How do October 2024’s dairy margins affect your farm’s bottom line? Ready to adapt and seize new opportunities?

Summary:

The dairy industry faces a transformative October in 2024, with fluctuating margins creating a mixed landscape for producers. There’s a decline in immediate margins, but potential strength in future months, as CME Milk futures experience early slumps followed by recovery, especially in deferred Class III contracts reaching new highs. This is amidst concerns over production constraints due to an aging herd and pressures from declining butter and cheese prices. With butter inventories expanding and cheese production shifting toward Italian varieties, the dynamics of supply, global demand, and competitive pricing become complex. Market recovery efforts are pivotal as U.S. butter and cheese regain global competitiveness. The industry sees a marked increase in cheese exports, driven by robust sales to Mexico. To navigate this volatility, dairy professionals are implementing strategic margin coverage plans, leveraging futures contracts, and adaptive strategies that can change with market conditions, safeguarding margins and fostering resilience. How are you positioning your business for what’s next?

Key Takeaways:

- Dairy margins showed mixed trends in October, with fluctuations in both nearby and deferred periods.

- Class III milk futures saw a new contract high, despite initial slumps, due to constrained production concerns.

- Butter prices experienced a significant drop, attributed to increased production and pre-holiday buying completion.

- Cheese prices dropped from record highs, with a marked preference shift towards Italian cheese varieties.

- Cheese exports increased by 14% in August, driven significantly by sales to Mexico.

- Strategic margin coverage adoption continues among clients, focusing on both protection and potential improvement.

Picture this: you’re managing your dairy farm, the crisp autumn air envelops you, and October feels calm before a storm. But in the dairy industry, storms can bring opportunity and risk. Are you prepared for the shifts in dairy margins this month? Understanding these dynamics is critical for strategic planning and navigating your firm through changing tides.

As we delve into the numbers from October 2024, we see a mixed bag of performance in dairy margins. They’ve fallen slightly in the short term, but there’s a silver lining of potential profit in the future. A combination of variables influences the present market dynamics:

- Price Recovery: CME Milk futures fell early but have recovered, with deferred Class III contracts reaching fresh highs.

- Global Competitiveness: Following a recent downturn, butter and cheese prices in the United States are recovering globally.

- Production Constraints: A shortage of replacement heifers reduces output, complicating the market further.

The Fluctuating Nature of Dairy Margins: An October Snapshot

Dairy margins changed in October, providing an intriguing glimpse into the current market dynamics. Let’s look at the critical developments shaping the dairy industry’s financial landscape.

Throughout the first part of the month, dairy margins could have been more consistent. There was a considerable decrease in nearby periods. However, there was significant strengthening further up the curve. So, what is causing this dichotomy?

The initial drop in CME Milk futures established a cautious tone for early October. Uncertainty in milk pricing caused concern among producers, hedgers, and market participants. However, as the month passed, a recovery became apparent. Deferred Class III contracts had a crucial influence in driving new contract highs. This spike reflects a rising concern about probable production restrictions. The scarcity of dairy replacement heifers is gradually aging the milking herd, while changes in global market dynamics are making U.S. butter and cheese more competitive abroad. This dichotomy in dairy margins, with nearby margins under pressure due to low pricing and high inventories but the prospect of future gains keeping sentiment positive, signifies a complex and shifting market that requires careful navigation.

After the slump, prices were more competitive, and industry participants appeared to modify their strategy. This created an opportunity for individuals who successfully negotiated these shifts. While nearby margins were under pressure due to low pricing and high inventories, the prospect of future gains kept sentiment positive. What does this combination of circumstances signify for dairy experts like yourself?

Given these factors, strategic thinking regarding covering and hedging becomes critical and empowering. As we navigate these uncertain times, careful margin management promotes resilience and enables you to profit from possible margins. Are your strategies in line with these growing patterns?

Butter’s Balancing Act: Supply Surge Sets Prices Tumbling

The butter market recently saw a significant shift, with prices falling from more than $3/lb to little more than $2.60. This reduction can be primarily attributable to market excess, fueled by a 14.5% increase in August butter production over the previous year. This supply surge resulted from [specific factors contributing to the increase in production]. But how does this increase in manufacturing affect inventory levels? Stocks have risen. The Cold Storage report emphasizes one crucial factor: Butter inventories increased by 10.8% in August compared to the previous year, reaching 323.3 million pounds. Such a supply boom resulted in an oversupply, causing buyers to step back after meeting their holiday demands early. As supply exceeded demand, prices naturally fell. This situation is a potent reminder of how production trends can directly impact market dynamics, particularly in the unpredictable dairy industry.

From Cheddar to Parmesan: A Shift in Cheese Preferences

The cheddar cheese market has recently shown some intriguing dynamics. The dramatic drop in cheese prices has generated discussion among dairy specialists. Cheddar barrel prices fell from historic highs before stabilizing at lower levels recently. So, what’s driving this massive shift?

One crucial factor is the changing consumer tastes. The increasing popularity of Italian cheese variants has significantly impacted cheddar manufacturing. With an emphasis on meeting this demand, cheddar, a mainstay, has seen a reduction in cumulative year-to-date production, down 6.6% from previous years. This shift in production focus implies that our cheese alternatives may soon reflect more Mediterranean preferences.

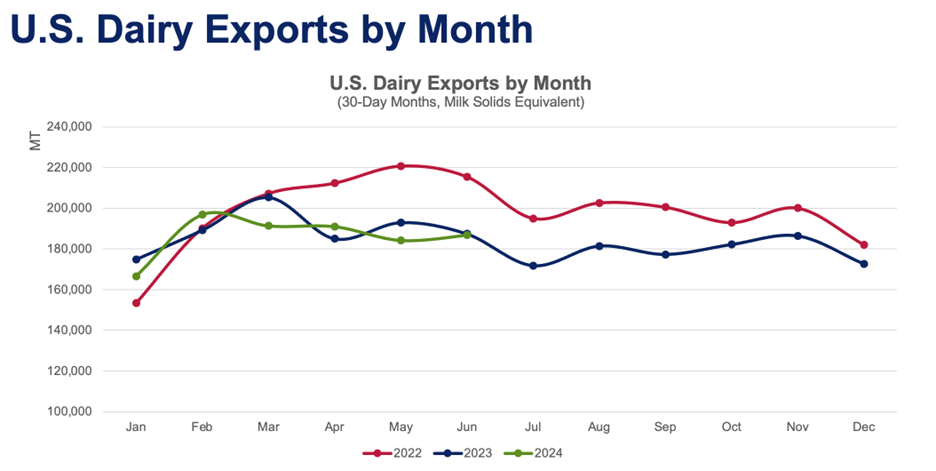

Despite these industrial adjustments, there is a silver lining. August data shows a noteworthy 14% increase in cheese exports, driven chiefly by solid sales to Mexico. This increase reflects the industry’s successful efforts to identify new markets and counter fluctuations in domestic demand, resulting in continued growth in foreign dairy sales.

Navigating the Dairy Market: Strategies for Securing Margins Amidst Volatility

Faced with volatile market conditions, dairy farmers and industry professionals implement strong tactics to weather the storm. How are they maintaining these critical margins despite the ebb and flow? These strategies include [specific strategies] designed to [explain the purpose and benefits of each strategy]. By implementing these strategies, dairy farmers can better navigate the market’s volatility and secure their margins.

Dairy farmers increasingly turn to custom margin coverage plans tailored to their requirements. This strategy entails studying future market patterns and implementing safeguards against probable price declines. It protects against volatility and creates opportunities for increased margins.

One crucial aspect is using postponed marketing periods. Farmers use futures contracts and options to lock in favorable pricing for milk and other dairy products in the future. This establishes a safety net that balances present and expected market conditions. Such forward-thinking strategies protect against immediate market disruptions while benefiting producers from potential advantages.

Furthermore, the value of flexibility cannot be emphasized enough. As margins continue to shift, a one-size-fits-all strategy may prove ineffective. Farmers and dairymen are implementing adaptive strategies that allow for changes based on market feedback. Flexible strategies allow for recalibration based on changes, such as a supply constraint or increased production, increasing profitability through strategic foresight.

This comprehensive approach to margin coverage emphasizes the importance of balancing the preservation of present operations with capitalization on possible market developments. For individuals in the dairy sector, flexibility is more than a strategy; it is a requirement for survival in an ever-changing environment.

Navigating the Global Tides: Currency, Trade, and Demand Dynamics in Dairy

The intricate web of global economic situations frequently casts a long shadow over dairy margins, creating a narrative transcending domestic borders. Currency swings, for example, can help or hurt dairy exports in the United States. A stronger dollar raises the cost of American items on the international market, thus reducing demand. The dollar’s strength has recently become a hot topic, with substantial implications for the competitiveness of U.S. dairy goods in lucrative markets such as China and the European Union. Do you find yourself planning about these currency fluctuations?

Trade agreements are significant in the global dairy industry. Their reconfiguration or establishment might create new market opportunities or close existing ones, altering the flow of dairy commodities. The recent approval of the USMCA has ensured continued trade with Canada and Mexico, ensuring that dairy products continue to find strong markets beyond our borders. Are your operations ready to take advantage of these trade developments?

Furthermore, foreign demand dynamics are essential in shaping dairy pricing. For example, rising middle classes in Asia increasingly favor dairy-rich diets, driving up demand dramatically. As a result, U.S. exports to these regions have significantly increased. A report stated that robust international sales, particularly to Mexico, had boosted overall demand despite evolving domestic cheese preferences. How are you adjusting your product offers to reflect these worldwide taste trends?

Understanding this worldwide tapestry is valuable and necessary for managing the difficulties of the dairy market today. Understanding how these large-scale economic forces interact can provide more apparent foresight into anticipated future market movements, allowing you to manage this volatile playing field more successfully.

Charting a Course Through Dairy’s Turbulent Seas: Proactive Strategies for Success

Innovate Cost Control: Controlling production costs is vital. Evaluate your feed strategy and optimize herd health management. Implementing these strategies can better position dairy farmers to navigate current challenges and seize emerging opportunities. Adaptability and proactive planning are critical to sustaining a profitable dairy operation.

When navigating the uncertain seas of the dairy market, a proactive strategy can make a big difference. Here are several methods to help dairy producers not just weather the storm but potentially thrive:

- Accept Risk Management Tools: The fluctuation in dairy margins necessitates a good risk management approach. To hedge against price volatility, consider using futures contracts, options, or margin protection programs. Understanding these instruments can be a safety net when market conditions are harsh.

- Innovate Cost Control: Cost control is critical for production. Evaluate your feed plan, improve herd health management, and invest in technology to increase operational efficiency. Minor modifications can result in significant savings over time.

- Diversify revenue streams. Look past traditional milk sales. Investigate prospects for value-added products or direct-to-consumer sales. For example, artisan cheesemaking or organic milk products appeal to specialized customers while increasing profitability.

- Use Farm Management Software to track and evaluate production statistics. This can help you discover inefficiencies and optimize resource allocation. Data-driven judgments are often more precise and produce better results.

- Stay informed and connected. Knowledge is power. Review market information and forecasts regularly and connect with industry networks. Joining a cooperative or group can provide valuable information and assistance during challenging times.

- Adopt Flexible Marketing Strategies: Given the market’s volatility, a flexible marketing strategy allows you to capitalize on opportunities while reducing risks. Be willing to renegotiate contracts or explore alternative distribution channels.

Implementing these tactics can help dairy farmers overcome problems and embrace new opportunities. Adaptability and proactive planning are essential for maintaining a viable dairy operation.

The Bottom Line

As we examine the fluctuating dynamics of the dairy market, one thing is clear: adaptability and foresight are crucial. Butter and cheese prices behave unpredictably, driven by surges in production and shifting consumer preferences. Dairy margins are constantly in flux, highlighting the importance of strategic planning and flexible margin coverage to harness potential opportunities and mitigate risks.

The insights from this evolving landscape prompt a reflective pause: How will these market dynamics affect your dairy operations? This thought-provoking scenario invites proactive strategizing. As industry leaders, isn’t it essential to anticipate and respond effectively to these shifts?

The call to action couldn’t be more straightforward. Staying informed, adopting adaptable strategies, and continuously evaluating market trends will position you firmly as the dairy industry evolves. How will you adapt your strategy to navigate the evolving dairy market landscape? The time to consider this is now.

Learn more:

- Mid-Year 2024 Global Dairy Business Review: Key Developments from January to June

- Rising Milk Prices and Lower Feed Costs Boost Profitability: May Dairy Margin Watch

- Is 2024 Shaping Up to Be a Disappointing Year for Dairy Exports and Milk Yields?

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!