Explore the rapid growth of Texas’ dairy industry as it narrows the milk production gap with Idaho. What are the key factors behind this impressive rise, and is Texas poised to overtake Idaho in the near future?

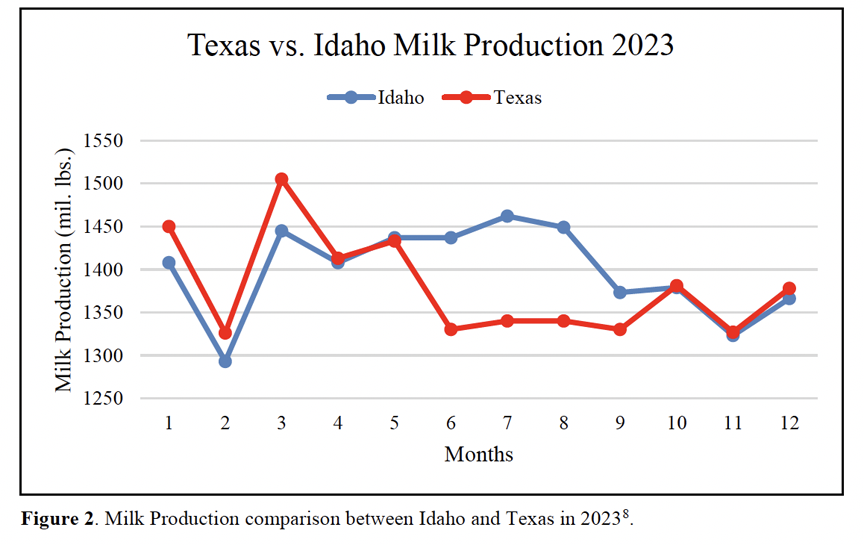

Regarding milk production, Texas is making remarkable strides in closing the gap with Idaho. As of the end of 2023, the Texas dairy industry trails Idaho by just 1.4%, a substantial leap given the past two decades. From 2003 to 2023, Texas has surged with an 11.5 billion pound increase in milk production, achieving an impressive growth rate of about 195%. This rapid increase has propelled Texas from the ninth to the fourth largest milk-producing state in the U.S., positioning it on a trajectory that could soon overtake Idaho. As the numbers show, “Texas produced more milk than Idaho during the early months of 2023,” a testament to the state’s growing dominance in the dairy industry.

Let’s delve into the factors driving Texas’s impressive growth in milk production and its potential to surpass Idaho as a leading dairy producer.

Historical Growth (2003-2023)

Texas is fast closing the milk production gap with Idaho, now trailing by just 1.4% at the end of 2023. This impressive surge stems from the state’s dramatic growth in milk production from 2003 to 2023. Here’s a breakdown of key data illustrating this progress:

| Year | Milk Production (billion pounds) | Ranking in the US |

|---|---|---|

| 2003 | 5.9 | 9th |

| 2010 | 8.3 | 7th |

| 2015 | 10.4 | 5th |

| 2020 | 12.5 | 4th |

| 2023 | 17.4 | 4th |

The rapid increase in milk production has propelled Texas from the ninth to the fourth largest milk-producing state in the U.S.

From 2003 to 2023, Texas witnessed an astounding jump in milk production by 11.5 billion pounds, marking an impressive growth rate of roughly 195%. This explosive growth has established Texas as a vital player in the U.S. dairy industry and elevated its status on the national stage.

Rising from ninth to fourth largest milk-producing state, Texas overtook New York in 2020, showcasing the dynamic expansion of its dairy sector over the past two decades.

Despite the challenges posed by the summer heat, Texas’s dairy industry has shown remarkable resilience. While the heat stress led to a decline in production during the hotter months, it did not deter Texas’s annual production gains. This resilience underscores the dairy industry’s adaptability and its potential for further growth.

Regional Focus on Milk Production

| Year | Texas Milk Production (Billion Pounds) | Idaho Milk Production (Billion Pounds) | Difference (Billion Pounds) |

|---|---|---|---|

| 2003 | 5.9 | 9.6 | 3.7 |

| 2008 | 7.8 | 12.3 | 4.5 |

| 2013 | 9.6 | 13.5 | 3.9 |

| 2018 | 11.3 | 15.0 | 3.7 |

| 2023 | 17.4 | 17.7 | 0.3 |

The Texas Panhandle plays a pivotal role in the state’s dairy industry, significantly influencing its milk production. A staggering 75% of Texas’s milk supply originates from this region, with Hartley County alone contributing an impressive 19% of the state’s total. This concentration of dairy farming makes the Panhandle a key player in Texas’s dairy sector.

Meanwhile, Eastern New Mexico is also a significant player in the region’s milk production, contributing about 80% of New Mexico’s total. When you compare these two areas, it’s evident that both are dairy powerhouses. However, the Texas Panhandle stands out with its highly concentrated and efficient dairy production model that drives the state’s impressive growth.

Key Drivers Behind Texas’ Dairy Boom

The surge in dairy cow inventory has been pivotal in driving Texas’ milk production upward. Over the past two decades, the doubling of dairy cow numbers has directly influenced the total milk output.

Advancements in genetic selection have empowered farmers to breed cows that are both more productive and resilient. Enhanced nutrition and state-of-the-art facilities ensure that each cow achieves optimal milk production efficiency.

Technological innovations have also been transformative. Contemporary dairy operations leverage advanced tools such as health monitors, rumination collars, and robotics. These technologies help mitigate production costs and labor shortages and enhance animal welfare.

Furthermore, expanding processing plants has provided much-needed infrastructure to match the growing milk production. With new facilities coming online, Texas dairy producers are well-equipped to handle larger milk volumes, ensuring a resilient supply chain.

Obstacles and Innovations

The Texas dairy industry faces several challenges, with the reduction in dairy farms being among the most significant. This decline mirrors a broader national trend but has noticeable effects on local production dynamics. Despite fewer farms, Texas has managed to sustain and expand its milk production capacity through crucial adaptations.

One significant adaptation in the Texas dairy industry is the strategic shift towards producing higher-priced fluid milk. This shift allows dairy farmers to achieve better returns, compensating for the decreased volume with higher prices. The industry views this change positively, as it could potentially lead to slight price increases for all milk sold, thereby benefiting the producers.

“Increased focus on fluid milk offers better returns for dairy farmers, helping to offset the decline in the number of operational farms.”

Additionally, technological adoption has been transformative for the Texas dairy sector. Producers increasingly embrace innovations such as health monitors, rumination collars, and robotics to manage production costs and enhance efficiency. These technologies address labor shortages and improve animal welfare and productivity.

- Health monitors

- Rumination collars

- Robotics

These advancements represent a substantial evolution in dairy farming, enabling Texas producers to remain competitive and resilient in a challenging market.

The Future of Texas Dairy

The potential for Texas to overtake Idaho in milk production is not just promising, but exciting. Should the current trends persist, Texas could soon secure the third-place ranking. The ongoing increase in dairy cow inventory, enhanced dairy farming techniques, and a shift toward higher-priced fluid milk all contribute to this optimistic outlook, signaling a potential turning point in the industry.

New processing plants in Texas are poised to help meet or exceed Idaho’s production levels. Innovative technologies—such as health monitors, rumination collars, and robotics—are enhancing the efficiency and productivity of Texas dairy farms. These advancements also address labor shortages and improve animal welfare, setting the stage for future growth.

Although climate challenges, like summer heat stress, remain a concern, advanced management practices and cooling technologies may help Texas dairy producers mitigate these effects.

The Bottom Line

As Texas closes in on Idaho’s milk production, it’s clear that the state’s dairy industry has experienced a significant transformation over the past two decades. Increased dairy cow inventories, technological advancements, and a focused regional approach contributed to this impressive growth. Despite challenges like heat stress and decreased dairy farms, Texas innovates and invests strategically. With these efforts, the state is well-positioned to climb higher in the national rankings, heralding a bright future for its dairy sector.

Key Takeaways:

The Texas dairy industry is on the rise, closing the gap with Idaho and showcasing substantial growth over the past two decades. Below are some key takeaways illuminating Texas’ remarkable journey in milk production:

- Texas is trailing Idaho by just 1.4% in milk production as of 2023.

- The state has seen a significant increase, growing by 11.5 billion pounds from 2003 to 2023, a growth rate of about 195%.

- The Texas dairy industry surged from ninth to fourth place nationally in milk production within two decades.

- Heat stress during summer months poses challenges, but Texas has been producing more milk than Idaho at certain times of the year.

“This remarkable growth propels Texas onto the national stage, highlighting its capacity to potentially overtake Idaho in the future.”

Summary:

Texas has experienced a significant growth in milk production from 2003 to 2023, becoming the fourth largest milk-producing state in the U.S. with a growth rate of about 195%. The Texas Panhandle region, which accounts for 75% of Texas’s milk supply, is a key player in the dairy sector. Key drivers include increased dairy cow inventory, genetic selection advances, enhanced nutrition, state-of-the-art facilities, and technological innovations. Texas dairy producers are using advanced tools like health monitors, rumination collars, and robotics to mitigate production costs and labor shortages. Expanding processing plants provides infrastructure to handle larger milk volumes. Despite challenges like reduced dairy farms, Texas has managed to sustain and expand its milk production capacity through adaptations. Technological adoption has been transformative for the Texas dairy sector, with producers embracing innovations like health monitors, rumination collars, and robotics to manage costs and enhance efficiency. The potential for Texas to overtake Idaho in milk production is promising, with new processing plants poised to meet or exceed Idaho’s levels.