Why are U.S. cheese exports soaring while NFDM/SMP plummets? What does this mean for dairy farmers? Get the key insights and trends now.

Summary: 2024 has been a mixed bag for U.S. dairy exports. Cheese and whey have shown impressive growth, with cheese exports increasing by 24% year-to-date and whey exports growing by 12% in June, driven by demand from Mexico, Central America, China, and Southeast Asia. However, nonfat dry milk/skim milk powder (NFDM/SMP) exports have struggled, leading to an overall decline of 1.7% in dairy exports and a 5% decrease in year-to-date export values to $4.09 billion. Economic challenges, such as a weakened peso in Mexico and rising U.S. cheese prices, are impacting U.S. suppliers, who will need to reconsider pricing strategies and explore new markets in the second half of the year.

- Cheese and whey exports have seen significant growth, with cheese exports up 24% year-to-date.

- Whey exports grew by 12% in June, driven by demand from Mexico, Central America, China, and Southeast Asia.

- NFDM/SMP exports have struggled, contributing to an overall 1.7% decline in dairy exports.

- Year-to-date export values have decreased by 5%, amounting to $4.09 billion.

- Economic challenges, including a weakened peso in Mexico and rising U.S. cheese prices, are impacting U.S. suppliers.

- U.S. suppliers need to reconsider pricing strategies and explore new markets in the second half of the year.

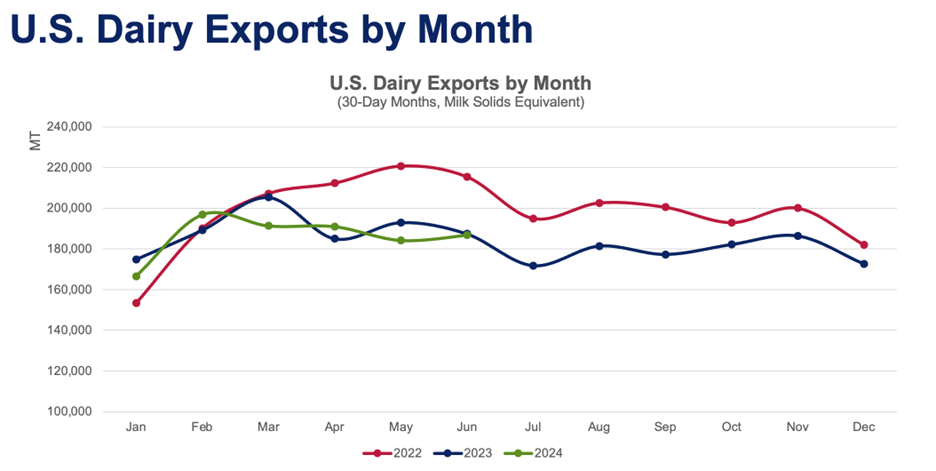

Did you know that the United States’ dairy exports fell unexpectedly in the first half of 2024? The worldwide dairy market had a 1.7% fall, indicating a tumultuous year for producers and exporters. However, the U.S. dairy industry has shown remarkable resilience in the face of these challenges. How may this affect your operations? Throughout these struggles, there have been both highs and lows. Cheese exports have been a bright area, with significant increases. However, NFDM/SMP needs to perform better. Please remain with me as we investigate these events and their implications for the industry. At the halfway mark of 2024, U.S. dairy exports showed a 1.7% decline.

Have You Noticed the Remarkable Climb in U.S. Cheese Exports This Year?

| Month | U.S. Cheese Exports (Jan 2024 – Jun 2024) | U.S. Cheese Exports (Jan 2023 – Jun 2023) |

|---|---|---|

| January | 38,400 metric tons | 31,200 metric tons |

| February | 37,000 metric tons | 29,500 metric tons |

| March | 40,500 metric tons | 32,800 metric tons |

| April | 43,000 metric tons | 35,000 metric tons |

| May | 41,800 metric tons | 33,000 metric tons |

| June | 38,876 metric tons | 35,500 metric tons |

Have you seen the extraordinary increase in U.S. cheese exports this year? We’re talking about a staggering 24% year-to-date rise, which sets an unparalleled record pace. What is driving this tremendous growth? For starters, increased demand from key countries such as Mexico and Central America has played a significant role. For example, in June, US cheese exports to Mexico grew by 12%, while shipments to Central America jumped by 27%. These main markets are driving the rocket and aren’t slowing down anytime soon.

The Winning Streak: How U.S. Whey Exports are Soaring to New Heights

| Period | Dry Whey (Metric Tons) | WPC (Metric Tons) | Modified Whey (Metric Tons) | WPC80+ (Metric Tons) |

|---|---|---|---|---|

| Jan 2023 – Jun 2023 | 12,500 | 15,300 | 14,200 | 36,200 |

| Jan 2024 – Jun 2024 | 14,000 | 16,200 | 17,460 | 43,086 |

Whey exports continue to rise, with low-protein and WPC80+ products doing exceptionally well. They increased by 12% in June alone, reaching 5,446 metric tons. This spike is mainly driven by strong demand from leading consumers in China and Southeast Asia.

Why is this happening, you ask? While overall dairy demand has been weak, China’s whey market has shown resiliency, with a 1% year-over-year reduction in June—the smallest drop this year. This tiny drop demonstrates a steady interest despite more considerable market changes. More impressively, the increase in high-protein whey products cannot be ignored. WPC80+ shipments climbed by 5% in June, totaling 344 metric tons. Year-to-date results are even more promising: WPC80+ exports increased significantly by 19%, totaling 6,886 metric tons. Both growing markets like Brazil and established players like China saw significant improvements.

So, what is the end outcome of all this growth? It puts upward pressure on domestic whey pricing, which has seen spot-dry prices reach multi-year highs. Due to growing worldwide demand, especially in Asian markets, the U.S. dairy sector is expected to gain more success in 2024.

What’s Behind the Significant Decline in NFDM/SMP Exports?

| Month | NFDM/SMP Exports (Jan-Jun 2024) | NFDM/SMP Exports (Jan-Jun 2023) |

|---|---|---|

| January | 50,000 metric tons | 52,000 metric tons |

| February | 48,000 metric tons | 50,500 metric tons |

| March | 47,500 metric tons | 51,000 metric tons |

| April | 45,000 metric tons | 48,000 metric tons |

| May | 44,000 metric tons | 47,500 metric tons |

| June | 42,500 metric tons | 46,000 metric tons |

Dairy producers, have you seen the decline in NFDM/SMP exports to critical markets such as Mexico and Central America? With decreases of 21% and 36%, respectively, these numbers are more than simply statistics; they reflect actual concerns for U.S. suppliers. What’s causing the drops? Several variables are in play. Economic difficulties in Mexico, such as a weakened peso and slower GDP growth in the second quarter, pose substantial challenges. These financial circumstances restrict Mexican purchasers’ buying power, lowering demand for imported U.S. dairy goods.

Rising cheese costs in the United States complicate competition even more. As cheese prices rise, so do the costs for U.S. vendors to make and export NFDM/SMP. This cost increase causes customers in crucial markets to look for more economical alternatives, thus reducing NFDM/SMP export quantities. So, what comes next? As we enter the second half of the year, the burden is on U.S. suppliers to navigate these treacherous seas. They must balance their pricing strategies and expand into new areas to compensate for deficiencies in existing ones.

Do you see similar tendencies on your farm? How are you going to adapt?

A Tale of Two Markets: Navigating the Ups and Downs of U.S. Dairy Exports in 2024

The narrative of U.S. dairy exports in 2024 is full of contrasts. In June, export volumes in South America, South Korea, and the Caribbean increased by 2,131, 2,033, and 1,620 metric tons, respectively. These increases not only indicate significant demand but also the potential for future market development in these locations. Exports to Mexico fell 12% in June, reflecting the challenges posed by a weaker peso, slower GDP growth, and increased cheese costs in the United States. These contrasting developments reflect a complicated export market that American dairy producers must carefully navigate in the coming months.

Resilience Across Markets: How U.S. Dairy is Adapting to Global Shifts

China’s total demand for dairy imports remains low, a pattern that has harmed key exporters, notably the United States. Despite this, dairy exports from the United States to China fell by just 1% year on year in June, the lowest decrease this year. This suggests that the market remains resilient amid more significant demand issues. One dairy business buddy told me, “Sometimes you’ve got to take the small wins when they come.” That is the case here.

The narrative becomes more favorable when we move our focus to Southeast Asia. After two months of decrease, U.S. dairy exports to this area recovered sharply in June. Nonfat dry milk/skim milk powder (NFDM/SMP) and low-protein whey drove this recovery. Shipments to Southeast Asia increased by 21% for NFDM/SMP (3,474 metric tons) and 19% for low-protein whey (1,912 metric tons). This increase in demand from Southeast Asia is a breath of fresh air for U.S. dairy exporters, providing a solid counterweight to China’s more sluggish demand.

The divergent results in China and Southeast Asia underscore the need for diversifying export tactics. While one market may be decreasing, another may offer strong growth potential, which may assist in stabilizing total export performance. “Adaptability is key in this business,” a seasoned exporter recently told me, and it seems that U.S. dairy exporters are doing just that.

Grasping Global Market Dynamics: The Key to Understanding U.S. Dairy Export Trends

Understanding the global market factors that drive these patterns is critical for seeing the broader picture. Currency changes, trade rules, and the economic situations of important importing nations all substantially impact U.S. dairy exports.

- Currency changes are the critical factor. A lower U.S. currency typically makes American dairy goods more competitive overseas, increasing export volumes. A higher currency, on the other hand, may reduce demand by raising the cost of American goods for international consumers. Despite other economic concerns, the current strength of the peso versus the dollar has increased cheese exports to Mexico.

- Likewise, trade policies have a significant influence. Tariffs, trade agreements, and regulatory changes may all impact U.S. dairy exports in different countries. The United States-Mexico-Canada Agreement (USMCA) has proven critical to sustaining strong dairy commerce with neighboring nations. However, ongoing conflicts and renegotiations might create uncertainty, impacting exporters’ planning and strategies.

- Economic factors in key importing nations are also influential. Countries experiencing economic development tend to boost imports, which benefits U.S. dairy exporters. Conversely, economic downturns may diminish demand. For example, China’s dampened dairy import demand has followed its economic downturn. However, this has been somewhat offset by increased demand in other places, such as Southeast Asia.

Geopolitical events and global disasters, such as the COVID-19 pandemic, add further difficulties. These events can disrupt supply chains, change consumer behavior, affect international logistics, and influence export patterns.

Overall, remaining informed about global market dynamics gives dairy farmers and exporters the information they need to manage an ever-changing world. Understanding these effects may aid in strategic decision-making, trend forecasting, and competitiveness in the global dairy industry.

So, What Do These Export Trends Mean for You, the Dairy Farmer?

So, what do these export patterns imply for you as a dairy farmer? If you make cheese, the percentages are definitely to your advantage. The strong 24% growth in year-to-date cheese exports suggests high demand, particularly in major countries such as Mexico and Southeast Asia. This might result in higher product pricing and more steady revenue.

However, only some things are going well. If your farm largely relies on producing nonfat dry milk/skim milk powder (NFDM/SMP), the 1.7% drop in U.S. dairy exports may be worrying. Significant decreases in NFDM/SMP shipments to Mexico and Central America indicate issues ahead. Sluggish economic growth and a devalued peso may further reduce demand in these sectors.

Have you considered changing your company strategy to reflect these trends? This is an excellent moment to rethink your product strategy or explore other markets. After all, remaining agile might mean the difference in the ever-changing environment of dairy exports.

The Bottom Line

As we’ve examined the midyear report on U.S. dairy exports, it’s evident that the industry is seeing mixed results. Cheese exports have stood out, continuously increasing and reflecting strong global demand. In sharp contrast, NFDM/SMP exports have fallen significantly, prompting worries about changing market dynamics and competitiveness. While whey exports show potential, especially in major Asian countries, the intricate interplay of global economic variables continues to drive the U.S. dairy industry. Let me ask a big question: How can dairy producers adjust to changing international circumstances to secure long-term export growth?

Learn more:

- U.S. Dairy Exports Drop 5% in May as Cheese Continues to Shine Amid a Challenging Year

- Markets are not Bullish or Bearish, but Indecisive: Cheese Stocks Shrink Amid Soaring Milk Demand

- How Cheese Exports and China’s Demand are Powering the US Dairy Economy in 2024