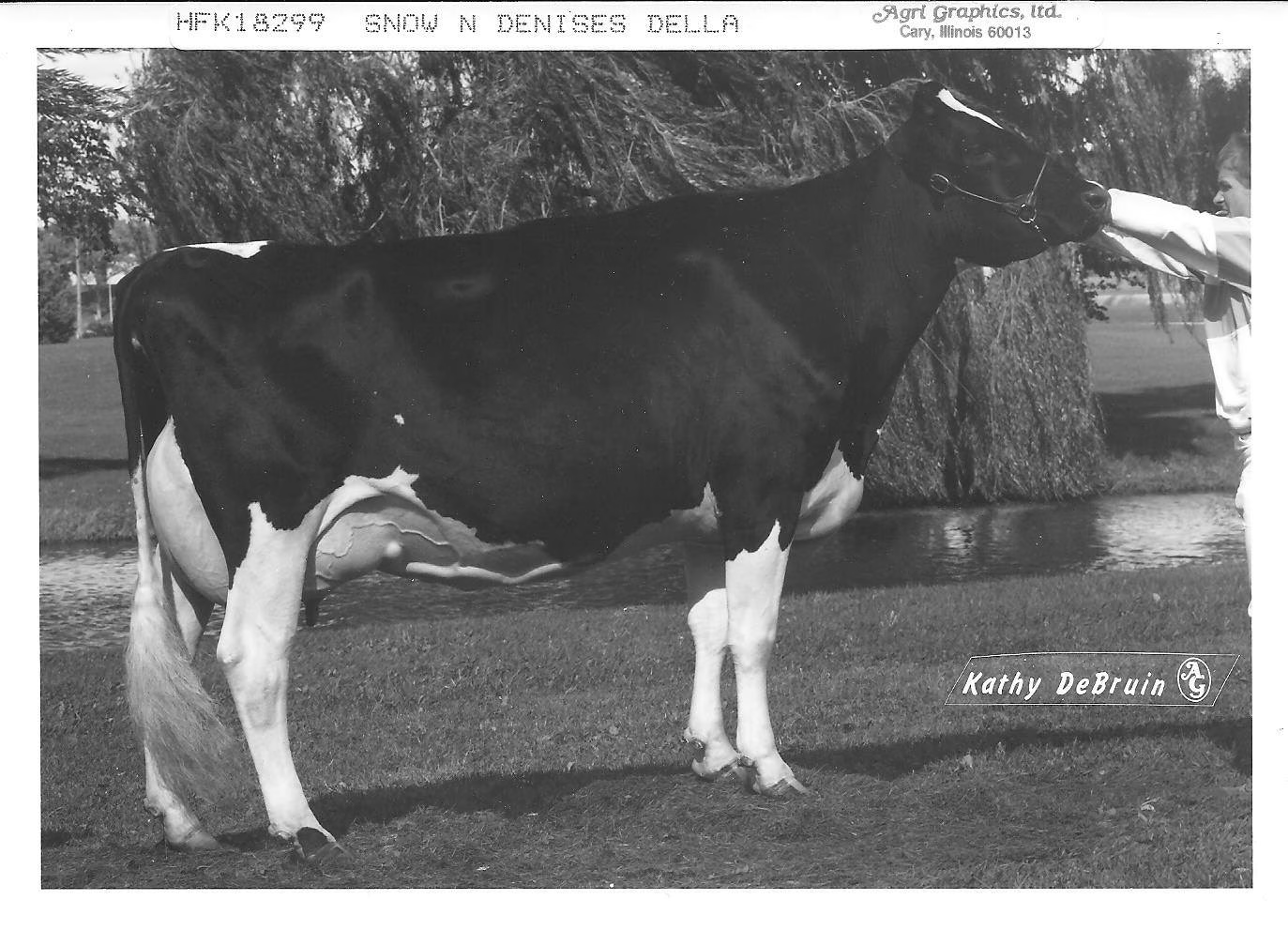

Meet Snow-N Denises Dellia, the Holstein that revolutionized dairy genetics. Born in 1986, this Wisconsin wonder cow shattered breeding norms, producing sons that became industry titans and daughters that conquered show rings worldwide. Discover how one remarkable bovine’s legacy still shapes your milk nearly four decades later.

It’s a crisp December morning in 1986, and on a small Wisconsin farm, a Holstein calf takes her first wobbly steps. The farmer, Bob Snow, has no idea he’s just witnessed the birth of a legend. This calf—Snow-N Denises Dellia—is about to rewrite the rules of dairy genetics and leave an indelible mark on the industry for generations to come.

Fast forward to today. Walk into any top-tier dairy farm, flip through AI catalogs, or chat with breeders at elite cattle auctions, and you’ll hear whispers of “Dellia blood.” But how did a single cow from Monroe County become the matriarch of modern Holsteins?

Buckle up, dairy enthusiasts. We’re about to dive into a tale of strategic breeding, record-breaking sons, globe-trotting embryos, and a genetic cocktail so potent it’s still shaping udders and milk checks nearly four decades later. This isn’t just Dellia’s story—it’s how one remarkable cow challenged everything we thought we knew about balancing type and production.

So, grab a glass of milk (preferably from a Delia descendant), and let’s unravel the DNA of a bovine superstar. Trust us, by the end of this, you’ll never look at your herd the same way again.

The Making of a Legend: When Bob Snow Played Genetic Roulette

Bob Snow: The Bachelor with a Bovine Obsession

A Wisconsin bachelor named Bob Snow, whose idea of a hot date was poring over Holstein pedigrees. It sounds like a real party animal, right? But trust me, this guy’s obsession with cow genetics was about to change the dairy game forever.

Now, Bob wasn’t born with a silver milk pail in his mouth. He inherited a run-of-the-mill grade herd from his old man. But he got bit by the registered Holstein bug somewhere along the line. Hard. We’re talking fever-dream levels of Holstein mania here.

The 1970s: When Snow Went Pro

So, the ’70s roll around. While everyone else is doing the Hustle, Bob hustles to turn his “Snow-N” prefix into dairy royalty. His mission? Blend strength, udder quality, and milk yield into the perfect cow cocktail. Sounds simple. It’s about as simple as teaching a cow to tap dance.

But here’s where it gets interesting. In 1970, Bob crashes a herd dispersal sale in Rice Lake, Wisconsin. Now, most folks would be there for the free coffee and donuts. Not our Bob. He’s there with his eye on the prize.

The Auction That Changed Everything

Picture the scene: Dust in the air, the rapid-fire chatter of the auctioneer, and Bob Snow cool as a cucumber in a dairy case. He spots two cows that most people wouldn’t look at twice: Ce-Buerg Creator Hartog Fobes and her daughter, Ce-Buerg Creator Fobes Garnet.

“Hold up,” you might be thinking. “Those names sound about as exciting as watching paint dry.” And you’d be right. These gals were sired by some obscure bull called Creator Fobes Governor. It’s not exactly a name that rolls off the tongue.

But Bob? He saw potential. He saw the sixth and seventh dams of a future legend. He saw… well, honestly, who knows what he saw. Maybe he just liked their spots. But whatever it was, he bought ’em.

The Snow-N Strategy: Go Big or Go Home

Here’s where Bob drops a truth bomb that’ll make you spit out your milk. He says, and I quote, “I wasn’t interested in the middle or the bottom. If I went to the sale, I would buy off the top.”

Hold onto your udders, folks. This guy wasn’t messing around. He wasn’t there for the bargain bin bovines. He wanted the cream of the crop, the top of the herd, the… okay, I’ll stop milking these puns now.

The Genetic Cocktail: Shaken, Not Stirred

So what did Bob’s crazy auction adventure get him? It’s a genetic cocktail that would make James Bond jealous. On one side, you’ve got strength courtesy of MD-Sunset-View R A Wonder. On the other hand, Dairy Elegance is available via Carlin-M Ivanhoe Bell.

Bob was playing genetic Jenga, stacking traits and hoping it wouldn’t all come crashing down. Spoiler alert: It didn’t. This madcap mixture was about to create a cow so legendary that she’d make other Holsteins look like they were still in calf school.

The Million-Dollar Question

Now, I know what you’re thinking. “This is all good, but how does this lead to Dellia?” Well, my friend, that’s a tale for another paragraph. But let me tell you, if Bob Snow’s Breeding Strategy were a Netflix series, this would be the cliffhanger ending of season one.

So, are you ready to dive into the next chapter of this moo-ving saga? Because trust me, things are about to get even more enjoyable. And by interesting, I mean we’re talking about a cow that’s about to flip the dairy world upside down. Buckle up, buttercup—this ride’s just getting started!

The Golden Cross: When Chief Mark Met Bell (and Magic Happened)

A Match Made in Holstein Heaven

Alright, folks, buckle up your overalls because we’re about to dive into some serious bovine romance. Do you know how people talk about power couples? Well, in the dairy world, we’ve got power pairings, and boy, oh boy, did we hit the genetic jackpot with this one.

Meet the Parents: A Tale of Two Traits

On one side of this love story, we’ve got Walkway Chief Mark. Now, Chief Mark wasn’t just any old bull. He was the Michelangelo of udders, a true specialist in the art of mammary magnificence. With a VG-87 score, he was the kind of sire that made other bulls say, “Dang, I wish I could hang udders like that guy.”

But every great rom-com needs two leads. Enter Snow-N Dorys Denise, our leading lady. This gal was packing some serious Bell family genes. We’re talking about the perfect balance of fame and fertility. She was like the Swiss Army knife of cows—versatile, reliable, and scoring an impressive EX-90 2E GMD DOM. (Don’t worry if that sounds like alphabet soup to you. Just know it’s the cow equivalent of a straight-A report card.)

The “Golden Cross”: More Than Just a Fancy Name

When these two genetic powerhouses got together, something magical happened. The dairy world’s matchmakers dubbed it the “golden cross.” And let me tell you, this wasn’t just some marketing gimmick. This pairing was like peanut butter meeting jelly for the first time—a perfect combination that makes you wonder how we ever lived without it.

Breaking the Mold (and a Few Industry Norms)

Here’s where things get interesting. Back then, farmers often had to choose: Did they want great milk producers or cows that looked good enough to grace the cover of “Holstein Monthly”? It was like trying to find a supermodel who could also deadlift 300 pounds—not impossible, but pretty rare.

But Dellia? She said, “Hold my milk pail,” and proceeded to shatter expectations faster than a bull in a china shop. She was the total package, defying the era’s trade-offs between production and type. It’s like she read the “How to Be a Perfect Cow” manual and decided to check every single box.

X Marks the Spot (Chromosomally Speaking)

Now, let’s get a bit sciency for a second. Tim Abbott puts it this way: “Dellia shattered the maternal-paternal dichotomy.” In plain English? She got the best of both worlds.

Her X chromosomes were like a genetic all-you-can-eat buffet. From Chief Mark, she inherited udder quality that would make any dairy farmer weep with joy. And from the Bell side? Metabolic efficiency that could turn feed into milk like nobody’s business.

This combination was rarer than a cow with a pilot’s license. It’s like Dellia’s DNA looked at the usual genetic rules and said, “Nah, I’m good. I’ll do my own thing.”

The Two Million-Dollar Question

So, what happens when you combine udder perfection with metabolic mastery? Well, my friends, that’s where our story kicks into high gear. Dellia wasn’t just a cow; she was a revolution with hooves.

Are you ready to see how this golden girl turned the dairy world upside down? Because trust me, we’re just getting to the good part. Grab your milking stools and hold onto your hats—this ride’s about to get wild!

From Show Ring Sensation to Global Domination: Dellia’s Regancrest Revolution

The Wisconsin Spring Show Showdown

Picture this: It’s 1991, and the Wisconsin Spring Show is hotter than a cow pie in July. The air’s thick with anticipation (and probably a fair bit of manure smell, let’s be honest). Enter our girl Dellia, strutting her stuff like she owns the place. And boy, does she!

Judge Niles Wendorf takes one look at her, and BAM! Grand Champion, baby! He’s gushing about her “tall, sharp frame and trouble-free udder” like he’s describing the Mona Lisa of milk cows. I mean, can you blame the guy? Dellia served looks and utility, a combo rarer than a vegetarian at a barbecue.

Frank Regan: The Man, The Myth, The Madman?

Now, here’s where things get spicy. Enter Frank Regan, an Iowa breeder with more guts than a slaughterhouse. While everyone else is still picking their jaws up off the floor, Frank’s already whipping out his checkbook. He buys Dellia for a sum so hefty that it probably makes other cows jealous.

But hold your horses (or cows, in this case). The dairy world wasn’t exactly rolling out the red carpet for Frank. Bless his heart, Bob Snow spills the tea: “They were upset that a ‘nobody’ could come in and clean up.” Ouch! Talk about a cold glass of milk to the face!

Regancrest Farm: Where Legends Are Born (and Bred)

So, did Frank’s gamble pay off? Does a cow moo? Dellia became the cornerstone of Regancrest Farm faster than you can say, “holy Holstein!” We’re talking:

- 76 registered daughters (More offspring than a rabbit on espresso!)

- 44 AI-sampled sons (Spreading the Dellia magic far and wide)

- Embryos jetting off to Europe, Japan, and Brazil (Talk about international appeal!)

It’s like Dellia looked at Regancrest and said, “Challenge accepted!” She wasn’t just producing calves; she was creating a dynasty!

The Sand Incident: Dellia’s Near-Death Experience

Now, brace yourselves for a plot twist that’ll curdle your milk. After her grand entrance at Regancrest, Dellia spits things up by ingesting sand. Yeah, you heard that right. Sand. If you understand, it’s not strictly part of a balanced bovine breakfast.

Most cows would’ve kicked the bucket after a stunt like that. But Dellia? She bounces back like it’s nothing! She starts pumping out embryos like they’re going out of style—15 per flush on average. That’s not just impressive; that’s downright miraculous!

The Global Dellia Effect

Before you could say “Got Milk?”, Dellia’s genetic material was more sought after than tickets to a rock concert. Breeders from Europe to Japan were lining up, cash in hand, ready to get a piece of the Dellia pie (or should I say, the Dellia cheese?).

Her embryos were sold for prices that would irritate the average dairy farmer. We’re talking premium, top-shelf, crème de la crème stuff here. It was like watching the stock market, but people traded in potential udders and milk production instead of shares.

The Three Million Dollar Question

So, what made Dellia so special? Why were breeders falling over themselves to get their hands on her genetics? Well, my friend, that tale involves more twists and turns than a country road. But let me tell you, it’s a story that’ll make you look at your morning glass of milk in a new light.

Ready to dive deeper into the Dellia dynasty? Buckle up, buttercup—this ride’s about to get even wilder!

The Billionaire Boys Club: Dellia’s Sons Take Over the World

From Momma’s Boy to Dairy Royalty

Alright, folks, grab your wallets because we’re about to talk about some seriously expensive baby-makers. Did you think your kid’s college fund was steep? Ha! That’s chump change compared to what Dellia’s boys are worth. Let’s dive into the crème de la crème of bull-dom, shall we?

Durham: The Five-Time Champ

First up, we’ve got Durham. This guy’s like the Michael Jordan of dairy bulls. He’s been named Premier Sire at the World Dairy Expo not once, not twice, but FIVE times! I mean, come on! At this point, they should rename it the Durham Dairy Expo.

But wait, there’s more! Durham didn’t just look pretty in the show ring. He revolutionized fertility traits with a +0.2 DPR. For you city slickers out there, that’s like turning every cow into a baby-making machine. Moo-raculous, right?

Die-Hard: The Bull That Keeps On Giving

Next up, we’ve got Die Hard. And boy, does this bull live up to his name! This Roebuck son has sired a mind-boggling 1.75 million semen doses. That’s not a typo, folks. 1.75 MILLION! He’s like the Energizer Bunny of the bull world—he keeps going and going and going…

If Die-Hard’s offspring formed their own country, it’d have a seat at the UN. Talk about leaving a legacy!

Million: The Big Cheese

Last but certainly not least, we’ve got Million. This outside son might not have his brothers’ flashy numbers but don’t underestimate him. His descendants are the kings and queens of cheese merit rankings.

Think about that next time you’re enjoying a nice cheddar. Chances are, you’re tasting a bit of Million’s magic. He’s not just a bull; he’s a one-person cheese factory!

The Dellia Effect: Changing the Game

Now, you might be wondering, “What’s the big deal? They’re just bulls, right?” Oh, my sweet summer child. Let me enlighten you with a quote from Scott Culbertson:

“Dellia’s impact through Durham alone transformed how we approach longevity in herds.”

That’s not just a compliment; that’s a revolution in a sentence. We’re talking about changing the entire approach to dairy farming. It’s like Dellia and her boys rewrote the rulebook overnight!

The Genomic Explosion: Dellia’s 21st Century Takeover

But wait, there’s more! (I feel like an infomercial host, but I swear, this stuff is legit.) Dellia’s influence didn’t stop with her sons. Oh no, this cow’s legacy is the gift that keeps giving.

Sapphire: The Robotic Milking Queen

Let’s talk about Sandy-Valley Planet Sapphire. This gal is Dellia’s great-granddaughter, and boy, did she inherit the family talent. Her offspring include:

- Rubicon: The first bull to sell 500,000 sexed semen doses. That’s half a million lady calves, people!

- Saloon: A former #1 TPI sire. That’s like being the valedictorian of bull school.

Greg Bauer from Sandy-Valley Holsteins puts it best:

“The Sapphires are efficiency queens—great udders, trouble-free, and built for robotic milking.”

Imagine a cow so perfect that even robots are impressed. That’s Sapphire for you!

Halo: The Global Superstar

And let’s not forget about Cookiecutter MOM Halo. This Goldwyn descendant is like the Beyoncé of the bovine world. She’s produced:

- Helix: 2018 Outcross Sire of the Year. It’s like winning a Grammy but for bulls.

- Halogen: A global conformation leader. Think of him as the Brad Pitt of bulls—he looks good from every angle.

The Four Million Dollar Question

So, what does all this mean for the future of dairy farming? Well, my friends, that’s where things get interesting. We’re not just talking about better milk production or prettier cows. We’re talking about a complete revolution in how we approach breeding, efficiency, and even the definition of what makes a “good” cow.

Are you ready to dive into the brave new world of genomic breeding? Because trust me, after Dellia and her descendants, nothing in the dairy world will ever be the same again!

Delia’s Daughters: The Global Glamour Girls of the Dairy World

From Wisconsin to the World Stage

Alright, folks, buckle up your overalls because we’re about to take a whirlwind tour of Dellia’s international superstars. These girls aren’t just your average Bessies chewing cud in the back forty. Oh no, they’re the Beyoncés of the bovine world, strutting their stuff on the global stage and leaving jaws dropped from Switzerland to British Columbia.

DH Gold Chip Darling: The Swiss Miss with Sass

First up, let’s talk about DH Gold Chip Darling. This gal isn’t just a pretty face (though with a name like that, you know she’s got looks for days). She’s a bona fide Swiss Expo Champion. She took on the best of the best in the land of chocolate and cheese and came out on top.

But wait, there’s more! Darling isn’t just winning beauty pageants. She’s got some profound family connections. Her maternal brother, Ptit Coeur Doorman Darlingo, is Europe’s #1 confirmation sire. Talk about keeping it in the family! It’s like the Kardashians of the cow world but with more utility and less drama.

You might think, “Sure, she’s pretty, but can she produce?” Well, let me tell you, this girl’s got the goods to back up her glamour. She’s not just a show cow; she’s a blueprint for the future of dairy. Farmers across Europe are lining up to get a piece of her genetic gold.

Elmbridge Goldwyn Darling: The Canadian Queen

Let’s move to British Columbia, where Elmbridge Goldwyn Darling holds court. This VG-88-scored beauty isn’t just another pretty face in the barn. She’s a baby-making machine with the credentials to prove it.

Get this: Darling has produced 28 brood stars. For you city slickers, that’s like having 28 kids who all grew up to be doctors or lawyers. It’s the cow equivalent of being a supermom. But she didn’t stop there. Oh no, this overachiever also gave birth to 9 EX daughters. Those are NINE daughters who scored excellent in confirmation. It’s like Serena Williams had nine daughters who all won Wimbledon.

All this genetic excellence didn’t go unnoticed. In 2014, Darling was crowned “BC Cow of the Year.” The entire province looked at all its cows and said, “Yep, this one’s the best we’ve got.” It’s like winning an Oscar but with more methane.

The Global Impact: More Than Just Pretty Faces

You might wonder, “Why should I care about these glamour girls?” Well, let me tell you: These aren’t just pretty faces chewing cud. These cows are shaping the future of dairy farming worldwide.

Think about it. When a cow like DH Gold Chip Darling wins in Switzerland, it’s not just a blue ribbon for her owner. It’s a statement about what excellence looks like in dairy cattle. Farmers from the Alps to the Andes take notice. They ask, “How can I get Darling magic in my herd?”

And Elmbridge Goldwyn Darling? Her impact goes beyond her impressive personal achievements. Those 28 brood stars and 9 EX daughters? They’re out there, passing on their mother’s excellent genes to the next generation. It’s a genetic ripple effect improving herds across Canada and beyond.

The Five Million Dollar Question

So, what does this mean for the future of dairy farming? Well, my friends, that’s where things get interesting. We’re not just talking about prettier cows or bigger milk checks (though those are nice perks). We’re talking about a global revolution in dairy genetics.

These global ambassadors prove that Dellia’s influence isn’t confined to one farm, state, or country. It’s a worldwide phenomenon changing how we think about breeding, production, and what makes a truly excellent dairy cow.

Are you ready to see how these international superstars are shaping the future of your morning latte? Because trust me, after learning about these girls, you’ll never look at a glass of milk the same way again!

The Bottom Line

Snow-N Denises Dellia wasn’t just a cow; she was a genetic phenomenon that reshaped the dairy industry. Born from the “golden cross” of Walkway Chief Mark and Snow-N-Dorys Denise, Dellia shattered the either/or mentality of dairy breeding. She proved that a single cow could excel in production, conformation, longevity, and fertility—a combination once thought impossible. From her Grand Champion win at the 1991 Wisconsin Spring Show to becoming the cornerstone of Regancrest Farm, Dellia’s impact was immediate and profound.

But Dellia’s true greatness lies in her enduring legacy. Her sons—Durham, Die-Hard, and Million—became industry titans, revolutionizing everything from fertility traits to cheese merit rankings. Her daughters and granddaughters, like DH Gold Chip Darling and Sandy-Valley Planet Sapphire, took her genetics global, winning championships and setting new standards from Switzerland to Canada. Even in the genomic era of the 21st century, Dellia’s influence continues to shape modern dairy breeding, with her descendants excelling in robotic milking efficiency and cheese yield improvements.

Nearly four decades after her birth, Dellia’s genetic fingerprint remains indelible in dairy herds worldwide. She didn’t just raise the bar; she launched it into the stratosphere, challenging us to think bigger, breed smarter, and never settle for “good enough” in our pursuit of the perfect dairy cow. In a world where change is constant, and progress is measured in increments, Dellia represents a quantum leap—a paradigm shift on four legs that forever altered the course of dairy genetics. That’s why Snow-N Denise’s Dellia will always be remembered as one of the most excellent cows in dairy history, a testament to an exceptional animal’s extraordinary impact on an entire industry.

Key Takeaways

- Born in 1986, Snow-N Denises Dellia revolutionized Holstein breeding

- Result of the “golden cross” between Walkway Chief Mark and Snow-N Dorys Denise

- Excelled in both production and type, breaking industry norms

- Won Grand Champion at the 1991 Wisconsin Spring Show

- Became the cornerstone of Regancrest Farm

- Produced influential sons: Durham, Die-Hard, and Million

- Her daughters and granddaughters won championships globally

- Genetic influence spans from fertility traits to cheese merit rankings

- Descendants excel in robotic milking efficiency, and cheese yield improvements

- Impact still felt in dairy herds worldwide nearly four decades later

- Considered one of the most influential cows in dairy history

Summary

Snow-N Denises Dellia, born in 1986 on Bob Snow’s Wisconsin farm, became a legend in Holstein breeding. The result of a “golden cross” between Walkway Chief Mark and Snow-N-Dorys Denise, Dellia shattered industry norms by excelling in production and type. Her impact was immediate, winning Grand Champion at the 1991 Wisconsin Spring Show before becoming the cornerstone of Regancrest Farm. Dellia’s sons, Durham, Die-Hard, and Million, revolutionized the industry with their fertility traits and cheese merit rankings. Her daughters and granddaughters, like DH Gold Chip Darling and Sandy-Valley Planet Sapphire, took her genetics global, winning championships from Switzerland to Canada. Even in today’s genomic era, Dellia’s influence persists, with her descendants excelling in robotic milking efficiency and cheese yield improvements. Nearly four decades after her birth, Dellia’s genetic legacy continues to shape dairy herds worldwide, cementing her status as one of the most influential cows in dairy history.

Learn more:

- Pietertje 2d—Foundation Families of the Holstein Breed

- The 12 Sires You Should Consider Breeding Your Show-Winning Goldwyns to

- Top Ten Most Influential Holstein Breeders of All-Time

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!