Consumer confidence hits 2021 low! Discover how savvy dairy farmers are turning economic anxiety into profit opportunities (strategies inside).

EXECUTIVE SUMMARY: With U.S. consumer confidence at its lowest since 2021, dairy farmers face a critical juncture: economic anxiety is shifting demand toward affordable staples like milk and cheddar while threatening premium products. A potential $6B industry loss looms from tariffs, labor shortages, and federal cuts, but strategic pivots—rebalancing product mixes, automating labor, optimizing milk components, and diversifying sales channels—offer resilience. Insights from Cornell University and USDA data reveal global parallels to Europe’s 2012 crisis, proving dairy’s essentials can thrive in downturns. The article provides 5 actionable plans to protect margins and capitalize on shifting consumer behavior.

KEY TAKEAWAYS:

- Shift from premium to basics: Focus on recession-proof staples like conventional milk/cheese as demand softens for artisanal products.

- Automate or stagnate: With 51% of dairy labor at risk, robotics are critical for survival.

- Component optimization pays: Prioritize butterfat/protein to align with strong cheese/butter prices.

- Diversify beyond foodservice: Expand retail/direct sales to offset restaurant spending declines.

- Global trade volatility: Retaliatory tariffs (e.g., China’s 10% levy) demand contingency planning.

The American consumer is getting nervous –nervous. Consumer confidence has plummeted to its lowest level since 2021, marking the fourth straight month of decline as economic worries intensify nationwide. For dairy producers navigating volatile markets, this shift in consumer sentiment creates a complex landscape of immediate challenges and strategic opportunities. Let’s dive into what’s happening and how forward-thinking dairy operations can thrive despite the economic anxiety.

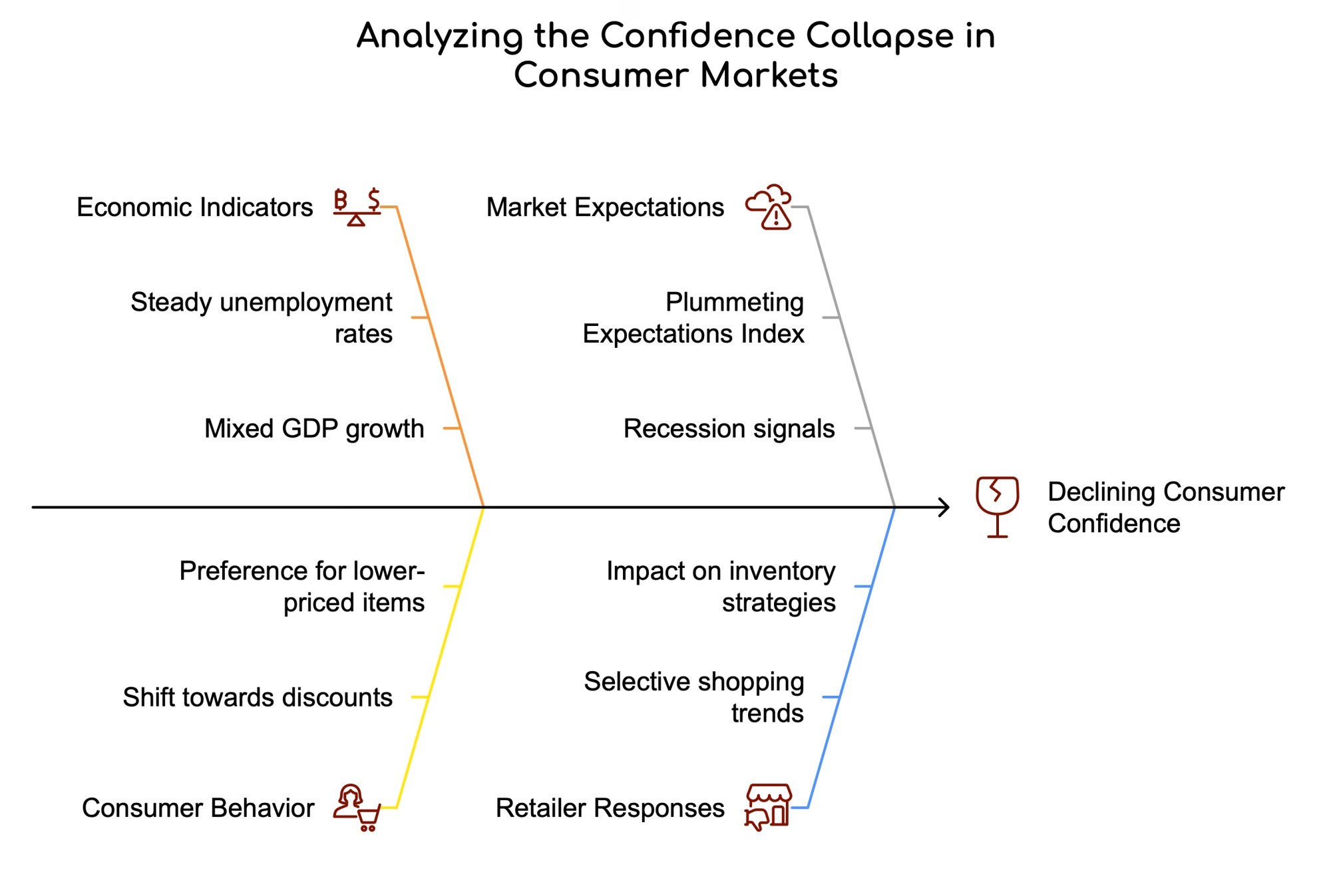

THE CONFIDENCE COLLAPSE: HARD NUMBERS BEHIND CONSUMER FEARS

The Conference Board Consumer Confidence Index dropped 7.2 points in March to just 92.9, hitting its lowest level since January 2021 and falling well below analysts’ expectations. Even more concerning, this marks the fourth consecutive monthly decline, revealing a persistent downward trend that’s impossible to ignore.

Most alarming is the Expectations Index – which measures consumers’ short-term outlook for income, business, and labor conditions – which has plunged to 65.2, its lowest point in 12 years. This figure sits dangerously below the critical 80-point threshold that typically signals a recession is on the horizon.

Despite this confidence crash, other economic indicators present a more mixed picture, creating a confusing landscape for business planning:

- The job market remains surprisingly resilient, with unemployment steady at 4.1% and initial jobless claims beating expectations at 224,000

- Fourth-quarter GDP grew at 2.4%, slightly better than previous estimates, though slower than Q3’s 3.1% growth

- Major retailers like Target and Walmart report shoppers becoming more selective, gravitating toward discounts and lower-priced items

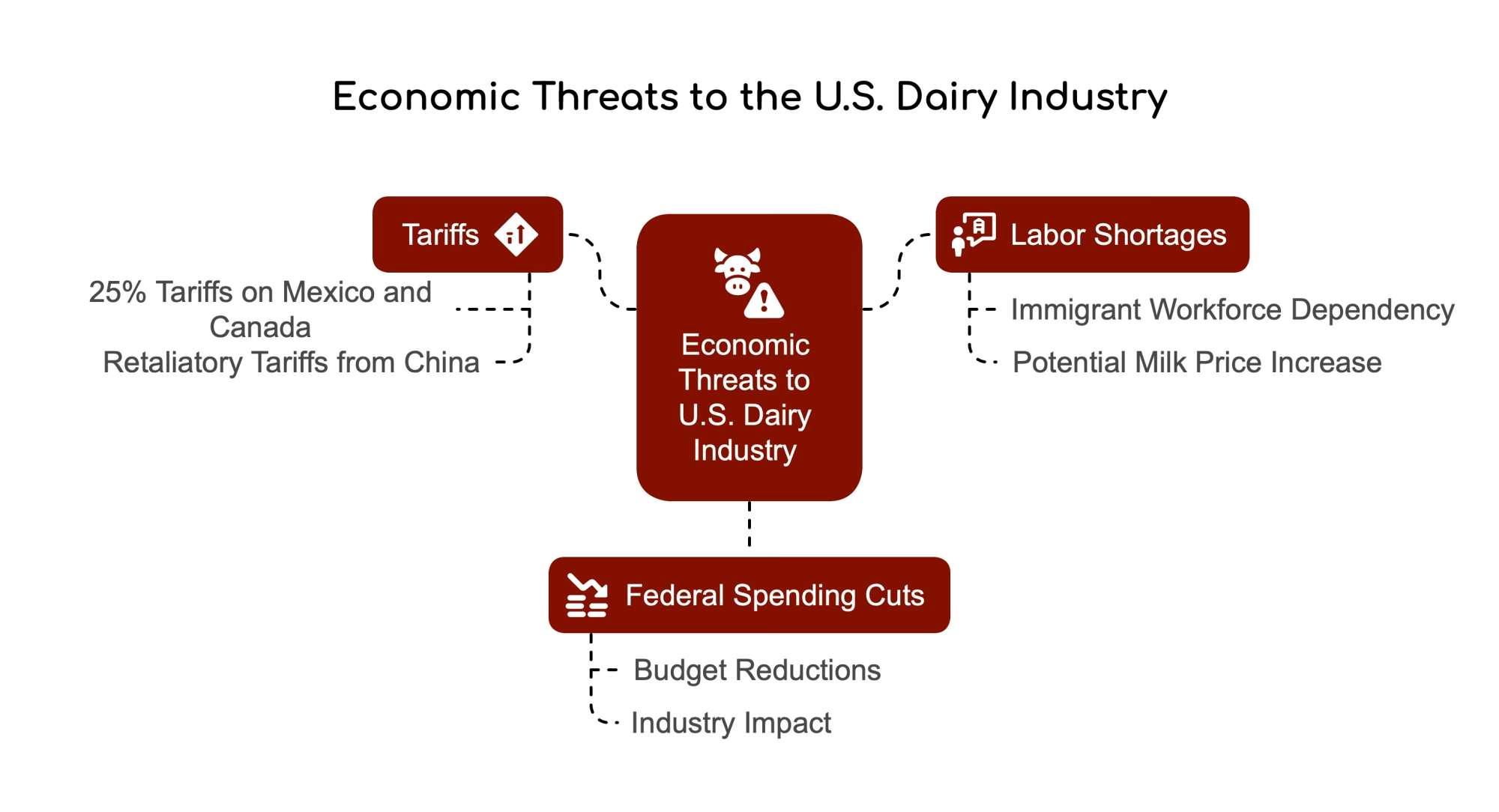

THE $6 BILLION THREAT: WHY THIS DOWNTURN IS DIFFERENT FOR DAIRY

This isn’t just another economic hiccup – it’s potentially the start of a perfect storm for dairy producers. Analysis from Cornell University suggests the U.S. dairy industry could lose a staggering $6 billion over the next four years due to the combined impact of tariffs, labor shortages, and federal spending cuts.

The 25% tariffs recently imposed on goods from Mexico and Canada – critical export markets for U.S. dairy – threaten to disrupt essential trade relationships. History shows the danger here – retaliatory tariffs from China alone resulted in approximately $2.6 billion in lost revenues for U.S. dairy farms from 2019 to 2021, according to Cornell University adjunct associate professor Charles Nicholson.

Compounding these trade pressures, labor shortages continue to plague the industry. According to the National Milk Producers Federation, immigrants comprise approximately 51% of all dairy workers, and dairies that employ immigrant labor produce 79% of the U.S. milk supply. Research from NMPF estimates that losing this workforce would nearly double retail milk prices and cost the U.S. economy more than $32 billion.

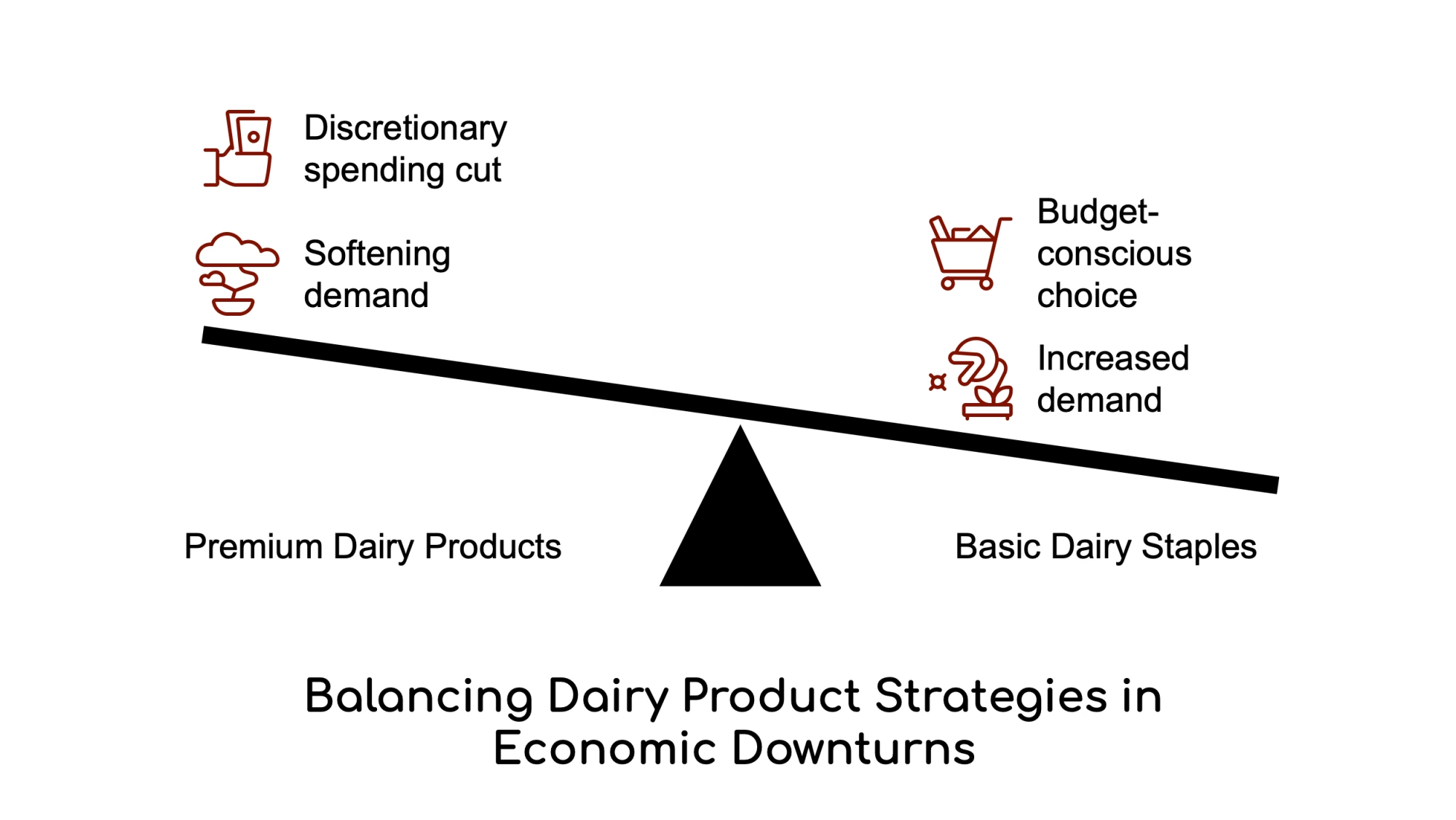

THE BASIC VS. PREMIUM PARADOX: WHY SPECIALTY PRODUCTS MAY BE YOUR BIGGEST VULNERABILITY

When consumer confidence plummets, spending patterns shift dramatically – but not all dairy products fare equally. This is where conventional industry wisdom often gets it wrong.

While many dairy operations have been chasing premium, value-added products with higher margins, economic anxiety is reshaping consumer behavior in ways that favor the basics. Major retailers report shoppers becoming increasingly selective, gravitating toward discounts and lower-priced items as budget consciousness grows.

This shift creates a clear divide:

- Premium dairy products (specialty cheeses, artisanal yogurts, organic offerings) face softening demand as consumers cut discretionary spending

- Basic staples (conventional milk, Cheddar, butter) often benefit as consumers seek affordable nutrition basics

The lesson from previous downturns is clear: when money gets tight, shoppers prioritize essential foods with high nutritional value per dollar – a category where many essential dairy products excel. The industry’s recent obsession with premium products may become a liability in this economic environment.

However, it’s worth noting that not all premium products suffer equally during downturns. Some artisanal producers have successfully maintained demand by emphasizing quality and value even when consumers tighten their belts. As Mike North of EverAg notes, the market needs to strike a delicate balance between prices and what the U.S. consumer is willing to pay.

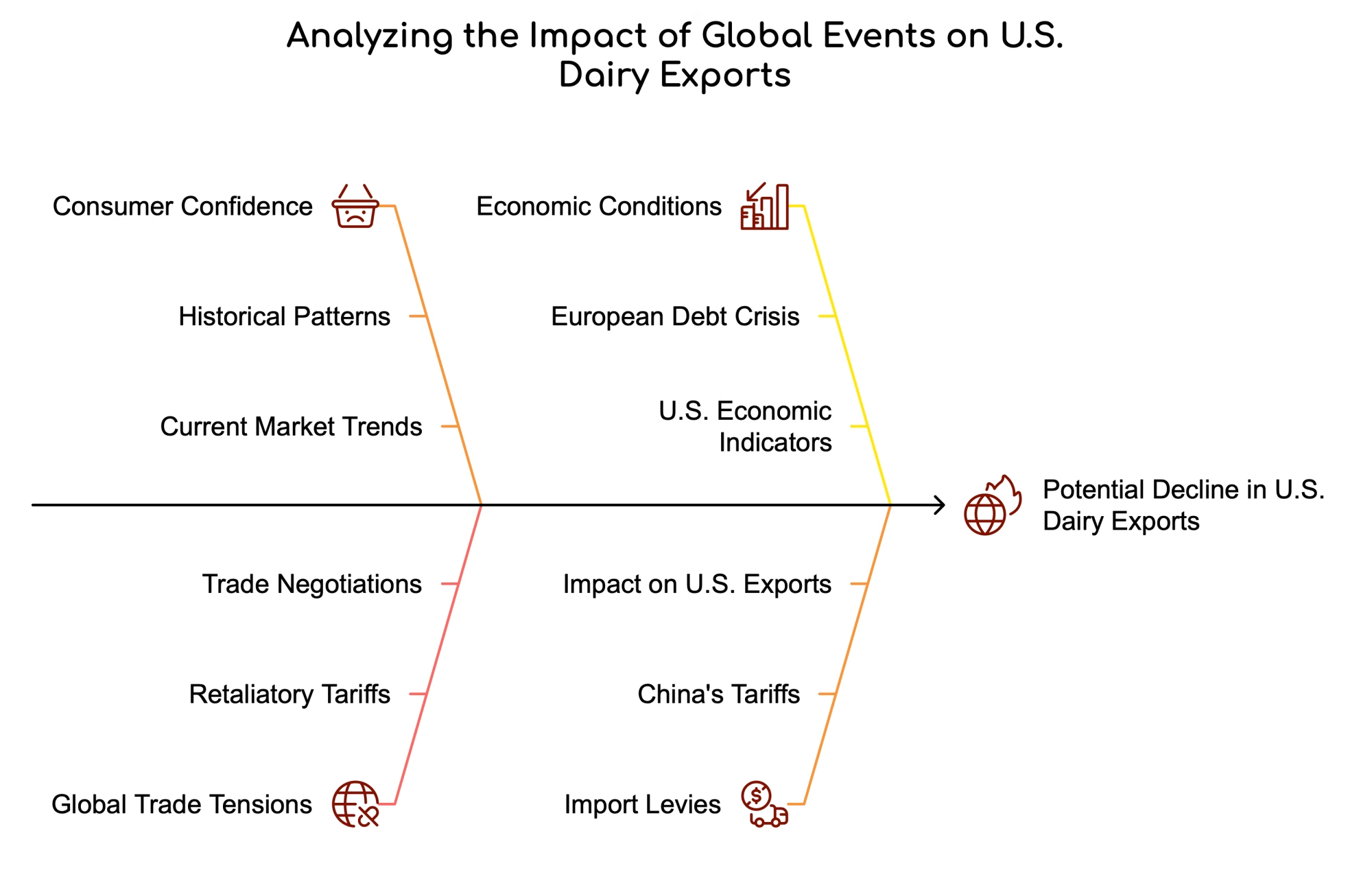

GLOBAL LESSONS: WHAT OTHER MARKETS REVEAL ABOUT YOUR FARM’S FUTURE

The current U.S. consumer confidence crash mirrors patterns we’ve seen in other global markets, offering valuable insights for strategic planning. During Europe’s debt crisis, consumers similarly pulled back from premium dairy products while maintaining purchases of essential staples.

According to the U.S. Dairy Export Council, the total value of U.S. dairy product exports increased by 20% year-over-year in January 2025, reaching a record $714 million. However, this strong performance occurred before the implementation of retaliatory tariffs, which could significantly alter the export landscape.

In China, the world’s largest dairy importer, 26 dairy products are now subject to a 10% levy as part of retaliatory measures that took effect on March 10, 2025. This came when U.S. dairy exports to China showed signs of recovery, highlighting the precarious nature of global trade relationships.

STRATEGIC REPOSITIONING: FIVE ACTIONABLE PLANS FOR DAIRY FARMS

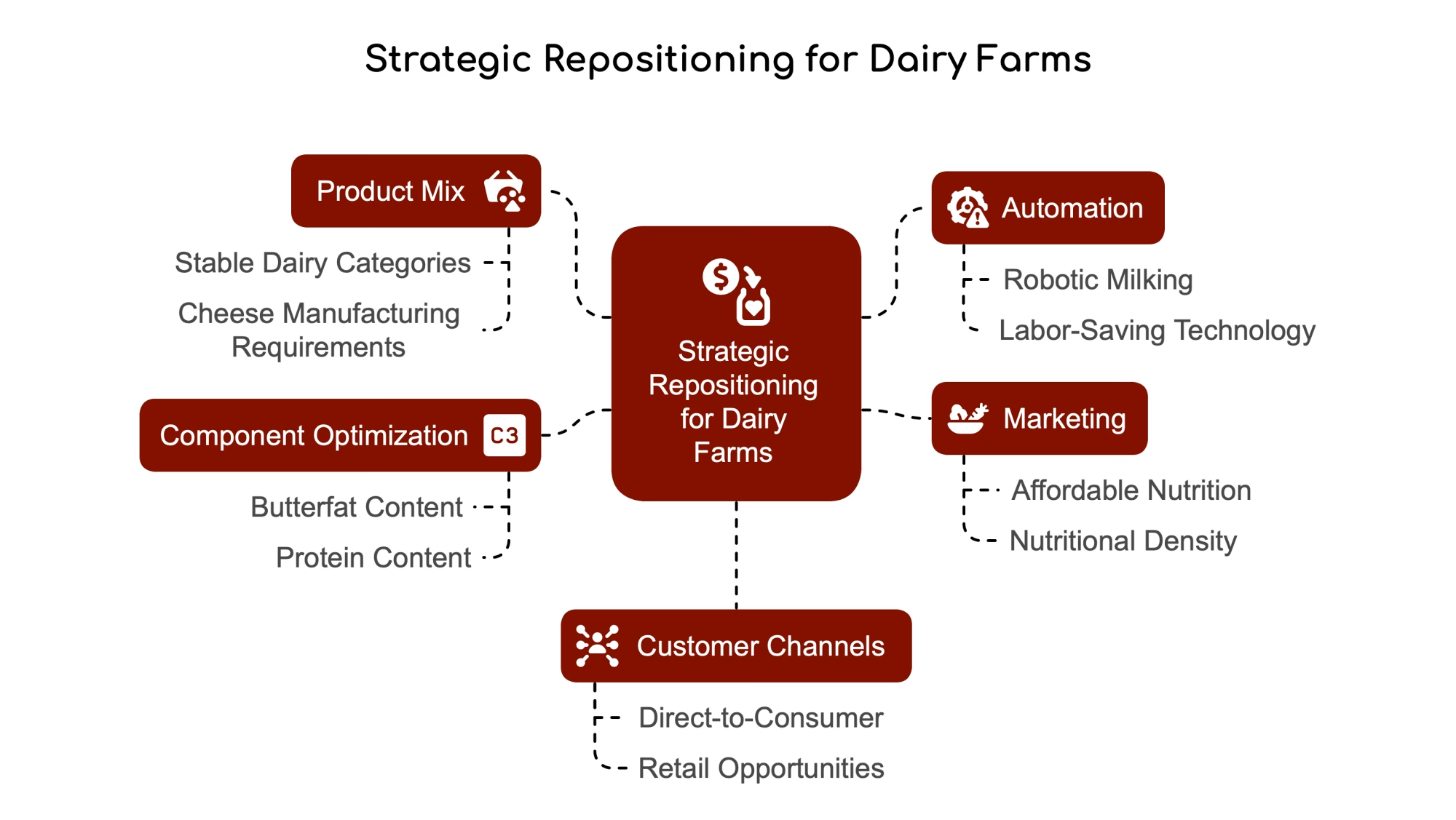

Innovative dairy operations are already pivoting strategies to capitalize on changing consumer behavior. Here’s how to position your operation for success:

1. Recalibrate Your Product Mix

Instead of chasing premium markets exclusively, consider strengthening your position in stable, essential dairy categories. The 2025 USDA forecasts show cheese prices continuing to strengthen while other dairy commodities face varying pressures. Farms that can align their milk component profiles with cheese manufacturing requirements may capture premium opportunities despite broader market volatility.

As noted by dairy analyst Ben Buckner, “Demand looks good, as far as we can tell. In terms of total disappearance, there is nothing remarkable there. And things like butter, it has been pretty remarkable”.

2. Invest in Automation to Counter Labor Risks

With immigrant labor accounting for over half the dairy workforce and consumer confidence declining, the labor situation becomes increasingly vulnerable. Investing in labor-saving technology like robotic milkers and feeders isn’t just about efficiency—it’s about risk management. These investments can insulate your operation from labor shortages and margin pressures as consumer spending tightens.

3. Leverage the “Affordable Nutrition” Positioning

Despite economic pressures, consumers still seek value. The winning formula appears to be “affordable premium” – products that offer superior quality and functional benefits at accessible price points. Emphasize dairy’s nutritional density and cost-effectiveness in your marketing to capture value-conscious consumers.

4. Focus on Component Optimization

The divergence in dairy commodity prices means component optimization is more valuable than ever. Farms that optimize for butterfat and protein content can capture premium returns even during broader market adjustments.

According to Lucas Fuess, senior dairy analyst for RaboResearch Food and Agribusiness, “We are pretty optimistic on milk prices in the next year. We think with the feed costs being lower, the profitability will be there, and overall, it’s pretty good news looking ahead for dairy farmers”.

5. Diversify Your Customer Channels

Restaurant spending typically contracts during periods of low consumer confidence, threatening a critical driver of dairy demand. Mike North of EverAg notes, “Foot traffic at restaurants really hasn’t been that great since last spring… And 51% of the food dollar in America is spent out of the home. So, what happens at restaurants is very important to what comes through on dairy demand”.

Operations heavily dependent on food service should begin diversifying their customer base, developing direct-to-consumer channels, or exploring retail opportunities to buffer against food service volatility.

THE BALANCING ACT: BRIDGING IMMEDIATE ACTIONS WITH LONG-TERM PLANNING

The current consumer confidence crash requires both immediate tactical responses and strategic repositioning. While taking steps to protect your cash flow and margins in the short term, don’t lose sight of long-term investments that will strengthen your position when confidence eventually rebounds.

CoBank’s Knowledge Exchange states, “After the best three-year stretch for farm incomes in history, the coming year will be challenging for row crop producers due to ample domestic stocks and the relentlessly strong U.S. dollar.” However, the dairy outlook remains more positive, with futures prices indicating 2024 could be the third-highest milk price year on record. However, sluggish international dairy trade and tepid domestic demand have slowed dairy product sales growth.

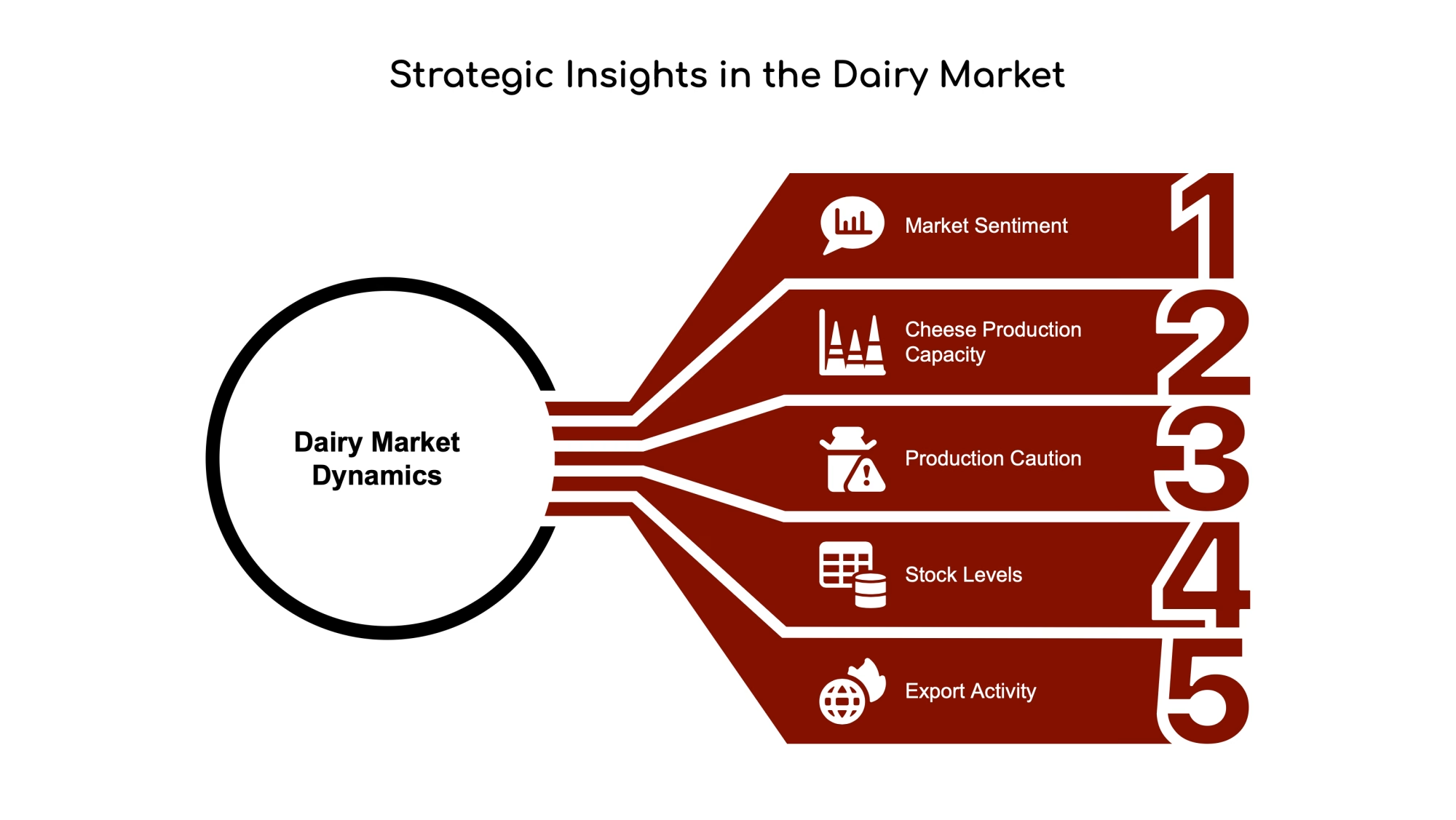

BEYOND THE HEADLINES: WHERE SMART MONEY IS MOVING

Despite the gloomy consumer confidence numbers, several bright spots exist for strategic dairy operators. According to dairy market analyst Nate Donnay, “At the start of 2025, market sentiment and supply and demand risks are tilted toward the downside, but I think we’ll see decent milk prices and margins for dairy farmers despite the risks”.

One of the most significant discussion points has been the new cheese plant capacity coming online between the fourth quarter of 2024 and the middle of 2025. If all new plants ran at full capacity and all existing plants continued to run at their current rate, we would see U.S. cheese production expand by about 6%, which would be a record increase.

However, cheesemakers have been cautious about overproducing, with January to November 2024 cheese production up just 0.4%, domestic disappearance up 0.3%, and exports up almost 18%. This resulted in cheese stocks being down more than 7% (104 million pounds) from the prior year in November, suggesting that well-positioned operations focused on the right product mix can still capture significant value despite broader economic concerns.

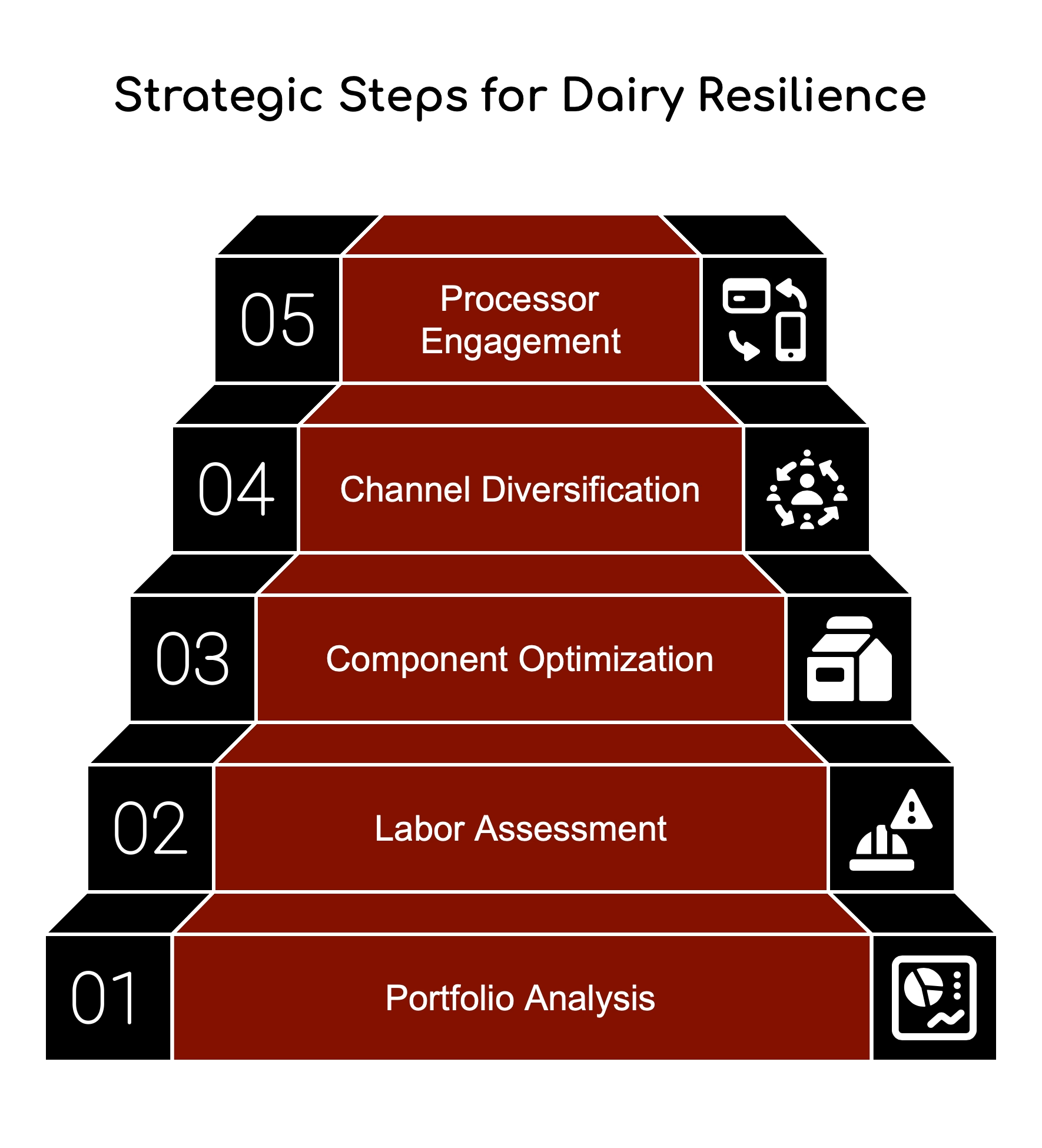

YOUR ACTION PLAN: NEXT STEPS FOR IMMEDIATE IMPLEMENTATION

- Conduct a product portfolio analysis: Evaluate your current product mix against emerging consumer trends, identifying areas to shift emphasis from vulnerable premium categories to more recession-resistant basics.

- Assess your labor vulnerability: Calculate your operation’s exposure to potential labor disruptions and evaluate ROI on automation investments that could reduce this risk.

- Optimize your component strategy: Work with your nutritionist to fine-tune feeding programs that maximize valuable milk components, particularly those aligned with stronger price forecasts.

- Diversify your customer channels: Identify opportunities to expand your customer base beyond traditional channels vulnerable to consumer confidence shifts.

- Engage with your processor: Understand how your milk buyer’s strategy is evolving in response to changing consumer behavior and align your production accordingly.

The sharp decline in consumer confidence presents evident challenges for America’s dairy farmers, but it also creates opportunities for those who understand the shifting landscape and position themselves strategically. By focusing on the basics, optimizing for high-value components, addressing labor vulnerabilities, and aligning with changing consumer priorities, forward-thinking dairy operations can weather this economic uncertainty and emerge stronger on the other side.

Read more:

- Robotic Milking Systems: Calculating ROI in Volatile Dairy Markets

Explore how automation investments pay off during economic uncertainty, with real-world case studies of labor cost reductions and productivity gains. - Building a Recession-Proof Herd: Genetic Selection for Economic Downturns

Learn how to prioritize genetic traits like feed efficiency and component yields to thrive in shifting market conditions. - Global Trade Wars: Protecting Your Dairy Operation from Tariff Whiplash

A tactical guide to hedging against trade disruptions, including contract diversification and supply chain resilience tactics.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!