Uncover the factors behind the current lag in dairy cattle culling trends. How are rising beef demand and a shortage of replacement cattle shaping the strategic decisions of dairy farms? Dive in for more details.

The current landscape of dairy cattle culling is diverging from historical trends. Despite the high prices for dairy cattle cull, dairy farms must seize the opportunity to capitalize on this market. In the first quarter of this year, only 747,600 dairy cows were sent to slaughter, a notable decline from the 870,600 head culled during the same period in the previous year. This shift is further exemplified by recent data from the week ending May 4, where only 48,975 dairy cows were culled, marking the first instance in nearly eight years that slaughter numbers have fallen below 50,000 head during a non-holiday week.

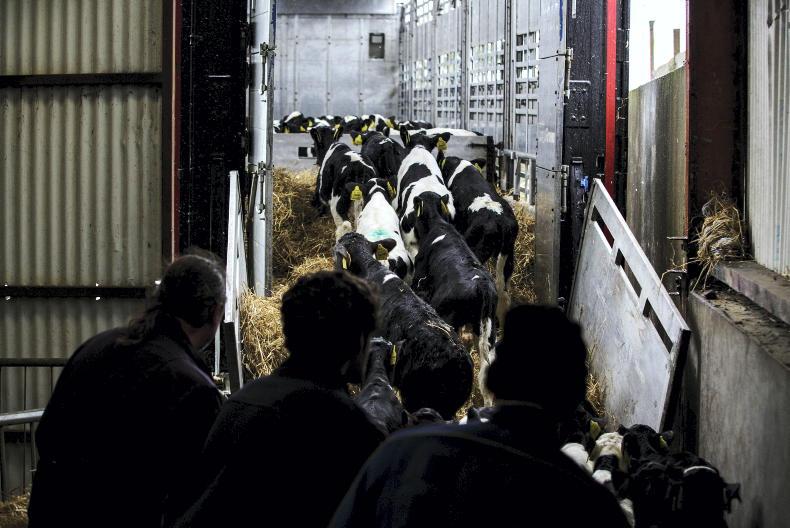

Culling plays a critical role in maintaining herd health and productivity. Farmers can ensure that resources are optimized by removing less productive or unhealthy cows from the herd, and overall milk production remains high. While culling is essential for sustaining a robust dairy operation, current trends indicate a reluctance among producers to part with their cattle.

Slaughter has been about 6,400 head below historical trends since September. This lag in culling rates can be directly linked to the interplay between beef demand and culling practices. As the beef cattle herd contracts, the demand for beef from dairy-beef crosses, and dairy cull cows rises. However, many dairy farms opt to retain their cattle instead of meeting this demand, influenced by rising Class III futures prices and a shortage of replacement dairy cattle. This complex dynamic underscores the necessity for careful decision-making in dairy operations, balancing immediate economic gains with long-term herd viability.

Historically, dairy cattle culling rates have experienced considerable fluctuations influenced by many economic and environmental factors. Decades ago, culling decisions were primarily driven by the immediate necessity to remove unproductive or unhealthy cows from the herd, directly impacting the farm’s operational efficiency. However, in recent years, culling rates have tended to reflect broader market conditions, including milk prices, feed costs, and, more recently, the interplay with beef markets.

In the past, factors such as advances in veterinary medicine and breeding technologies contributed to changes in culling practices. Improved animal health and productivity meant fewer cows needed to be culled prematurely. Conversely, periods of economic downturn, including low milk prices and high feed costs, saw elevated culling rates as farmers sought to maintain financial viability by reducing herd size and retaining only the most productive animals.

The impact of culling on the overall sustainability of the dairy industry cannot be overstated. Strategic culling can help maintain a healthy and productive herd, ensuring long-term farm sustainability. Conversely, excessive culling without adequate replacement can lead to a diminished national dairy herd, adversely affecting milk production capacities and economic stability within the industry. The current lag in culling rates further underscores the delicate balance that dairy producers must maintain between optimizing short-term financial gains and ensuring the long-term viability of their operations.

The increased demand for beef has undeniably reshaped culling patterns within the dairy industry. While dairy-beef crosses and cull cows fulfill a vital niche in the beef market, the current lagging cull rates reveal a tension between harnessing this economic opportunity and managing herd sustainability. With beef prices rising, dairy farmers are inclined to breed more dairy cattle with beef semen, as evidenced by the 7.9 million units used in 2023, up by nearly 1 million from the previous year. However, this strategy also leads to a shortfall in dairy replacements, constraining farmers’ ability to cull at traditional rates.

The dual objective of meeting dairy and beef market demands presents several challenges for dairy farmers. On the one hand, optimizing for beef production through crossbreeding can inflate short-term profits and capitalize on high beef demand. On the other hand, failing to sustain adequate dairy cattle numbers can impair milk production capacities and compromise long-term farm viability. The USDA’s data from April indicates that dairy cow marketing for beef has trailed year-ago levels for 32 consecutive weeks, highlighting this precarious balance. Farmers must navigate these conflicting demands while contending with high rearing costs and reduced availability of dairy replacements.

To resolve this conundrum, dairy producers need a multifaceted approach:

- Leveraging advanced reproductive technologies can help optimize breeding programs, ensuring that dairy herds remain robust while meeting beef market needs.

- Strategic herd management practices, including targeted culling and health monitoring, can mitigate the risks associated with increased crossbreeding.

- Policy support and financial incentives from governmental and industry bodies could bolster farmers’ efforts to achieve this delicate equilibrium, aiding them in balancing dairy herd sustainability with burgeoning beef demand.

Replacement shortages have significantly impacted culling decisions, with dairy farms grappling with maintaining herd productivity despite the reduced availability of new heifers. Historically, robust heifer supplies allowed producers to cull lower-performing or unproductive cows aggressively. However, with the contraction in dairy heifer replacements, farms are now compelled to retain older or less productive animals longer, which may compromise overall herd productivity and health.

Producers can implement strategies such as optimizing reproductive performance through advanced technologies like genomics and embryo transfer to navigate these replacement shortages while sustaining herd productivity. This can accelerate genetic progress and enhance the efficiency of breeding programs, ensuring a steady influx of high-quality replacements. Additionally, integrating precision livestock farming tools for monitoring animal health and productivity can help make informed decisions about which cows to retain and when to cull, ultimately enhancing herd performance.

Long-term planning is paramount in addressing replacement shortages. Developing a comprehensive breeding and culling strategy that aligns with market demands and herd sustainability goals is essential. This might include diversifying genetic lines to reduce inbreeding risks and investing in education and training for farm staff to enhance their skills in herd management and reproductive technologies. By adopting a forward-thinking approach, dairy producers can mitigate the impact of current replacement shortages and position their operations for future growth and stability.

In conclusion, while the dairy cattle culling rates have notably decreased, this phenomenon can be attributed to several factors, including higher Class III futures prices and a diminished supply of replacement heifers. Dairy farms increasingly turn to beef semen to meet the burgeoning demand for beef, further complicating the replenishment of dairy herds. Despite the struggles with low milk prices and drought conditions, the imperative to adapt remains pressing.

Dairy farmers must take proactive steps to address these culling challenges. By fine-tuning their breeding and herd management strategies, they can optimize production and economic outcomes. Farmers should also consider leveraging advancements in reproductive technologies and staff training to maintain herd vitality and productivity.

Adapting to these changing market demands is crucial for long-term sustainability. As the industry evolves, embracing innovative practices and forward-thinking solutions will be essential for dairy producers to thrive. These adaptive strategies can ensure dairy operations’ resilience and continued success in a shifting agricultural landscape.

Key Takeaways

- The decline in dairy cattle culling rates signifies a departure from historical trends and poses challenges to herd management practices.

- Dairy farms are retaining older cows longer, influenced by rising Class III futures prices and the decrease in available replacement heifers.

- A marked increase in the use of beef semen on dairy cows reflects the broader industry shift towards dairy-beef crossbreeding to meet beef market demands.

- The current reduction in dairy herd size, coupled with a drop in domestic dairy semen sales, complicates efforts to maintain robust culling rates.

- Sustaining the dairy industry amidst these changes requires a nuanced strategy that incorporates advanced reproductive technologies and adaptive herd management practices.