U.S. dairy’s genetic revolution: Butterfat & protein smash century-old records as genomics redefine milk’s DNA. Are your herds future-ready?

The U.S. dairy industry is experiencing an unprecedented transformation as genetic improvements drive historic gains in milk components. While milk production remains flat, butterfat and protein levels are climbing at record rates, creating extraordinary value for producers and processors alike. This genetic revolution is perfectly timed to meet growing demand as $8 billion in new processing capacity comes online through 2027.

The Component Surge: Breaking Records at Breakneck Speed

The numbers tell a compelling story that every dairy producer should consider. Butterfat has posted its fourth consecutive annual record when evaluating data over a century. In 2021, milkfat broke through the symbolic 4% ceiling, surpassing a record that had stood since the end of World War II. By 2024, butterfat levels charged even higher to average 4.23% nationally.

Protein hasn’t been left behind, with new consecutive yearly records posted from 2016 to 2024. The 2024 milk marketing year finished with an average protein content of 3.29%—a remarkable jump from the 3.04% level recorded just two decades ago in 2004.

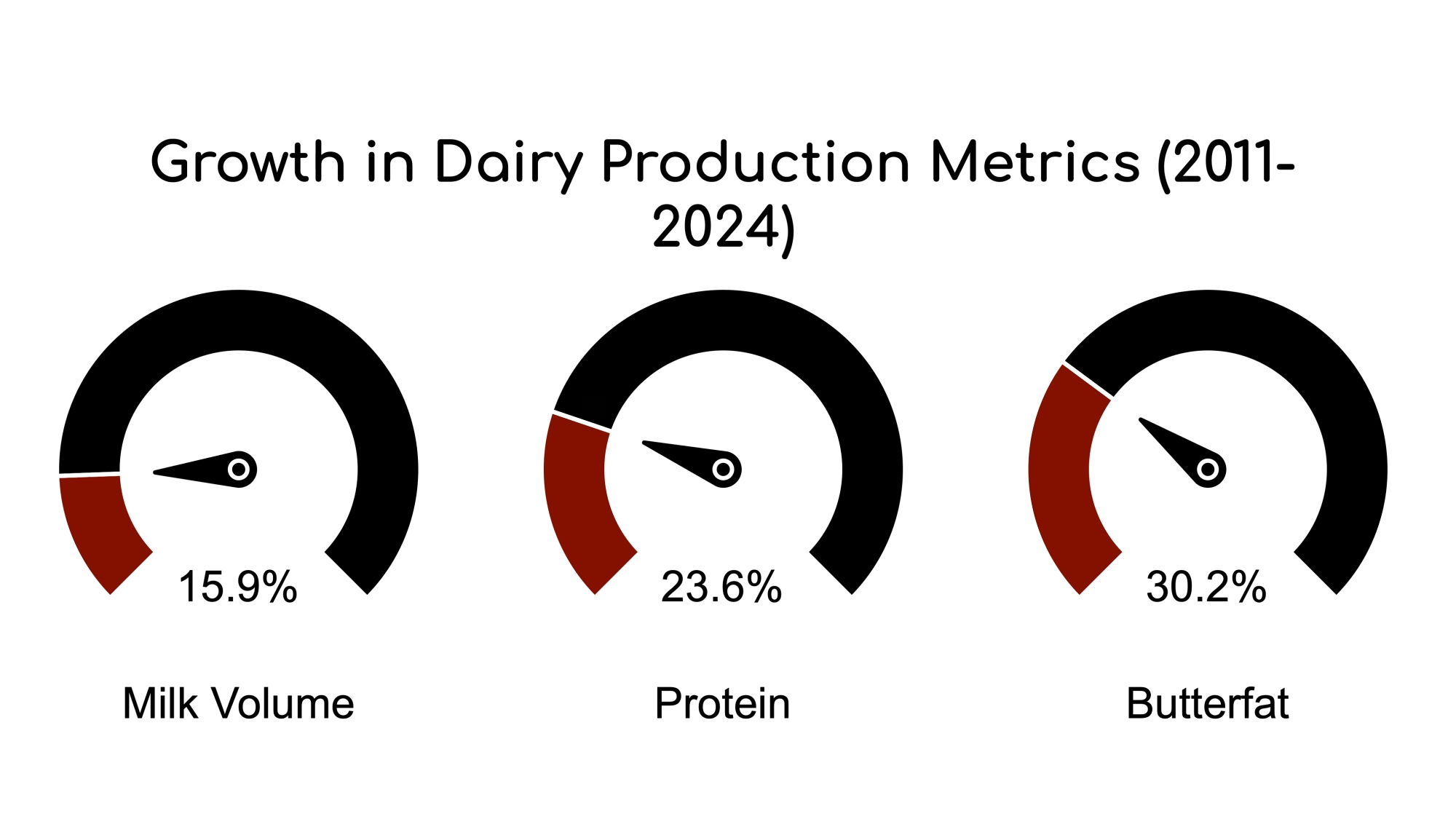

These gains are particularly noteworthy because they’ve decoupled from overall milk volume trends. From 2001 to 2010, milk volume, butterfat, and protein production improved at similar rates, ranging from 13.8% to 15.4%. Since then, however, the metrics have diverged dramatically:

| Production Metric | Growth 2011-2024 |

| Milk Volume | 15.9% |

| Protein | 23.6% |

| Butterfat | 30.2% |

This divergence is occurring at a critical moment, as U.S. milk production has stalled. The country experienced its first back-to-back years of declining production since the 1960s, with output falling by -0.04% and -0.23% in 2023 and 2024, respectively, following minimal growth of 0.07% in 2022.

The Genomic Game-Changer: How DNA Testing Revolutionized Breeding

The driving force behind this component revolution is unquestionably genomics—a technology that has fundamentally altered dairy cattle breeding. Genomic testing allows producers to compare an individual animal’s DNA to the overall population, revealing about 70% of a young calf’s genetic potential before she matures into a cow.

“The dairy cow has become the most studied domestic animal on the planet,” explains Dr. John Cole, research lead at USDA-AGIL. “Humans and laboratory mice are the only species with larger genetic datasets than dairy cows. However, those species don’t have a comprehensive phenotypic dataset in dairy cattle. That dataset drives accuracy for genomic predictions.”

The adoption of genomic testing has grown exponentially since its introduction. After the technology was released to the dairy industry in 2009, it took seven years to genotype the first million dairy males and females. As producer confidence in the system grew, testing ramped up dramatically—the industry reached 5 million tests by March 2021 and surpassed the 10 million mark in December 2024. 66% of these tests have been conducted on U.S. dairy cattle, with the remaining 34% from 72 other countries.

This widespread adoption of genomic testing has fundamentally altered the balance between genetics and management as drivers of production improvements:

- 1957-1980s: Management factors (nutrition, housing, health) were the primary force behind productivity gains

- 1980-2000: Management and genetics contributed roughly equally to production improvements

- 2000-2009: Genetics began overtaking management as the primary driver

- 2015: Genetics contributed over 60% to improvements in milk production

- 2022: Genetics accounted for over 70% of production gains

The April 2025 Genetic Reset: What Every Producer Needs to Know

The U.S. dairy industry will experience its most significant genetic recalibration in decades. On April 1, 2025, the Council on Dairy Cattle Breeding (CDCB) will implement simultaneous updates to lifetime merit indices and shift all genetic evaluations to a 2020-born cow base.

This dual adjustment—the first combined overhaul since 2015—aims to reflect the 28% faster genetic progress in key traits while aligning economic weightings with today’s market realities and sustainability pressures.

Resetting the Genetic Compass

CDCB adjusts its genetic evaluations every five years to account for industry progress—comparable to upgrading a smartphone’s operating system. The 2025 shift compares all animals against cows born in 2020 rather than 2015, creating these projected PTA adjustments:

| Trait | Holstein | Jersey | Ayrshire |

| Milk (lbs) | -750 | -380 | -550 |

| Fat (lbs) | -45 | -20 | -28 |

| Protein (lbs) | -30 | -15 | -18 |

“Think of it like resetting an odometer after driving 100,000 miles,” explains Dr. Cole. “The numbers get smaller, but the vehicle’s capability hasn’t changed.”

One can examine the pace of genetic base changes to appreciate the scale of genetic improvement. In 2025, the Holstein base will roll back 51 pounds for butterfat and 36 pounds for protein. This represents a dramatic acceleration compared to earlier periods—in 2015, the Holstein base rolled back just 17 pounds for butterfat and 12 pounds for protein.

The Jersey breed, which, along with Holsteins and their crosses, makes up over 95% of the U.S. dairy cow population, has shown similar genetic progress. The April 2025 genetic evaluations reveal a 20-pound base change for butterfat and a 15-pound rollback for protein in Jerseys.

Merit Index Overhaul

Simultaneously, the revised Net Merit $ (NM$) formula now prioritizes:

- Butterfat (↑13% weighting): Reflects cheese demand driving fat prices to $3.20/lb

- Feed Efficiency (↑41% combined impact): Addresses $300/ton feed costs

- Livability (↑100%): Responds to cull values exceeding $1,800/head

“We’re essentially giving fertility traits a 20% promotion and putting milk volume on performance improvement plans,” notes CDCB Chair Amy Hazel.

The updated Lifetime Merit Indices include adjustments to the economic weights of individual traits, with an increased emphasis on feed efficiency, milk component pricing, and fertility. For instance, the weight for fat in NM$ has increased from 28.6 to 31.8, while the weight for protein decreased from 19.6 to 13. These changes reflect evolving market demands and research advancements.

Regional Strategies: How Different Dairy Areas Are Leveraging Genetics

The genetic revolution has played out differently across America’s dairy landscape, with distinct regional approaches to production improvement. Economists have identified notable differences between “traditional” dairy states in the Midwest and Northeast, with small herd sizes and a long history of dairy production, and “modern” dairy states, primarily in the West, with large herds where the dairy sector has only recently reached its current scale.

Traditional vs. Modern Production Approaches

While each region contributes roughly equal shares to total U.S. milk production, their growth strategies differ. Traditional dairy states have focused primarily on increasing milk yield through genetic and management improvements. In contrast, modern dairy states have grown production by increasing milk yield and total cow numbers.

The contrast in herd size is stark—Western states have substantially larger herds, with nearly all averaging above 1,000 cows per operation. Traditional dairy states in the Midwest and Northeast have much smaller herds but have been catching up in productivity. In 2000, modern dairy states had a significant yield advantage of 1,721 pounds per cow versus 1,473 pounds in traditional states. By 2022, this gap had narrowed to less than 100 pounds (2,070 versus 1,984 pounds per cow).

Convergence in Yield Improvement

This convergence in productivity coincides with the introduction of genomic testing, suggesting that traditional dairy states have embraced genetics as their primary growth strategy. Unable to expand cow numbers due to land constraints, zoning regulations, and environmental concerns, these states have invested heavily in genetics, enhanced milking technology, and improved management practices.

As cow numbers across the country begin to level off, modern dairy states may follow the lead of traditional regions by focusing more intensively on yield improvements rather than herd expansion. This mirrors a broader trend in U.S. agriculture, where productivity gains increasingly drive output growth rather than expanding production areas.

The Economics of Components: Why This Matters to Your Bottom Line

The shift toward higher-component milk is creating significant economic value throughout the dairy supply chain. With over 80% of the U.S. milk supply going into manufactured dairy products that rely on butterfat and protein content, these genetic gains are perfectly aligned with market demands.

“Selecting animals for highly heritable traits and having a market incentive to do so has formed a strong foundation for dairy producers to develop their herds to produce more butterfat and protein.”

The U.S. milk pricing system, which pays premiums for components, has created powerful incentives for producers to select for these traits. These market signals have spurred innovations in breeding technology beyond genomic testing:

- Gender-sorted semen: By 2024, 61% of all dairy semen sold in the U.S. came from this category, giving rise to the strategy described by some farmers as “sexed semen on the best and beef semen on the rest.”

- Embryo technology: More recently, dairy farmers have begun creating conventional and in vitro fertilized embryos from elite females, further accelerating genetic progress

The surge in milk components comes at a strategic time for the industry, with $8 billion in new dairy processing capacity scheduled to come online through 2027. This expansion heavily focuses on cheese, butter, and other manufactured products that yield from components rather than fluid volume.

Accelerating Technologies: What’s Driving the Next Wave of Genetic Progress

The 2025 genetic reset paves the way for even more advanced selection tools:

- Rumen Microbiome PTAs (expected by 2028): Linking microbial profiles to feed conversion efficiency

- Methane Emission Indexes: Responding to potential EPA enteric fermentation regulations

- Heat Tolerance Updates: Critical as 73% of U.S. counties face higher heat stress days

These emerging technologies will further enhance producers’ ability to select economically important traits while addressing sustainability concerns.

The Bottom Line: Positioning Your Herd for Future Success

April’s genetic overhaul serves as both a progress report and crystal ball—validating two decades of genomic advances while redirecting selection pressure toward tomorrow’s profitability drivers. As dairy economist Chris Wolf notes, “The cows we’ll milk in 2035 are being designed today through these evaluations.”

Producers who realign breeding strategies with NM$ 2025’s economic reality—where every 1 lb of fat equals 2.3 kg of protein in revenue—position themselves to thrive in dairy’s next era. Here’s what forward-thinking producers should consider:

- Recalibrate sire selection thresholds: What was once +2000 NM$ becomes approximately +1300 NM$ after the base change

- Focus on component ratios: The economic value of fat relative to protein continues to increase

- Prioritize feed efficiency: With high feed costs, efficient feed conversion to components becomes increasingly important.

- Don’t ignore fertility and health traits: The revised indices emphasize these economically important traits.

The question of how high butterfat and protein percentages can ultimately go remains open. Industry experts believe there is still untapped potential as dairy farmers continue to leverage genetics programs to select component traits.

The genetic revolution in U.S. dairy production represents one of the most successful applications of genomic science in agriculture. Unprecedented gains in milk components are transforming dairy production and processing economics, creating new opportunities throughout the supply chain. While milk volume has plateaued, the continued improvements in butterfat and protein composition ensure the industry can meet the growing demand for manufactured dairy products.

As genomic testing becomes even more widespread and breeding strategies continue to evolve, the U.S. dairy industry is positioned to maintain its leadership in genetic improvement. Whether through traditional family farms in the Midwest focusing on component yield or large Western operations balancing yield and scale, producers across the country are embracing genetics as the key to future profitability and sustainability in an increasingly competitive global dairy market.

The dairy industry’s genetic revolution is far from over—it’s just getting started.

KEY TAKEAWAYS:

- Component production now outpaces milk volume (+30% butterfat growth vs. +16% milk since 2011)

- Genomics drive 70% of gains – 10M cattle tested globally, transforming breeding decisions

- 2025 genetic reset prioritizes feed efficiency (+41% weighting) and fat value ($3.20/lb market reality)

- Regional strategies diverge: Small herds optimize genetics, large operations balance yield + scale

- Emerging tools (rumen microbiome PTAs, methane indexes) will shape 2030s’ herds

EXECUTIVE SUMMARY:

The U.S. dairy industry is achieving unprecedented butterfat (4.23%) and protein (3.29%) levels through genomic breakthroughs, with genetics now driving 70% of production gains. As milk volumes stagnate, component-focused breeding strategies align perfectly with $8B in new processing capacity for cheese and butter. The 2025 genetic base reset accelerates progress, while regional approaches (traditional herds optimizing yield vs. modern operations balancing scale) showcase adaptation. With feed efficiency and sustainability traits gaining priority in updated merit indices, producers leveraging advanced technologies like sexed semen and embryo transfer position themselves to capitalize on dairy’s component-driven future.

Read more:

- Genomics Meets Artificial Intelligence: Transforming Dairy Cattle Breeding Strategies

Explore how AI decodes complex gene interactions to balance productivity and climate resilience in modern breeding programs. - BANNs Crush Traditional Models: The AI Secret Weapon Reshaping Dairy Genetics

Dive into how Biologically Annotated Neural Networks boost prediction accuracy by 5-7%, revolutionizing mastitis resistance and milk yield. - Optimizing Dairy Grazing Profitability: Unraveling the Genetics of the Ideal Grazing Cow

Discover how genetic selection impacts pasture-to-profit efficiency and why grazing-specific traits are critical for sustainable operations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!