The latest EU medium term outlook has been released, concluding that sustainability will be the main driver shaping EU production in the next 10 years.

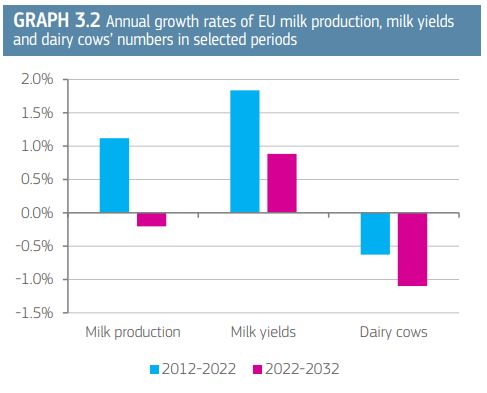

Overall EU-27 milk production is expected to decline by 0.2% per year in the 10 years to 2032. This will mostly be due to reductions in the milking herd as environmental concerns lead to contraction in the size and intensity of dairy farming. Over the forecast period, the reduction in the herd may be as high as 10% compared with 2020-2022. Alternative systems such as organic and grass-based are set to grow, and an increased focus on welfare is expected to allow for some yield growth, although not at high enough levels to compensate for the reduction in the milking herd.

Source: European Commission, DG-Agri

Globally, milk production is set to increase at around 2% per year, with Asian and African countries becoming increasingly self-sufficient. Although the main importing markets will remain in deficit, dairy imports are expected to be lower. The EU will continue to be one of the largest exporters of dairy products, accounting for 24% of global exports, although volumes could be up to 3% lower compared with 2020-2022 levels.

Rising global disposable incomes and increased consciousness about sustainability, health and nutrition are expected to push demand for high quality products, which the EU is well placed to provide. This means the EU export portfolio is likely to change, focussing on quality and adding value to traded products.

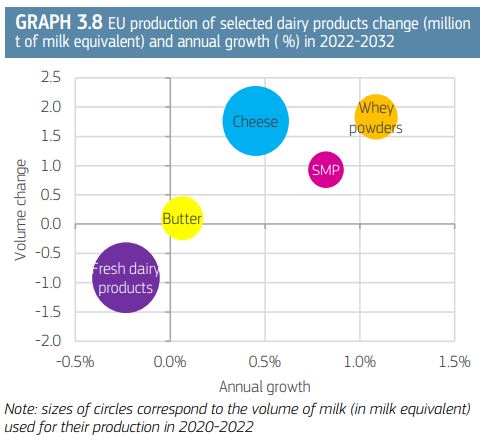

There is also likely to be a reduction in SMP and WMP production, and exports, due to decreased global demand and the high levels of growth achieved from 2012-2022. As powders are mainly used as an input for manufacturing, with increased global milk production there will be less import demand. Cheese and whey exports are also expected to see lower growth than in previous decade, although to a lesser extent than seen for milk powders. The butter export market is expected to remain stable.

Source: European Commission, DG-Agri

The domestic market is expected to remain the largest market for EU dairy, accounting for 83% of production by 2032. However, shifts in consumer tastes and preferences on the domestic market could also impact on the EU product split. Drinking milk demand is likely to continue to decline. Butter demand is anticipated to remain stable, however, it may face increased competition with other fats such as olive oil due to their health attributes. Cheese will continue to be a flagship dairy product for the EU, with further growth in domestic demand anticipated on top of the uplift seen during COVID.

Source: ahdb.org.uk