Trade wars meet cheese gluts: Dairy farmers battle tariffs, feed chaos & a milk flood in 2025’s make-or-break year.

Have you checked milk prices lately? Let me tell you, it’s wild out there. We’re staring down trade wars that make Game of Thrones look tame, feed costs swinging like a barn door in a tornado, and cheese production booming like never before. Grab your coffee (or a gallon of whole milk) – we need to talk survival strategies.

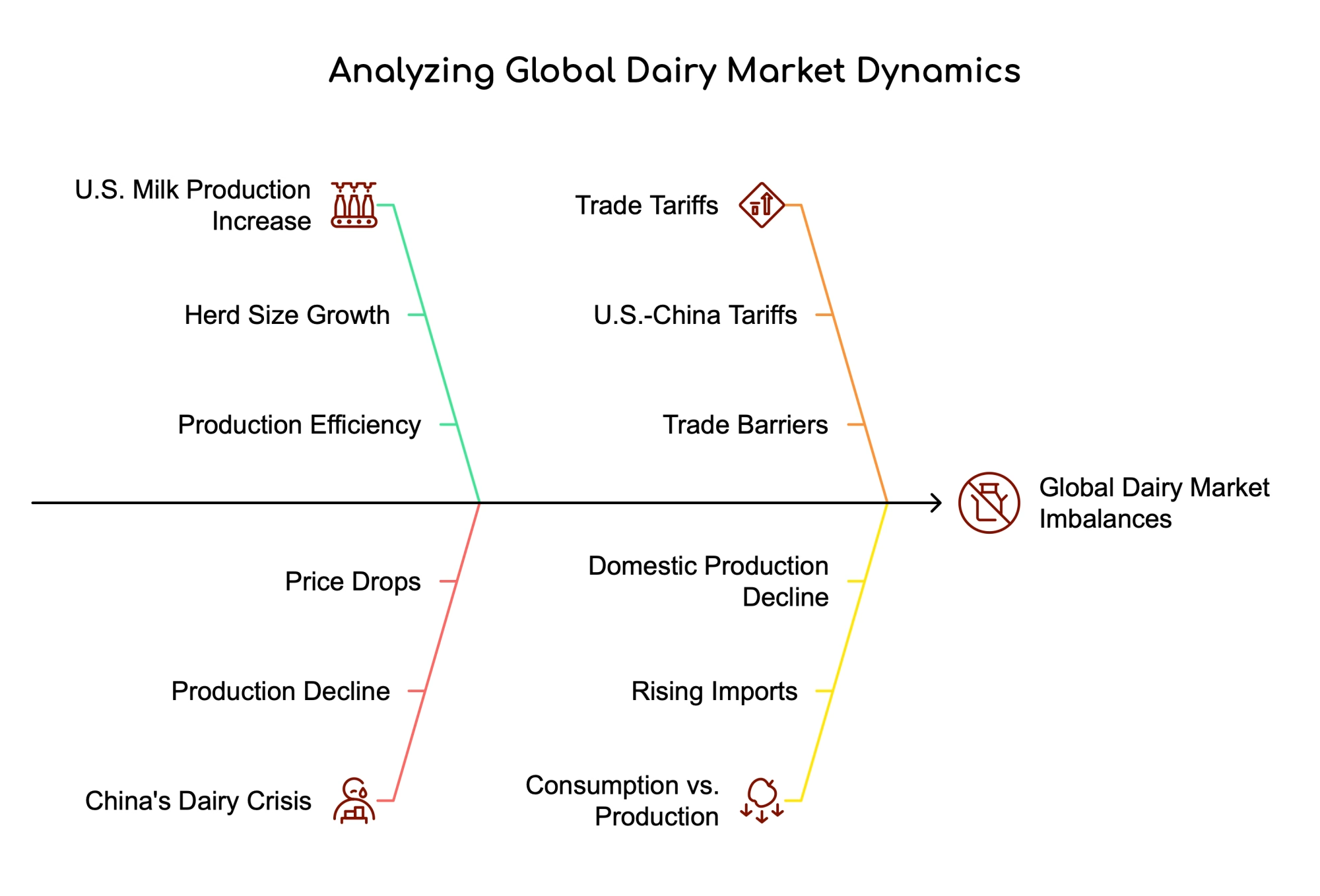

TRADE WARS: YOUR HERD’S NEW WORST ENEMY

Man, our dairy industry’s stuck in the middle of a global slap fight. Since February 2025, we’ve been watching a new round of tariff battles unfold that’s got everyone on edge. Mexico and Canada—our #1 and #2 dairy buyers—are now caught in the crossfire of retaliatory measures. China’s joining the party, too, with 10% duties on U.S. dairy products that went live on March 10th.

You should care: We shipped $8.22 BILLION in dairy products overseas last year. That’s the second-highest export value ever! Mexico alone took $2.47 billion worth, with Canada importing a record $1.14 billion. That’s enough cheese to cover every nacho in Texas! But now? Those golden pipelines clog up faster than a milking machine with bad filters.

The Canada Conundrum “Canada’s screwing us with 300% tariffs!” you’ve heard politicians yell. Here’s the kicker, though – those sky-high tariffs only hit AFTER we fill their import quotas. And guess what? We’re not even CLOSE to hitting those limits.

According to Bloomberg’s March 26th report, “In practice, close to 99.9% of U.S. dairy exports to Canada enter the country duty-free.” But try explaining that to Washington. Now, we’re threatening matching tariffs on their products. It’s like two bulls charging at each other across a frozen pond – nobody wins.

MILK FLOODS & CHINA’S COW CRISIS

Get this – U.S. milk production jumped 1% in February. That doesn’t sound huge until you realize it’s the most significant leap we’ve seen in years. The USDA just raised their projection for the average number of cows in the U.S. herd by 5,000 head to 9.380 million for 2025. Meanwhile, China’s dairy scene is collapsing faster than a heifer on ice skates.

The China Shock:

- Milk production DOWN 2.6% in 2025 (second straight drop)

- Farmgate prices have declined for 24 consecutive months

- Farmers dumping cows like bad Tinder dates

What surprised me is China’s dairy consumption keeps rising while its production tanks. According to Rabobank forecasts, China’s dairy imports are expected to increase by 2% in 2025 after three years of decline. That should be our golden ticket. Except we’re too busy slapping tariffs on each other to cash in. It makes you want to bang your head against the bulk tank.

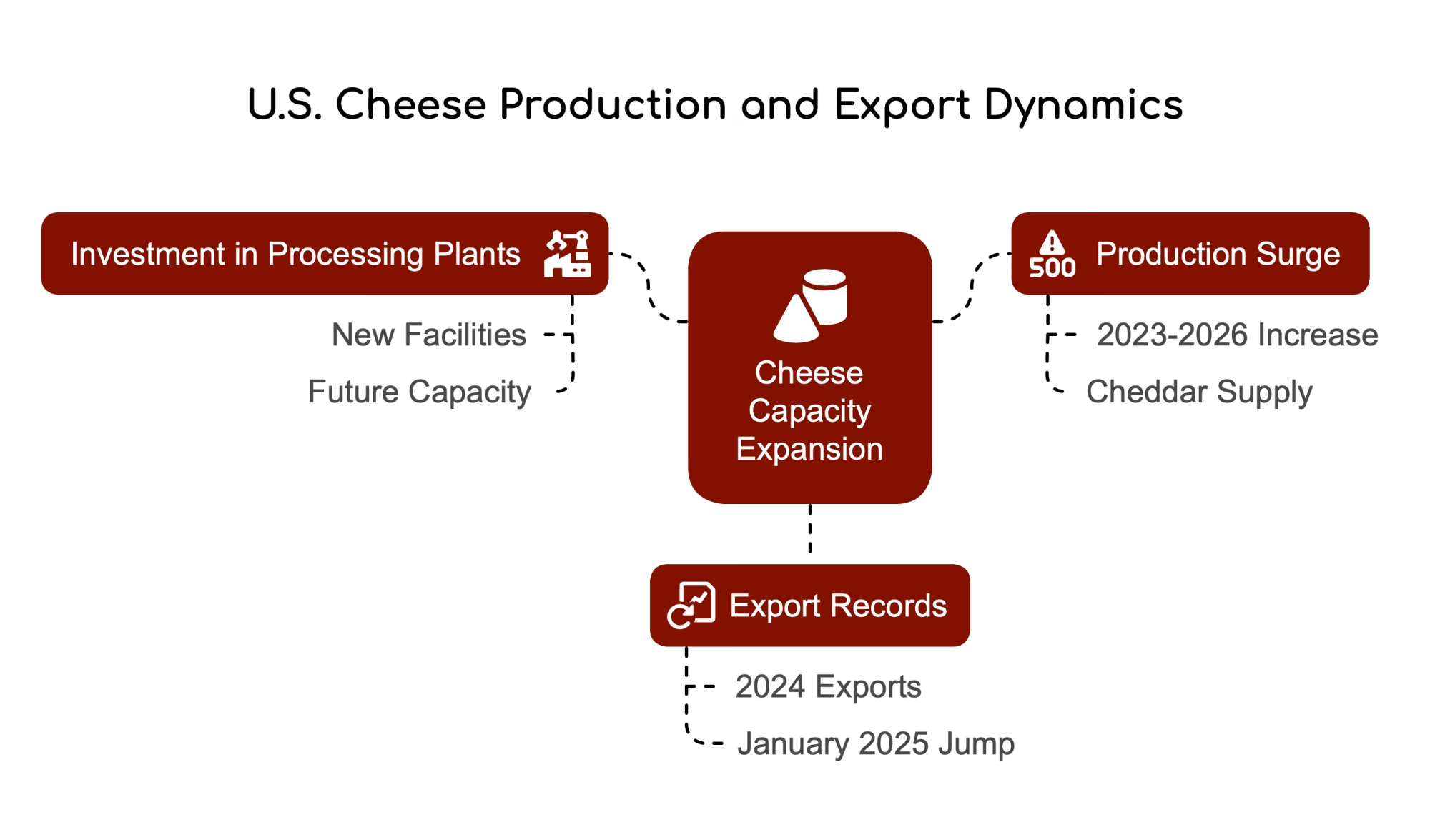

CHEESE CAPACITY: BOOM OR BUST?

Cheese lovers, brace yourselves – we’re building processing plants like no tomorrow. New facilities coming online could drown us in cheddar.

The U.S. dairy industry has invested more than billion in new processing capacity that will come online in the next few years. With more than 450,000 metric tons of new cheese production capacity between 2023 and 2026, we’re looking at a serious supply surge.

The Gut Punch:

- U.S. cheese exports hit 508,808 metric tons in 2024 (17% year-over-year growth)

- Every month since July 2024 has been a monthly cheese export record

- January 2025, cheese exports jumped 22% to 46,680 MT—another record!

Here’s where things get sticky – we’re building cheese plants faster than calves hit puberty. If exports stumble, we’ll be swimming in mozzarella. The latest export data shows U.S. dairy exports inched up just 0.4% to start 2025, with export value rising 20% to 4 million—a January record. However, this growth could quickly reverse with China implementing new tariffs and increasing trade tensions.

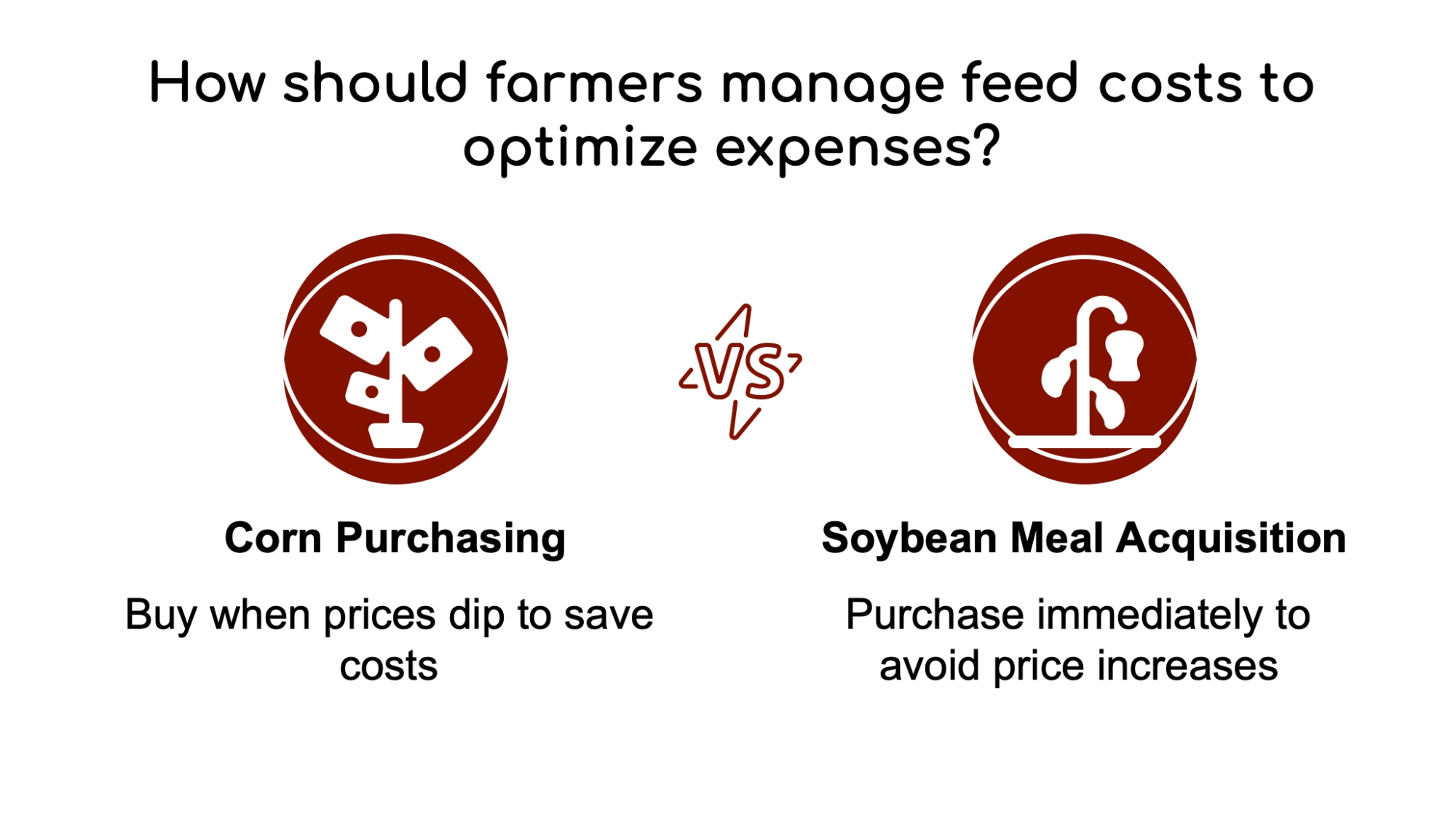

FEED FRENZY: LOCK IT IN NOW

Let’s talk about the elephant in the barn – feed costs could make or break your year. According to USDA’s 2025 dairy forecast, feed expenses are projected to decrease by 10.1% to .4 billion. That’s a bright spot in an otherwise turbulent market.

Pro Tip: When corn dips, buy next year’s supply like you’re stocking up for the apocalypse. And grab that cheap soybean meal NOW – this train won’t stay at the station forever.

Reality Check: I talked to a farmer in New York who was quoted $21k extra for steel barn stalls due to tariffs. “I can’t pass costs on to buyers,” he grumbled. We’re getting squeezed like udders at 5 AM.”

BEEF SAVES THE DAY (FOR NOW)

Here’s the bright spot – beef prices are hotter than a fresh manure pile in July. Those crossbred calves and cull cows? They’re walking ATMs right now.

But (there’s always a but)… If the economy tanks, consumers might balk at premium beef prices. One rancher warned me: “People can only stomach so much $25/lb ribeye before they switch to Spam.”

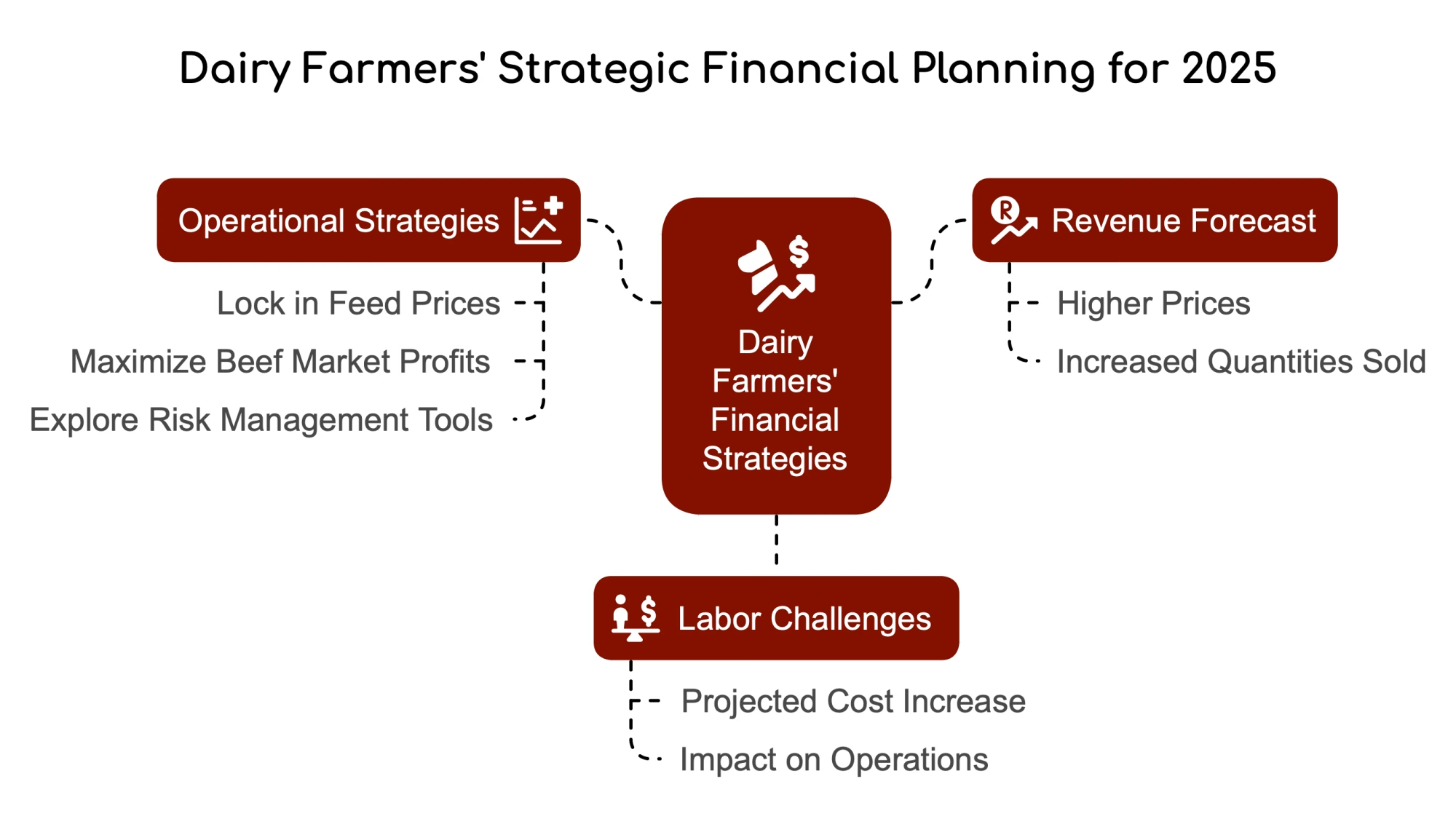

YOUR SURVIVAL TOOLKIT

Here’s the cold, hard truth – dairy farmers must be proactive in their financial and operational strategies throughout 2025. But get this: The USDA’s farm income forecast shows milk receipts are expected to increase by .4 billion (2.7%) to reach .1 billion in 2025, driven by higher prices and quantities sold.

Must-Do Moves:

- Lock in feed prices when the market dips

- Milk every penny from beef markets while they’re hot

- Explore risk management tools like Dairy Margin Coverage (DMC)

Labor Landmines: Labor costs are projected to increase by 3.6% to $53.5 billion in 2025, adding another challenge to dairy operations nationwide.

THE BOTTOM LINE

Here’s what I’m keeping my eye on:

- China’s import recovery: Projected 2% increase in dairy imports for 2025

- Cheese export momentum: January 2025 already set new records

- Milk production trends: USDA projects 226.2 billion pounds in 2025

“Adapt or get milked dry,” as my granddad used to say. The farms that survive will be those dancing between risk management and bold moves. Maybe plant some extra corn, cozy up to your beef buyers, and, for goodness’ sake – keep those export market updates on speed dial.

Now, if you excuse me, I need to recheck feed prices. Clinks coffee mug against yours. Here’s to navigating the dairy chaos together!

Key Takeaways:

- Tariff Tinderbox: 25-300% retaliatory tariffs threaten critical Mexico/Canada markets, risking $2.47B in annual cheese exports.

- China’s Milk Meltdown: Production drops 2.6% as U.S. misses export chances due to trade spats.

- Cheese Tsunami: 450,000+ metric tons of new processing capacity could drown markets without export growth.

- Beef Lifeline: Record prices prop up farms, but consumer spending shifts threaten this safety net.

- Survival Playbook: Lock feed costs, use DMC insurance, and monitor tariffs like your herd depends on it (it does).

Executive Summary:

Dairy farmers face a volatile 2025 as escalating trade wars threaten .22B in exports, China’s collapsing production opens unclaimed opportunities, and a U.S. cheese boom risks oversupply. While feed costs offer rare relief, tariffs, and labor expenses squeeze margins. Beef markets provide temporary relief, but recession risks loom. Survival hinges on locking in feed prices, leveraging risk management tools, and navigating export turbulence. With milk production rising and global tensions mounting, adaptability separates thriving farms from those getting “milked dry.”

Learn more:

- USDA Slashes 2025 Milk Price Forecast By $1: What Dairy Farmers Need to Know

Dive into the math behind the USDA’s controversial price projections and tactical cost-cutting strategies to offset $125K losses. - New 25% Border Tax Hits Dairy Trade: What It Means For Your Farm

Breakdown of how retaliatory tariffs impact cross-border genetics trade, cheese exports, and your herd’s profitability. - Expansion in Cheese Production: Preparing for Surplus and Its Impact on Dairy Markets

Action plan for navigating the 20M-pound daily cheese glut – from export strategies to inventory management.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!