20% US tariffs hit EU dairy: Ireland’s Kerrygold exports at risk while NZ pays half. Trade war looms—who pays the price?

EXECUTIVE SUMMARY: The US has imposed 20% tariffs on EU dairy imports, disproportionately impacting premium products like Ireland’s €500M Kerrygold butter exports while giving New Zealand a 10% rate advantage. European dairy leaders warn of market distortions and rural economic fallout, citing the EU’s minimal 2% US market share. US producers counter that tariffs address a $3B trade imbalance and EU geographical indication barriers blocking American cheese exports. With retaliatory measures escalating and USDA support programs rolling out, dairy farmers on both continents face volatile markets, higher consumer prices, and urgent decisions about export diversification.

KEY TAKEAWAYS:

- Tariff Inequity: EU dairy faces 20% US tariffs vs. NZ’s 10%, risking Ireland’s €500M Kerrygold exports and 7.5% of its dairy revenue.

- Trade War Fuel: US cites $3B EU dairy imports vs. $167M exports; EU argues tariffs punish niche products that don’t compete with US brands.

- Geographical Indications Clash: US cheesemakers demand reciprocity, protesting EU rules blocking terms like “feta” for American products.

- Grass vs. Grain Systems: Due to export dependency, Ireland’s pasture-based farms face higher risks than diversified EU operations.

- Farmer Action Steps: Assess export exposure, model tariff impacts, and leverage USDA/EU crisis programs to mitigate losses.

The European dairy industry is reeling from Wednesday’s announcement that the US will slap a hefty 20% tariff on EU imports, creating what many industry experts call an unjustified competitive disadvantage that threatens both European producers and American consumers. With New Zealand facing just 10% tariffs on similar products, European dairy leaders warn that this isn’t just about cheese – it’s about the future of transatlantic agricultural trade.

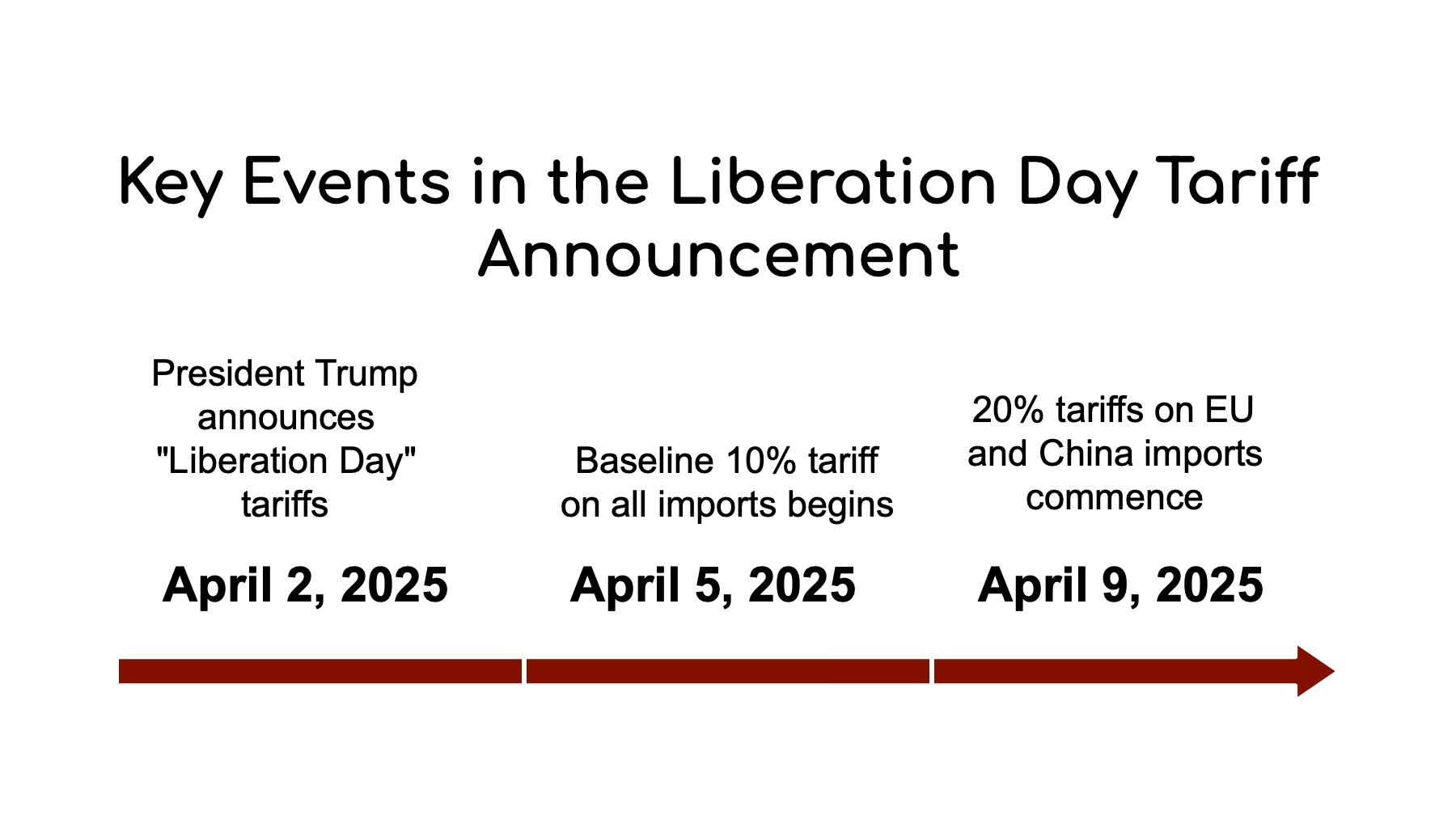

The Liberation Day Bombshell

On Wednesday night (April 2, 2025), President Trump announced sweeping new tariffs on imported goods in what he dubbed “Liberation Day” for American manufacturing and agriculture. The plan imposes a baseline 10% tariff on all imports starting Saturday (April 5) but significantly higher 20% rates for the European Union and China beginning April 9.

The European Dairy Association (EDA) immediately condemned the decision as “unjustified,” pointing out that EU dairy exports—particularly cheese—account for less than 2% of US domestic consumption. Alexander Anton, the EDA’s secretary general, emphasized that European cheeses “serve a unique market segment in the US, offering choice and excellence to US consumers, and therefore do not compete directly with American dairy products.”

The situation is particularly troubling for European producers because of the competitive disadvantage created by the tariff structure. While EU dairy products face a 20% barrier, New Zealand dairy will only be hit with a 10% tariff, tilting the playing field toward one of Europe’s biggest competitors in premium dairy.

Ireland’s Grassland Dairy Empire Feels the Squeeze

Ireland stands to take one of the hardest hits from these tariffs. In 2024, the country exported €1.9 billion in food and drink to the US, with dairy products accounting for a substantial €830 million of that total.

The Irish Farmers Association (IFA) has specifically highlighted concerns about Kerrygold butter, now the second-best-selling butter brand in the American market. Ireland sent almost €500 million worth of Kerrygold to the US in 2024, with the market representing approximately 7.5% of Ireland’s total dairy exports.

“The fact that New Zealand only has a 10% tariff for dairy products while the EU will have 20% tariffs will leave us at a competitive disadvantage against some of our biggest competitors,” warned the IFA in a statement released this morning.

The Timing Couldn’t Be Worse

This latest trade salvo comes at a challenging moment for Europe’s dairy sector, which is already navigating multiple global challenges.

“Our sector is already under enormous pressure from China’s anti-subsidy investigation and ongoing global challenges. Now, US tariffs risk compounding that crisis,” Anton stressed. “This is a blow to European rural economies – and to the spirit of fair and rules-based trade.”

The timing creates a perfect storm combined with the EU’s recent announcement (March 14) of $28 billion in counter-tariffs on US goods, including dairy products. This back-and-forth implementation of trade barriers suggests a concerning pattern of retaliatory measures that could continue to damage both economies.

US Dairy’s Perspective: Addressing Long-Standing Imbalances

While European dairy organizations condemn the tariffs, US dairy leaders have expressed support for the measures, viewing them as necessary tools to address what they see as longstanding trade inequities.

“Tariffs can be a useful tool for negotiating fairer terms of trade. To that end, we are glad to see the administration focusing on long-time barriers to trade that the European Union and India have imposed on our exports,” said Gregg Doud, President and CEO of the National Milk Producers Federation (NMPF).

Doud went further, suggesting the 20% tariffs might not go far enough: “In fact, 20% reciprocal tariffs are a bargain for the EU considering the highly restrictive tariff and non-tariff barriers the EU imposes on our dairy exporters. If Europe retaliates against the United States, we encourage the Administration to respond strongly by raising tariffs on European cheeses and butter”.

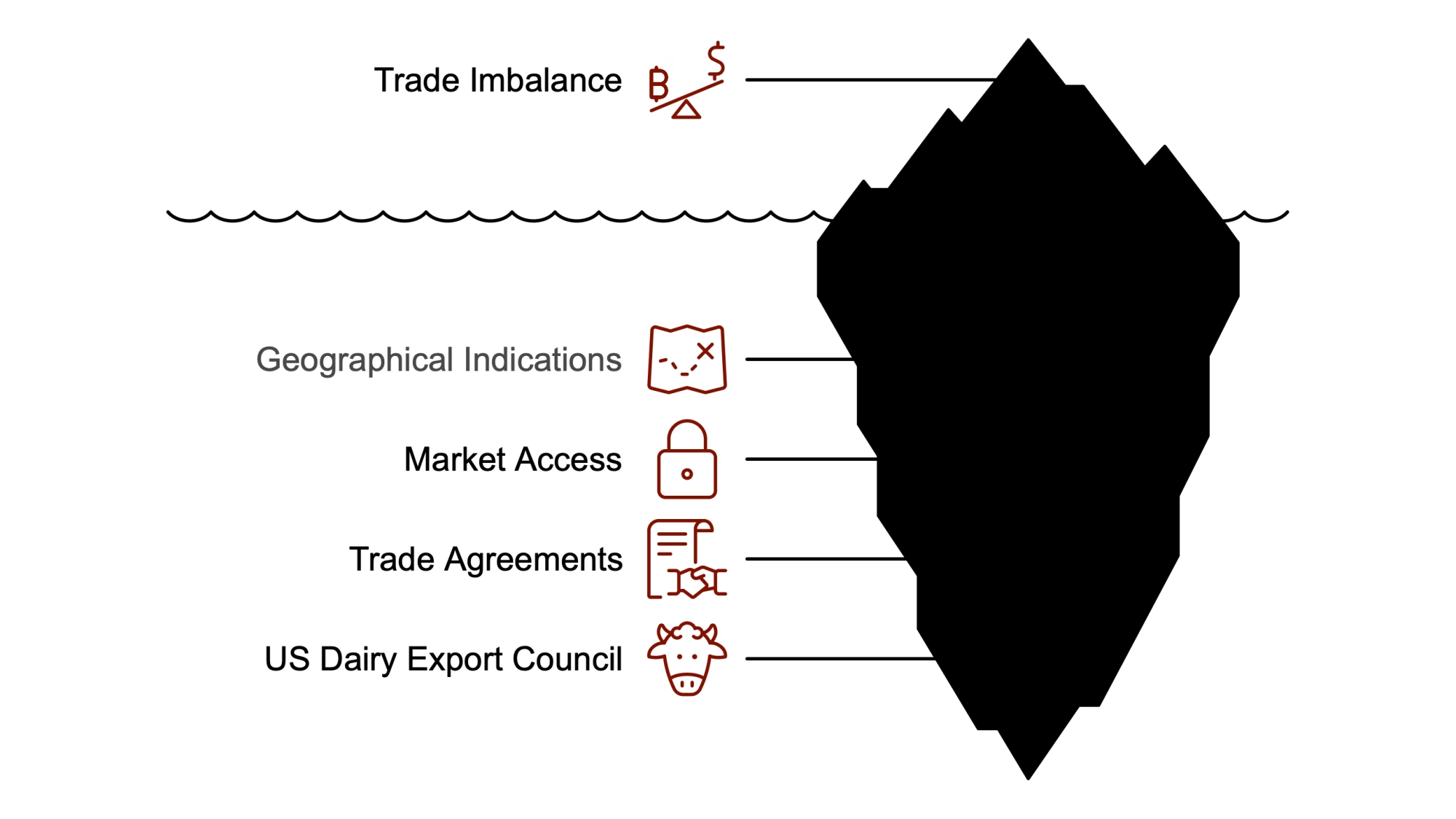

The Trade Imbalance Debate

A significant trade imbalance between the US and EU dairy sectors is at the heart of the dispute. Jaime Castaneda of the US Dairy Export Council highlighted this disparity: “It is clear that, for instance, we need to reset our trade imbalance with Europe. It can’t be that we import three billion dollars of dairy products from Europe, and they buy 167 million dollars from us.”

This 18:1 ratio in dairy trade has long frustrated US producers, who argue that European policies, particularly around geographical indications (GIs), create unfair barriers to American dairy exports. The EU’s protection of terms like “feta” and “gorgonzola” prevents US cheesemakers from using these names in European markets and, through trade agreements, increasingly in other global markets.

NMPF and the US Dairy Export Council submitted joint comments to the US Trade Representative’s Office on March 11. They detailed what they described as “the outrageous trade imbalance between the United States and the European Union and outlined the unreasonable European trade policies driving this disparity.”

The Geographical Indications Battle

The US has long fought the EU over geographical indications for cheese. GIs—which encompass around 3,500 agricultural products, wines, and spirit drinks—are a type of trademark and a way for European producers to promote their regions’ cultural heritage.

These designations mean US cheesemakers cannot call their products “feta” or “gorgonzola” on the EU market because these terms are reserved for use by regionally-made cheeses. A decade ago, the EU caused controversy by wanting to restrict the use of terms such as “parmesan” on US-made cheese as well.

Krysta Harden, President and CEO of the US Dairy Export Council, specifically mentioned this issue: “A firm hand and decisive approach to driving changes are most needed with the European Union and India to correct their distortive trade policies and mistreatment of American agriculture including both imbalanced tariff barriers and nontariff choke-points such as the misuse of Geographical Indications to block sales of our cheeses.”

Global Dairy Chess Game: Beyond the EU-US Dispute

The broader picture reveals a complex web of dairy trade relationships at risk. The US exported $8.2 billion of dairy products in 2024, with projections for 2025 reaching $8.5 billion despite trade tensions. More than half of these exports go to Mexico, Canada, and China – all countries engaged in tariff battles with the US.

The EU-US dairy dispute is just one piece of a more significant trade conflict. President Trump’s “reciprocal tariffs” approach has led to a 10% baseline tariff on all imports, with higher rates for specific countries. The EU (20%), China (54%), and India (26%) face the steepest tariffs, while countries like the UK and Brazil face a baseline of 10%. Notably, Canada and Mexico were excluded from this latest round of tariffs.

USDA Support for Affected Farmers

Recognizing the potential impact of retaliatory tariffs on American agriculture, the US Department of Agriculture (USDA) has announced support measures. Secretary of Agriculture Brooke Rollins stated, “The USDA is prepared to support farmers while tariffs go into place.”

The USDA provided more than $23 billion in federal subsidies during Trump’s first term to help offset the economic impacts of tariffs. Rollins has indicated that similar programs will be implemented this time, noting that the 2018 US-China trade war led to an estimated $27 billion in US agricultural export losses.

On March 18, USDA announced the Emergency Commodity Assistance Program (ECAP), which will directly provide up to $10 billion to agricultural producers to help mitigate the impacts of increased input costs and falling commodity prices. While not explicitly designed for tariff impacts, this program could relieve dairy farmers affected by market disruptions.

Real Farm-Level Impact: The 7.5% Export Vulnerability Factor

These tariffs create concrete business challenges for individual dairy producers. Irish dairy farmers are particularly vulnerable, with 7.5% of their export revenue now threatened by higher tariffs. Using the “€1M in Irish butter tariffs → 14 family farms at risk” formula that industry analysts have modeled, Ireland’s €500 million Kerrygold exports face potential disruption that could impact hundreds of family farms.

German dairy exports, by comparison, send only about 2% of their production to the US market, creating significantly less exposure. This regional disparity means grass-based seasonal systems like Ireland’s face disproportionate harm compared to more diversified continental European dairy operations.

Strategic Response: The EDA’s Call to Action

The EDA has called upon the European Commission to shield EU dairy from further fallout and to respond strategically to the US tariffs. Anton emphasized that “Trade policy must be smart, not punitive. Dairy is not the problem here; using it as a pawn only creates new problems on both sides of the Atlantic”.

The warning extends beyond producer impacts to consumer outcomes, with the EDA cautioning that tariffs could “significantly restrict choice and drive up prices in the American market.” With premium European cheeses, creams, and specialty products appreciated by US buyers, American consumers stand to lose access to products they value.

Where Do We Go From Here? Four Strategies for Dairy Producers

For dairy producers navigating this volatile trade environment, industry experts recommend four key strategies:

- Assess your specific export exposure: Nearly one-fifth of US dairy components (mostly nonfat solids) are exported, so understand how shifting trade flows might affect your milk utilization. European producers selling to premium US markets need to evaluate alternative destinations quickly.

- Implement layered risk management: Consider using the “Trade War Impact Calculator” to model revenue losses under 20% tariffs and breakeven scenarios when shifting to alternative markets. Combine price risk management with strategic inventory management.

- Analyze regional production economics: Production systems based on seasonal grazing (like Ireland’s) face different challenges than year-round confinement operations. Understand your production model’s vulnerability to export disruption.

- Maintain production flexibility: Global dairy demand fundamentals remain strong despite current challenges. Producers who can navigate near-term market volatility while maintaining production capacity will be positioned to benefit when trade conditions normalize.

US vs EU Dairy Trade Positions

| Metric | US Claim | EU Counter |

| Market Share | “EU cheeses threaten domestic growth” | “2% niche share, no competition” |

| Tariff Justification | “Level playing field” | “NZ gets 10% rate unfairly” |

| Trade Balance | “$3B imports vs $167M exports” | “Premium products don’t compete directly” |

| Geographical Indications | “Block sales of US cheeses globally” | “Protect cultural heritage and quality” |

The Final Calculation: Who Pays?

While politicians frame tariffs as protection for domestic industries, the math tells a different story. For European producers, 20% tariffs erode margins that were already thin. For American consumers, reduced access to premium imported products means fewer choices and higher prices. And for rural communities on both sides of the Atlantic, the economic ripple effects threaten jobs and investment.

As one industry analyst put it, “20% tariffs, 98% fallout.” Targeting niche dairy products that represent just 2% of US dairy consumption threatens to disrupt the global dairy industry’s fragile balance while doing little to address the structural trade issues politicians claim to be solving.

The message for dairy farmers watching this unfold is clear: be prepared for more volatility ahead, watch for market signals carefully, and don’t expect a quick resolution to a trade dispute that’s quickly becoming a full-blown trade war.

Crisis Protocol Resources

For EU dairy exporters affected by the tariffs:

- Contact the European Commission’s Trade Defense Instruments team

- Review the USDA’s Dairy Tariff-Rate Quota Import Licensing Program for potential exemptions

- Connect with your national dairy association for market-specific guidance

For US dairy farmers concerned about retaliatory measures:

- Monitor the USDA’s Emergency Commodity Assistance Program (ECAP) for support options

- Applications for ECAP must be submitted to local FSA county offices by August 15, 2025

- Stay informed through the National Milk Producers Federation’s trade policy updates

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!