In the short term, fewer pigs mean less demand for pig feed and the U.S. whey products that fortify that feed. But USDEC sees longer-term opportunities.

South Korea confirmed a sixth case of African swine fever on Wednesday in a town near its border with North Korea. This follows an acknowledgement last week of the first case in South Korea, indicating the deadly virus is spreading in Asia, with rippling effects on global markets, including dairy.

“There is no treatment or vaccine available for this disease,” says the U.S. Department of Agriculture in an AFS fact sheet. “The only way to stop this deadly

disease is to depopulate all affected or exposed swine herds.”

More than 20,000 pigs had been slaughtered in South Korea as of Tuesday, with about 30,000 more expected to be culled as a preventative measure, according to a report by Reuters news agency. Meanwhile, China’s pig herd is down about one-third from a year ago, according to the Chinese government. Outside analysts have suggested that number is most likely too low, and that the ASF toll will get worse before it gets better.

“We hold the view that it will take over five years for China’s pork production to recover fully from ASF,” Rabobank said in a recent analysis.

What does this mean for U.S. dairy exports?

In the short term, fewer pigs mean less demand for pig feed and the U.S. dairy whey products that fortify that feed.

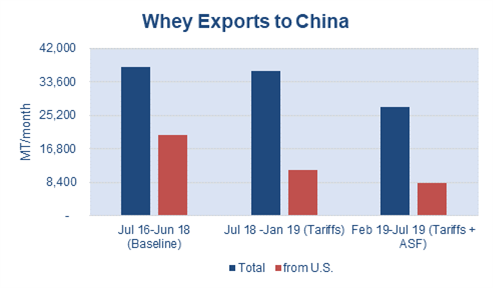

“Swine fever and retaliatory tariffs have imposed a double-whammy on U.S. whey exports,” said Al Levitt, U.S. Dairy Export Council vice president of market analysis.

China’s whey imports have declined by about 10,000 tons a month since February, when ASF began to spread more aggressively, according to an analysis by Levitt.

Includes exports of HS 040410 from U.S., EU, Belarus, Argentina, Ukraine, Australia. Source: USDEC, Global Trade Atlas.

With lost overall demand and lost share due to retaliatory tariffs, U.S. exports are down about 12,000 tons a month compared to the two years prior to retaliatory tariffs being imposed.

South Korea imported 34,633 tons of whey last year with 15,102 tons coming from the United States.

Looking ahead, the U.S. dairy industry has the ingredients, science and nutrition expertise to help Asian countries rebuild their business. Our recommendation for increasing the ratio of permeate in the feed presents a win-win for both growers and U.S. exporters. The potential was discussed last week at a gathering of USDEC’s Ingredient Advisory Group (IAG) meeting in Denver.

American Farm Bureau Federation Economist Michael Nepveux traced the progression of ASF across Asia and explained at the USDEC meeting how China’s pork industry will restructure in the future as small producers are replaced by larger commercial operations.

This could, over time, drive demand for commercial feed rations (using whey permeate) as China’s pig herd is repopulated, he said.

- Is a severe viral disease affecting domestic and wild pigs.

- Is responsible for serious production and economic losses.

- Is a transboundary animal disease (TAD) that can be spread by live or dead pigs, domestic or wild, and pork products.

- Insects and ticks can also transmit ASF.

USDEC discusses solutions in China

In an Aug. 30 meeting in Beijing with government officials at the Ministry of Finance and Commerce (MOFCOM), USDEC President and CEO Tom Vilsack said the United States has the dairy ingredients, scientific research and practical know-how to help rebuild China’s pig herd.

At an Aug. 30 meeting with Chinese government officials in Beijing, Secretary Vilsack (center right) said the U.S. dairy industry has ingredients and expertise to help China rebuild its decimated pig herd. Photo: Courtesy of China Ministry of Finance and Commerce (MOFCOM).

“Research shows that more permeate given to piglets in a higher ratio results in faster growth,” said Vilsack, describing the China meeting in an article he wrote. “We also know that more whey protein given to lactating sows results in more pigs per sow.”

The Chinese thanked Vilsack for his offer. Eleven days later China announced it was waiving its retaliatory tariff on U.S. permeate for feed (protein content 2%-7% by weight, lactose content 76%-88%). Effective Sept. 17, permeate sold under HS 04041000 reverted to its pre-retaliatory tariff rate of 2%.

“Our permeate can now compete on a level playing field in a nation that produced and consumed roughly half of the world’s pork last year,” said Vilsack.

The decision culminated months of groundwork by USDEC staff pursuing the tariff exemption by working closely with Chinese government and industry officials.

China tariffs + ASF = declining exports

The tariff waiver by China only applies to permeate but will help nonetheless.

Levitt echoed Nepveux’s expectation for a recovery in whey demand once herds begin to repopulate over the next several years. In fact, a shortage in the world’s largest pork market has led to record-high prices, making pigs very profitable.

“Operations have a strong financial incentive to restock as soon as it’s safe to do so,” Levitt said. “They also should be quite receptive to increasing whey permeate inclusion rates on piglets to bring them to market faster.”

USDEC organizes ‘win-win’ feed seminars

USDEC is looking to play a role in accelerating the uptake of permeate to rebuild China’s swine population with two full-day seminars Oct. 29 in Beijing and Oct. 31 in Nanchang.

The meetings will present the latest scientific findings demonstrating how incorporating permeate into swine nursery diets can improve profitability, optimize nursery pig growth and gut health, and help farmers rebound from the disease.

“We trust that the information and perspectives shared during our event will help the Chinese swine industry during its herd-rebuilding efforts,” said Annie Bienvenue, USDEC’s vice president, technical services. “We believe that increasing the inclusion rate of permeate in nursery pig diets is a cost-effective strategy to help maximize pig productivity and offers a ‘win-win’ dairy solution for the U.S. and China.”

Source: USDEC