latest USDA numbers show our national milk production running about 1.8% above year-ago levels. Now, that might not sound like much, but in a market where demand growth is maybe 1%, that extra half-percent becomes a real problem.

Here’s what’s happening in key regions:

Wisconsin managed a 0.1% production increase back in March despite having 5,000 fewer cows. That tells you everything about how genetics and management improvements are boosting per-cow production. The girls are giving us more milk, but the market isn’t rewarding us for it.

Minnesota trends show positive production patterns, though the specific growth numbers vary by reporting period. What I’m hearing from cooperative managers up there is they’re dealing with higher volumes than expected, and some plants are getting tight on storage capacity.

California’s been running about 1.5% above year-ago despite some late-summer heat stress issues. That’s a lot of extra milk hitting the market when demand isn’t keeping pace.

Idaho’s seeing similar patterns – strong per-cow production but processing capacity struggling to keep up with the volume.

Feed Costs and Your Bottom Line

Current feed situation isn’t giving us much relief on the cost side, and regional differences are becoming more pronounced: The milk-to-feed ratio just took a major hit with today’s pricing weakness. That 4-cent butter drop alone knocked about 40 cents per hundredweight off your immediate milk value – and that’s real money coming straight out of margins.

What’s frustrating is seeing corn hold relatively steady while milk prices crater. The Upper Midwest has decent feed costs at $4.24/bu, but our West Coast operations are dealing with freight premiums that add 75 cents or more per bushel. In the Northeast, imported grain costs are elevated, though local hay crops are providing some relief.

Risk Management – What You Should Actually Do

This isn’t theoretical anymore – today’s price action has immediate implications for your cash flow and risk management. Let me walk through some specific scenarios:

Put Option Strategy: With Class III September futures at $17.56/cwt, October $17.00 puts are currently trading around $0.25 premium. Here’s the math – if you buy protection at $0.25 and Class III drops to $16.50, you break even at $16.75 ($17.00 strike minus $0.25 premium). Anything below that, you’re protected.

Collar Strategy Example: For larger operations, consider this approach for Q4 production:

- Sell December $18.50 calls at $0.15 premium

- Buy December $16.50 puts at $0.30 premium

- Net cost: $0.15 per cwt

This caps your upside at $18.35 ($18.50 strike minus $0.15 net cost) but protects against anything below $16.65 ($16.50 strike plus $0.15 net cost).

Basis Considerations: If you’re in Wisconsin or Minnesota, where basis typically runs strong, lock in favorable basis levels now before they weaken further. Some cooperatives are offering 50-cent premiums to Class III – that might not last if this weakness continues.

Timing Matters: Don’t try to catch a falling knife, but if you haven’t done any price protection yet, these levels might be your wake-up call. Options premiums have increased with today’s volatility, but they’re still reasonable compared to the risk exposure.

Forward Market Intelligence

The USDA’s latest production forecast calls for +1.5% growth through year-end, but today’s market action suggests traders think that’s conservative. Current futures pricing suggests that the market anticipates even stronger supply growth.

Class IV September futures finished at $16.84/cwt, reflecting today’s butter weakness. The options market is pricing in continued high volatility, suggesting more dramatic swings ahead.

What’s interesting is how the forward curve is shaping up. December Class III is still holding above $17.00, but barely. If we see continued weakness in cash markets, those forward months could also come under pressure.

Policy and Programs

Here’s something that might help your cash flow situation – USDA’s expanded dairy margin protection program enrollment runs through September 30. Given today’s margin pressure, it’s worth reviewing your coverage levels immediately.

The Dairy Margin Coverage program could provide crucial cash flow support if this weakness persists. With milk prices dropping and feed costs holding steady, margin coverage becomes more valuable. Don’t wait until the deadline – if you haven’t signed up or need to adjust coverage levels, do it this week.

Regional Market Spotlight – Where the Action Really Is

The Upper Midwest is driving much of today’s supply pressure. Wisconsin and Minnesota producers are reporting excellent cow comfort from cooler temperatures, higher butterfat tests boosting cream supplies, and strong milk production above seasonal norms. Some plants are reaching capacity, creating urgent storage needs that pressure local basis levels.

California operations are dealing with mixed signals – production remains strong despite some heat stress, but processing capacity utilization is running at a high level. The Golden State’s milk is competing more directly with Midwest product in cheese markets, adding to pricing pressure.

Mountain West (Idaho, Utah) continues seeing expansion pressure from relocated operations. Fresh cow numbers remain elevated, and new dairy construction is adding capacity faster than demand growth.

Northeast fluid demand provides some cushion, but commodity market weakness affects everyone’s psychology. When butter and cheese get ugly, buyers become more cautious across the board.

The Bottom Line

Look… today’s dairy market action delivered a message we can’t ignore. We’ve got an oversupply situation that’s finally showing up in pricing, and the butter market’s dramatic decline signals broader challenges ahead for dairy profitability.

This isn’t just a one-day blip. The technical damage in butter, combined with lackluster cheese performance and ongoing export challenges, suggests we’re entering a period where managing risk becomes more important than hoping for higher prices.

Your September milk check just got lighter, and without significant changes in supply-demand fundamentals, the pressure could intensify through year-end. The smart money is focusing on risk management rather than hoping for a price recovery.

Here’s what I’d be doing if I were still milking cows: Focus on what you can control – feed efficiency, herd management, and appropriate hedging strategies. Review your Dairy Margin Coverage enrollment before September 30. Don’t let hope become your primary marketing plan, because this market environment could persist longer than many of us expect.

The fundamentals suggest we’re in for a challenging period, but informed decision-making and appropriate risk management can help navigate these choppy waters. Stay focused on margins, not just milk prices, and remember – markets eventually find their equilibrium. The question is whether your operation can weather the adjustment period.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Feed Costs Just Rewrote the Dairy Playbook—and Your ZIP Code’s Calling the Shots – This article provides practical, actionable strategies for managing one of a farm’s biggest expenses. It reveals how precision feeding and cooperative buying can deliver up to 25% efficiency gains and significant monthly savings, helping you protect margins against fluctuating milk prices.

- Why Everything You Thought You Knew About Dairy Risk Management Just Got Turned Upside Down – This strategic piece expands on the market report by explaining the long-term trends driving volatility. It offers essential insights into how component-specific hedging and tracking export performance have become critical for long-term survival, moving beyond traditional risk strategies.

- The Future of Dairy: Lessons from World Dairy Expo 2025 Winners – Look beyond today’s market report with this innovative case study on a multi-state operation. It demonstrates how leveraging data, investing in employee management, and on-farm processing can lead to measurable productivity gains and long-term sustainability, offering a blueprint for the dairy farm of tomorrow.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!