I wondered how the dockworkers’ strike would affect the dairy supply chain and holiday shipping. Stay informed to protect your business. Read on!

Summary:

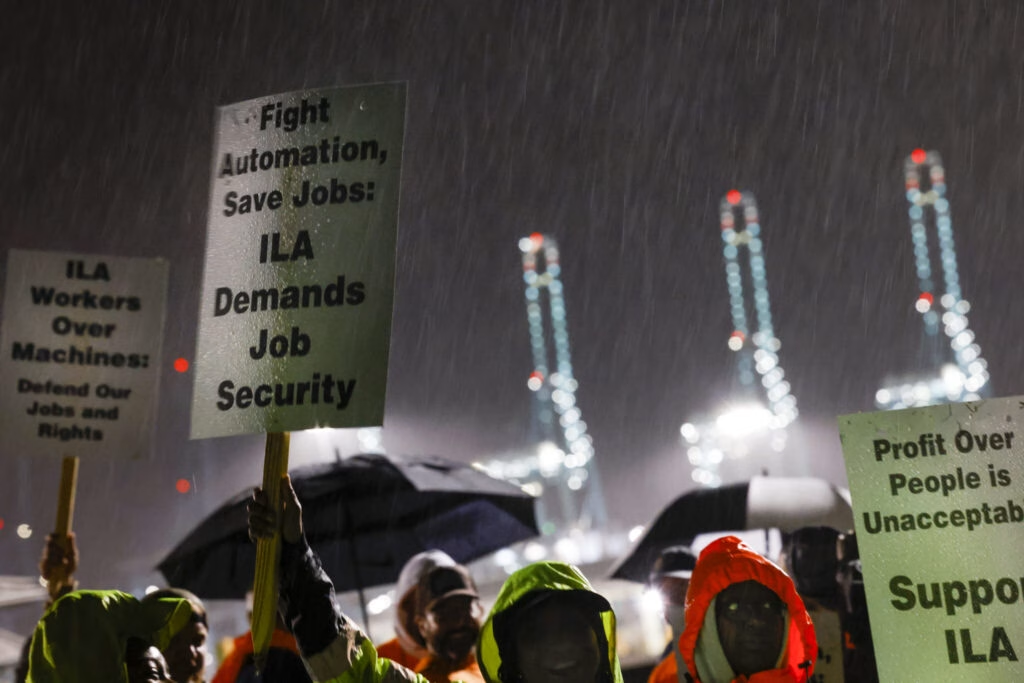

As of today, the International Longshoreman’s Association (ILA) has initiated a strike, citing unresolved issues with the United States Maritime Alliance (USMX) concerning wages and protection from automation. Impacting 36 ports along the East and Gulf Coasts, this strike halts the loading and unloading of cargo ships and automobiles while sparing cruise ships, fuel movement, and municipal waste shipments. The economic ramifications are severe, with JP Morgan estimating daily losses between $3.8 and $4.5 billion, and clearing the backlog could take a month, even with a strike duration of only one week. According to the American Farm Bureau, the strike could cost $1.4 billion per week in agricultural exports and imports, with the National Milk Producers Federation projecting a $32 million weekly hit to dairy producers alone. As the harvest season continues, the disruption may create supply chain hiccups, potentially lowering harvested grain prices.

Key Takeaways:

- The International Longshoreman’s Association initiated a strike affecting 36 ports on the East and Gulf Coasts.

- The strike’s focus is on disputed wages and protection from automation.

- Economic losses are estimated at $3.8 to $4.5 billion daily, with potential long-term repercussions.

- President Biden has resisted calls to invoke the Taft-Harley Act to end the strike.

- The strike heavily impacts containerized agricultural exports and imports, costing the agricultural sector significantly.

- The National Milk Producers Federation projects a $32 million weekly loss for dairy producers due to the strike.

- Supply chain disruptions during harvest may depress grain prices and affect overall product movement.

Prepare for the worst: the prolonged dockworkers’ strike is on the verge of disrupting the dairy supply chain and Christmas deliveries at a crucial time. With 36 ports on the East and Gulf Coasts in the line of fire, this strike could throw a wrench into our vital dairy exports, the broader agriculture economy, and consumer holiday plans. The International Longshoremen’s Association (ILA) is in the eye of the storm, battling for fair wages and protections against automation. This fight has escalated tensions with the United States Maritime Alliance (USMX). “The economic fallout of this strike could be catastrophic,” warns JP Morgan, estimating daily losses of $3.8 to $4.5 billion. “A backlog that might take a month to clear, even if the strike lasts only a week.” With President Biden’s decision not to intervene, the consequences are looming, especially with the upcoming elections and the winter holiday season. The dairy business is facing a critical juncture. According to Gregg Doud of the National Milk Producers Federation, the potential loss of $32 million per week is a significant blow that could have far-reaching consequences across the supply chain.

The Union’s Legacy vs. Automation: A High-Stakes Battle for the Future of U.S. Ports

The International Longshoreman’s Association (ILA) represents more than 60,000 longshore workers on the East Coast, Gulf Coast, Great Lakes, Puerto Rico, and Eastern Canada. The organization’s history dates back to 1892, and it has been instrumental in obtaining labor rights for dockworkers via various discussions and strikes, a legacy it is fiercely defending in the current battle against automation.

The United States Maritime Alliance (USMX) represents the employers of the East and Gulf Coast longshore industry in collective negotiations. This comprises port organizations, cargo carriers, and maritime terminal operators.

Tensions between the ILA and USMX are not new. Disagreements on salaries, benefits, and working conditions have often complicated past talks. One of the major flashpoints in recent years has been the growth of port automation. While companies believe that automation increases productivity, the ILA claims it endangers employment and undermines worker safety.

The significance of the impacted ports along the East and Gulf coasts cannot be emphasized. These ports are key commerce centers, connecting the United States to worldwide markets. They handle large cargo, including agricultural products, consumer items, and industrial supplies. Any disturbance to their operations has a knock-on effect on supply networks, affecting everything from product flow to economic stability.

The Ports of New York and New Jersey, Savannah, and Houston are among the biggest in the United States. Their strategic placement enables the efficient movement of products around the nation. The protracted strike threatens the area’s economy and national and worldwide commerce.

The Economic Ripple Effect: Dockworker Strike Sends Shockwaves Through Key Industries

The economic consequences of the dockworkers’ strike are staggering. JP Morgan forecasts that the closure will result in daily losses ranging from $3.8 to $4.5 billion. This significant financial damage does not vanish into thin air; it spreads across the economy, hurting various businesses, including dairy farming and agricultural exports. The potential losses are not just numbers on a balance sheet but a stark reality that could profoundly impact the industry and the economy at large.

Consider this: the American Farm Bureau reports that the suspension affects containerized agricultural exports and imports. They estimate that 14% of U.S. agricultural exports and 53% of imports may be halted. What is the probable weekly cost? A staggering $1.4 billion. Dairy producers face similarly frightening figures. According to the National Milk Farmers Federation, the strike may cost dairy farmers $32 million weekly. Disruptions in product transportation to essential markets such as Mexico, Canada, and Asia might worsen pre-existing logistical issues, putting further pressure on an already stretched supply chain.

These numbers underscore the strike’s more significant economic impact. As harvest season progresses, delayed product transit might cause supply chain disruptions, decreasing harvested grain prices. Dairy farmers, who depend significantly on timely exports, may need long-term financial assistance. This confluence of issues emphasizes the necessity for a prompt settlement of the continuing labor conflict. The potential long-term implications of this strike are dire, underscoring the urgent need for a resolution.

President Biden’s Calculated Gamble: A High-Risk Strategy or Strategic Genius?

President Biden’s Calculated Gamble: President Biden’s choice not to intervene in the dockworkers’ strike has received criticism and appreciation from diverse sources. So far, the President has rejected demands to activate the Taft-Hartley Act, which would require striking workers to return to work. Some see this attitude as a calculated attempt to retain labor support during an election campaign. However, the implications of this judgment are multifarious. Potential solutions to the strike include negotiations between the ILA and USMX or the intervention of a neutral third party to mediate the dispute.

National Security Concerns: A group of business executives and politicians has expressed alarm about the consequences for national security. The Taft-Hartley Act, which has historically been utilized to protect national security, is still a divisive instrument. Its prospective invocation emphasizes the problematic balance between protecting worker rights and guaranteeing the seamless operation of essential sectors. Some fear protracted port disruptions might jeopardize the country’s economic stability and expose supply chain weaknesses. For example, the flow of critical items, such as medical supplies and food, may experience considerable delays, directly threatening public health. This strike could lead to shortages of essential goods, higher prices, and potential job losses, affecting the daily lives of many Americans.

The strike’s economic impact is immediate and severe. Several economic experts, including those from JP Morgan, have estimated daily losses of approximately $4.5 billion. Agricultural exports and imports are especially susceptible, resulting in increased demand from agricultural coalitions for government action. As our agricultural community struggles with shrinking margins, prolonged interruptions have a cascade impact, influencing pricing and the supply of crucial supplies. According to Gregg Doud of the National Milk Producers Federation, dairy producers may face unplanned expenditures of $32 million per week.

Political Pressure: Political stakes are similarly significant. Politicians ‘ demands are growing with the approaching winter holiday and an election looming. Only three senators have publicly pushed President Biden to alter his position, citing the possible political and economic consequences if the strike persists [source required]. The Biden administration’s handling of the problem will be seen as a test of its crisis management abilities and a pivotal point in its relationship with labor unions.

President Biden’s approach to the dockworkers’ strike is a sophisticated, high-risk bet. His choice will affect the economy and politics, altering the President’s position with labor, industry leaders, and the public.

Dairy Farmers on the Brink: Can Your Operation Weather the $32 Million Weekly Storm?

The strike couldn’t be worse for dairy farmers and companies that rely on them. The National Milk Producers Federation’s Gregg Doud estimates that the strike would cost dairy producers $32 million weekly. Can your business afford a hit like that?

Now, think about the logistics. You can explore rerouting your exports via West Coast ports. But let us be realistic here. These pathways are already stretched thin. Product redirected to the West Coast would strain already congested truck and rail systems, resulting in unavoidable delays. Can you afford to have your items stalled in transit?

Furthermore, the complicated ballet of supply chains implies that even modest interruptions may escalate into major issues. For example, a scarcity of necessary feed supplies or equipment components for dairy producers might pose complications. This is when “just-in-time” delivery strategies begin to operate against you.

What are the alternatives? Stockpiling may seem plausible, but it is not always practicable or cost-effective. Dairy firms confront two challenges: perishable goods and rigorous storage regulations. Said you cannot leave milk on a shelf for weeks.

As the strike continues, keeping informed and preparing for contingencies is critical. Whether modifying your operations or pressing for speedier results, being proactive will be crucial. Gregg Doud said, “The sooner we resolve this, the less damage we’ll see across all sectors, especially agriculture.”

The Domino Effect: How Dockworker Strikes are Disrupting Your Supply Chain and Bottom Line

The strike’s repercussions go well beyond the ports, generating widespread supply chain disruptions that are already causing severe problems. With product flow slows, harvested grains languish in limbo, waiting to be exported. Have you considered how this delay may affect your bottom line?

The domino effect is inescapable. When produced grains cannot move, storage facilities rapidly fill up, and prices may fall owing to oversupply concerns. This storage glut spills into transportation, where trucks and rail networks are already overburdened.

Logistical issues grow as manufacturers seek other routes or storage choices. Could this cause significant delays in bringing your items to market? Farmers that rely on timely grain supplies may soon face a pinch, resulting in reduced revenues or lost chances during important sales cycles.

Furthermore, price variations are practically unavoidable when supply chain bottlenecks disrupt the equilibrium of supply and demand. Grain prices may fall locally while increasing in markets desperate for fresh supplies. How ready are you to traverse these rough waters?

The walkout threatens to disrupt the complex ballet of logistics and finance that keeps the agriculture industry running. Being proactive and aware of these possible difficulties might help reduce their influence on your business.

The Bottom Line

As we negotiate the turbulence generated by the dockworker strike, the ripple effects reach crucial industries. The stakes are high, with a possible $4.5 billion daily economic loss and a $32 million weekly hit to the dairy sector. With supply chains affected and Christmas holiday shipments jeopardized, the need to end this strike cannot be stressed. If not addressed, the long-term implications might devastate numerous sectors beyond recovery.

As you think about these changes, consider how the dairy business, which is already on the verge of collapse, will respond to this unprecedented upheaval. Furthermore, what does this portend for the future of Christmas shipping and customer pleasure as the peak season approaches? The issues ahead need our attention and immediate, determined action.

Learn more:

- Unmasking Supply Chain Vulnerabilities: The Untold Struggles of Dairy Farmers in Times of Disruptions and Pandemics

- The Impact of Mass Deportations on America’s Dairy Industry: Who Will Milk the Cows?

- American Dairy Farmers Grapple with Trade War and Immigration Policies: The Fight to Stay Afloat