$1,000+ calves rewrite dairy profits! Why beef shortage means YOUR herd is now a goldmine.

EXECUTIVE SUMMARY: Record-high calf prices ($1,000+/head) are reshaping dairy economics as U.S. beef herds hit 64-year lows. A perfect storm of drought-driven herd liquidation, critically low heifer retention, and booming beef demand has feedlots scrambling for calves – especially beef-on-dairy crossbreds. Pennsylvania auctions command premium prices ($1,375/cwt) due to regional demand and infrastructure. While tariffs and feed costs loom as risks, experts predict 2-3 more years of sky-high returns. Dairy farmers leveraging beef genetics are banking unprecedented profits while redefining cattle’s dual-purpose value.

KEY TAKEAWAYS

- Beef shortage locks in high prices: Cattle herds won’t rebound before 2028, keeping calf demand fierce

- Beef-on-dairy = profit turbocharge: Crossbred calves now outvalue pure dairy by 50-100% at auction

- PA’s $1,075 secret: Regional premiums from veal demand + Midwest feedlot pipelines

- Trade war threat: New tariffs could spike feed costs 25%, eroding margins

- Act now: Window to maximize $1,000+ calves closes in 24 months as herd rebuilding begins

Look, I’m not going to sugarcoat it – we’re living through something I never thought I’d see in my lifetime. Baby calves from dairy farms hitting $1,000+ at auction? Five years ago, you’d have laughed me off the farm for suggesting it. But here we are in 2025, watching beef-on-dairy crossbreds command prices that make your eyes water.

This isn’t just another market blip that’ll disappear next month. We’re talking about a fundamental shift putting serious money in dairy farmers’ pockets – and it’s not ending anytime soon.

WHY CALF PRICES ARE THROUGH THE ROOF

The numbers tell the story. America’s cattle herd has shrunk to levels we haven’t seen since your grandpa milked cows. USDA’s January count showed just 86.7 million total cattle – down another 1% from last year and continuing a slide that started in 2019.

The beef cow herd? Down to 27.9 million heads – smallest since 1961. That’s right since JFK was president.

Three things are driving this train:

First, that brutal drought hammered cattle country and forced ranchers to sell off cows they couldn’t feed. Even now, 43% of cattle in the country still deal with dry conditions.

Second, beef producers are selling heifers to feedlots instead of keeping them for breeding, with feeder prices so darn high. When you can get $274/cwt for a feeder today versus waiting two years for a return on a breeding heifer, the math is simple.

Third, we’re stuck in a nasty cycle. The January report showed 38.7% of feedlot cattle are heifers – way above the 32-33% level needed to rebuild herds. As Tara Felix from Penn State puts it: “We’re a good two, possibly three years out before we can even start to see a turnaround.”

Meanwhile, folks are still eating beef like there’s no tomorrow, even with grocery prices up. That’s creating a feeding frenzy for any available calves.

THE BEEF-ON-DAIRY REVOLUTION

Smart dairy farmers aren’t just sitting back and enjoying the ride – they’re actively capitalizing on this market. About 72% of dairy farms use beef semen on some of their cows.

The economics are a no-brainer. At New Holland’s auction in late March, beef-on-dairy calves hit $1,375/cwt, with even straight Holstein calves breaking $1,000/cwt. The sale averaged $858 per head across 615 calves.

Ryan Kolb at New Holland puts it perfectly: “If you buy a good springing heifer for $2,000 bred to an Angus bull, you could get a $1,000 bull calf. Now you have a brand-new fresh cow for $1,000.”

That’s changing how we think about dairy economics. Those bull calves that used to be practically worthless? They’re now a serious profit center.

PENNSYLVANIA’S PREMIUM MARKET

While prices are strong nationwide, Pennsylvania’s auctions are flat-out smoking hot. Beef cross calves (60-100 lbs) fetch $931-$1,075 per head in New Holland, compared to $690-$945 in Wisconsin and $700-$985 in Minnesota.

Why the premium? Pennsylvania’s dense dairy industry, established auction markets, direct pipelines to Midwest feedlots, and even some demand from the Philadelphia veal market.

If you’re shipping calves to auction, it pays to know where the hot markets are.

HOW THIS CHANGES YOUR OPERATION

This isn’t just about getting better calf checks. The beef-on-dairy boom is reshaping everything about dairy farming:

- Those calf checks provide a crucial buffer when milk prices tank.

- Cull cows now fetch $2,500 or more, making you more aggressive about culling problem animals.

- Replacement heifers have nearly doubled in price since 2018, from $823 to over $1,600 per head.

- With fewer dairy heifers in the pipeline (hitting a 47-year low of 3.91 million head in January), the industry can’t expand milk production as quickly when prices rise.

WHAT’S AHEAD: OPPORTUNITY AND RISKS

The tight supply isn’t ending anytime soon. USDA projects cattle numbers will bottom out this year, with beef prices likely peaking in 2026. Even if ranchers started rebuilding herds today, the biological reality is we’re looking at years before supplies recover.

But there are storm clouds on the horizon:

Those new tariffs on Canada, Mexico, and China could be a real problem. They account for nearly 37% of our ag exports; retaliation could hurt. Plus, tariffs on Canadian fertilizer could drive up your input costs.

Feed costs look decent now (corn projected at $4.20/bushel for 2025), but that could change quickly if trade wars escalate.

And let’s not forget we’re running a record $49 billion agricultural trade deficit this year, with beef imports exceeding exports by 1.8 billion pounds – the largest gap since 2006.

MAKING THE MOST OF THIS MARKET

So, what’s a smart dairy farmer to do? Here’s my take:

- Get your breeding strategy dialed in. Balance beef-on-dairy breeding with maintaining enough replacements. With heifers scarce and expensive, run the numbers on raising versus buying.

- Focus on quality. Not all beef-on-dairy calves are created equal. Select beef sires that complement your cows’ genetics for optimal crossbred performance. Those premium calves will command top dollar.

- Lock in feed costs while they’re favorable. With corn prices projected to lower in 2025, consider forward contracting to protect against potential tariff-driven increases.

- Keep an eye on trade developments. Watch what happens with Canada (the source of 75% of U.S. canola meal) and Mexico (a key dairy export market).

The clock is ticking on this unprecedented opportunity. Those who adapt quickly will maximize profits in this new era where dairy cows are finally getting respect as dual-purpose animals.

Bottom line: We’re not going back to the days when a Holstein bull calf was worth next to nothing. This is the new normal – at least for the next few years. Make the most of it.

Download “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” Now!

Download “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” Now!

Are you eager to discover the benefits of integrating beef genetics into your dairy herd? “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” is your key to enhancing productivity and profitability. This guide is explicitly designed for progressive dairy breeders, from choosing the best beef breeds for dairy integration to advanced genetic selection tips. Get practical management practices to elevate your breeding program. Understand the use of proven beef sires, from selection to offspring performance. Gain actionable insights through expert advice and real-world case studies. Learn about marketing, financial planning, and market assessment to maximize profitability. Dive into the world of beef-on-dairy integration. Leverage the latest genetic tools and technologies to enhance your livestock quality. By the end of this guide, you’ll make informed decisions, boost farm efficiency, and effectively diversify your business. Embark on this journey with us and unlock the full potential of your dairy herd with beef-on-dairy integration. Get Started!

Learn more:

- Beef Prices Soar: How Dairy Farmers Are Rethinking Breeding Strategies

Explore how record-high beef prices are driving dairy farmers to embrace beef genetics, balancing short-term profits from crossbred calves with long-term herd sustainability. - Beef-Dairy Crossbreds: The Feed Efficiency Revolution Rewriting Dairy Costs

Dive into how beef-on-dairy crossbreeding slashes feed costs by $457/head, accelerates growth rates, and unlocks premium pricing while boosting sustainability. - Dairy Heifer Shortage Deepens as Beef-Cross Calves Gain Market Share

Understand how record-low heifer inventories and soaring beef-cross calf prices are reshaping the dairy industry, forcing tough choices between immediate profits and future milk production.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!

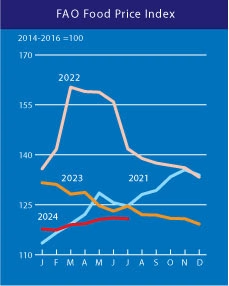

Understanding the effects of the July Dairy Price Index (DPI) adjustment is critical for dairy producers. The DPI fell to 127.7 points, a slight 0.1% decline from June. While this shift may not seem substantial initially, the underlying reasons reveal a more complex picture. This change gives vital market information that may help you make intelligent business choices.

Understanding the effects of the July Dairy Price Index (DPI) adjustment is critical for dairy producers. The DPI fell to 127.7 points, a slight 0.1% decline from June. While this shift may not seem substantial initially, the underlying reasons reveal a more complex picture. This change gives vital market information that may help you make intelligent business choices.