USDA’s 2025 dairy forecast brings good news: milk receipts are up 2.7% to $52.1B, and feed costs are down 10.1%. But regional challenges persist – from labor shortages to water regulations. How are innovative dairy farmers adopting? Get the full story on what this means for your operation.

Summary:

According to the USDA, the dairy industry is set for better profitability in 2025, thanks to higher milk prices and lower feed costs. Despite facing challenges like labor shortages and environmental rules, farmers in regions like the Midwest and California are optimistic. Technology and innovative cost management are vital, and experts advise using risk management tools to handle market changes. The industry’s positives include more exports, rising consumer demand, and new farm management innovations that boost efficiency and sustainability. The USDA report forecasts increased milk sales and decreased feed costs, with detailed insights into regional price shifts and challenges. The article balances hopeful market trends with practical issues, helping farmers navigate the complexities expected in 2025.

Key Takeaways:

- The dairy industry sees promising prospects for 2025 with rising milk prices and falling feed costs.

- Projected increase in milk receipts by $1.4 billion could enhance profitability for dairy farms.

- Regional challenges vary, with technology and local adjustments playing crucial roles in adaptation.

- Smart risk management and labor strategies remain essential for maximizing benefits from favorable economic conditions.

- Environmental regulations require further innovation in sustainable practices.

- Advancements in technology, such as automation and precision feeding, are driving efficiency in dairy operations.

- Proactive managing costs, labor, and technology integration is key to capitalizing on improved margins.

- Engaging with industry experts and peers can provide valuable insights and strategies for 2025 readiness.

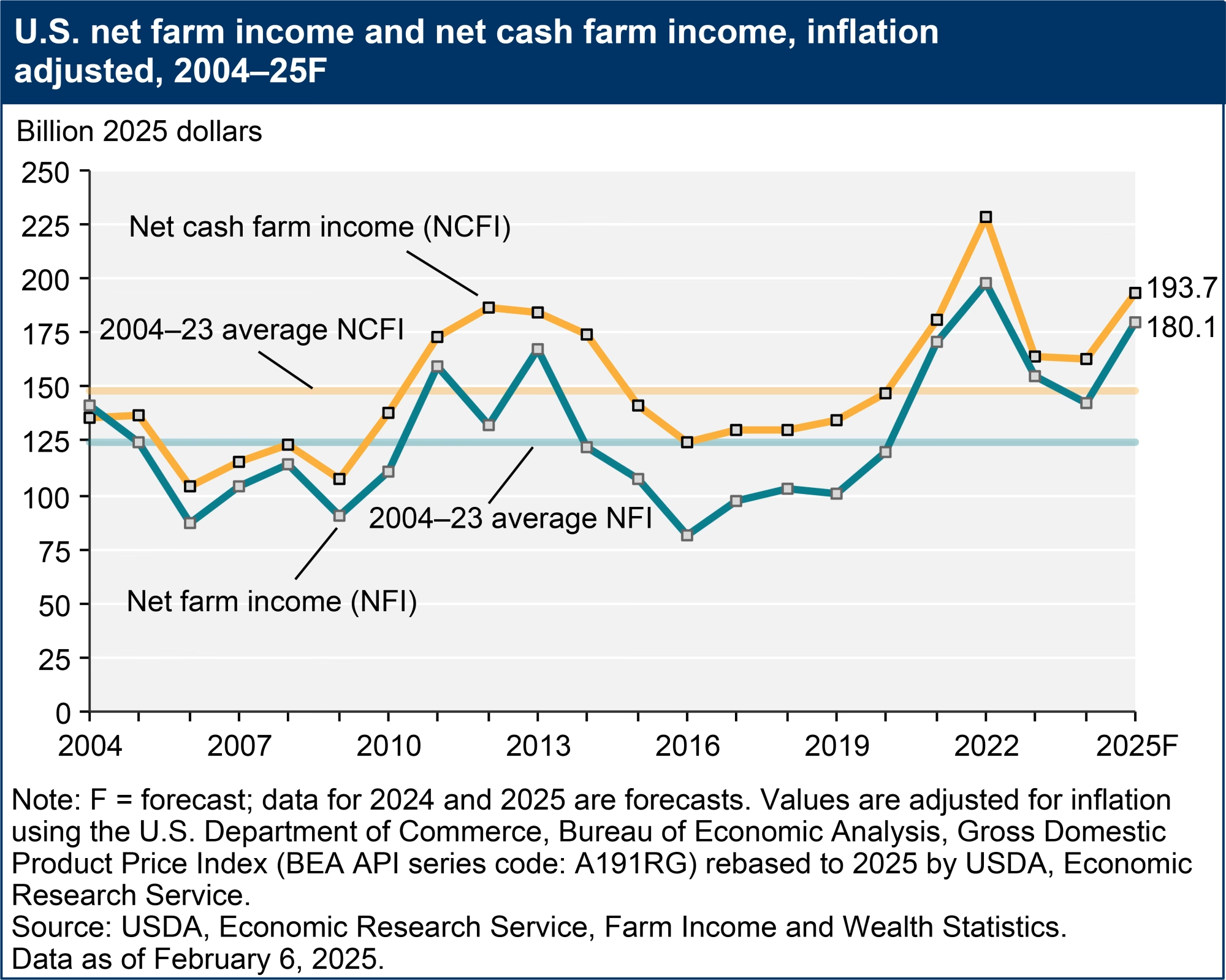

Despite ongoing challenges in the broader agricultural sector, the dairy industry emerges as a bright spot in USDA’s latest farm income forecast for 2025. Let’s explore what this means for dairy farmers nationwide and how different regions adapt to changing market conditions.

The Bottom Line for Dairy

Good news arrives on two critical fronts – milk prices are heading up while feed costs are trending down. Milk receipts are expected to climb by $1.4 billion in 2025, reaching $52.1 billion. This 2.7% boost could significantly improve dairy farm profitability, especially with declining feed costs.

The dairy sector shows notable resilience in USDA’s latest farm income forecast, with several key factors affecting profitability:

Revenue Projections

- Milk receipts are forecast to rise by $1.4 billion (2.7%) in 2025, reaching $52.1 billion from $50.8 billion in 2024.

- The all-milk price is projected at $23.05 per hundredweight, a $0.50 increase from previous forecasts.

- Total animal/animal product receipts are expected to increase by $3.8 billion (1.4%) to $275.4 billion.

Production Costs and Margins

| Cost Category | 2025 Forecast | Change from 2024 |

|---|---|---|

| Feed Expenses | $62.4 billion | -10.1% |

| Labor Costs | $53.5 billion | +3.6% |

| Interest Expenses | Slight decline | -0.5% |

Regional Performance Variations

| Region | Profit per Cow | Key Driver |

|---|---|---|

| Southeast (>5000 cows) | $1,640 | Operational Efficiency |

| Northeast (Large Herds) | $1,625 | Market Access |

| Southeast (<250 cows) | $531 | Improved Margins |

Government Support Impact

- Dairy Margin Coverage (DMC) payments are projected to decrease by $8.9 million (12%) in 2025 compared to 2024, driven by lower feed costs.

- The decrease in DMC payments suggests improving dairy farmers’ operational margins rather than relying on government support.

Market Challenges

- Production constraints due to lower milk per cow yields (24,200 pounds, down 85 pounds).

- Labor shortages continue to impact operations despite wage increases.

- Environmental regulations requiring additional investment in sustainability measures.

This analysis suggests that while dairy farmers face ongoing challenges, the sector shows promising signs of market-driven profitability improvements rather than reliance on government support programs.

Regional Variations and Challenges

The impact of these projections varies significantly depending on location:

| Region | Price Outlook | Biggest Challenge | Adaptation Strategy |

|---|---|---|---|

| Midwest | +3.5% | Finding good help | Robotic milking systems |

| California | +2.8% | Water restrictions | Advanced irrigation |

| Northeast | +2.2% | High feed transport costs | Local sourcing |

| Southeast | +1.9% | Heat stress | Cooling systems |

Production and Herd Outlook

The USDA’s 2025 forecast offers a comprehensive production and herd outlook, highlighting key indicators for the dairy industry:

- Total milk production: 227.2 billion pounds

- Average number of dairy cows: 9.390 million head

- Milk per cow: 24,200 pounds (a decrease of 85 pounds from previous estimates)

Significant changes in input costs have been projected regarding market analysis and financial strategies. Feed expenses, the most considerable cost category for dairy farmers, are expected to decline sharply by $7 billion, or 10.1%, to $62.4 billion in 2025. However, labor costs are anticipated to increase by 3.6%, reaching a record high of $53.5 billion. Due to lower feed costs and the subsequent improvement in milk-feed margins, Dairy Margin Coverage (DMC) payments are set to decrease by $8.9 million (12%) in 2025 compared to 2024.

Looking Ahead

While the outlook for the dairy sector is promising, achieving success in 2025 will largely hinge on:

- Effectively managing production costs

- Adapting to regional challenges

- Embracing technological innovations

- Implementing robust risk management strategies

The Bottom Line

The 2025 dairy outlook presents a unique opportunity for dairy farmers to strengthen their operations. With higher milk receipts projected alongside lower feed costs, the focus should shift from survival to strategic growth and innovation.

Key takeaways for dairy operations:

- Take advantage of improved margins to invest in efficiency-enhancing technology

- Review your risk management strategy as DMC payments decrease

- Consider regional challenges when planning expansions or improvements

- Evaluate labor needs against automation options

- Prepare for stricter environmental regulations

Combining more substantial milk prices, lower input costs, and advancing technology suggests that 2025 could be pivotal for dairy operations willing to adapt and innovate. While challenges remain around labor and environmental compliance, the fundamental improvements in dairy economics provide a solid foundation for strategic investment and growth.

Learn more:

- Rising Milk Prices and Lower Feed Costs Boost Profitability: May Dairy Margin Watch

- Big Milk Checks and Low Feed Costs: A Profitable Summer for Dairy Producers

- US Dairy Farmers’ Revenue and Expenditure Rise Slightly in March

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!