Are you curious about USDA‘s new farm income forecast and what it means for dairy farmers and agribusinesses? Let’s dive into the positive trends and key insights!

Summary: The USDA’s latest farm income forecasts for 2024 present both challenges and opportunities for the agricultural sector. While net farm income is predicted to decline by $6.5 billion (4.4 percent) and net cash farm income by $12.0 billion (7.2 percent), both measures remain above long-term averages. Crop receipts expect a sharp fall by $27.7 billion (10 percent), yet animal/animal product receipts are set to increase by $17.8 billion (7.1 percent). Government payments are anticipated to decrease by $1.8 billion (15.1 percent). For dairy farmers and agribusiness professionals, the focus should be on efficiency and strategic planning to navigate these shifts, balancing the resilience in higher animal product revenues with the need to counter declining crop receipts.

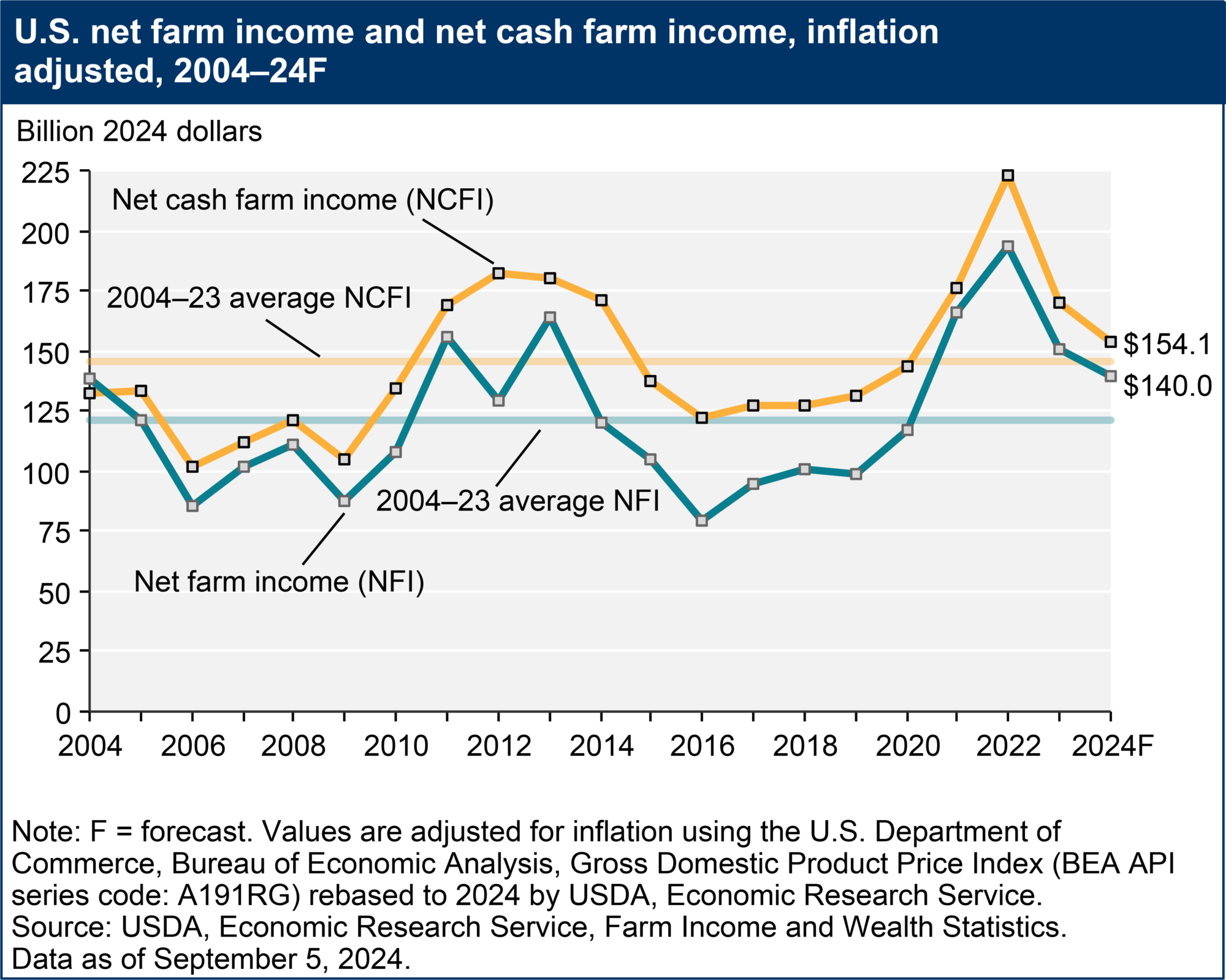

- Net farm income in 2024 is forecasted to decline by $6.5 billion (4.4 percent) but remains above long-term averages.

- Net cash farm income is expected to decrease by $12.0 billion (7.2 percent).

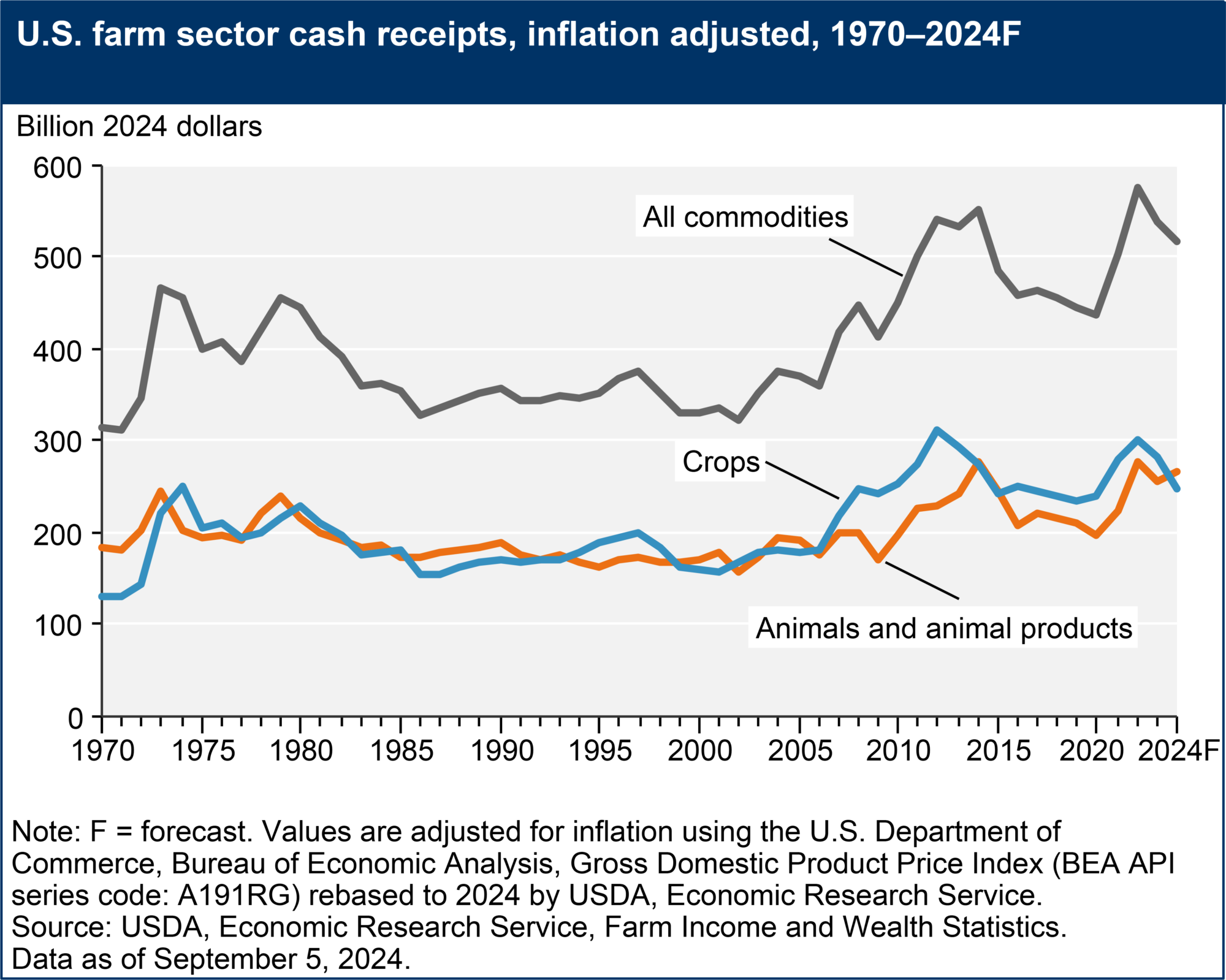

- Crop receipts are projected to fall sharply by $27.7 billion (10 percent).

- Animal/animal product receipts are forecasted to increase by $17.8 billion (7.1 percent).

- Government farm payments are anticipated to reduce by $1.8 billion (15.1 percent).

- Dairy farmers and agribusiness professionals must focus on efficiency and strategic planning.

- Key strategy: balance higher animal product revenues with declining crop receipts.

According to the USDA’s most recent agricultural income prediction, we may finally have good news to report. After a hard couple of years, the decline in agricultural sector revenue is expected to decelerate, offering a more positive picture for the future. Understanding these data is critical for those heavily invested in dairy and farming. So, are you prepared for a brighter 2024? The ramifications of this prognosis are significant. You may plan more confidently now that net farm revenue and cash receipts are stabilizing. These figures have a direct impact on dairy farms and their supply chains. Let’s dig further into what this implies for your business and how you may take advantage of this cautiously hopeful outlook.

The USDA’s 2024 Forecast: A Ray of Hope in Challenging Times

The USDA’s 2024 prediction shows a cautiously optimistic outlook for the agriculture industry. While net farm income is predicted to fall by $6.5 billion (4.4%) and net cash farm income by $12.0 billion (7.2%), the pace of decline will be less than in 2023. It’s a symbol of stability in the face of hardships. Despite these declines, the overall prognosis remains good, with both net farm income and net cash farm income being above the two-decade norms when adjusted for inflation. This resilience is supported by higher animal product revenues and a minor decrease in production expenditures, indicating a more balanced financial picture in 2024.

A Mixed But Hopeful Picture for 2024’s Farm Income

The projected net and cash farm income increases for 2024 paint a mixed but encouraging picture. Let’s go into the statistics and their relevance.

First, net farm income in 2024 is expected to fall by $6.5 billion (4.4 percent) from 2023, bringing the total to $140.0 billion in nominal terms. While this continues the downward trend from the $182.0 billion peak in 2022, it is a far slower fall than the $35.6 billion (19.5 percent) dip between 2022 and 2023.

In 2024 dollars adjusted for inflation, net farm income is expected to decline by $10.2 billion (6.8 percent) from the previous year. Despite this, the nominal and inflation-adjusted values for 2024 remain higher than the historical averages for 2004 to 2023. This shows that, despite a slump, the industry is doing better than in previous years.

Similarly, net cash farm income—which includes cash receipts from farming and other farm-related income—will decrease. Net cash income is expected to fall by $12.0 billion (7.2 percent) to $154.1 billion in 2024 after falling sharply from $210.1 billion in 2022 to $166.1 billion in 2023. Adjusted for inflation, net cash farm income will drop by $16.3 billion (9.6 percent) from 2023.

So, what does all this mean? Historically, these statistics indicate strong performance as compared to long-term norms. Even after accounting for the predicted losses, net farm income and net cash farm income are still much higher than inflation-adjusted levels in previous years. While the dip is significant, it comes after a high peak. It does not jeopardize the sector’s long-term development prospects.

Understanding these shifts is critical for farmers and industry stakeholders. The decreases are due to various variables, including reduced predicted crop revenues from maize and soybeans. However, the robustness of animal product revenues, forecast to increase by $17.8 billion, provides reason for confidence. As usual, remaining educated and responding to economic trends will be critical for agriculture’s future success. What measures are you contemplating to deal with these projected changes?

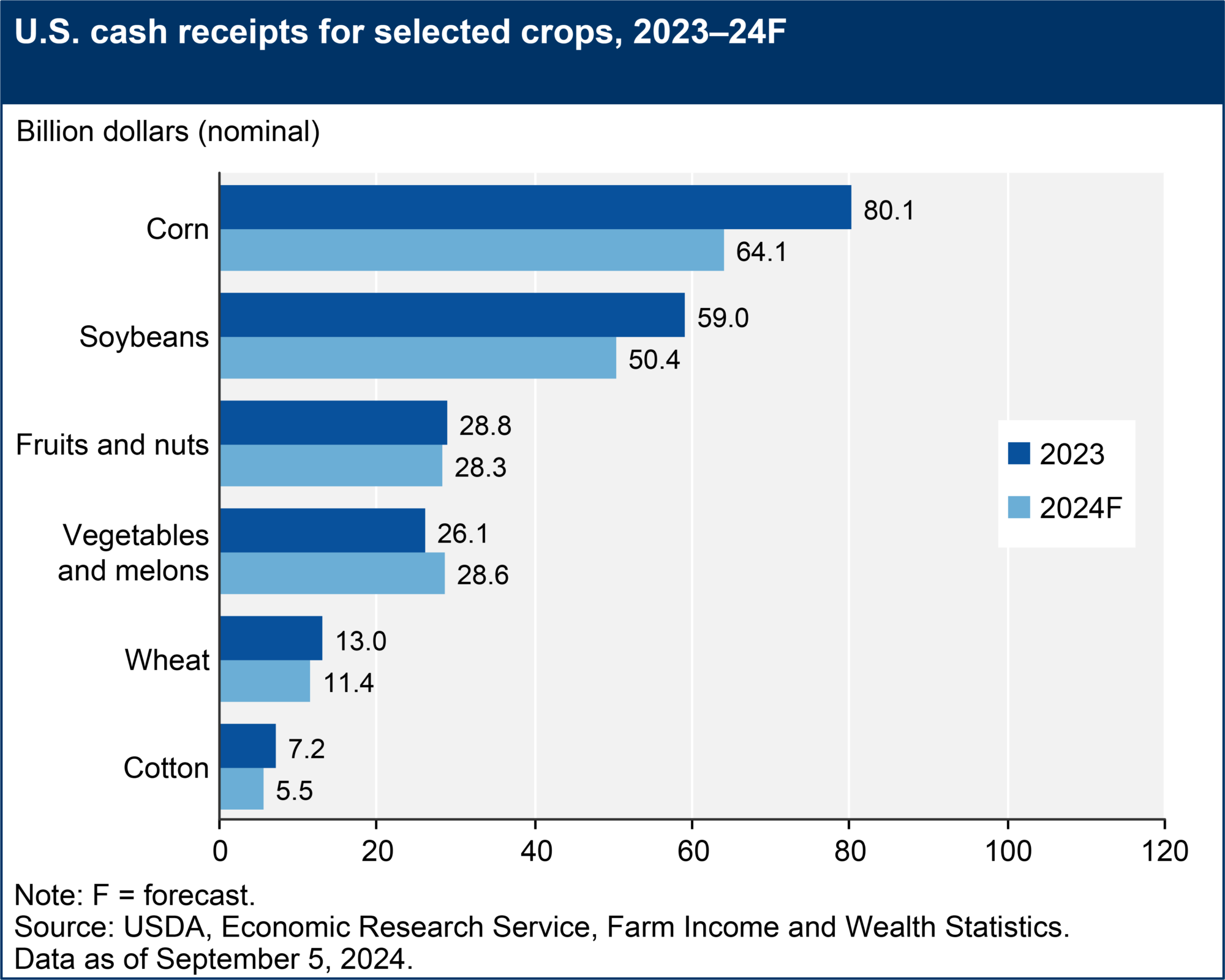

Brace for Impact: Steep Declines Forecasted for Key Crops in 2024

As we examine the projected fall in crop revenues for 2024, it becomes clear that numerous critical commodities will see severe declines. Corn and soybeans, essential commodities for many farmers, are expected to face a $24.6 billion revenue decline. Corn revenues are expected to fall by $16.0 billion, a significant 20.0 percent decrease. This reduction is primarily due to lower projected prices, which are anticipated to offset increasing quantities sold. Soybean revenues are also expected to dip by $8.6 billion (14.6 percent), with lower prices surpassing increased amounts sold.

Cotton and wheat are not exempt from these declining tendencies. Cotton revenues are expected to fall by $1.7 billion (23.6 percent) due to lower pricing and fewer units sold. Similarly, wheat revenues are likely to fall by $1.6 billion (12.3 percent) as lower prices balance prospective improvements in volume sold.

Interestingly, vegetable and melon revenues are expected to increase by $2.5 billion (9.8 percent) in 2024. This growth may be ascribed to improved pricing and consistent demand, which supports the quantity supplied.

Crop revenues fluctuate due to a mix of price and quantity influences. For most main crops, the negative effect of lowering prices is more significant, eroding any advantages from higher sales volume. Farmers face a problematic climate as market prices fall despite their efforts to adjust by selling more.

In contrast, the expected increase in vegetable and melon revenues demonstrates that specific crops may maintain or increase their market value despite considerable economic challenges. This disparity emphasizes the need for market diversification and careful crop planning to ensure farm revenue stability in volatile agricultural markets.

Animal Agriculture Outshines: A Positive Outlook on Cash Receipts in 2024

Animal/animal product revenues are expected to rise considerably in 2024. Precisely, cash revenues for these goods are predicted to increase by $17.8 billion (7.1%). This increase demonstrates a broader resilience in the animal farm industry, even if crop revenues are expected to fall.

Let’s delve into the details:

- Milk Receipts: The projection predicts a $4.3 billion (9.4%) rise. Higher milk prices will fuel this expansion, giving dairy producers a much-needed lift after years of unpredictable market circumstances.

- Cattle and Calves: Cash revenues for cattle and calves are expected to increase by $6.6 billion (6.5%). This increase is primarily due to higher pricing, reflecting increased beef demand and relatively steady supply.

- Chicken Eggs: The most significant rise in chicken egg revenues is expected to be $6.9 billion (38.7 percent). This substantial gain will be driven by better prices and increasing volumes sold, underscoring the poultry sector’s resilience.

The factors driving these increases are multifaceted:

- Higher Prices: We notice an upward trend in milk, livestock, and egg prices. These price increases are often connected to rising customer demand, supply chain modifications, and inflationary pressures that impact manufacturing costs.

- Increased Quantities Sold: Increased sales, in particular, compensate for price rises in chicken eggs. This shows a developing market in which both production and demand are increasing.

The general optimism about animal/animal product revenues balances out the less promising prognosis for crop receipts. This implies that although farmers should prepare for obstacles in certain areas, they may discover opportunities for development in others.

Government Farm Payments: A Shrinking Safety Net in 2024

Government agricultural subsidies, a lifeline for many farmers, are expected to fall by 15.1 percent in 2024, totaling $10.4 billion. This decrease is primarily due to expected decreased Dairy Margin Coverage (DMC) program payouts and less supplementary and ad hoc catastrophe assistance. Due to declining milk prices, the DMC program received $1.2 billion in payouts in 2023, a record high. However, by 2024, the figure is expected to have dropped significantly to $100.1 million.

Additionally, the Emergency Relief Program (ERP), a supplementary disaster relief effort, anticipates a $1.0 billion (14.1 percent) decrease from the prior year. This accounts for a significant chunk of the total drop in government payments. The predicted decreased compensation reflects fewer instances requiring emergency assistance compared to 2023.

On the positive side, conservation payments are expected to grow by $401.9 million (11.0 percent), reaching $4.0 billion in 2024. This increase is due to the rise in Conservation Reserve Program (CRP) acres, increased payments from Natural Resources Conservation Service (NRCS) programs, and monies from the Inflation Reduction Act for USDA conservation activities.

Good News for Budgets: Production Expenses to Dip in 2024

Production expenditures in the farm sector are expected to fall modestly in 2024, providing much-needed respite to many. Costs are expected to decline by $4.4 billion, or 1.0 percent, from 2023 levels. We should predict an even more significant drop of 3.4% when adjusted for inflation.

Decreased Expenses: Feed, Fertilizer, Pesticide, and Fuel

The expected reductions in crucial spending areas are remarkable. Feed expenditures, the most major single cost for farmers, are expected to decrease by $9.8 billion (12.3 percent) from 2023 levels. This decline is primarily due to lower feed costs, which should alleviate the financial pressure on dairy producers.

Fertilizer expenditures, including lime and soil conditioners, are predicted to fall by $3.5 billion (9.7 percent) to $32.4 billion. This decrease is primarily due to an expected decline in fertilizer costs, an economic move that every farmer should be aware of.

Pesticide expenses are also expected to fall by $2.3 billion (10.4 percent), driven mainly through decreased pricing in the next year. Similarly, gasoline and oil expenditures are expected to reduce by $1.7 billion (9.6 percent), reflecting lower global energy prices.

The USDA’s Latest Forecast Signals Mixed Implications for Dairy Farmers and Agribusinesses

The USDA’s new projection has mixed consequences for dairy farmers and agribusinesses. Let’s look at what these data represent for you on the ground.

First, some good news: milk receipts are up. The prediction predicts a considerable rise in milk revenues of $4.3 billion, or 9.4%, in 2024. This increase is primarily due to better pricing and bodes suitable for dairy producers. Higher revenues imply more income pouring into your operations, an excellent buffer in these volatile market times.

Along with this, there’s more to grin about. Production expenses are decreasing. Total production expenditures will fall by $4.4 billion, or 1%, from 2023. This translates into reduced feed and fuel expenses for dairy producers, among other benefits. Feed purchases, a substantial portion of your costs, are expected to decline by 12.3%, adding to a better bottom line.

So, what can you do to capitalize on these positive trends? Here are a few actionable insights:

- Optimize Your Feed Strategy: With anticipated lower feed costs, consider investing in high-quality feed to boost milk production. Enhanced nutrition can lead to better herd health and productivity.

- Plan for Capital Investments: The increase in milk receipts might create a buffer for long-desired upgrades to your equipment or facilities. Investing in technology could further reduce labor costs and improve efficiency.

- Focus on Energy Efficiency: With fuel expenses projected to decrease, now is an excellent time to evaluate your energy usage. Implementing energy-saving technologies can lead to long-term savings, freeing up more of your budget in future years.

- Risk Management: Given the variability in government payments, ensure a robust risk management strategy. Tools like crop insurance and diversified income streams can provide stability amid the ebb and flow of federal support.

Although the expected drop in crop revenues may present problems, the increase in milk receipts and reduced production expenditures provide excellent prospects for dairy farmers and agribusinesses. By effectively controlling expenses and reinvesting profits, you may manage the following year with increased resilience and optimism.

The Bottom Line

The USDA’s most recent agricultural revenue statistics show a complicated but encouraging picture for 2024. While total farm cash revenues and net income are expected to fall, the loss pace has eased, indicating some stability. The predicted increase in animal and animal product revenues, notably dairy, cattle, and eggs, provides a positive view of these problems. Production costs are also expected to fall, thereby alleviating financial strains.

Despite expected drops in crop revenues, particularly for essential commodities such as maize and soybeans, the overall trend remains encouraging. These insights urge us to question how you will use this projection to secure a profitable 2024 for your farm and company.

To stay ahead, you must be both knowledgeable and proactive. Subscribe to updates, engage in industry forums, and stay current on trends to adjust quickly to changes. Explore the USDA’s statistics tables and figures, or read our linked articles on 2024 dairy exports and milk yields and the influence of cheese exports on Chinese demand.

Learn more:

- Is 2024 Shaping Up a Disappointing Year for Dairy Exports and Milk Yields?

- How Cheese Exports and China’s Demand are Powering the US Dairy Economy in 2024

- US Dairy Farmers’ Revenue and Expenditure rose slightly in March

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!