Navigate market volatility with Dairy Revenue Protection. Learn how this risk management program can stabilize your dairy farm’s income amid fluctuating milk prices.

Compared to prior years, a significant decrease in Class III milk prices has troubled the industry. This change has squeezed profit margins and added financial pressure on our farms. But remember, change opens the door for innovation and new ways to tackle emerging issues. In the unfolding market scenario, dairy farmers have potent strategies they can adopt to enhance their financial stability. One strategy that is getting deserved attention is taking part in risk management programs such as the Dairy Revenue Protection (Dairy-RP) program. This vital program acts as a financial safety net for producers, offering a pathway through market unpredictability and strengthening their revenue streams. Being responsive and adaptable in times of change is key to surviving and thriving.

What Is Dairy Revenue Protection?

As dairy farmers, you must be aware of programs like Dairy-RP that are designed to assist you. The program is a highly important initiative from the USDA’s Risk Management Agency (RMA) specifically designed to mitigate risks. A prominent feature of Dairy-RP is its reach, being accessible in every single state in the US. Dairy-RP has had a significant role since its inception in 2020, protecting about a quarter of all milk generated in the country.

Dairy-RP’s key focus is providing support for you, the producers, in comprehending various aspects of your business, such as costs, milk markets, and the capabilities of your herds. The program computes the expected revenue based on future prices for milk and dairy commodities, along with the amount of covered milk production you opt for. Unique to Dairy-RP, the covered milk production is linked to your operation’s marketing order or production arena.

Under the Dairy-RP program, you, as a producer, have the option to secure up to 95% of your expected quarterly revenue. This insurance becomes a safety net at the end of the policy period, when, if your actual milk revenue comes below the final revenue guarantee, you might receive compensation for the shortfall. This unique and robust feature of Dairy-RP is sure to support your business stability and financial security.

Revenue Pricing Options Under the Dairy-RP Program

As a dairy farmer considering the Dairy Revenue Protection (Dairy-RP) program, you’ll have the flexibility to choose between two distinct pricing models: class pricing and component pricing. Making this choice should align with your farm’s operational scale, production methods, and financial objectives.

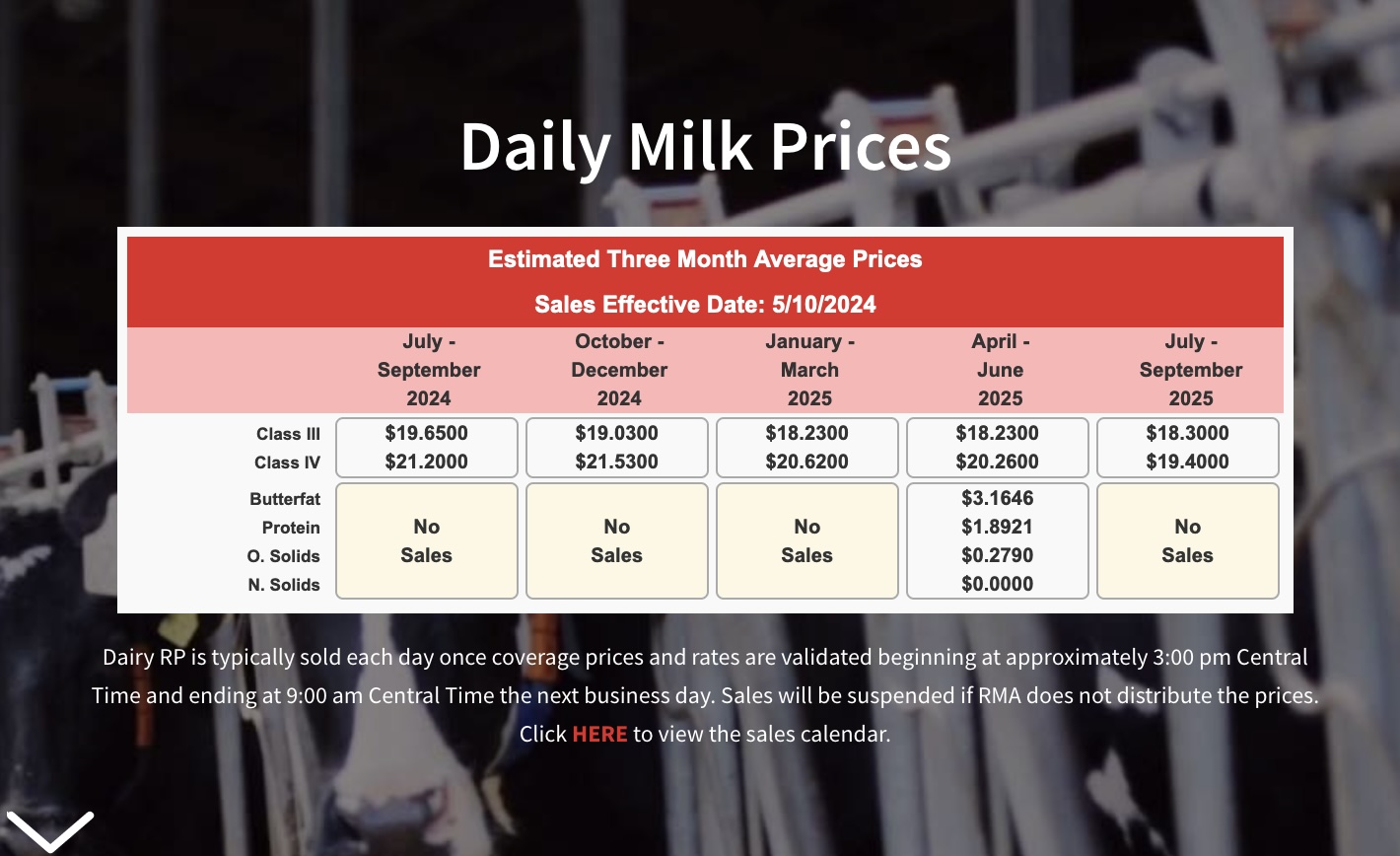

Choosing class pricing could be your preferred path if market fluctuations in Class III and Class IV milk prices directly affect your farm. This model’s protection is built upon a regionalized revenue index, formulated with Class III and Class IV milk prices – the primary classes representing your operation’s milk’s manufacturing value. Here, you have the opportunity to set your price guarantee per hundredweight, providing a safety net against unpredictable dips in milk prices.

Alternatively, if your farm’s revenue predominantly relies on the value derived from milk component production, you should consider opting for the component pricing route. This model calculates your revenue protection based on the production of milk components, including butterfat and protein, allowing you to customize the inclusion percentages of these essential milk constituents. This model also includes a fixed percentage allocation for other solids at 5.7%, adding another layer of comprehensive coverage for your dairy operation.

With these revenue protection options, Dairy-RP provides a flexible approach to secure your farm’s financial stability, allowing you to choose a model that best suits your farm’s unique needs and circumstances. Remember that the goal is to manage risk and safeguard your revenue while testing market conditions.

How Does Dairy Revenue Protection Work?

Dairy-RP is a substantial resource designed specifically to bolster financial stability within the dairy industry. This program aims to foster enduring stability and ease producers’ entry into risk management through the provision of subsidized premiums. Given the varying headwinds you, as dairy farmers, confront—such as fluctuating milk prices, mounting input costs, and challenges in market access—the commitment of Dairy-RP is vital to your operation.

One of the standout aspects of the Dairy-RP program is its adaptability. Unlike a generic, one-size-fits-all program, Dairy-RP allows customization according to the individual requirements of each dairy operation. This attention to detail means that the program can better align with your specific needs, taking into account everything from regional pay structures to environmental factors impacting your operation.

Moreover, the Dairy-RP program actively encourages you to connect with local experts for personalized advice. This localized approach enhances the program’s efficacy, ensuring you understand the specifics of your situation and receive the most relevant support to help streamline your operations. Their valuable insights and support can directly contribute to your bottom line, proving pivotal to your success.

By teaming up with Dairy-RP, you partake in a concerted effort to navigate market volatility effectively, maximizing your revenue while minimizing risks associated with dairy production.

Looking Beyond Historical Programs Toward Comprehensive Solutions

Past risk management approaches like Dairy Margin Coverage (DMC) have proved limiting in certain aspects, leading to the conception of Dairy-RP — a program designed to fill in these gaps, offering a more extensive solution. Therefore, as a dairy producer, you must adopt a multi-faceted strategy that incorporates both DMC and Dairy-RP into your risk management practices.

With ever-increasing industry expenses, ensuring financial stability is a pressing matter for all dairy producers who have competitiveness on their radar. As such, Dairy-RP steps in as an invaluable tool that can guarantee dependable base income, significantly mitigating financial risks associated with inadequate risk management.

Working With Knowledgeable Partners

As a dairy farmer, aligning with companies that demonstrate both expertise and passion for the dairy industry can be invaluable. With their deep understanding and proficiency, these organizations are primed to offer robust Dairy-RP solutions and cater to producers’ unique needs.

Considering the escalating costs and swift advancements in the U.S. dairy industry, the adoption of ground-breaking risk management tools like Dairy-RP is integral. Simultaneously, forging ties with a steadfast ally committed to delivering these tools is critical for a dairy operation to stay competitive. They can provide the tools and the necessary guidance and support to navigate this complex landscape effectively and sustainably.

If you’re contemplating whether to dive into the Dairy-RP pool, let me assure you, your deliberation ends here: just do it! Capable of molding itself to multiple operations, Dairy-RP is one of the top-notch risk management programs designed to back producers during uncertain periods. Its objective is to empower you to face, manage, and even thrive amidst unpredictable market trends.

Unlocking the Benefits of the Dairy Revenue Protection Program

As a dairy producer, diving headfirst into the world of Dairy Revenue Protection (Dairy-RP) can seem daunting. It’s a comprehensive program with many different components to consider. But don’t worry! The benefits far outweigh the learning curve. Let’s delve deeper into what this program has to offer you.

Firstly, Dairy-RP acts as insurance against unexpected declines in your quarterly revenue from milk sales. The unexpected can and often does happen in dairy farming. These variables can affect your bottom line, whether it’s fluctuating milk prices or changes in milk production levels. With Dairy-RP, you have a safety net built to safeguard your income against such unpredictable scenarios.

Secondly, the program offers a degree of customization that aligns with the realities of your farm. You can choose from a variety of milk pricing options under Dairy-RP that align with Federal Milk Marketing Order end-product pricing formulas and the manufacturing value of Class III and Class IV milk. Such flexibility allows for a more accurate reflection of your farm’s unique selling and production attributes.

Indeed, the federal government’s support has been key in creating and maintaining a robust risk management ecosystem like Dairy-RP for dairy farmers. The United States Department of Agriculture Risk Management Agency has proactively developed programs like Dairy-RP, stressing the need for practical measures to mitigate potential revenue fallout.

To take full advantage of Dairy-RP’s potential, a partnership with a veteran in dairy operations could be the game-changer in your journey toward risk management. Companies specializing in the dairy industry are well-equipped to provide valuable insights and help navigate the intricacies of Dairy-RP. These experts can offer a level of consultative support, ensuring that you understand and effectively utilize your Dairy-RP policy.

The Bottom Line

Navigating the complexities of the Dairy-RP program might appear daunting at first glance. However, with comprehensive assistance and adequate understanding, this program has immense potential to greatly bolster your financial resilience and the overall robustness of your dairy operation. By leveraging the advantages of Dairy-RP, you can ensure the long-term profitability and sustainability of your dairy farming endeavor. So, don’t hesitate! Embrace the Dairy-RP program and be assured of better market stability, even in the face of unpredictable dairy market dynamics.

Key Takeaways:

- Embracing the Dairy-RP program can bolster the financial resilience of dairy operations.

- Through Dairy-RP, long-term profitability and sustainability of dairy farming can be ensured.

- The program provides an assurance of better market stability amidst unpredictable dairy market dynamics.

- Dairy-RP aids in mitigating risks associated with fluctuating milk prices and market uncertainties.

- Understanding and effectively utilizing Dairy-RP demands tailored advisory support and proactive participation by farmers.

If you’re a dairy producer, now is the time to take action. Secure your financial stability amidst market volatility by exploring what the Dairy Revenue Protection (Dairy-RP) program can do for you. Benefit from unparalleled support, guidance, and mitigated risks tailored for your dairy operation. Don’t delay – enroll in the Dairy-RP program today and let us help secure your dairy farming future together. Act now, for a more secure dairy farming tomorrow.