Discover how April 2024’s DMC margin held at $9.60 per cwt despite steady feed costs. Curious about the factors influencing this stability? Read on to find out more.

April concluded on a reassuring note for dairy producers , with a robust $9.60 per cwt income over the feed cost margin through the DMC program. Despite the challenges posed by strong feed markets, milk prices remained steady, ensuring no indemnity payments for the second time this year. This stability in income is a testament to the reliability of the DMC program.

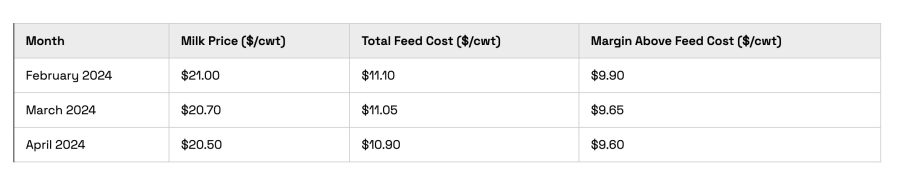

| Month | Milk Price ($/cwt) | Total Feed Cost ($/cwt) | Margin Above Feed Cost ($/cwt) |

|---|---|---|---|

| February 2024 | $21.00 | $11.10 | $9.90 |

| March 2024 | $20.70 | $11.05 | $9.65 |

| April 2024 | $20.50 | $10.90 | $9.60 |

The USDA National Agricultural Statistics Service (NASS) , released its Agricultural Prices report on May 31. This report, which served as the basis for calculating April’s DMC margins, demonstrated how a late-month milk price rally balanced steady feed market conditions.

The DMC program, a key pillar of risk management for dairy producers, protects against rising feed costs and milk prices, ensuring a stable income. In addition, programs like Dairy Revenue Protection (Dairy-RP) play a crucial role, covering 27% of the U.S. milk supply and providing net gains of 23 cents per cwt over five years.

“April’s margin stability shows milk prices’ resilience against fluctuating feed costs, a balance crucial for dairy producers,” said an industry analyst.

April’s total feed costs fell to $10.90 per cwt, down 15 cents from March, while the milk price dipped to $20.50 per cwt, down 20 cents. This kept the margin at $9.60 per cwt, just 5 cents lower than March.

Milk price changes varied by state. Florida and Georgia saw a 30-cent increase per cwt, and Pennsylvania and Virginia saw a 10-cent rise. In contrast, Idaho and Texas saw no change. Oregon experienced a $1.10 per cwt drop.

The market fluctuations observed in April underscore the dynamic nature of the dairy market. In such a scenario, the importance of risk management programs like DMC and Dairy-RP cannot be overstated. As of March 4, over 17,000 dairy operations were enrolled in the DMC for 2023, with 2024 enrollment open until April 29. This proactive approach to risk management is crucial for navigating the uncertainties of the dairy market.

Key Takeaways:

- April’s Dairy Margin Coverage (DMC) margin was $9.60 per hundredweight (cwt), with no indemnity payments triggered for the second time in 2024.

- USDA NASS’s Agricultural Prices report detailed April’s margins and feed costs, revealing a robust dairy income despite strong feed markets.

- Notable changes included Alfalfa hay at $260 per ton (down $11), corn at $4.39 per bushel (up 3 cents), and soybean meal at $357.68 per ton (down $4.49).

- Milk prices averaged $20.50 per cwt, marking a slight 20-cent drop from March but sufficient to offset stable feed costs.

- Major dairy states mostly saw a 20-cent decrease in milk price, with a few exceptions like Florida, Georgia, Pennsylvania, and Virginia experiencing modest growth.