Milk is a commodity. While you can get different levels of fat and protein content etcetera, for the most part all milk is seen as the same. As the world goes to more and more global trade, milk producers around the world need to realize that in a commoditized market, he who produces the lowest cost milk will win. Currently the world average cost of production is $46USD/100 kg of milk. So for those countries and producers that either don’t know their cost of production, or know it and see that it’s over $50USD/100 kg of milk, this is a direct wakeup call!

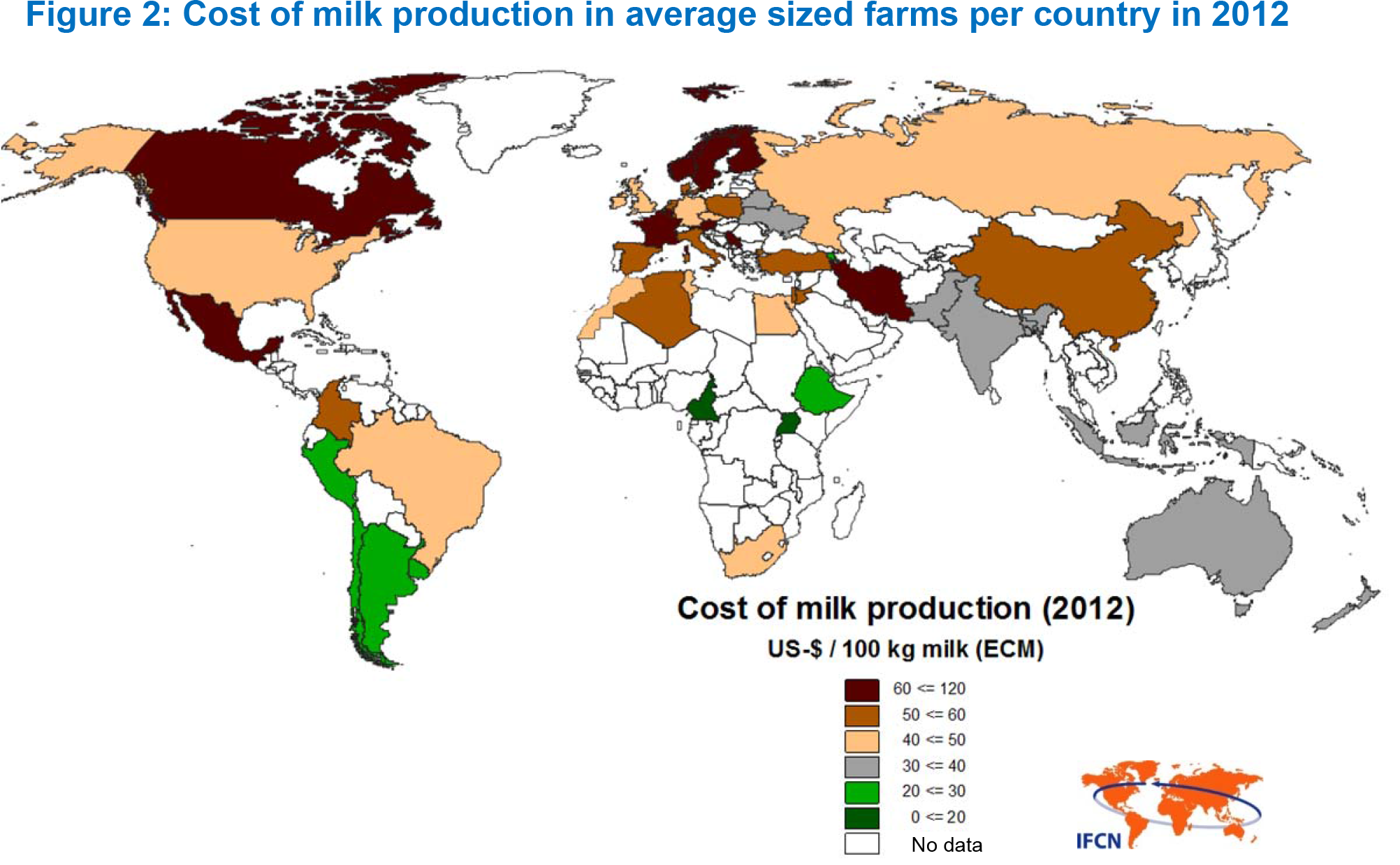

A recent IFCN report shows that low cost regions Argentina, Peru and Uruguay, Central and Eastern Africa Central and Eastern Europe and some selected countries in Asia (except Japan and large farms from China) all had the lowest costs of milk production in the world. Also very noticeable in the report was how countries like Canada, Mexico, Norway, Sweden, Denmark, Portugal and France all had costs of production over $60US/100 kg milk.

While most major milk production countries in the world have seen their costs of production increase significantly over the past 12 years, the range of difference has come much closer together. Some low cost production countries from 12 years ago are now almost at par with countries like the US. New Zealand was actually the lowest cost producer back in 2000, with average cost of production at $12 USD/100 kg of milk, but with increases in input prices and an appreciating currency, costs increased to a level of $35 USD per 100 kg milk. That is an increase of over 291% in just 10 years! With such drastic changes in costs of production, it’s no wonder that New Zealand milk producers are having trouble competing on the world market.

As milk production becomes more globally than regionally focused, it’s countries like Chile, Peru and Saudi Arabia that are going to have the competitive edge. It also means that countries like Canada, Sweden and France are going to find it harder and harder to compete. Furthermore, it indicates that the world’s biggest dairy product exporters (on a milk equivalent basis) who are currently New Zealand, the European Union and the U.S. could start to see South American countries joining them on these top lists.

Actually the world’s cheapest milk is made in Cameroon, where it comes from beef cows and is a by-product of producing meat. There the production costs work out to just $1.82 per hundredweight. But it is not produced in such mass amounts that it can be considered a world player.

One of the scariest trends for all dairy producers is how the cost of production is increasing while the price of milk is not increasing at the same rate. This trend is sure to cause many problems for producers around the world as we go forward. Another scary trend for producers is the volatile price of feed, as was very evident in the summer of 2012 when milk prices fell and feed prices increased. Also when you factor in the increasing costs for transportation, environmental issues, food safety and labor, in the future where milk is produced could be quite different from where it has been produced up until now.

The Bullvine Bottom Line

World economic models will show you that, over time, those who can produce their products the cheapest will win. This is also true for Milk. As free trade agreements are breaking down the barrier to entry into many countries and the removal of government support programs, more and more producers are going to have to look at their operations and see if they can compete in a global marketplace. If you cannot produce your milk for less than $46 – 50 USD/100 KG of milk, or you simply don’t know your cost of production, now is the time to either shape up or get out. The future does not look bright for those who can’t answer those two questions. It is not too early to start planning for your future.

Get original “Bullvine” content sent straight to your email inbox for free.