According to a recent analysis from worldwide financial services firm Rabobank, restricted milk supply growth and weak demand will result in flat dairy commodity prices in 2023. However, the global dairy industry looks to be entering the next stage of its cycle, with prices expected to rise until 2024. Nonetheless, the market is tightly balanced, and underlying demand for 2024 remains unclear.

As 2023 approaches, the global dairy industry is on a precarious balance of limited “new” milk and slow demand. Due to worse underlying fundamentals, global dairy commodity price was lackluster this year. Global milk supply growth has been disappointing, with three quarters of increase. Lower milk prices, higher expenses, and weather disruptions then put the clamps back on.

According to the paper, titled Shifting to the Next Phase of the Cycle, “tightening margins drove increased culling and subsequent milk production pullback” in the United States. Slaughter has slowed, and profits are recovering but not yet indicating growth.”

Other important regions, such as the European Union and South America, are experiencing challenging margins amid reductions with pockets of optimism.

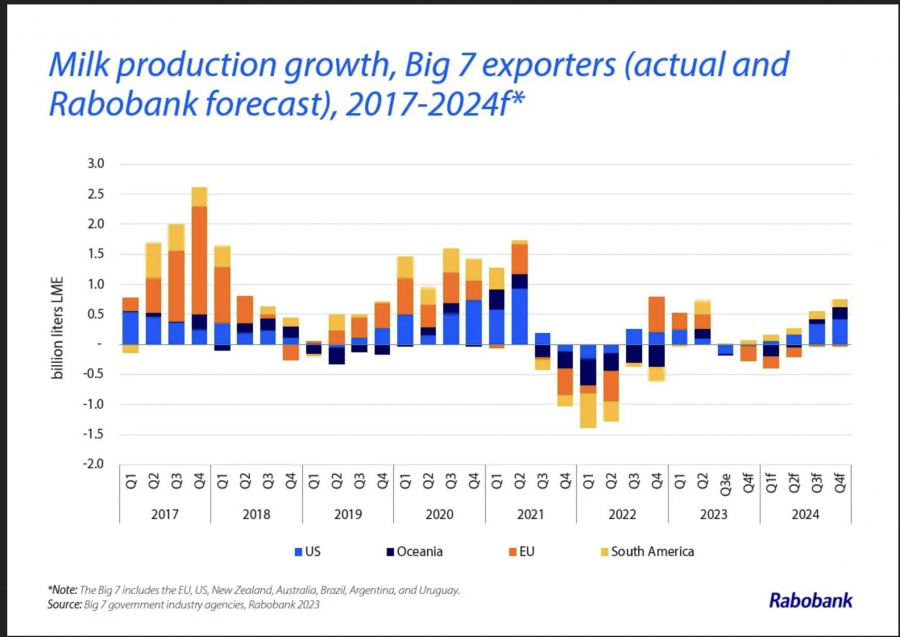

Rabobank’s forecast for milk supply in 2024 has decreased, with slow growth projected across most export areas.

“The milk supply export engine never fully fired on all cylinders in 2023, and it fell by 0.2 percent year on year in the third quarter,” said Michael Harvey, senior dairy analyst at Rabobank. “Year-over-year milk production from the Big 7 exporting regions is expected to fall through the first quarter of 2024 before turning positive.” Overall, milk supply is expected to increase by 0.3 percent this year.”

Other things to keep an eye on in 2024 include a modestly lower grain and oilseed price expectation, El Nio and weather-related concerns, mixed animal markets in export areas, and the influence of the Israel-Hamas conflict on global markets.

A sluggish price recovery

In local currencies, farmgate milk prices in the export zones will end 2023 anywhere from 20% to 40% lower than they began the year. However, with the prospect for 2024 feed costs improving, several regional milk prices have lately climbed, bolstering farmgate profits.

“We expect a slow recovery in dairy commodity prices back to long-term averages,” Harvey went on to say. “However, current fundamentals are ideal for price volatility and potential market whiplash.” Geopolitical instability threats, fluctuating energy markets, and bad macroeconomic circumstances will all be factors to consider for global dairy markets in 2024.”

There will be some demand unpredictability in the future.

With significant dairy inflation, wider cost-of-living difficulties, and low consumer confidence still on the horizon, demand will be a major aspect to monitor in 2024. Peak food and dairy inflation has gone, but market uncertainty persists, and growing unemployment will have an even greater effect on buying power in 2024. The most vulnerable are emerging markets and low-income families.

Consumer prices in China are lowering, and restaurant recovery is continuing, but total consumption growth is slow. China’s demand for dairy commodities is projected to drive any Oceania commodity price rise in 2024. “Rabobank expects China’s import volume to flatline in 2024, which would be a positive result, given the previous two years of withdrawal from the global markets,” he says. “This is an opportunity for importers outside of China to build stocks in 2024.”