Cheese prices surge 3¢, butter up 0.5¢ as CME markets rebound—futures signal trader confidence despite global trade risks.

EXECUTIVE SUMMARY: The CME dairy markets saw a strong recovery on April 7, 2025, with cheese blocks rising 3.00¢ and barrels gaining 2.00¢, reversing last week’s volatility amid tightening inventories and renewed buyer interest. Butter edged up 0.50¢ despite ample stocks, while futures premiums for cheese ($1.825/lb vs. $1.67/lb cash) signaled trader optimism. Export markets showed strength, with US cheese shipments up 12% year-to-date, though potential trade tensions loom. USDA forecasts revised milk production downward but highlighted strategic opportunities in forward contracting as markets balance domestic demand growth against global uncertainty.

KEY TAKEAWAYS

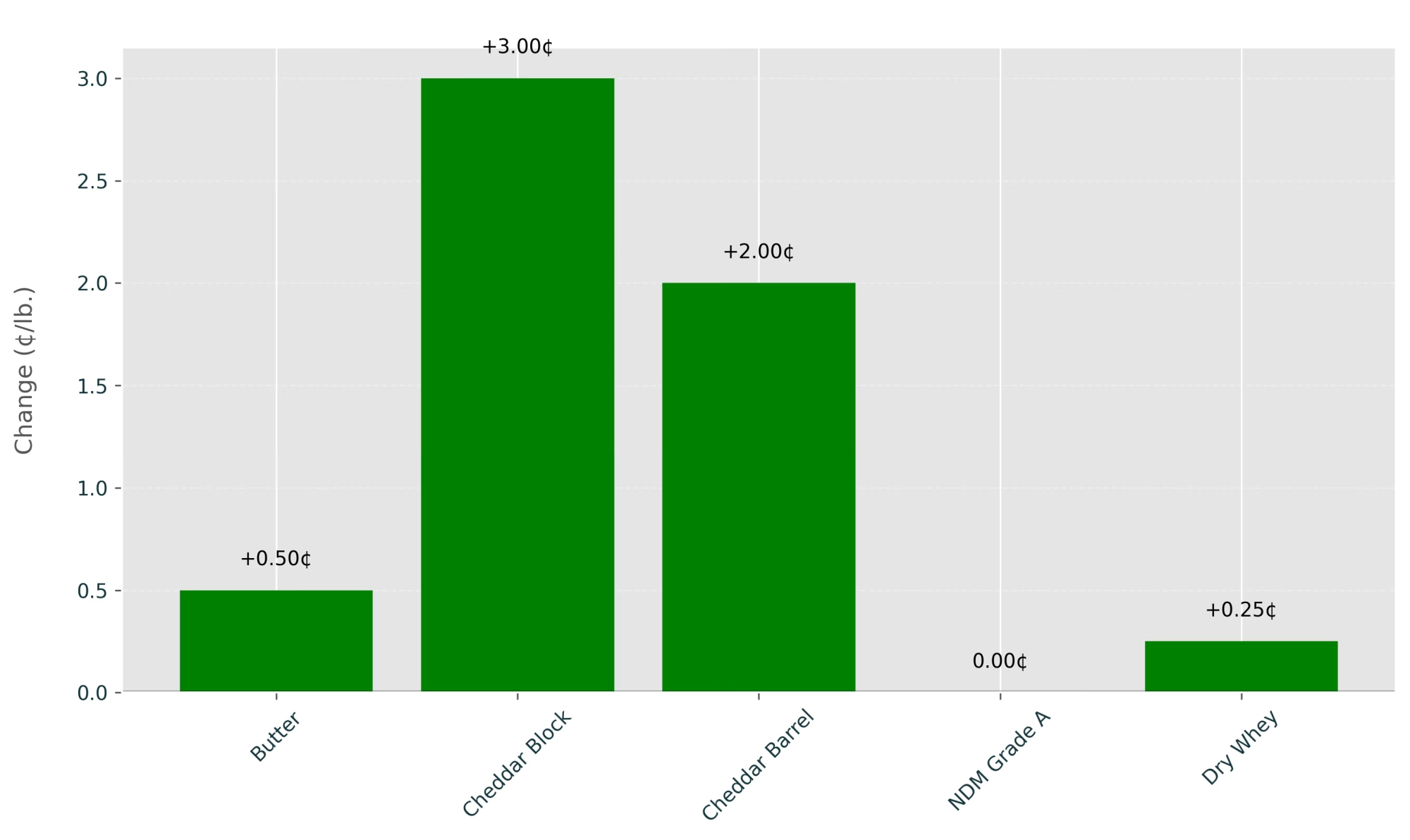

- Cheese leads recovery: Blocks (+3.00¢) and barrels (+2.00¢) rebounded sharply on tight inventories and cleared offers.

- Futures signal strength: Cheese futures trade at $1.825/lb (vs. $1.67/lb cash), indicating trader confidence in continued price support.

- Export momentum: US cheese exports surged 22% in value year-to-date, with Mexico and Canada driving 51% of total dairy export growth.

- Strategic pivot: Producers are advised to prioritize component optimization, while processors should monitor capacity expansions impacting milk supply competition.

- Risk watch: Feed costs and potential tariff impacts remain critical for Q2 profitability.

Today’s dairy markets showed substantial strength across cheese products, with Cheddar Blocks rising 3.00¢ and Barrels up 2.00¢, extending the recovery from last week’s volatility. Butter continued its modest upward trend with a 0.50¢ gain, while Dry Whey edged increased25¢. The overall uptick reflects recovering domestic demand, tightening inventories for cheese, and substantial futures premiums, signaling trader confidence despite ongoing concerns about global trade tensions. Trading activity was particularly notable in cheese blocks, which cleared all offers, while barrels saw active bidding interest, suggesting further potential gains in coming sessions.

The Chicago Mercantile Exchange dairy markets saw a significant recovery in cheese prices today, with blocks and barrels posting substantial gains as butter edged higher amid balanced trading activity. This price strength comes after last week’s volatility, suggesting renewed confidence in dairy fundamentals despite lingering global trade concerns.

Key Price Changes & Market Trends

| Product | Closing Price | Change | Trades | Bids | Offers |

| Cheddar Block | $1.6700/lb | +3.00¢ | 3 | 0 | 0 |

| Cheddar Barrel | $1.6800/lb | +2.00¢ | 1 | 3 | 2 |

| Butter | $2.3000/lb | +0.50¢ | 3 | 2 | 1 |

| NDM Grade A | $1.1575/lb | Unchanged | 0 | 3 | 1 |

| Dry Whey | $0.4925/lb | +0.25¢ | 2 | 0 | 1 |

CME dairy markets demonstrated substantial recovery in cheese prices, with blocks gaining 3.00¢ and barrels adding 2.00¢, effectively recapturing losses experienced late last week. The strength follows volatile trading patterns in early April, when cheese markets crashed on April 3 amid softening demand concerns. Butter continued its modest upward trajectory with a 0.50¢ increase, reflecting resilient export competitiveness despite ample stocks. Nonfat Dry Milk remained unchanged, while Dry Whey posted a small gain of 0.25¢.

The cheese market’s robust performance appears to be driven by tightening inventories and renewed buyer interest, reversing sentiment from last week’s market concerns. Current butter prices continue to navigate a vastly different market environment compared to early 2024 when tight stocks drove prices to record seasonal levels, but have since stabilized with rebuilt inventories.

Volume and Trading Activity

| Product | Bid/Ask Spread | Weekly Change in Spread | Trading Volume |

| Cheddar Block | No spread (market cleared) | -2.00¢ | 3 trades |

| Cheddar Barrel | 1.00¢ | -0.50¢ | 1 trade |

| Butter | 0.75¢ | -1.25¢ | 3 trades |

| NDM Grade A | 0.50¢ | Unchanged | 0 trades |

| Dry Whey | 0.25¢ | -0.50¢ | 2 trades |

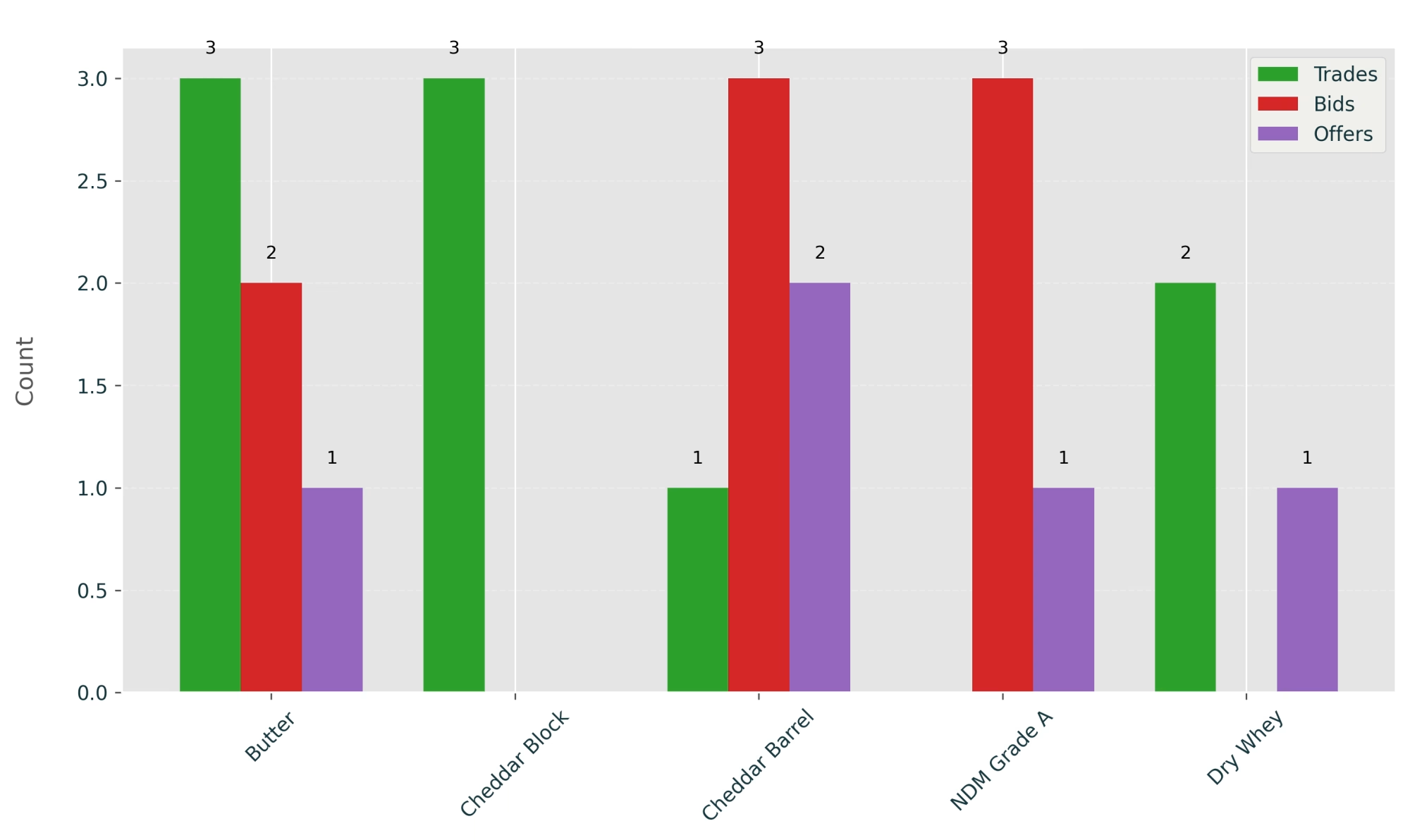

Trading activity showed a balanced market with clear signs of buyer interest across multiple product categories. Cheese blocks recorded three trades with no remaining bids or offers at session close, indicating a well-cleared market with potential for continued upward momentum. Barrel cheese saw more limited trade execution with just one transaction, but three active bids suggest strong underlying buyer interest that could support prices in upcoming sessions.

Butter markets demonstrated healthy activity with three trades alongside two bids and one offer remaining, reflecting balanced market dynamics. Despite three active bids and one offer, NDM saw no trades, indicating buyer interest that failed to match seller expectations. Dry Whey recorded two trades with one offer remaining close, suggesting stable market conditions with moderate trading interest.

The weekly comparison highlights mixed price trends compared to last week’s averages:

| Product | Current Avg. | Prior Week Avg. | Change | 5-Year Seasonal Avg. (Early April) |

| Butter | $2.3000/lb | $2.3290/lb | -$0.0290/lb | $2.2750/lb |

| Cheddar Block | $1.6700/lb | $1.6455/lb | +$0.0245/lb | $1.7200/lb |

| Cheddar Barrel | $1.6800/lb | $1.6605/lb | +$0.0195/lb | $1.6950/lb |

| NDM Grade A | $1.1575/lb | $1.1665/lb | -$0.0090/lb | $1.1800/lb |

| Dry Whey | $0.4925/lb | $0.4935/lb | -$0.0010/lb | $0.4875/lb |

Cheese prices remain slightly below the 5-year seasonal average compared to typical early April patterns, while butter is trading above historical norms for this time of year. This seasonal divergence suggests potential for continued price recovery in cheese markets as we move deeper into Q2.

Global Context

| Export Market | YoY Change (Jan-Feb 2025) | Value (Jan-Feb 2025) |

| Mexico | +10% | $396.2 million |

| Canada | +41% | $232.3 million |

| China | +20% | $203.4 million |

| Japan | +35% | $86.6 million |

| South Korea | +39% | $79.5 million |

The global dairy landscape shows significant regional divergence, creating challenges and opportunities for US producers and exporters. European milk production is projected to decline by 0.2% in 2025 due to regulatory pressures and shrinking herd sizes. Meanwhile, the US dairy sector is experiencing expansion, with producers adding 34,000 dairy cows between July and December 2024.

The FAO Dairy Price Index reached 148.7 in February 2025, its highest level since October 2022, driven by strong demand for cheese and whole milk powder despite seasonal production challenges in Oceania. This global price strength supports US export opportunities, particularly for butter and specialty cheese products.

US dairy exports have shown remarkable strength in early 2025, with total export value reaching $1.43 billion in January-February, up 14% from last year. Cheese exports have been robust, increasing 12% in volume and 22% in value during the first two months of 2025. Chinese import patterns continue to evolve favorably for specific product categories, with whey imports surging 52% year-over-year. However, potential trade tensions loom as proposed US tariffs could trigger retaliatory measures, potentially threatening the 18% of US milk production tied to exports.

Forecasts and Analysis

According to the most recent USDA forecasts released on March 17, 2025, the US dairy herd is projected to average 9.380 million head, up 5,000 from previous estimates. However, milk production projections have been revised downward to 226.2 billion pounds (-0.7 billion from the prior forecast) due to slower-than-expected growth in output per cow.

The all-milk price forecast is $21.60 per cwt, $1.00 lower than the previous month’s forecast. Class III and Class IV milk price forecasts have been adjusted to $17.95 and $18.80 per cwt, respectively. These adjustments reflect changing expectations for component prices, with cheese values showing more resilience than butter, nonfat dry milk, and dry Whey.

Current CME futures markets show April Class III milk at .10 per cwt and Class IV at .86 per cwt. The significant futures premiums for cheese ($1.825/lb vs. $1.67/lb cash) and butter ($2.445/lb vs. $2.30/lb cash) suggest traders are anticipating strengthening markets in the coming weeks despite recent volatility.

The current spread between futures and cash prices creates strategic opportunities for producers and processors. Producers may benefit from exploring forward contracting options, while processors could consider the current basis levels for strategic inventory building.

Market Sentiment

“Despite cash market weakness last week, futures premiums for cheese and butter suggest traders anticipate a rebound as we move deeper into Q2,” a Midwest dairy broker noted in a recent market commentary.

“The whipsaw action we’re seeing in cheese markets underscores the fundamental uncertainty about domestic demand as we head into what should be the spring buying season,” observed another analyst. “Today’s strong trading activity suggests buyers are returning to the market after last week’s price declines.”

“The divergence between cash and futures markets points to trader expectations that current weakness is temporary. The substantial premium built into April cheese futures indicates confidence in strengthening fundamentals despite last week’s cash market declines,” commented a dairy economist with a primary agricultural lender.

Industry perspectives remain cautiously optimistic about domestic demand despite ongoing export uncertainties. The significant new cheese processing capacity coming online in 2025 (potentially expanding US cheese manufacturing by approximately 6%) creates opportunities and challenges. While this expansion could pressure cheese prices later in the year, the tight inventory situation provides near-term support.

Rabobank’s global dairy quarterly report identified key watch factors for 2025, including potential tariff impacts on US exports, exchange rate volatility affecting trade flows, and sustained support for butterfat prices. These factors suggest a market environment where strategic positioning and risk management will be critical for dairy stakeholders.

Closing Summary & Recommendations

In summary, today’s dairy markets showed significant strength, particularly in cheese prices, which rebounded sharply from recent declines. Butter continued its upward trend with a modest gain, while other products remained relatively stable. Trading activity was balanced across most categories, with particular strength noted in cheese blocks.

The current market environment presents several strategic considerations for stakeholders:

For producers, component optimization rather than volume maximization should remain the priority, as cheese-driven returns continue supporting milk prices despite other sectors’ uncertainties. The current futures premium over cash markets offers potential opportunities for forward contracting a portion of production.

For processors, the evolving supply situation warrants careful inventory management strategies. The planned expansion in cheese manufacturing capacity creates the potential for increased competition for milk supplies in certain regions despite the overall growth in national milk production.

Looking ahead, stakeholders should monitor three critical factors: 1) export demand developments, particularly any shifts in trade policy affecting key markets; 2) domestic milk production trends as we move through the spring flush period; and 3) feed cost dynamics, which have provided some relief through lower corn prices but remain a significant factor in overall dairy profitability.

The Bottom Line

The April 7th CME dairy markets demonstrated renewed strength across most product categories, suggesting market participants may be finding balance after recent volatility. The substantial gains in cheese prices and strong futures premiums indicate confidence in the market’s fundamental support despite ongoing global uncertainties. With mixed signals from domestic and international markets, strategic risk management and flexibility will be essential for navigating the evolving dairy landscape through Q2 2025.

The key challenge lies in balancing the growth in US processing capacity against the backdrop of constrained milk production growth while simultaneously adapting to shifting global trade dynamics. Those stakeholders who can align their operations with these emerging trends will be best positioned to capture value in what appears to be an increasingly complex but opportunity-rich dairy environment.

Learn more:

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers

Explore USDA’s latest dairy forecasts, including tightening milk supplies, evolving price dynamics, and actionable strategies for producers in 2025. - Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape

Dive into how declining EU production and US expansion reshape global dairy markets, with insights on adapting to regional shifts and emerging opportunities. - Global Weekly Dairy Market Recap: Production Surges, Trade Tensions, and Consumer Shifts

Analyze key weekly trends in global dairy markets, including production growth, trade dynamics, and evolving consumer preferences shaping the industry.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!