There is likely to be lower milk production in the EU and the US during 2023 which could “stabilise” global market prices, according to a new report from Rabobank.

There is likely to be lower milk production in the EU and the US during 2023 which could “stabilise” global market prices, according to a new report from Rabobank.

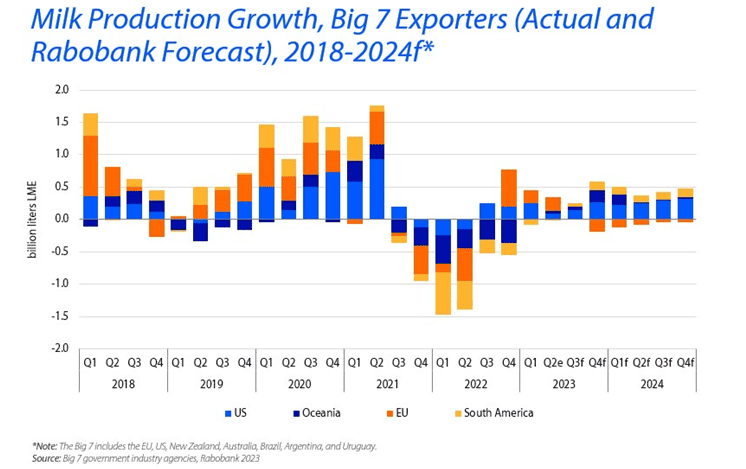

Overall global milk production is still rising but, according to the bank, it is “losing momentum”.

In its latest Global Dairy Quarterly report, Rabobank also warned that there are signs of weakening dairy demand in some markets.

“The cumulative effects of high food-price inflation over the past 24 months, in most cases significantly higher than salary growth, along with slowing economic activity in 2023 have translated into lower dairy demand in developed and emerging markets,” it stated.

As a result it has lowered its 2023 milk production forecast from last quarter’s forecast of 0.7% to 0.5%.

In the report, the bank detailed that slower growth is attributed to “stagnant output in the EU”.

It expects that in quarter three, EU milk production will be flat year-on-year and noted that while some farmers had managed to “sustain production growth” – despite lower farmgate prices – weather volatility in some regions could “slow deliveries further”.

Rabobank also outlined that a contracting dairy herd and lower yields are likely to slow milk production in the US while in New Zealand and Australia the “dairy pool is stabilising”.

“While profitability remains challenging for New Zealand farmers, current estimates suggest that output could be higher next season.

“Meanwhile, Australia’s milk pool is showing signs of stablisation after a nearly 5% year-on-year decline in the 2022/23 season.

“Water and feed availability should support production growth next season,” the report highlighted.

South American milk production also remains under pressure and according to Rabobank Argentina, is likely to “experience a significant contraction” in milk production because of low forage after a very dry summer.

The bank also expects to see milk production in China while imports decline.

“Chinese dairy imports (liquid milk equivalent excluding whey) declined by 36% year-on-year in quarter one 2023, adding pressure to already weaker global prices in the short term,” the report outlined.

According to Andres Padilla, senior analyst dairy at Rabobank, some price deflation in dairy could help “sustain” demand levels in key markets during the second half of 2023.

The U.S. dairy industry grew significantly over the past two years, adding nearly 60,000 new jobs, increasing average wages by 11%, and increasing its total impact on the U.S. economy by $41 billion, according to the latest economic impact report from the International Dairy Foods Association (IDFA).