Universities aren’t training farmers anymore—they’re training corporate tech reps.

When a major university bulldozes perfectly good dairy facilities to go all-in on automation, you know something big is happening. The question is: are they seeing the future, or about to become a very expensive cautionary tale?

You know how conversations go at the feed mill—somebody always brings up the latest university nonsense. But Ohio State’s new robot dairy? That’s got producers talking from Defiance County clear down to Washington County.

Here’s what happened. They took their 110 registered Jerseys—the same herd that’s been training students since Nixon’s day—bulldozed those trusty but tired 1972 facilities, and dropped a whopping $6.2 million on what they’re calling a “fully autonomous dairy operation”.

That’s not small potatoes for a 60-cow setup.

Here’s Why This Isn’t Just Another Equipment Upgrade

They didn’t renovate. They didn’t hedge their bets. Ohio State went full nuclear option—demolished everything and built from scratch with two Lely Astronaut A5 robots, a Vector automated feeding system, robotic manure vacuums… the whole nine yards.

Most rational folks would’ve spent the smaller money patching up the old place while adding some robot experience. Keep both conventional and automated training. But no—Ohio State torched their safety net completely.

“It would be more cost-effective to tear down the outdated structure,” Associate Dean Graham Cochran explained. But any producer who’s priced farm construction knows that math only works if you’re trying to make retreat impossible.

The gamble? That robotic milking explodes from niche curiosity to mainstream necessity before their current students graduate and discover that 97% of dairies still milk the old-fashioned way.

The Numbers Tell a Brutal Story

Let’s talk reality. Currently, fewer than 3% of US operations utilize robotic milking. We’re talking maybe 800 robot dairies out of 26,000+ total operations nationwide. That’s not exactly a revolution sweeping the countryside.

The economics are tough. A comprehensive study tracking operations across 13 countries found that robots cut labor input by 28%, which sounds great, but also increases investment costs by 58%. The real kicker? Only 6% of producers achieved payback periods under 12 years.

Those aren’t adoption-driving numbers for an industry where most operations run on margins thinner than skim milk.

But here’s where it gets interesting… maybe Ohio State sees something in the labor crisis that changes this whole equation.

The Immigration Time Bomb Nobody Wants to Discuss

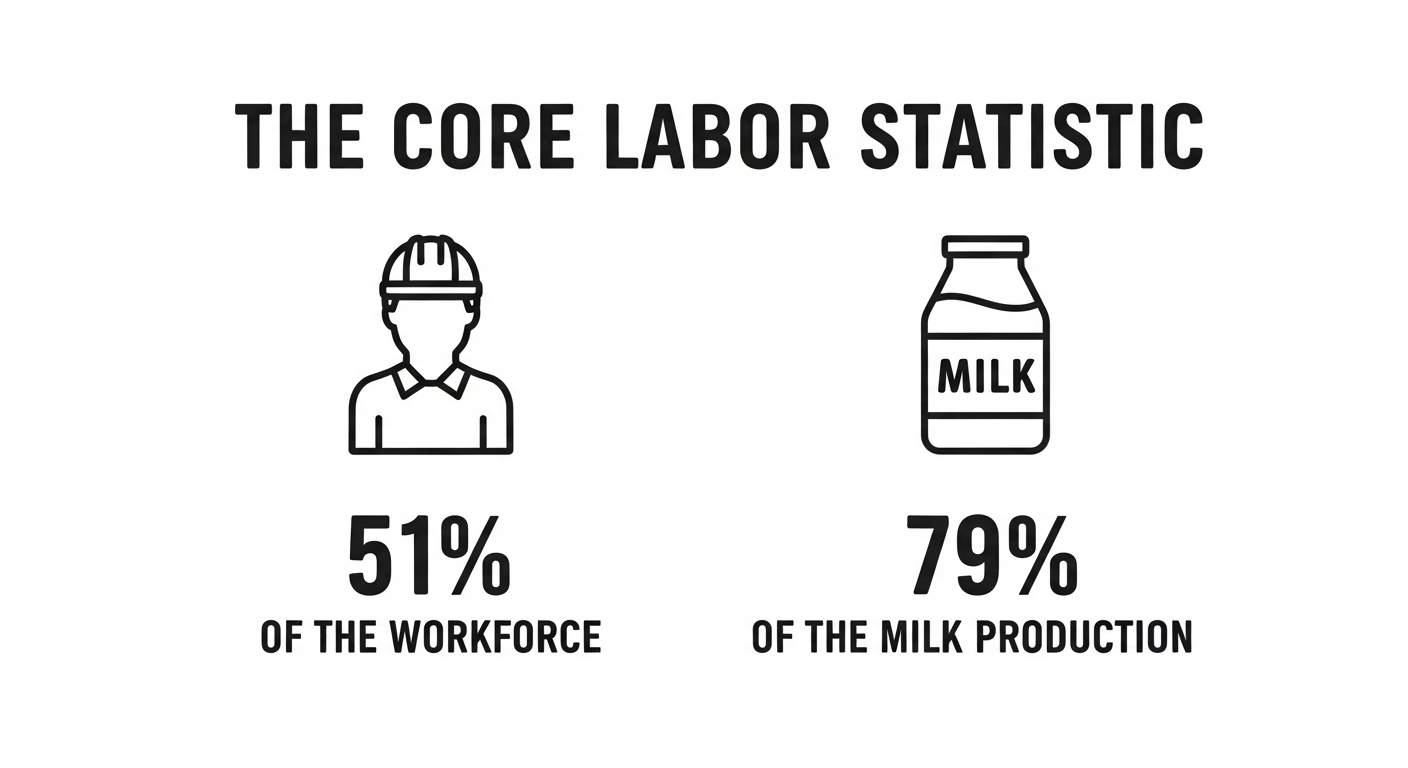

Our industry runs on immigrant workers—51% of the workforce producing 79% of America’s milk. With current deportation pressures and policy uncertainty, that labor foundation isn’t just shaking—it’s cracking.

Now, Ohio’s different from those California mega-dairies. Our 1,350 farms average 185 cows each—mostly family operations with seasonal help rather than year-round immigrant crews. Different labor dynamics entirely.

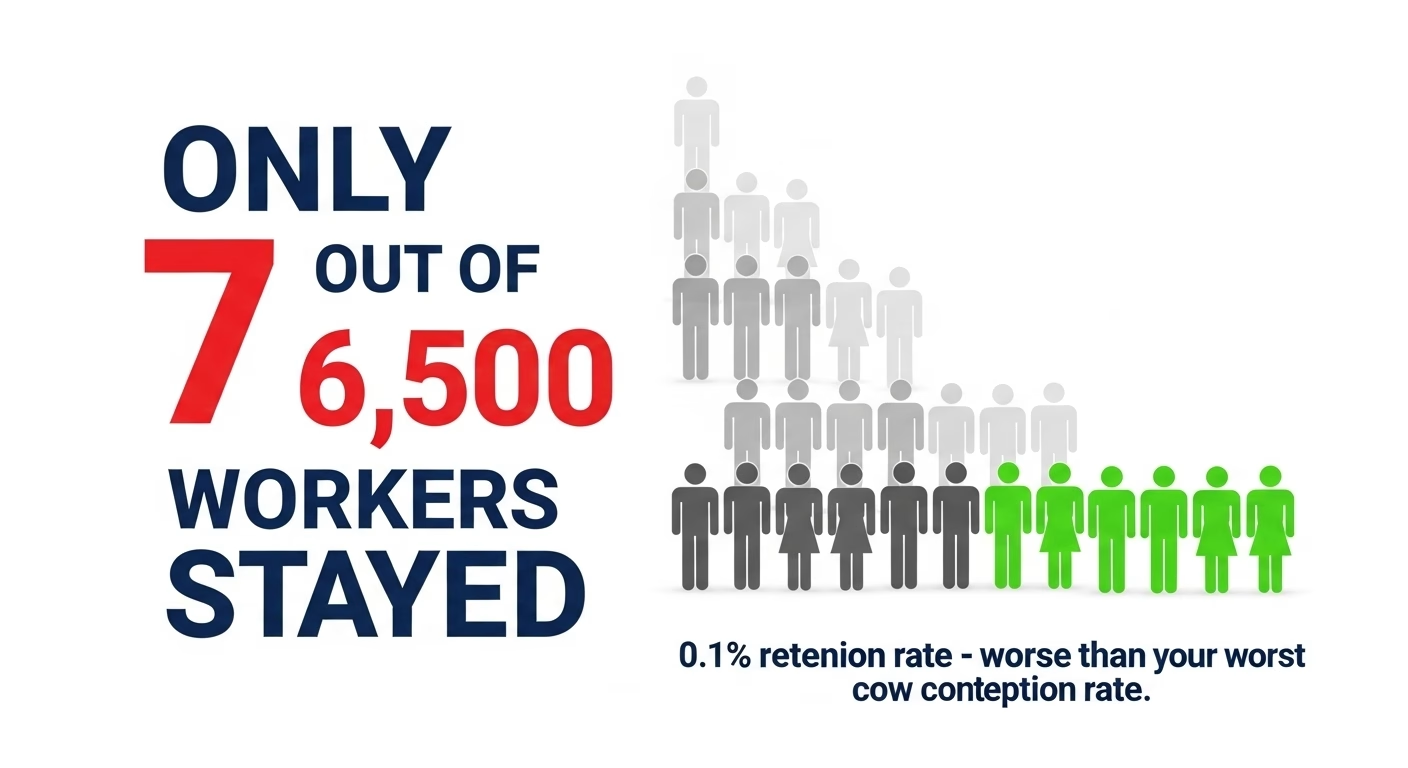

But even family farms are feeling the squeeze. Operations nationwide are dealing with 30-38% annual employee turnover. That’s not just expensive recruitment costs—it translates to production drops and higher calf mortality when your crew keeps changing.

Scott Higgins from the Ohio Dairy Producers Association told me: “It is exciting to see this investment in a modern dairy that will impact the student experience and tell the story of dairy farming”. But between the lines, you can hear the concern about workforce stability.

If immigration policy suddenly removes a significant portion of the 51% dairy workforce, automation stops looking like a nice-to-have technology. It starts looking like survival equipment.

The Real Shocker: They’re Not Training Farmers

This development caught me completely off guard when I started digging deeper.

Ohio State isn’t training the next generation of dairy farmers or farm managers. They’re training corporate employees for the agricultural technology sector.

Think about the economics. Their graduates will likely command competitive starting salaries that could price them out of most actual farm management positions. A typical 200-cow operation in Ohio can’t afford to pay premium wages when the whole operation might only net $100,000-150,000 annually.

But equipment companies? They desperately need technical support reps, installation crews, and customer training specialists. Lely already runs comprehensive training centers offering “complete working knowledge of robots and feeding products”.

Jason Hartschuh from Ohio State Extension put it this way: “The new facility will allow students to be ready for a career in the dairy industry in all sectors, from farm management to sales and service”. Notice how “sales and service” got equal billing with “farm management.”

The Corporate Training Competition They’re Ignoring

Here’s where Ohio State’s strategy gets really questionable, and honestly, nobody’s talking about this elephant in the room.

When a producer installs robotic equipment, manufacturers provide free training “for as long as you own and operate” their systems. Lely’s got dedicated training facilities. GEA partners with major universities. These corporate programs deliver hands-on equipment access, immediate updates when software changes, and commercial incentives for customer success—because if you fail, they lose future sales.

So what exactly does a four-year Ohio State degree add that manufacturer training doesn’t provide better, faster, and cheaper?

The Lely Vector system Ohio State installed saves customers about 8 hours of weekly labor plus up to 1,452 gallons of diesel annually, according to multiple documented case studies. However, producers learn system optimization through manufacturer support and their neighbors’ experience, rather than university coursework.

The Jersey Factor That’s Got Me Scratching My Head

Here’s something that’s been bugging me about Ohio State’s approach…

Industry observations suggest that Jerseys present different challenges for robotic systems—smaller frame sizes, varied udder configurations, and higher component milk — that can affect sensor performance differently than Holstein-focused automation development.

Most Ohio producers run 100-300 cows—potentially too small for multiple robots but too large for optimal single-robot economics. So Ohio State is training students for a facility design that exists on maybe a few dozen farms nationwide.

That’s… interesting strategic thinking.

Research Goldmine or Corporate Welfare Program?

Ohio State supporters keep pointing to research potential, and I’ll admit, something is compelling here.

Their individual cow monitoring systems will generate data streams that conventional operations literally cannot produce: real-time milk composition analysis, continuous health tracking, and precise feed intake measurements down to individual animals.

Maurice Eastridge from Animal Sciences says this will be “a tremendous asset” for research. If automation adoption accelerates, their faculty could become the go-to licensing experts for breakthrough insights worldwide.

But here’s what makes me uncomfortable: Lely owns the core technology generating this data. Ohio State is essentially providing research services that benefit equipment manufacturers while using American taxpayer funds.

This conflicts with what land-grant universities were created to achieve. The Morrill Act of 1862 established these institutions to make agricultural knowledge freely available to all farmers. Now they’re positioning to license discoveries, creating a two-tiered system where technological advantages go to whoever can afford premium prices.

What This Actually Means for Working Producers

The thing about Ohio State’s gamble is that it’s going to tell us something important about where this industry is heading, whether they succeed or fail spectacularly.

Technology Timing Intelligence: Their willingness to stake their entire program on automation acceleration suggests some industry leaders expect much faster adoption than public projections indicate. That’s worth monitoring as market intelligence—they might know something about policy changes or economic pressures that haven’t hit the news yet.

Training Source Strategy: When you’re evaluating robotic systems, prioritize manufacturer training and peer producer experience over academic credentials. The company selling you equipment has much stronger commercial incentives for your operational success than any university program.

Labor Reality Check: Focus on systems that enhance your current crew’s productivity rather than requiring completely different skill sets. Automation isn’t about replacing experienced managers—it’s about making reliable help more productive and reducing dependence on hard-to-find manual labor.

Economic Calculations: That international study showing 28% labor reduction but 58% higher investment costs suggests most operations aren’t economically ready for this leap yet. But if immigration policy shifts suddenly removes available workers, those calculations flip overnight.

The Bottom Line

Ohio State just demonstrated that even major agricultural institutions are making unprecedented bets on industry transformation. Whether that represents visionary leadership or an expensive miscalculation will signal whether dairy automation moves from niche curiosity to mainstream necessity.

Their success or failure offers valuable intelligence about industry direction, but here’s what concerns me: they’re essentially experimenting using students’ career prospects and taxpayer funding to test theories about automation timing.

If they’re right about acceleration, their graduates become valuable professionals in a growing sector. Their research drives industry transformation. Their facility becomes the model others follow.

If they’re wrong… well, they’ve trained students for jobs that don’t exist while abandoning the 97% of operations that still need competent managers who understand actual dairy work.

The revolution might indeed be coming. But it’s being driven by equipment manufacturers solving real problems for working producers, not universities training corporate employees.

For family operations trying to stay competitive, that distinction makes all the difference. The question isn’t whether Ohio State’s bet pays off for them—it’s whether their gamble helps or hurts the actual dairy farmers who are supposed to benefit from land-grant education.

That verdict is still several years away. But watching their results will tell us whether we’re witnessing the future of dairy education… or an expensive institutional mistake that forgot who it’s supposed to serve.

Either way, the dice are rolling, and the stakes couldn’t be higher for all of us trying to make a living in this business.

Key Takeaways

- Labor math is changing fast: With 51% immigrant workforce at risk and 30-38% annual turnover crushing production, automation stops being a luxury and starts being survival gear (Source: National dairy workforce analysis, 2025)

- ROI reality check: Robots slash labor 28% but spike investment 58%—crunch your numbers hard before jumping, because payback often stretches past 10 years (International meta-analysis, 13 countries)

- Small wins add up: Lely’s Vector feeding system saves 8 hours weekly labor plus 1,452 gallons of diesel annually—not sexy, but that’s $3,000+ yearly on a 200-cow operation (Company performance data, 2025)

- Training trumps degrees: Skip the classroom, stick with manufacturer programs and neighbor networks—companies like Lely offer lifetime training with equipment purchase, no tuition required (Industry intelligence)

- Size matters for automation: Ohio State’s 60-cow Jersey setup is rare; most Midwest operations (100-300 cows) sit in automation’s awkward middle ground—too big for one robot, too small for multiples (Ohio dairy demographics, 2025)

Executive Summary:

Ohio State just torched their safety net—dropping $6.2 million on a fully robotic dairy while demolishing perfectly good conventional facilities. Here’s what’s wild: only 3% of US farms use robot milkers, yet they’re betting everything on automation. With immigrant workers making up 51% of dairy labor, producing 79% of our milk, and immigration crackdowns tightening the screws, maybe they see something we’re missing. But the math’s brutal—robots cut labor 28% while jacking costs up 58%, with most farms waiting over a decade for payback. We dug deep into Ohio State’s gamble, the labor crisis driving it, and what it means for your operation. Bottom line: automation isn’t coming someday—it’s here, and you need a strategy now.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – This article provides the tactical numbers and ROI calculations missing from the main piece. It details how to evaluate if your operation is financially ready for automation and the specific data points that drive profitability and efficiency gains.

- How Dairy Farmers Are Finally Breaking Free From the 365-Day Grind – and Finding More Time and Profit – Focusing on the strategic impact, this piece explores the significant quality-of-life and labor management benefits of automation. It offers a counter-narrative to the main article’s focus on corporate training by highlighting improved work-life balance for family operations.

- Revolutionizing Dairy Farming: How AI, Robotics, and Blockchain Are Shaping the Future of Agriculture in 2025 – For a future-oriented view, this article looks beyond milking to how AI and integrated data systems are transforming herd management. It reveals how technology creates value in areas like genetic selection, preventative health, and overall operational intelligence.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!