In its Australian Dairy Seasonal Outlook released last week, the bank said farm exits, reductions in the size of the national cattle herd and subdued farmer investment sentiment would result in record levels of surplus processing capacity in the new season.

Rabobank senior analyst Michael Harvey said there was likely to be more than two billion litres of excess processing capacity across Australia due to a shortfall in milk supply.

“Excess capacity is a challenge for most dairy companies operating in Australia,” Mr Harvey said.

“There is significant movement of milk across the regions, but the system is being stretched and the chronic shortage signifies the urgency to rebuild milk supply to help restore profitability in the processing sector.”

Mr Harvey told The Weekly Times, while rises in the farmgate milk price were inevitable, it was farmers’ margins that were the key to recovery in the industry.

“An autumn break makes a huge difference,” he said.

“It determines whether a farmer has enough home-grown feed or not.

“We do see local feed prices coming off (reducing) over the next 12 months, but that could be six months away at least.

“So margins will be pretty tight for farmers in the first six months of the new season.

“It feeds into the view that milk production could fall even further this year, and with consolidation of herds, farmers continuing to exit (the industry).”

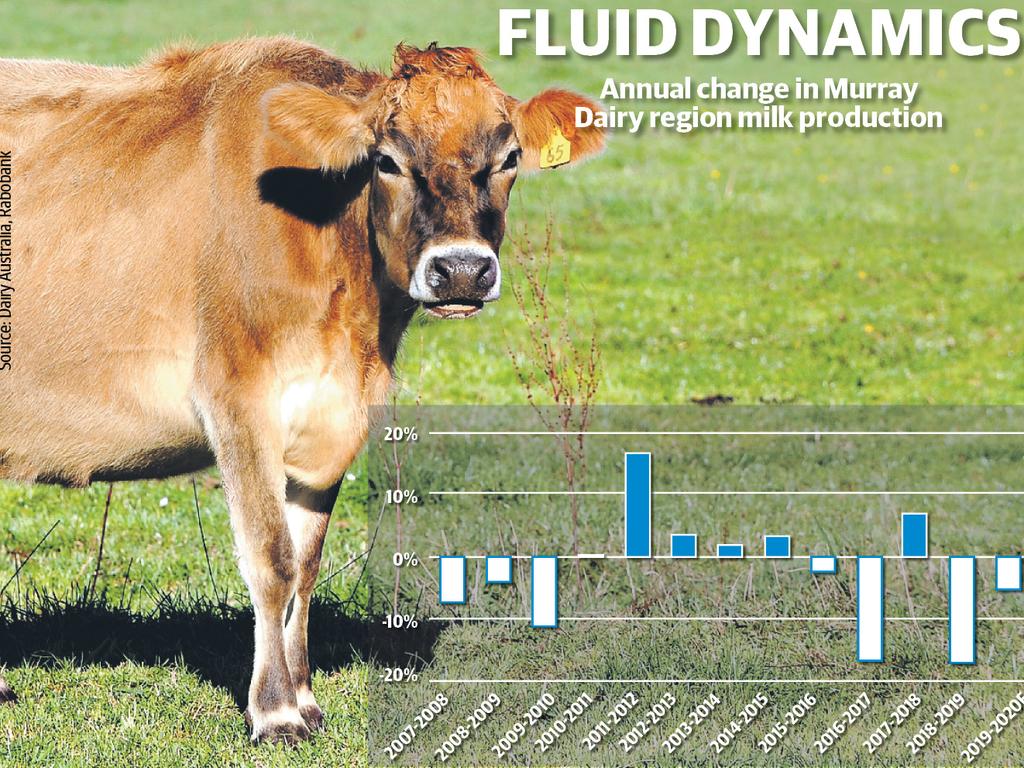

Mr Harvey said the Murray Dairy region was a key to the industry’s fortunes.

Milk production in the region to February had fallen 16 per cent, accounting for 70 per cent of the national decline.

“Rabobank is forecasting another decline in milk production for the Murray Dairy region in 2019-20 — of 5.1 per cent — with the risk weighted to the downside of an even larger fall,” Mr Harvey said in the report.

He said irrigation water prices were likely to remain high due to:

LOWER water storage levels.

AVERAGE to dry inflows forecast for key months.

LOW opening allocations and high risk of lower full-year allowances.

STRONG demand from alternative agricultural users.

United Dairyfarmers of Victoria vice-president John Keely said he agreed with Rabobank’s outlook for the northern region.

Mr Keely said water prices recently shot up to $600 a megalitre, putting it out of the reach of dairy farmers.

“You’re not going to make money on that,” Mr Keely said.

“It’s just guaranteeing you’re going to go broke now, rather than later.”

Mr Keely said it was going to take “a good rain” to return confidence to the industry.

But he expected milk production to fall again next season.

“A lot of farmers will seriously look at their future in the industry up here,” he said.

Source: The Weekly Times