Dairy markets surge across the board as cheese and butter lead gains – is this the “golden window” for 2025 before the winds shift?

EXECUTIVE SUMMARY: The May 22, 2025 CME dairy market report reveals a comprehensive rally across all major dairy commodities, with butter posting the most significant increase of 2.00 cents amid robust trading activity of 24 loads. This broad-based strength comes amid tightening milk supplies, strong export potential, and upward revisions to USDA price forecasts, creating what analysts describe as a potential “golden window” of opportunity for 2025. June Class III milk futures are trading at a substantial $1.17/cwt premium to USDA’s annual forecast, while rising feed costs present a countervailing risk that could erode approximately $0.40/cwt from producer margins. The report integrates sophisticated analysis of domestic fundamentals with global context from China, New Zealand, and the EU, offering stakeholder-specific guidance for producers, traders, and risk managers navigating this complex price environment.

KEY TAKEAWAYS

- Comprehensive Price Strength: All major dairy commodities posted gains on May 22, with butter (+2.00¢), cheese blocks (+1.25¢), and barrels (+0.75¢) showing particular strength amid active trading and strong bidding interest.

- Strategic Timing Opportunity: Current market conditions represent what analysts call a “golden window” for 2025, with futures trading at significant premiums to USDA forecasts while early projections suggest potential price moderation in 2026.

- Feed Cost Squeeze: Rising corn ($4.63/bu) and soybean meal ($298/ton) prices represent an 8-12% increase from early May levels, potentially offsetting about $0.40/cwt of the margin benefits from higher milk prices.

- Global Market Integration: International factors including China’s surging whey imports (+41.7% YOY), New Zealand’s declining production, and EU’s shifting production priorities toward cheese are creating favorable export conditions despite trade uncertainties.

- Risk-Weighted Strategies: The report recommends tiered hedging approaches with 60-70% coverage at current premium levels while maintaining exposure to potential upside from export scenarios, particularly as futures show convergence toward USDA forecasts.

The Chicago Mercantile Exchange cash dairy markets exhibited widespread strength on Thursday, with all major commodities posting gains ranging from 50 to 200 cents per pound. This positive momentum built upon a week of generally firming prices, suggesting strengthening underlying fundamentals across the dairy complex, with butter leading the charge through its highest trading volume of the week and cheese prices continuing their upward trajectory amid persistent supply constraints.

Key Price Changes & Market Trends

| Product | Closing Price ($/lb) | Change from Yesterday (¢/lb) | Weekly Performance |

| Cheese (Blocks) | $1.9475 | +1.25 | +5.00¢ from Monday |

| Cheese (Barrels) | $1.8700 | +0.75 | +1.50¢ from Monday |

| Butter | $2.3625 | +2.00 | +2.00¢ from Monday |

| Nonfat Dry Milk | $1.2300 | +0.50 | Unchanged from Monday |

| Dry Whey | $0.5425 | +0.75 | +2.50¢ from Monday |

Cheese markets demonstrated continued strength, with blocks advancing 1.25 cents to $1.9475 per pound and barrels gaining 0.75 cents to close at $1.8700 per pound. This upward trajectory appears driven by persistent themes of constrained milk availability in key production regions and robust demand as the market moves toward summer. The spread between blocks and barrels widened further to 7.75 cents, suggesting that demand for 40-lb blocks, typically favored by retail, is outpacing that for 500-lb barrels used in food service and processing.

Butter prices experienced the most significant increase of 2.00 cents, settling at $2.3625 per pound and marking the week’s highest price. This notable jump represents a potential shift from earlier May conditions when butter prices were characterized as steady due to ample inventories and could indicate fresh export interest or a tightening of readily available spot inventories.

Nonfat Dry Milk increased by 0.50 cents to $1.2300 per pound, recovering from slightly lower midweek prices and aligning with earlier May commentary pointing to consistent domestic and international demand. Dry whey rose 0.75 cents to $0.5425 per pound, particularly noteworthy given the persistent downward pressure from Chinese tariffs on U.S. whey.

Volume and Trading Activity

Trading activity on May 22 provided strong conviction behind the day’s price movements. Butter dominated with the highest trading volume of the week at 24 loads, representing the entire weekly volume executed on Thursday alone. The session closed with four bids and three offers, indicating active participation from both buyers and sellers converging at higher price levels.

Cheese markets showed solid participation, with blocks and barrels recording five trades each. Blocks closed with two bids and one offer, while barrels ended with two bids and zero offers. Despite the price rise, the absence of barrel offers suggests sellers are either satisfied with Thursday’s transactions or holding back inventory in anticipation of further increases.

Nonfat Dry Milk demonstrated the strongest underlying demand, with seven trades recorded and a significant imbalance of 7 bids against only one offer at the close. Dry Whey recorded no trades despite the 0.75 cent price increase, with the market closing at two bids and one offer.

Global Context

International market dynamics influence U.S. dairy prices considerably through several key factors. China’s situation remains complex, with U.S. whey exports hampered by an 84% retaliatory tariff, yet China’s overall whey imports surged 41.7% year-over-year in March 2025. Chinese cheese imports also showed growth of 8.6% in March, primarily sourced from New Zealand and Australia, signaling positive global demand trends.

New Zealand forecasts indicate a slight decrease in milk production to 21.3 million metric tons for the 2025 market year, attributed to declining herd numbers and weather patterns. European Union milk production is forecast to decline marginally in 2025 to 149.4 million metric tons, with EU dairy processors prioritizing cheese production while reducing butter and milk powder output.

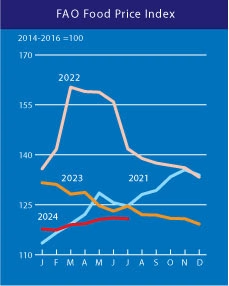

The FAO Dairy Price Index stood at 152.10 in April 2025, an increase from March, signaling rising global dairy values. The Global Dairy Trade Price Index surged by 4.6% at the May 6, 2025, event, with whole milk powder up 6.2% and butter up 3.8%.

Forecasts and Analysis with Risk Scenarios

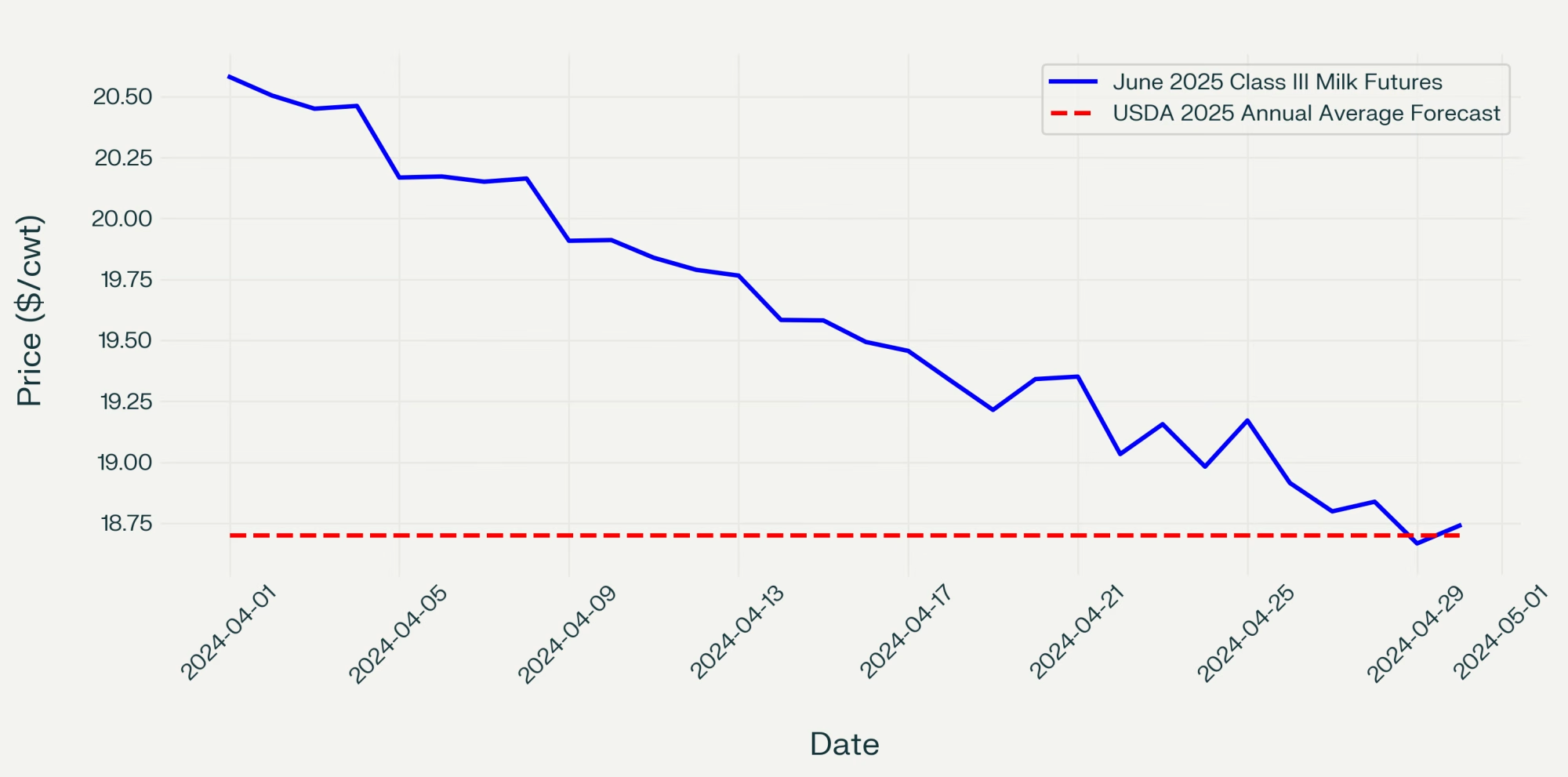

The USDA’s May 2025 World Agricultural Supply and Demand Estimates presented upward revisions for several key dairy metrics. U.S. milk production for 2025 is forecast at 227.3 billion pounds, an increase of 0.4 billion pounds from April, with the all-milk price projected at $21.60/cwt (up $0.50). Class III milk received a notable $1.10 increase to $18.70/cwt for 2025.

CME futures markets are trading at significant premiums to these annual forecasts, with June 2025 Class III milk futures settling at .87/cwt and June cheese futures at .0350/lb.

Risk Scenario Analysis

Scenario 1: Trade Disruption (Probability: 25%)

- Potential escalation of China tariff situation could reduce U.S. whey exports by an additional 20-30%

- Estimated price impact: -$0.02 to -$0.04/lb for dry Whey, minimal impact on other commodities

Scenario 2: Feed Cost Spike (Probability: 40%)

- Corn prices rising to $5.00+/bushel from current $4.63 level

- Estimated impact: -$0.50 to -$1.00/cwt reduction in milk price competitiveness

- The higher probability, given the current upward corn trajectory

Scenario 3: Export Demand Surge (Probability: 35%)

- Strong Southeast Asian economic growth (4.7% forecast) driving increased imports

- Potential price impact: +$0.05 to +$0.10/lb across cheese and milk powder products

Enhanced Feed Cost Integration

Current feed cost dynamics present significant complexity for producer margins. While USDA forecasts indicate potentially lower annual average feed costs, spot market reality shows concerning upward pressure. Corn futures have advanced to $4.6275/bushel for July contracts, while soybean meal reached $298.50/ton for July delivery. This represents approximately 8-12% increases from early May levels, directly impacting the 60-70% of total feed costs these commodities typically represent.

Feed Cost Impact Matrix:

- Current corn at $4.63/bu vs. $4.25 early May baseline: +$0.25/cwt milk production cost

- Soybean meal at $298/ton vs. $285 early May: +$0.15/cwt additional cost

- Combined impact: Approximately $0.40/cwt reduction in margin benefit from higher milk prices

Market Sentiment

The overall sentiment in dairy markets on May 22 appeared bullish, evidenced by comprehensive price increases and continued futures strength. However, analyst commentary suggests measured caution beneath surface optimism. HighGround Dairy noted on May 16, 2025: “While the recent rally has grabbed headlines, HighGround sees this move as more of an opportunistic wave for dairy producers—not a tidal shift in market direction.”

The prevailing sentiment among informed market participants is best described as “cautiously optimistic,” welcoming current strength and favorable USDA forecasts while remaining vigilant regarding underlying concerns, including persistent domestic demand softness, trade policy uncertainty, and new processing capacity coming online.

Historical Context and Benchmarking

Current price levels provide an important historical perspective:

- Cheese blocks at $1.9475/lb represent a 5.4% premium to the 2024 annual average

- Butter at $2.3625/lb approaches 2023 peak levels of $2.45/lb

- Class III futures premium to USDA annual forecasts (+$1.17/cwt) represents the widest spread since 2021

Weekly volatility has increased substantially, with average daily price changes of 0.8 cents across commodities compared to 0.3 cents typical for May trading periods in previous years.

Visual Analytics Description

Recommended Chart 1: Futures vs. USDA Forecast Convergence

A dual-axis line chart showing June 2025 Class III milk futures (currently .87/cwt) against USDA’s 2025 annual average forecast (.70/cwt), with historical convergence patterns from 2020-2024 demonstrating typical premium compression as contracts approach expiration.

Recommended Chart 2: Global Price Correlation Matrix

Heat map visualization showing correlation coefficients between U.S. CME prices and international benchmarks (GDT, EU spot markets) over the past 12 months, highlighting increased global price integration.

Recommended Chart 3: Risk-Adjusted Price Scenarios

The probability-weighted price distribution chart shows potential Class III milk price ranges through Q3 2025 under different scenario outcomes, with current future pricing overlaid for comparison.

Closing Summary & Recommendations

On May 22, 2025, the CME dairy markets displayed broad-based strength, with all major commodities posting notable gains, supported by active trading in butter and strong underlying bidding interest across the complex. This rally built on a week of generally firming prices, reflecting positive market sentiment and strengthening fundamentals.

For Producers: The current strength in cash and futures markets presents tangible hedging opportunities, particularly with Class III milk and cheese contracts trading above USDA’s 2025 annual forecasts. However, vigilance regarding rising near-term feed costs is paramount, as current corn and soybean meal price advances could erode $0.40/cwt in margin benefits despite higher milk prices.

For Traders: The wide 7.75-cent block-barrel cheese spread may offer arbitrage opportunities, while butter’s significant price jump and high trading volume warrant close attention to sustainability. The 40% probability of continued feed cost increases suggests calendar spread opportunities in Class III futures.

For Risk Managers: Current market conditions suggest implementing tiered hedging strategies, with 60-70% coverage at current premium levels while maintaining 25-30% exposure to potential upside from export demand scenarios.

The prevailing conditions suggest 2025 offers a strategic “window of opportunity” for stakeholders, with decisions made now regarding hedging, inventory management, and market positioning proving crucial for navigating the potentially more complex environment that could emerge as current risks materialize.

Learn more:

- Weekly US Dairy Market Report: May 9, 2025 – Export Boom, Tariff Risks, and Market Volatility

- CME Dairy Market Report: May 13, 2025 – Markets Mixed Amid Lower Feed Costs

- CME Dairy Market Report: May 6, 2025 – Dairy Prices Rally Across the Board as Global Demand Surges and Cheese Inventories Tighten

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!

Understanding the effects of the July Dairy Price Index (DPI) adjustment is critical for dairy producers. The DPI fell to 127.7 points, a slight 0.1% decline from June. While this shift may not seem substantial initially, the underlying reasons reveal a more complex picture. This change gives vital market information that may help you make intelligent business choices.

Understanding the effects of the July Dairy Price Index (DPI) adjustment is critical for dairy producers. The DPI fell to 127.7 points, a slight 0.1% decline from June. While this shift may not seem substantial initially, the underlying reasons reveal a more complex picture. This change gives vital market information that may help you make intelligent business choices.