How will expanded limits on Class IV, Butter, and NFDM impact dairy farmers amid market shifts?

Summary:

Today marks a significant shift in the dairy futures market, with Class IV, Butter, and Nonfat Dry Milk (NFDM) reaching expanded limits that have drawn the attention of dairy professionals. These developments follow volatility in Class III and Cheese futures, where low points have rebounded due to substantial trading volumes. The Global Dairy Trade auction could significantly influence international dairy markets, with a predicted 3.4% index increase supported by favorable New Zealand pasture growth. Meanwhile, the upcoming October Milk Production report is expected to highlight disruptions from avian influenza in California, affecting U.S. dairy output, particularly in NFDM production. As the industry grapples with these dynamic conditions, stakeholders must strategically navigate immediate challenges and opportunities for long-term resilience.

Key Takeaways:

- Class III and Cheese futures have shown a notable rebound, with a significant price increase following a period of decline.

- Futures trading volumes for Class III and Cheese have seen fluctuations, reflecting market volatility and the impact of spot price stability.

- The Global Dairy Trade (GDT) auction is anticipated to influence price trends, with expectations of a potential index increase.

- California’s avian influenza outbreak is expected to affect October milk production figures, causing a downward trend in national growth rates.

- Component analysis reveals a deceleration in fat and protein content growth compared to previous months, notably in California and the Pacific Northwest.

- There is mixed performance in Class IV Milk, Butter, and NFDM futures, with NFDM maintaining stability amidst supply concerns in California.

- The future outlook hints at supply chain challenges and the potential for global trading partners to adjust their powder inventory strategies.

Amidst the swirling eddies of market volatility, the dairy industry is witnessing a seismic shift with the expanded limits on Class IV, butter, and nonfat dry milk (NFDM). These changes are not mere figures on a graph; they are a wake-up call for dairy farmers and industry professionals who navigate the ever-fluctuating tides of supply and demand. As the faces behind the farm gate and decision-makers at the helm of industry giants see their margins pinched by oscillating prices and unpredictable futures, these developments have emerged as a beacon for strategic realignment and market adaptation. A seasoned market analyst recently noted, “Markets are pricing new realities – it’s time to adapt or be left behind” during an industry roundtable. This recalibration in limits ushers in significant implications, acting as both a barometer of market moods and a determinant of economic strategies that can fortify or crumble milk producers’ profitability. It calls for an agile approach, prompting industry stakeholders to rethink their short-term operations and long-term plans, with renewed limits highlighting the need for risk management strategies and sparking discussions on the future of dairy market negotiations and collaborations.

| Commodity | Current Price | Price Change (Last Week) | Market Trend | Volume |

|---|---|---|---|---|

| Class III Milk | $17.50 | +$1.42 | Rising | 3,000 contracts |

| Class IV Milk | $20.00 | Stable | Mixed | 150 contracts |

| Butter | $2.55 | -0.05 | Declining | 200 contracts |

| NFDM | $140.00 | +0.50 | Stable | 500 contracts |

| Cheese | $1.70 | Flat | Bullish Bounce | 530 contracts |

Rolling Tide of Change: Navigating Class III and Cheese Futures

Today’s dairy market illustrates a dynamic interplay between Class III and cheese futures, underpinned by recent bearish trends that have injected a dose of volatility into trading. Over the past month, traders have witnessed a consistently bearish sentiment in these markets, with considerable drops to new lows. These declines, however, were sharply counterbalanced by ‘bear bounces’—a term used to describe swift, significant upticks in prices following a downtrend.

On Friday, the robust trading volume exceeding 3,000 Class III futures underscored the market’s resilience as it rebounded from new lows. This reflects ‘bear bounces,’ where the market reacts swiftly, resulting in considerable price movements in a short period. As prices have climbed back, trading activity has seen some contraction, with reduced volumes indicating cautious optimism among future investors as they assess the stability of spot markets around the $1.70 mark.

With its penchant for reacting to market sentiments and upcoming economic indicators, the futures market is buoyed by expectations of supportive outcomes from global dairy auctions and production reports. As such, stakeholders are keen on potential developments that could further influence these fickle markets. The story of Class III and cheese futures is one of volatility underscored by rapid recoveries, challenging market participants to stay vigilant in navigating the complexities of this evolving landscape.

Global Dairy Trends: The Rising Tide of Opportunity

The upcoming Global Dairy Trade (GDT) auction holds significant potential to influence global dairy markets, with projections indicating a possible 3.4% rise in the index. This anticipated increase follows signals from the recent pulse auction, where Whole Milk Powder (WMP) and Skim Milk Powder (SMP) prices exhibited a positive trend. Such developments are integral for understanding the shifts in market dynamics as commodity prices play pivotal roles in shaping global dairy trade patterns. The potential of the GDT auction offers a ray of optimism in an otherwise volatile market.

Moreover, the supportive New Zealand (NZ) pasture growth index lends additional credence to the expected uptick in dairy prices. For months, this growth index has surpassed last season’s figures and the five-year average, suggesting favorable conditions for dairy production in one of the world’s leading dairy-exporting countries. As pasture growth is a critical determinant of milk supply, its robust performance is likely to bolster market confidence and future price stability.

These indicators present dairy farmers and industry stakeholders with a dual opportunity: to capitalize on potentially higher prices and to reassess production strategies in light of shifting global supply and demand. Therefore, the forthcoming GDT auction isn’t merely a price-setting event but a barometer for the broader landscape of international dairy trade. The results of this auction could significantly influence global dairy prices and trade patterns, providing valuable insights for industry stakeholders.

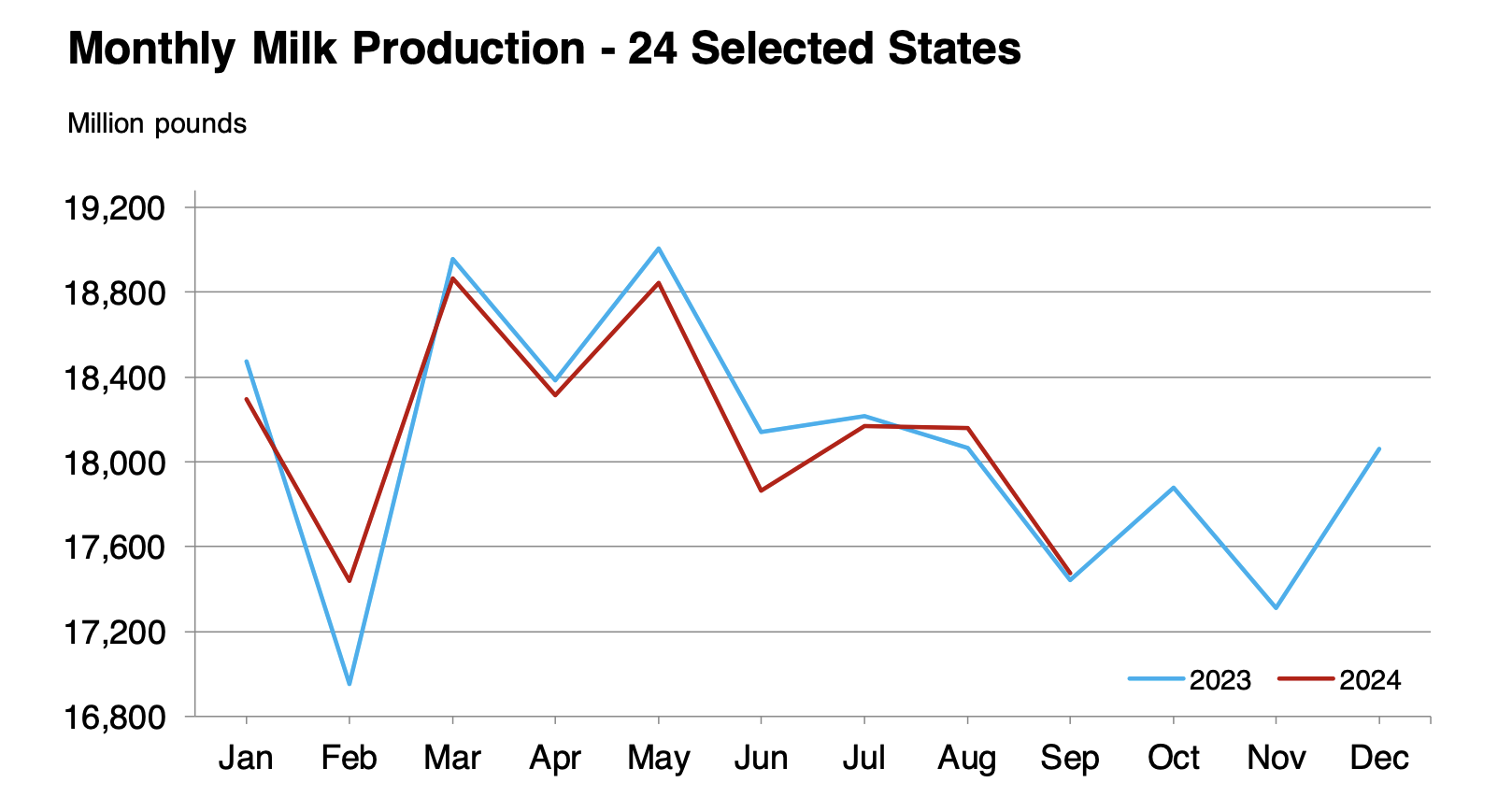

Anticipating Shifts: The Impact of Avian Influenza on October Milk Production

The eagerly awaited October Milk Production report is poised to reveal notable disruptions, chiefly attributable to avian influenza’s deleterious impact within California, a critical contributor to U.S. dairy output. This outbreak couldn’t have come more inopportunely, as the national scene witnessed a commendable rebound in production figures, shifting from a 1.7% downturn in June to a modest 0.4% uptick by August. However, the arrival of this viral adversary in late August has notably impeded California’s productivity, inevitably casting a shadow over national statistics, projected to dip by 3% or more due to this localized decline.

Beyond raw volume, the underlying composition of milk has also captured attention, particularly as anecdotal insights underscore a striking ascent in fat content during October. Milk orders from Federal Marketing Orders reported an average fat content surge of 4.22%. Yet, this increment marks a slowdown from the more vigorous growth rates charted in August and September. This trend mirrored across most federal jurisdictions, denoting a significant deceleration.

Protein levels, another vital metric, have paralleled fat content’s trajectory, edging upward by 0.8% from the previous year. While commendable, this growth remains pale compared to prior months, notably faltering within California and the PNW realms. The forthcoming report will indubitably serve as a litmus test for the industry’s resilience in the face of regional adversities. It will likely recalibrate expectations as the sector grapples with these unforeseen challenges.

Markets in Motion: Class IV Milk, Butter, and NFDM in the Balance

The landscape of the Class IV milk, butter, and NFDM markets reveals a tapestry of nuanced movements and underlying factors. The Class IV milk futures exhibit a steady to mixed trend, reflecting a market carefully balancing supply dynamics and future expectations. In contrast, butter futures have experienced a downward trend. This shift underscores the interplay between current consumer demand and producers’ readiness to place bids. The $2.50-$2.65 trading range, characteristic of last year’s period, presents a congestion zone, hinting at potential support levels amidst abundant cream supply and anticipated slowdown in seasonal sales.

Meanwhile, NFDM stands on a plateau of stability, with prices rooted firmly around the $140 mark. This consistency suggests the market’s current contentment with its pricing amidst subdued immediate demand and looming supply concerns linked to California’s milk production challenges. In 2023, California plants were responsible for half of the nation’s NFDM/SMP output. Therefore, it is no surprise that recent disruptions in production have had a significant impact. However, the narrative is complete by considering the potential rise in demand as international trading partners deplete their existing, less costly inventories, offering a glimmer of hope in the market.

California’s Dairy Dilemma: Navigating Avian Influenza and Supply Chains

California, a pivotal player in the dairy industry, faces significant supply-side challenges that impact NFDM production. Compounding pressure from avian influenza exacerbates the state’s dairy sector, which was already responsible for half of the nation’s NFDM/SMP output in 2023. This situation constrains California’s milk production capacity, reducing supply, which inevitably reverberates through the NFDM market. The concern lies in meeting market needs while navigating these headwinds.

Concurrently, as global trading partners exhaust their stocks of inexpensive powder inventories, potential shifts in demand could alter the market landscape. This depletion breeds an environment ripe for increasing demand, which could drive prices upwards if supply remains constrained. The observation here indicates a complex interplay between dwindling supply and the speculative rise in demand as international markets adjust to their inventory realities.

The Bottom Line

The dairy market presents a dynamic tableau of shifting trends and emerging challenges, demanding a strategic recalibration from industry stakeholders. Class III and Cheese futures have shown momentary buoyancy, highlighting the volatility that market participants must navigate. Meanwhile, global dairy trends signal a surge in opportunities, creating landscapes ripe for strategic exploration. However, the unforeseen impacts of avian influenza, particularly in California, underscore the susceptibility of production chains to biological threats, complicating supply forecasts and necessitating agile responses.

The future remains uncertain yet promising as markets swell and recede with the motion of macroeconomic tides. How will dairy farmers and professionals adapt their strategies to leverage market fluctuations, and what concrete steps can be taken to hedge against unforeseen disruptions? The key to thriving lies in balancing production and demand scales, incorporating innovative processes, and fostering resilience.

Consider this: How can the evolving landscape be turned into an advantage, ensuring sustained growth and profitability amidst inevitable market shifts? Will technology and innovation pave the way for a transformative leap forward in dairy operations, or will traditional methods prevail?

Engage with the transformative forces shaping your industry. Evaluate, strategize, and act—because the future of dairy is written by those who dare to question and adapt. Where do you stand amidst the shifting sands of the dairy industry? Let’s shape the narrative together.

Learn more:

- Is the Summer Heat Finally Over? Dairy Farmers See Milk Production Stabilize, but Challenges Remain!

- Will the Surge in Milk Prices Last? Analyzing Trends and Future Outlook

- Growth in Class III Milk Futures Amid Mixed Market Movements: CME Dairy Report – June 24, 2024

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!