84% tariffs slam U.S. dairy exports to China. Why can’t farmers capitalize on China’s milk shortage despite crashing prices & production?

EXECUTIVE SUMMARY: China’s dairy production is plummeting (-9.2% in 2025), but U.S. farmers face insurmountable barriers: 84% retaliatory tariffs, New Zealand’s duty-free dominance, and China’s lactose-intolerant population. While milk prices crashed by 15% and skim powder production dropped by 30%, structural issues like shrinking birth rates and economic stagnation limit demand. With FTAs favoring competitors and trade tensions escalating, experts urge dairy producers to pivot to Mexico, Southeast Asia, and value-added niches instead of chasing China’s shrinking market.

KEY TAKEAWAYS:

- 84% tariffs make U.S. dairy exports to China 104% more expensive than New Zealand’s duty-free shipments.

- New Zealand controls 46% of China’s import market—their FTA advantage is irreversible without policy shifts.

- China’s milk consumption growth is capped by lactose intolerance (87% in teens) and declining birth rates.

- Diversify or die: USDA grants and co-ops offer lifelines for exploring Latin America, MENA, and specialty markets.

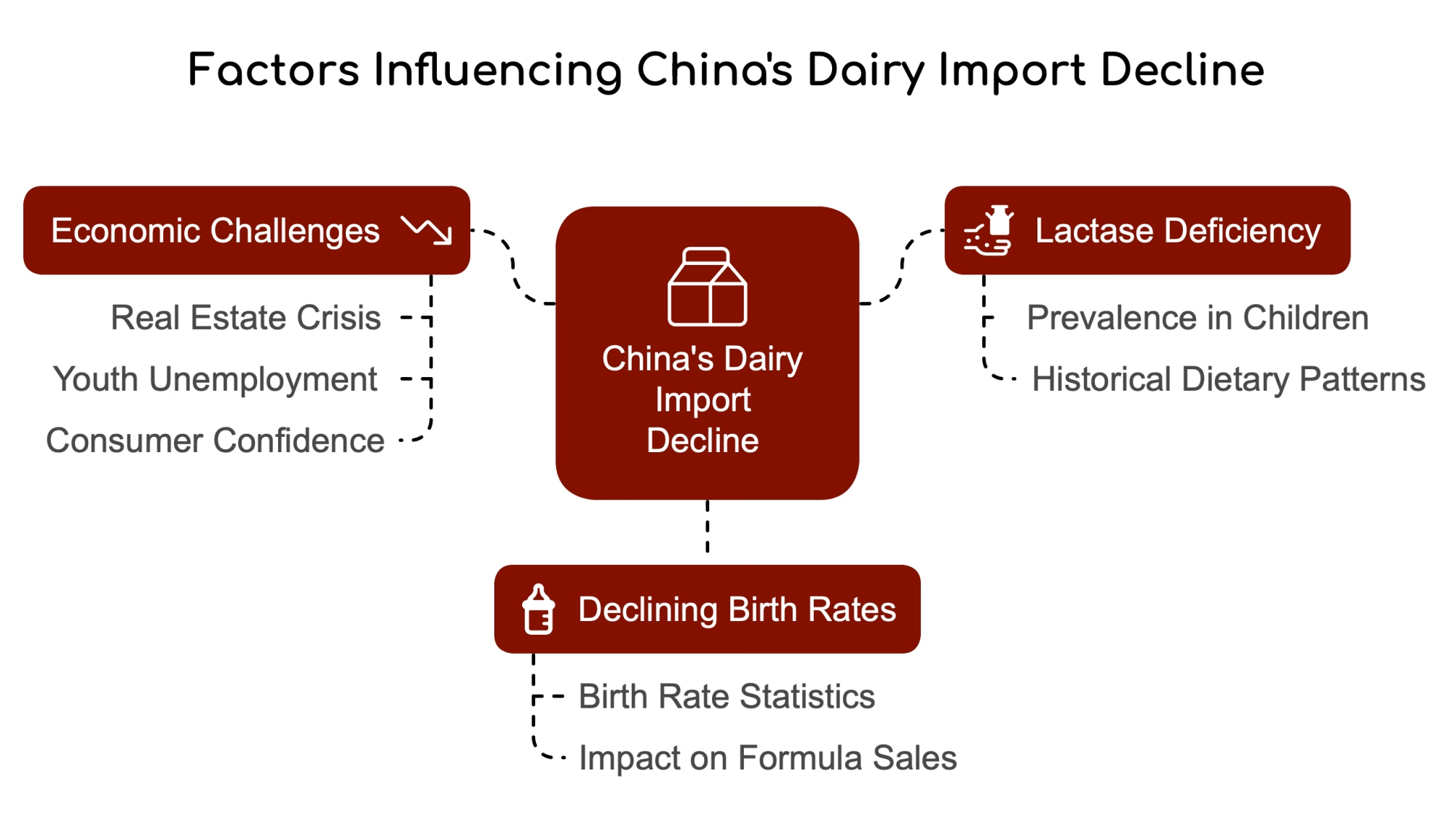

- Economic headwinds (real estate crisis, youth unemployment) slash Chinese spending on “non-essential” dairy.

China’s dairy sector is shrinking fast, with milk collections down 9.2% in early 2025 compared to last year. Milk prices have dropped 15%, and skim milk powder production has plummeted by more than 30%. While this might sound like an opportunity for U.S. dairy exports, the reality is much more brutal.

Why China’s Dairy Market is Shrinking

After years of pushing hard to expand its dairy industry, China is now dealing with serious oversupply problems. Between 2018 and 2023, their milk production jumped by 27% (24.7 billion pounds) as part of their national plan to rely less on imports.

“Dairy production has remained stable, and the number of cows has been gradually adjusted,” China’s agriculture ministry stated in December 2024. “While the oversupply of milk will continue in the first half of 2025, it is expected that supply and demand imbalances will ease in the second half of the year.”

The problem? Chinese consumers aren’t drinking enough milk to keep up with all this production. Raw milk prices crashed from 4.38 yuan/kg in 2021 to just 3.14 yuan/kg by September 2024 – a brutal 28% drop forcing many smaller farms out of business.

Why China Isn’t Buying

Trouble Digesting Milk

Let’s face it – many Chinese people simply can’t comfortably digest milk. Studies show that lactase deficiency affects about 38.5% of Chinese children aged 3-5, jumping to a whopping 87% in older kids. This biological reality means milk has never been a staple in Chinese diets.

Declining Birth Rates

China’s birth rate has fallen, dropping from 13.03 births per thousand people in 2013 to just 6.39 in 2023. This hits infant formula sales hard – historically a major driver for dairy imports.

There was a small bump in 2024 during the “Year of the Dragon” (considered lucky in Chinese culture), but that’s a blip in the long-term downward trend.

Economic Challenges

China’s economy struggles with real estate problems, high youth unemployment, and weak consumer confidence. As USDEC notes: “China’s economy continues to be challenged on multiple fronts—a real estate crisis; elevated youth unemployment; underfunded local governments; deflation; and disappointing GDP growth—not to mention potential fallout from trade battles with the U.S.”

When money’s tight, dairy products are often the first thing cut from shopping lists.

The Competitive Landscape: Why New Zealand Wins

- New Zealand’s Duty-Free Advantage: As of January 1, 2024, all New Zealand dairy products enter China completely duty-free. This gives Kiwi producers roughly $350 million in annual tariff savings compared to U.S. suppliers.

- Dominant Market Position: New Zealand commands a 46% share of China’s dairy import market. Their exports to China jumped significantly in late 2024, especially milk powder, butter, and cheese.

- U.S. Export Decline: Meanwhile, U.S. dairy exports to China tanked in 2024, falling to $584 million – the lowest since 2020. Overall volume dropped 9%, according to USDEC.

Bottom Line: New Zealand’s free trade advantage is practically impossible to overcome without significant policy changes. Any import opportunities created by China’s production decline will benefit New Zealand, not U.S. producers.

The Trade War Impact: 84% of Tariffs Close the Door

The trade relationship between U.S. dairy and China has gone from bad to worse. Here’s how quickly things escalated:

Tariff Timeline:

- February 1, 2025: U.S. slaps 10% tariff on all Chinese imports

- March 3, 2025: U.S. increases tariff to 20%

- March 4, 2025: China announces 10% retaliatory tariff on U.S. dairy (effective March 10)

- April 2, 2025: U.S. imposes additional 34% “reciprocal” tariff

- April 4, 2025: China matches with a 34% retaliatory tariff (effective April 10)

- April 9, 2025: U.S. increases reciprocal tariff to 84%

- April 9, 2025: China immediately matches with an 84% retaliatory tariff (effective April 10)

“China will impose a 10% tariff on US dairy products starting March 10 as the trade war intensifies,” reported The Bullvine in early March.

As of today (April 9, 2025), the U.S. has just announced an increase of its tariff on China from 34% to 84%, with China immediately matching. Starting tomorrow, virtually all U.S. dairy products entering China will face an additional 84% tariff on top of existing rates – effectively slamming the door shut on exports.

Quick Takeaways for Dairy Farmers

- Small Operations: Focus on domestic specialty markets; consider joining cooperatives with diversified export portfolios

- Medium Operations: Explore USDA Market Access Program funding for new market development in Southeast Asia and Latin America

- Large Operations: Evaluate product mix to target markets less impacted by tariffs; consider joint ventures with partners in FTA countries

Bottom Line for Dairy Producers

The brutal truth? U.S. dairy producers shouldn’t expect any meaningful export opportunities to China shortly. The triple whammy of sky-high tariffs, weak Chinese consumer demand, and competition from duty-free suppliers like New Zealand create a perfect storm that effectively locks us out of the market.

3 Steps for Farmers:

- Explore USDA Market Access Program grants for export market development (applications due June 14, 2025)

- Contact your co-op or industry association about market diversification strategies

- Look beyond China to Mexico, Southeast Asia, and the Middle East/North Africa markets

This trade war highlights why putting all your eggs in one export basket is risky. The most brilliant move now is to diversify your markets and focus on regions where U.S. dairy still has competitive advantages.

Learn more:

- China Slaps 10% Tariff on US Dairy: Exporters Face New Market Challenges

Explore how escalating tariffs are reshaping U.S. dairy exports to China and the ripple effects on American farmers and supply chains. - China’s Dairy Imports Expected to Surge in 2025, Ending Three-Year Slump

Find out how China’s anticipated rebound in dairy imports could impact global markets and open opportunities for exporters. - Trump’s Liberation Day Tariffs: A $8.2B Gamble for Dairy Farmers

Analyze the risks and strategies for U.S. dairy farmers facing export challenges from retaliatory tariffs and market disruptions.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!