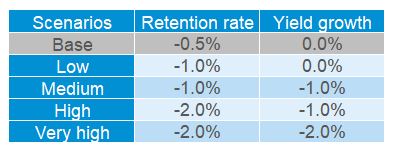

The uncertainty surrounding availability and prices of key inputs makes forecasting milk production for the upcoming season an even trickier task than normal.

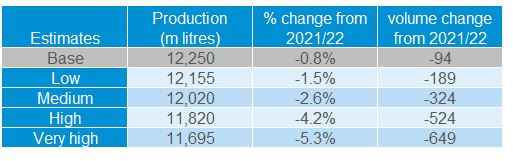

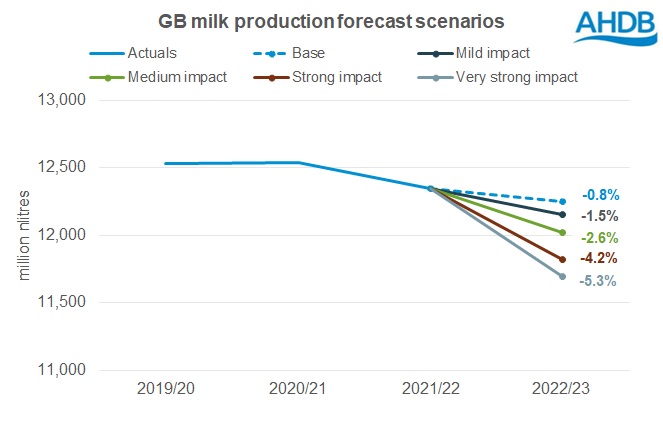

With access to key agricultural inputs and feed ingredients severely impacted by the Ukraine war, we have looked at how milk production may be impacted under alternative scenarios. GB milk production could fall by between 0.8% and 5.3% depending on what happens to feed prices, availability, and milk prices.

Our baseline forecast, completed in March following discussions at the Milk Forecasting Forum, set production for 2022/23 at 12,250 million litres. This represents a drop of 0.8% on the already reduced volumes delivered in 2021/22, estimated at 12,344 million litres.

The baseline forecast assumed a lower than average retention rate and reduced yield growth for the season to zero from the long-term trend of 2.3% annual growth.

Low impact

- Assumes feed costs remain high into the autumn, but milk prices increase sufficiently to cover costs. Good grass growth in the spring provides a good volume of winter silage

- Yield growth remains at 0% for the year as per baseline forecast

- High cull cow prices, plus uncertainty over cashflows in winter arising from a reduced SFP and higher feed costs accelerates destocking. This is accounted for by a reduction in retention rates by 1% from the long-term trend

Medium impact

- Assumes feed costs remain high into the autumn plus higher volume of purchased feed due to lack of silage

- Could also cover situation where there is sufficient winter silage but increases in milk prices are not large enough to cover increased costs leading to a low MFPR

- Either of these situations are assumed to lead to negative yields growth of -1% for the year

- High cull cow prices, plus uncertainty over cashflows in winter arising from a reduced SFP and higher feed costs accelerates destocking. This is accounted for by a reduction in retention rates by 1% from the long-term trend

High impact

- Assumes further increases in feed costs through the year, driven by poor yields in key exporting regions as a result of reduced fertiliser use. In addition, there is a lack of good quality or sufficient volumes of silage for winter feed, leading to increased purchases

- The added pressure to cash flows provides a stronger incentive to destock, so retention rates are reduced by 2% from the long-term trend

- Yield growth remains at -1% for the year

Very high impact

- In addition to the high feed costs and higher purchases (due to lack of good quality or sufficient volumes of silage), milk prices fail to keep up with rising input costs. Yields fall by 2% for the year due to the low returns on purchased feed

- The high cost to retain animals over the winter, plus the incentive to sell for cashflow reasons

- Retention rates lowered by 2% from long term trend due to high cost to keep animals over the winter plus incentive to sell to ease cashflow